Comprehensive Life And Disability Insurance Guide

Introduction to Life and Disability Insurance

Life and disability insurance are essential components of financial planning, offering protection and security in the face of life's uncertainties. These insurance products serve distinct purposes but share the common goal of providing financial support when you need it most. In this section, we'll delve into what life insurance and disability insurance entail.

What is Life Insurance?

Life insurance is a contract between you (the policyholder) and an insurance company, wherein you pay regular premiums in exchange for a financial benefit to be paid out to your beneficiaries upon your death. This benefit, known as the death benefit, is designed to provide financial security and support to your loved ones when you pass away. Here's a breakdown of key features:

Death Benefit: The primary purpose of life insurance is to provide a lump-sum payment to your chosen beneficiaries upon your death. This money can be used for various purposes, such as covering funeral expenses, paying off debts, replacing lost income, and ensuring your loved one's financial stability.

Types of Life Insurance

Term Life Insurance: Provides coverage for a specified term, typically 10, 20, or 30 years.

Whole Life Insurance: Offers lifelong coverage and includes a cash value component that can grow over time.

Universal Life Insurance: Combines lifetime coverage with flexibility in premium payments and death benefit adjustments.

Variable Life Insurance: Allows you to invest the cash value portion in various investment options.

Premiums: Policyholders pay regular premiums to maintain coverage. Premium amounts depend on factors such as age, health, coverage amount, and the type of policy.

Beneficiaries: You designate beneficiaries who will receive the death benefit. Beneficiaries can be family members, friends, or charitable organizations.

Underwriting: The insurance company assesses your risk profile, health, and lifestyle to determine your eligibility and premium rates.

Life insurance provides peace of mind, ensuring that your loved ones have financial protection in the event of your passing, allowing them to maintain their quality of life and meet financial obligations.

What is Disability Insurance?

Disability insurance, often referred to as disability income insurance, is designed to protect your income in the event that you become unable to work due to a disabling injury or illness. It provides a source of income replacement when you cannot earn a paycheck, helping you maintain your financial stability and meet your everyday expenses. Disability insurance policies typically cover two types of disabilities:

Short-Term Disability: This type of disability insurance provides benefits for a limited duration, typically a few months to a year, after a waiting period known as the elimination period. It is ideal for covering short-term medical conditions or temporary disabilities.

Long-Term Disability: Long-term disability insurance provides benefits for an extended period, often until retirement age, if you are unable to work due to a severe illness or injury. The elimination period for long-term disability insurance is usually longer than that of short-term coverage.

Disability insurance policies can be offered as part of employee benefits packages (group coverage) or purchased individually (individual coverage). These policies typically define disability based on specific criteria, such as your inability to perform your regular occupation or any occupation, depending on the policy's terms.

Why You Need Life and Disability Insurance

Life and disability insurance are vital components of a sound financial plan, offering protection and peace of mind in the face of life's uncertainties. Here are two compelling reasons why you need both types of insurance:

Financial Security

Debt Protection: Life insurance ensures that your loved ones are not burdened with your outstanding debts, such as mortgages, loans, or credit card balances, in the event of your untimely death.

Income Replacement: For breadwinners or those who contribute significantly to the family income, life insurance provides a financial safety net. It replaces lost income, allowing your family to maintain their standard of living.

Funeral and End-of-Life Expenses: The cost of funerals, burials, and related expenses can be substantial. Life insurance helps cover these immediate financial needs, sparing your family from additional stress during a difficult time.

Estate Planning: Life insurance can be a valuable tool for estate planning, helping to ensure your heirs receive an inheritance or that estate taxes are covered, preserving your legacy for future generations.

Business Continuity: If you are a business owner, life insurance can be used to fund buy-sell agreements, ensuring a smooth transition of ownership in the event of your death.

Protecting Loved Ones

Family Protection: Life insurance ensures that your family's financial needs are met if you pass away prematurely. It provides a financial safety net for your spouse, children, or dependents.

Education Funding: Life insurance can fund education expenses for your children or grandchildren, helping them achieve their educational goals.

Spousal Support: If your spouse relies on your income, life insurance can provide ongoing support, allowing your spouse to maintain their quality of life.

Estate Equalization: Life insurance can be used to equalize inheritances among heirs, ensuring that each beneficiary receives a fair share of your estate.

Types of Insurance

Life insurance is a valuable financial tool that can serve various purposes, from providing financial protection to building wealth. Understanding the different types of life insurance policies is essential for making informed decisions about your coverage.

