Free Employee Relocation Benefits Guide HR

I. Introduction

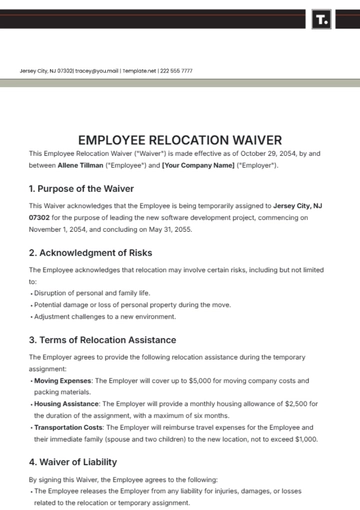

Welcome to the [Your Company Name] Employee Relocation Benefits Guide. This document outlines all the key information, policies, and procedures related to employee relocation at [Your Company Name]. Should you have any queries or require further information, please don’t hesitate to contact Human Resources at [Your Company Email].

II. Eligibility Criteria

Relocation benefits are an important part of our company's commitment to supporting our employees in their career progression. However, to maintain a balance between offering generous support and ensuring responsible use of company resources, we have specific eligibility criteria in place. These criteria serve as a basis for determining which employees qualify for the various benefits and services outlined in this guide. Below, we delve into the details of each criterion to provide you with a clearer understanding.

Position Level: Managerial or Above. At [Your Company Name], the relocation benefits package is primarily designed for employees who are in managerial roles or higher. The rationale behind this is twofold. First, managerial roles often require a level of expertise and specialization that may not be readily available in all locations. Second, these positions frequently involve a level of responsibility that justifies the investment in relocation. Therefore, you must hold a managerial position or above to be considered for relocation benefits.

Length of Service: At Least One Year with [Your Company Name]. We value longevity and commitment to the company. Therefore, you are required to have a minimum of one year of service with [Your Company Name] to be eligible for relocation benefits. This criterion ensures that both the employee and the company have had sufficient time to mutually gauge fit, skills, and commitment, thus making the relocation a worthwhile investment for both parties.

Job Requirements: Transferring to a Role that Necessitates Relocation. Not all job transfers within [Your Company Name] are eligible for relocation benefits. The move must be essential for your new role, which often means that the necessary skills are lacking in the location to which you are being relocated, or perhaps you are needed to lead a new or existing team there. In essence, the job itself must require your physical presence in the new location.

Approval: Signed Approval from Your Department Head. Even if you meet all other eligibility criteria, any relocation must have the formal approval of your Department Head. This ensures that the move aligns with the department's strategic goals and has the necessary managerial support. The approval usually comes in the form of a signed document, often after a series of discussions between you, HR, and your Department Head to discuss the relocation's logistics, timing, and necessity.

By adhering to these eligibility criteria, we aim to make the relocation process streamlined and fair, thereby ensuring that it is beneficial for both the employee and [Your Company Name].

III. Relocation Packages

As you prepare to embark on this exciting new chapter in your career with [Your Company Name], it's essential to understand the financial and logistical support that is available to you. We offer two main tiers of relocation packages to cater to the different needs and levels of our relocating employees: the Standard Relocation Package and the Executive Relocation Package.

These packages have been thoughtfully designed to cover the most crucial aspects of the moving process. They include benefits for moving expenses, temporary housing, and travel, but differ in the extent of their offerings depending on your role within the company. Whether you are eligible for the Standard or Executive package, each is intended to ease your transition into your new location and role.

In the sections that follow, we'll break down the specific benefits, provisions, and amounts associated with each of these packages. This information will help you plan effectively and set your expectations appropriately as you prepare for your relocation journey with [Your Company Name].

Standard Relocation Package

Benefit | Description | Amount/Provision | Benefit |

Moving Expenses | Cost of moving household goods | Up to $3,000 | Moving Expenses |

Temporary Housing | Hotel or furnished apartment | 30 days | Temporary Housing |

Travel Expenses | Airfare or mileage for the employee | One round-trip ticket | Travel Expenses |

Executive Relocation Package

Benefit | Description | Amount/Provision | Benefit |

Moving Expenses | Cost of moving household goods | Up to $10,000 | Moving Expenses |

Temporary Housing | Luxury accommodation | 60 days | Temporary Housing |

Travel Expenses | Business class airfare | One round-trip ticket | Travel Expenses |

IV. Relocation Assistance Services

Relocating for a job is more than just a career move; it's a life-changing event that impacts various aspects of your personal life. Beyond just getting you and your belongings to a new location, [Your Company Name] aims to help you settle in comfortably and adapt to your new surroundings. Our Relocation Assistance Services are designed to provide comprehensive support that goes beyond the financial aspects covered in our relocation packages.

