Financial Reporting SWOT Analysis

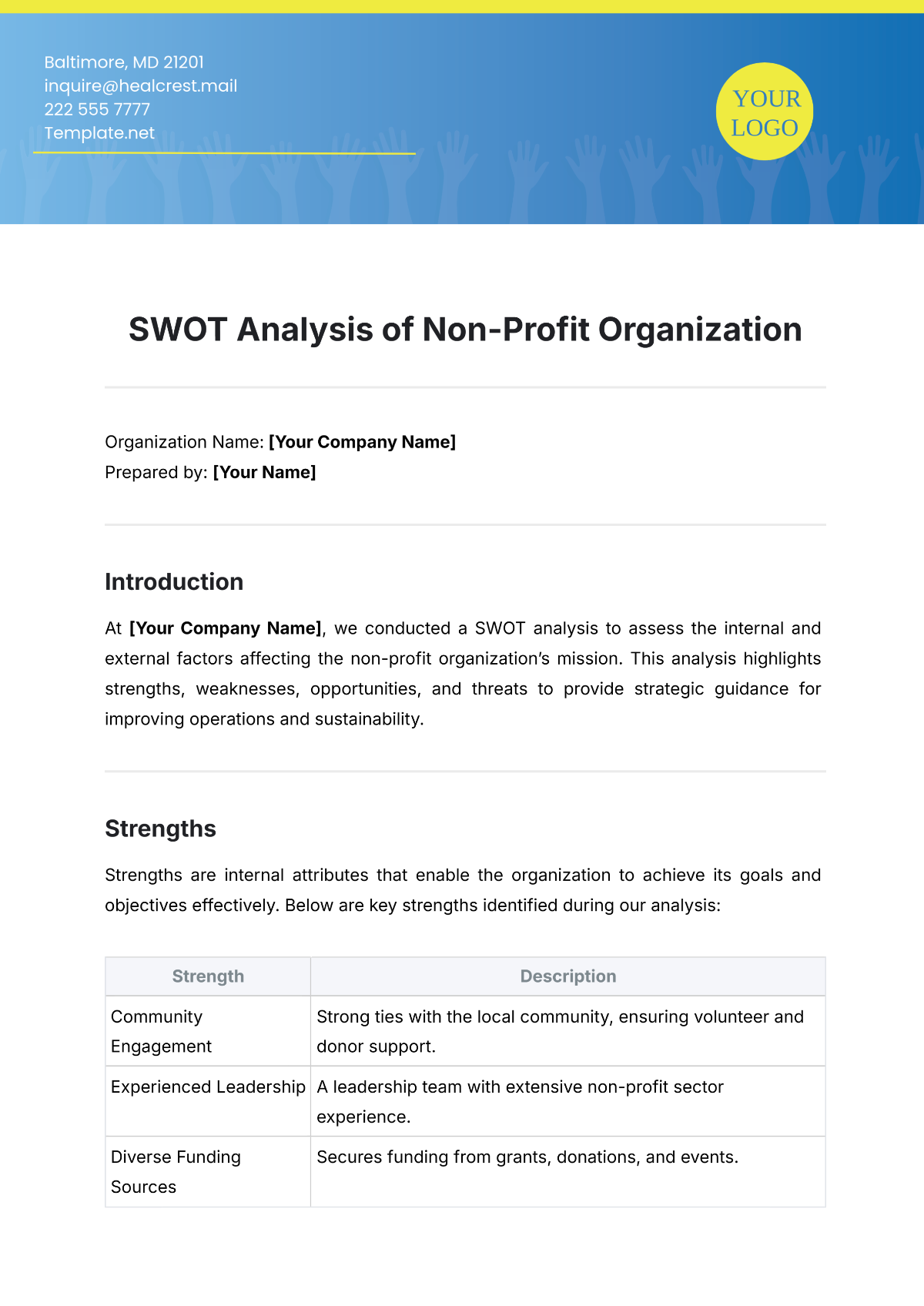

Introduction

Conducting a SWOT analysis of our company's Financial Reporting processes is crucial for strategic planning and improvement. This analysis provides an overview of our strengths, weaknesses, opportunities, and threats. Understanding these aspects is essential for enhancing our financial reporting quality, ensuring compliance with regulatory standards, and staying competitive in the face of technological and economic changes.