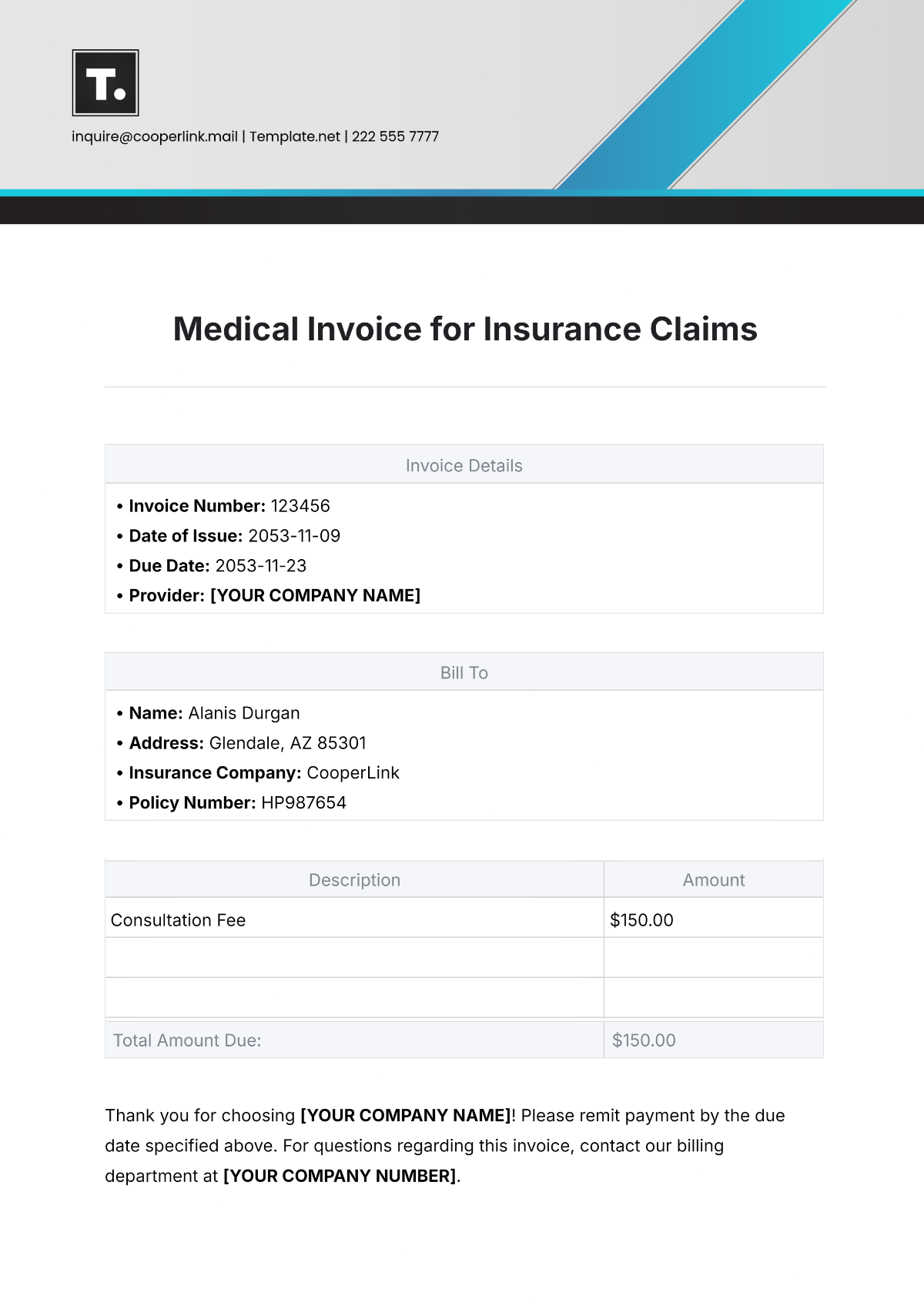

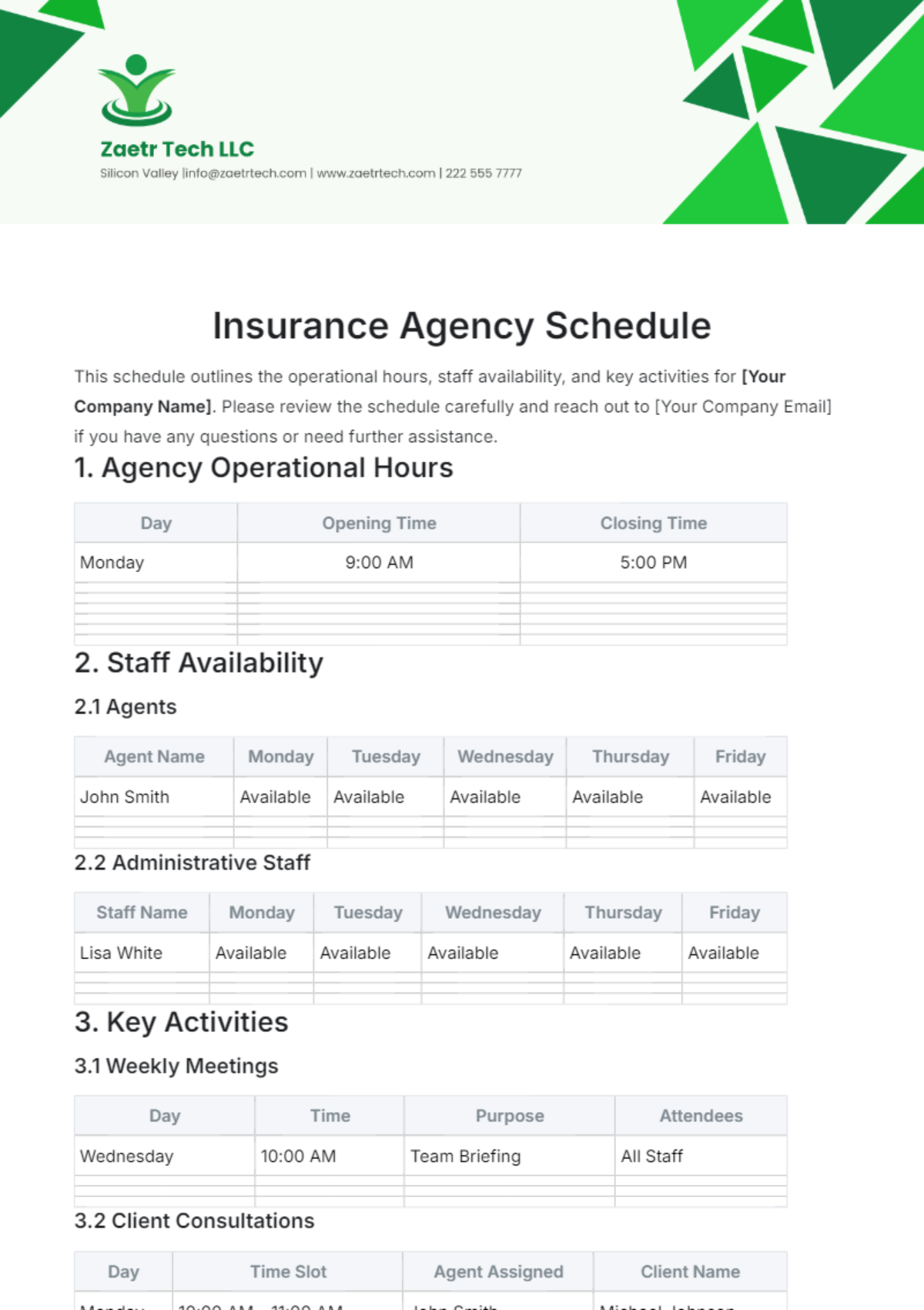

Insurance Type | Definition | Coverage | Benefit/Cash Value |

Term Life Insurance | Affordable insurance. Provides coverage for a specified term | In effect during the term. | Death benefits to the insured person’s beneficiaries |

Whole Life Insurance | Permanent insurance. Insures the person for a lifetime. | Offers lifetime coverage. | Can accumulate cash value over time. The cash value can be borrowed or withdrawn. |

Universal Life Insurance | Flexible permanent life insurance policy. Premium payments and death benefits can be adjusted. | Offers lifetime coverage. | Offers both a death benefit and a cash value component. The cash value can grow at variable or fixed interest rates. |

Variable Life Insurance | A type of permanent life insurance that allows policyholders to invest the cash value component in various investment options. | Offers lifetime coverage. | Offers both a death benefit and a cash value component. The cash value can fluctuate based on the investment’s performance. |

Term Life Insurance

Definition: Term life insurance is a straightforward and affordable form of life insurance that provides coverage for a specified term or duration, typically ranging from 10 to 30 years.