In this chapter, we will explore the additional services provided by [Your Company Name] to make your move as smooth as possible, categorized under three key areas: Housing Assistance, Family Support, and Moving Services. Each section delves into the specific types of assistance you can expect, enabling you to make well-informed plans and decisions.

Housing Assistance

Finding a suitable home in a new location can be challenging, especially when you're unfamiliar with the area. Our Housing Assistance services aim to eliminate the guesswork and stress from this important aspect of your move.

Help with Home-Selling. If you're currently a homeowner and wish to sell your property, we can assist in finding a qualified real estate agent and even provide some financial aid for home-staging services.

School Search Assistance for Kids. For those relocating with children, finding the right school is a top priority. We offer school search assistance to help you identify suitable educational institutions in your new area.

City Tours. Getting familiar with your new surroundings is important. We provide city tours to help you get to know the local amenities, main commuting routes, and any other areas of interest that can help you settle in quickly.

Family Support

If you're relocating with your family, their well-being and smooth transition are equally important. Our Family Support services aim to help your loved ones adapt to the new environment seamlessly.

Spousal Job Assistance. If your spouse will be seeking employment in the new location, we offer job assistance services including resume reviews and connections with local employment agencies.

Orientation Programs for Family. To help your family get acquainted with the new location, we offer orientation programs that cover various aspects like local culture, public transportation, and emergency services.

Moving Services

Moving your belongings can be one of the most stressful aspects of relocation. Our Moving Services are designed to minimize this stress by offering a range of helpful services.

Packing and Unpacking. We can arrange for professional packing and unpacking services to ensure your belongings are carefully handled and securely transported.

Car Shipping Services. If you own a vehicle, we provide car shipping services to help you get your car to your new location safely and efficiently.

Each of these services aims to mitigate the challenges commonly faced during relocation, thereby enabling you to focus on what truly matters: thriving in your new role and enjoying your new home.

V. Expense Reimbursement

After successfully relocating to your new position, one of the last steps in the process is to get reimbursed for your eligible expenses. At [Your Company Name], we understand the importance of a clear and efficient reimbursement process and strive to make this as straightforward as possible for you. This chapter focuses on the types of expenses that are reimbursable and those that are not, as well as the procedure for submitting your claims for reimbursement.

Reimbursable Expenses

Understanding which expenses are eligible for reimbursement is crucial as you plan and go through your move. Here are the types of expenses that [Your Company Name] will reimburse:

Packing and Moving Costs. The actual costs of packing and moving your belongings are reimbursable. This covers both self-packing and professional services, as outlined in your selected relocation package.

Fuel and Toll Expenses. If you are driving to your new location, you can be reimbursed for fuel and toll charges you incur during the move. Make sure to keep all relevant receipts.

Visa Fees. For international relocations, visa fees for you and any accompanying family members are reimbursable. This includes application fees and any related charges.

Non-Reimbursable Expenses

It's equally important to know what is NOT covered by [Your Company Name] to avoid any misunderstandings. The following are examples of non-reimbursable expenses:

Meals. Meal costs incurred during the move are considered personal expenses and will not be reimbursed.

Pet Relocation. The costs of moving pets are not covered by the company's relocation packages. These costs are considered a personal expense.

Tips to Movers. While tipping your movers is customary, these are considered a personal expense and are not eligible for reimbursement by [Your Company Name].

Expense Submission Process

Submitting your expenses for reimbursement is a time-sensitive task that requires careful attention to detail.

Submit all Relevant Receipts to the Finance Department within 30 Days via [Your Company Email].

Make sure to collect and keep all receipts related to your reimbursable expenses. Submit them to the Finance Department within 30 days of incurring the expense. Use [Your Company Email] for all correspondence related to expense reimbursement.

By understanding the expense reimbursement process and what is and isn't covered, you can plan your move more effectively, ensuring you're only spending what is necessary and will be covered by [Your Company Name].

VI. Tax Implications

Relocating for a job often comes with numerous financial transactions that may have tax implications. While [Your Company Name] strives to provide a comprehensive relocation package that covers various expenses and services, it's crucial to understand how these benefits might affect your personal tax situation. Though we aim to offer some general guidance in this chapter, we strongly recommend consulting a qualified tax advisor for personalized advice tailored to your specific circumstances.

Consult a Tax Advisor for Information on Tax Deductions and Liabilities

The benefits you receive as part of your relocation package—whether they're reimbursements for moving expenses, temporary housing allowances, or other financial incentives—may be considered taxable income by the government.

Why Consult a Tax Advisor?

Tax laws and regulations can be complex and vary by jurisdiction, especially if you're relocating to a different state or country. A tax advisor can help you navigate these complexities and offer advice on how to minimize your tax liability, potentially saving you a significant amount of money.

What Can a Tax Advisor Assist With?

A qualified tax advisor can provide you with detailed information on:

Taxable and Non-Taxable Benefits: Not all relocation benefits are taxed equally. Some may be exempt from taxes, while others are not. Your tax advisor can help you distinguish between the two.

Tax Deductions: You might be eligible for certain tax deductions related to your move, such as travel expenses or the costs of finding a new home. A tax advisor can help you identify these opportunities.

Filing Requirements: Depending on your situation and the laws of the jurisdiction you are moving to, you might have special filing requirements. This could include filing taxes in multiple states or countries.

Tax Planning: By understanding the tax implications of your move, you can plan more effectively, making decisions that are not only beneficial for your relocation but also for your overall financial health.

When to Consult a Tax Advisor?

It's advisable to consult a tax advisor both before and after your move. Before the move, you can discuss anticipated expenses and benefits to understand their tax implications. After the move, consulting a tax advisor can help ensure that you comply with all tax laws and take advantage of any deductions or credits for which you may be eligible.

Understanding the tax implications of your relocation is crucial for avoiding unexpected financial burdens and making the most of your benefits package. Consulting a tax advisor for personalized, expert advice is the best course of action to navigate this complex aspect of your move.

VII. FAQs

Frequently asked questions (FAQs) are an important resource for employees who are in the process of relocating or considering a move. We've compiled some of the most commonly asked questions to provide quick, easy-to-find answers to your pressing concerns.

Q: How soon do I need to relocate?

A: Within 30 days of the job offer.

The standard timeframe for relocation at [Your Company Name] is within 30 days of accepting your new job offer. This period allows enough time for both the employee and the company to make the necessary arrangements for a successful transition.

Q: Is the relocation package negotiable?

A: In special circumstances, contact your HR manager.

While our relocation packages are designed to be comprehensive and cater to the needs of most employees, we understand that individual circumstances can vary. If you have unique needs or face challenges that are not addressed by the standard package, please contact your HR manager to discuss potential adjustments.

Q: What documentation do I need for reimbursement?

A: Keep all original receipts and submit them within 30 days.

For any expenses to be reimbursed, you must keep all original receipts. These should be submitted to the Finance Department within 30 days of incurring the expense, as detailed in the Expense Reimbursement chapter.

Q: Are family members covered in the relocation package?

A: Yes, certain family support services are available.

Our relocation packages include various family support services like spousal job assistance and school search assistance for kids. Refer to the Family Support section for more details.

Q: How are temporary housing arrangements made?

A: Contact the HR department for options tailored to your needs.

Temporary housing can range from hotels to furnished apartments, depending on your package and needs. Please consult the HR department for personalized options.

Q: What if I decline the job after accepting the relocation package?

A: You may be liable for reimbursing the company for expenses incurred.

If you choose to decline the job after accepting the relocation package, you may be responsible for reimbursing [Your Company Name] for any expenses incurred as part of your move.

Q: Is international relocation handled differently?

A: Yes, additional services and allowances are provided for international moves.

International relocations come with their unique set of challenges, including visa applications and greater logistical complexities. Our international relocation packages are designed to address these issues comprehensively.

Q: Who can I contact for more information?

A: Reach out to the HR department via [Your Company Email] for all queries.

For any additional questions or clarifications, you're encouraged to contact the HR department. They can provide the most accurate and personalized assistance for your situation.

By addressing these FAQs, we hope to eliminate some of the uncertainties you may have regarding your relocation with [Your Company Name]. If you have additional questions that are not covered here, please don't hesitate to reach out to your HR department for further information.

VIII. Contact Information

For more information, visit [Your Company Website] or contact:

HR Manager: [Name]

Email: [Your Company Email]

Phone: [Your Company Number]

Address: [Your Company Address]

IX. Forms and Templates

Relocation Expense Report Form

Relocation Agreement Form

Download the forms at [Your Company Website].

X. Acknowledgment and Agreement

I, [Your Name], hereby acknowledge that I have read and understood the contents of this guide.

________________________

Signature

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate solution for seamless employee relocations with Template.net's Employee Relocation Benefits Guide HR Template. Crafted for HR professionals, this editable and customizable template streamlines the process. With our intuitive AI Editor Tool, effortlessly tailor relocation benefits to suit your company's needs. Simplify transitions and empower your workforce with this essential resource.

You may also like

- Employee Letter

- Employee ID Card

- Employee Checklist

- Employee Certificate

- Employee Report

- Employee Training Checklist

- Employee Agreement

- Employee Contract

- Employee Training Plan

- Employee Incident Report

- Employee Survey

- Employee of the Month Certificate

- Employee Development Plan

- Employee Action Plan

- Employee Roadmap

- Employee Poster

- Employee Form

- Employee Engagement Survey