Coverage Period: Coverage is in effect only during the term of the policy.

Premiums: Term life insurance generally has lower premiums compared to permanent life insurance policies.

Benefit: If the insured individual passes away during the term, the policy pays out a death benefit to the beneficiaries.

No Cash Value: Term life insurance does not accumulate cash value or savings; it is pure insurance coverage.

Whole Life Insurance

Definition: Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid.

Coverage Period: It offers lifetime coverage.

Premiums: Premiums for whole life insurance are generally higher than those for term insurance but remain level throughout the policy's existence.

Benefit: In addition to the death benefit, whole life insurance policies accumulate cash value over time. This cash value can be borrowed against or withdrawn.

Cash Value Growth: The cash value component of whole life insurance grows at a guaranteed rate, providing a stable savings component.

Universal Life Insurance

Definition: Universal life insurance is a flexible permanent life insurance policy that allows the policyholder to adjust the premium payments and death benefits over time.

Coverage Period: It provides lifetime coverage like whole life insurance.

Premiums: Premiums can be adjusted by the policyholder within certain limits, allowing flexibility in payment amounts and frequency.

Benefit: Universal life insurance offers both a death benefit and a cash value component. The cash value can grow at variable or fixed interest rates.

Cash Value Flexibility: Policyholders can use the cash value to pay premiums or increase the death benefit, providing adaptability to changing financial circumstances.

Variable Life Insurance

Definition: Variable life insurance is a type of permanent life insurance that allows policyholders to invest the cash value component in various investment options, such as stocks, bonds, or mutual funds.

Coverage Period: Like other permanent life insurance, it provides lifetime coverage.

Premiums: Premiums are fixed and generally higher than those for term insurance.

Benefit: Variable life insurance policies offer both a death benefit and a cash value component. The cash value can fluctuate based on the performance of the chosen investments.

Investment Component: Policyholders have control over how their cash value is invested, with the potential for higher returns but also greater risk.

How Life Insurance Works

Life insurance is a contract between an individual (the policyholder) and an insurance company. It provides financial protection to the policyholder's beneficiaries in the event of the policyholder's death. Understanding how life insurance works involves key components, including premiums, death benefits, and cash value (for permanent life insurance).

Premiums

Payment Frequency: Premiums can typically be paid monthly, quarterly, semi-annually, or annually, depending on the policyholder's preference.

Cost Determination: The cost of premiums is determined by several factors, including the policyholder's age, health, gender, occupation, and the type and amount of coverage.

Level or Increasing Premiums: In some policies, premiums remain level throughout the policy's term (e.g., term life insurance). In others (e.g., some types of universal life insurance), premiums may increase over time.

Grace Period: Most policies offer a grace period during which premiums can be paid even if the due date is missed. If the policy lapses due to non-payment, it may be reinstated within a certain timeframe, often with additional requirements.

Death Benefit

Definition: The death benefit, also known as the face amount or policy amount, is the sum of money that the insurance company pays to the designated beneficiaries upon the policyholder's death.

Beneficiaries: The policyholder designates one or more beneficiaries who will receive the death benefit. Beneficiaries can be individuals, trusts, or entities.

Payout: The death benefit is typically paid out as a tax-free lump sum to the beneficiaries. It can be used for various purposes, such as covering funeral expenses, paying off debts, replacing lost income, or funding long-term financial goals.

Policy Conditions: The death benefit is subject to policy conditions, including the policy's in-force status and the cause of the policyholder's death. Most policies have a contestability period during which the insurance company can contest a claim.

Choosing the Right Life Insurance Policy

Selecting the right life insurance policy is a critical decision that should align with your financial goals and needs. To make an informed choice, you must assess your needs and consider the fundamental choice between term and permanent insurance. Here's a detailed guide on how to choose the right life insurance policy:

Death Benefit

Income Replacement: Consider whether you need life insurance primarily to replace your income to support your dependents if you were to pass away prematurely.

Debt Coverage: Evaluate your outstanding debts, including mortgages, loans, and credit card balances. Determine whether you want your life insurance to cover these financial obligations.

Estate Planning: If you have significant assets and are concerned about estate taxes or want to leave an inheritance, factor in these considerations.

Education Funding: If you have children or plan to send them to college, calculate the cost of education and whether you want life insurance to fund it.

Funeral and Final Expenses: Think about the immediate expenses your loved ones may face, such as funeral costs.

Term Life Insurance

If you have short-term financial obligations, such as a mortgage or educational expenses, that need coverage.

When your budget is limited, and you need the most coverage for your premium dollars.

If you want to cover specific financial responsibilities that will decrease or disappear over time, such as a loan with regular payments.

During the years when your dependents are most financially vulnerable, such as when you have young children.

Key Characteristics

Provides coverage for a specific term (e.g., 10, 20, or 30 years).

Premiums are generally lower than permanent life insurance.

No cash value accumulation; it is pure insurance.

If you outlive the term, the policy expires with no payout unless you convert it or renew it at a higher premium.

Life Insurance Application Process

Applying for a life insurance policy involves several steps, including completing an application form and, in some cases, undergoing a medical exam. Here's a detailed guide on the life insurance application process:

Contact an Insurance Agent or Company

Start by contacting a licensed insurance agent or reaching out directly to an insurance company. They can guide you through the application process and help you choose the right policy based on your needs.

Initial Consultation

Your insurance agent or company representative will conduct an initial consultation. During this conversation, you'll discuss your financial goals, coverage needs, and any existing health conditions.

Application Submission

Complete the life insurance application form provided by the insurance company. The application form will require you to provide personal, financial, and medical information. Be prepared to provide details about your:

Name, address, and contact information.

Date of birth and Social Security number.

Employment and income details.

Beneficiary information (the individuals or entities who will receive the death benefit).

Medical history, including pre-existing conditions, surgeries, and medications.

Lifestyle habits, such as smoking, alcohol consumption, and participation in high-risk activities.

Financial information, including outstanding debts and existing insurance policies.

Disclosure of Information

Be honest and accurate when providing information on the application form. Misrepresentation or omission of material information can lead to a denial of coverage or claims in the future.

Signatures and Authorization

You will need to sign the application form, giving the insurance company permission to access your medical records and conduct underwriting assessments.

Payment Options

When you purchase a life insurance policy, you'll be required to pay regular premiums to keep the policy in force. Premium payment options can vary depending on the insurance company and the specific policy you choose. Here's a detailed guide on how premium payments work and the various payment options available:

Premium Definition

Premiums are the regular payments you make to the insurance company in exchange for the coverage provided by your life insurance policy. These payments ensure that your policy remains active and will pay out the death benefit to your beneficiaries when you pass away.

Payment Frequency

Insurance companies typically offer several payment frequency options, allowing you to choose how often you make premium payments. Common payment frequencies include:

Monthly | Premiums are paid every month |

Quarterly | Premiums are paid every three months |

Semi-Annually | Premiums are paid every six months |

Annually | Premiums are paid once a year |

The choice of payment frequency depends on your budget and preferences. Some individuals prefer to pay annually for convenience, while others may opt for monthly payments for better cash flow management.

Premium Due Date

Your policy will have a specified premium due date. It's essential to make payments on or before this date to ensure that your policy remains in force. Most insurance companies offer a grace period after the due date during which you can make a late payment without the policy lapsing.

Premium Amount

The premium amount is determined by various factors, including your age, gender, health, coverage amount, and the type of policy you have. Premiums may be level (remaining the same throughout the policy term) or may increase over time, particularly in certain types of permanent life insurance.

Policy Reviews

Maintaining your life insurance policy is essential to ensure that it continues to meet your financial goals and provides the necessary protection for your loved ones. Regular policy reviews are a crucial part of this process. Here's a detailed guide on maintaining your life insurance and conducting policy reviews:

Changing Needs: Over time, your financial situation and needs may change. Life events such as marriage, the birth of children, buying a home, or career advancements can impact your coverage requirements.

Economic Changes: Economic conditions and interest rates can affect the performance of certain types of life insurance policies, especially those with a cash value component.

Policy Performance: If you have a permanent life insurance policy, it's important to assess how the policy's cash value is growing and whether it aligns with your financial goals.

Beneficiary Updates: Ensure that your policy's beneficiary information is accurate and up to date. Life events like divorce, marriage, or the birth of children may necessitate beneficiary changes.

Conclusion

Life insurance is a fundamental financial tool that provides peace of mind and security for you and your loved ones. This comprehensive guide has covered various aspects of life insurance, from understanding what it is to choosing the right policy, maintaining it, and answering common questions.