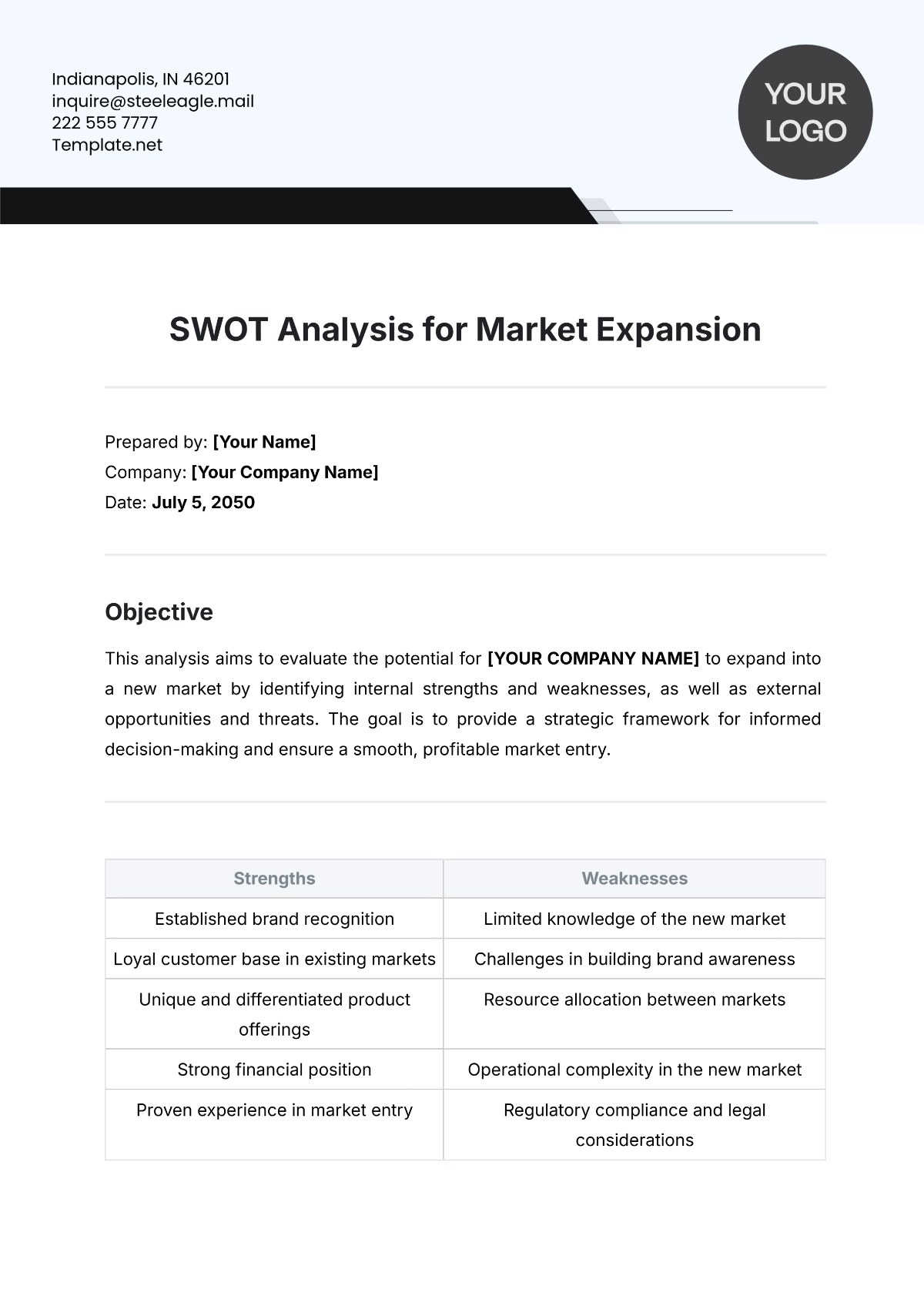

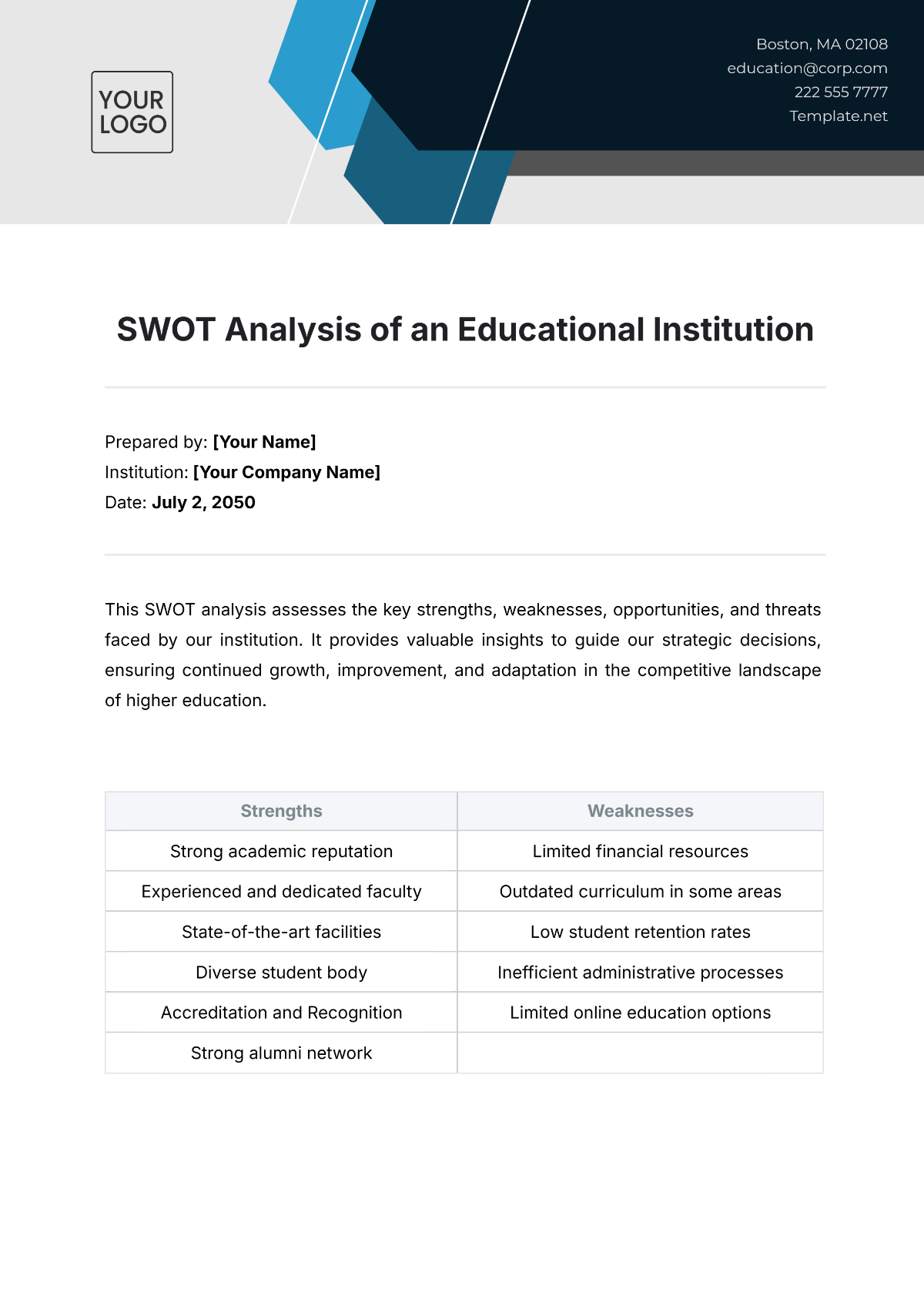

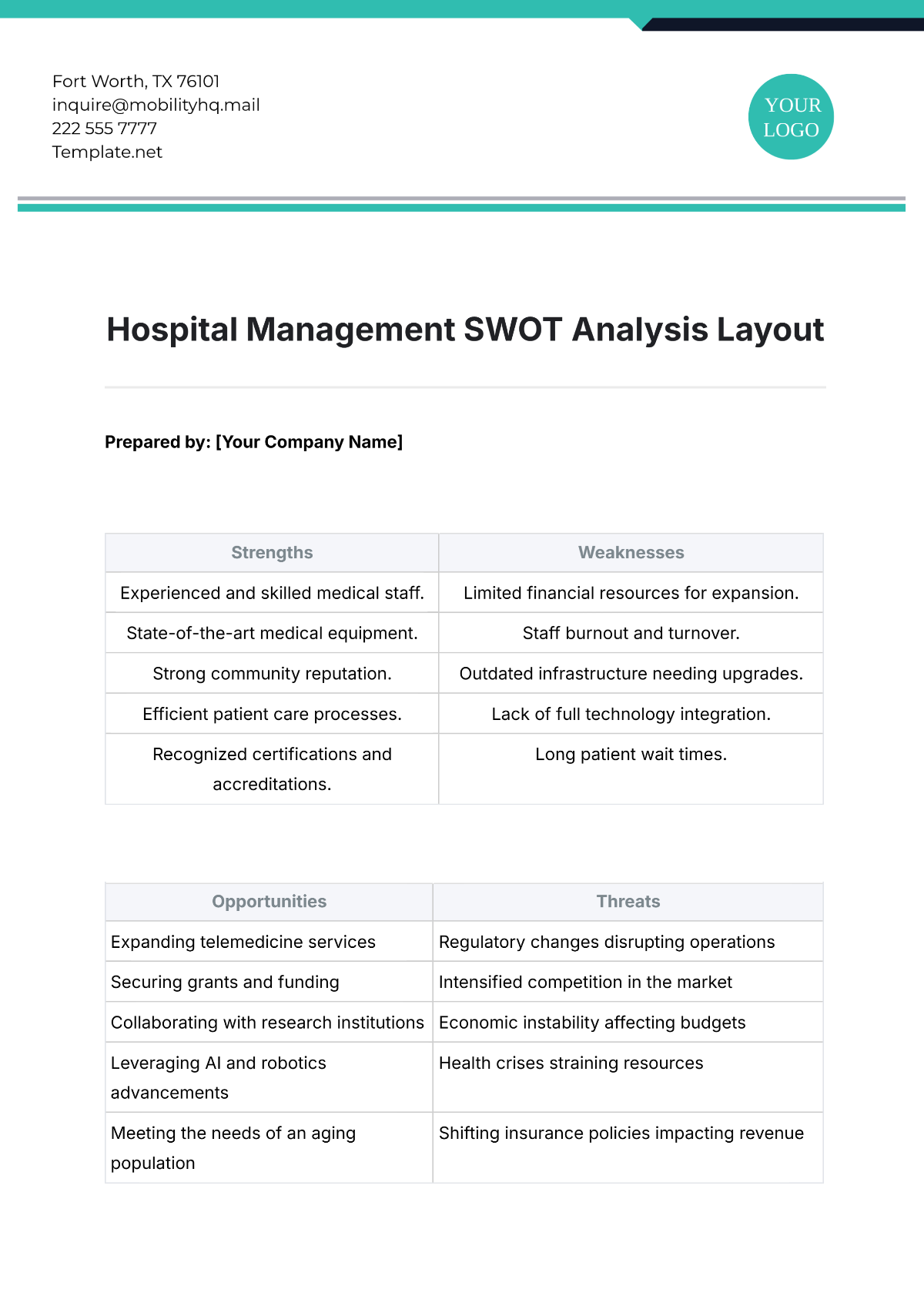

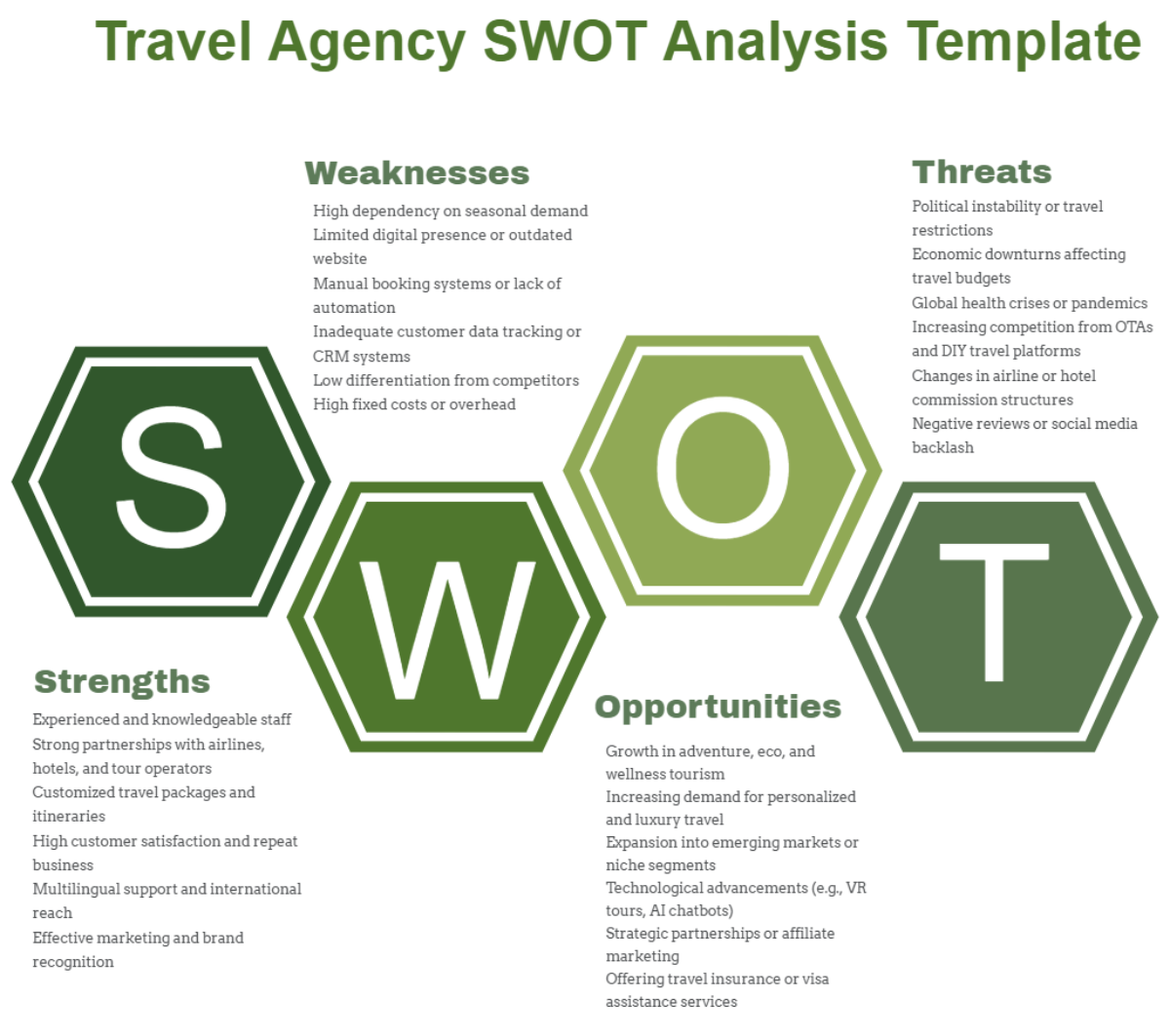

Strengths

Accurate and Timely Reporting

Our financial reporting is renowned for its accuracy and punctuality. This ensures that all stakeholders have access to reliable information, which is crucial for effective decision-making.

Advanced Software Utilization

We use advanced financial software tools that enhance the precision and efficiency of our reports. Below is a table summarizing the key software tools we utilize:

Software Tool | Functionality | Impact on Reporting |

SAP | Comprehensive financial management | Streamlines processes, enhances data integrity |

Oracle Financials | Robust accounting and financial solutions | Ensures accuracy, offers in-depth financial analysis |

IBM Cognos | Business intelligence and performance management | Provides real-time data analysis, improves reporting speed |

Efficient Reporting Process

Our streamlined reporting process guarantees timely report dissemination. The process optimization has led to a significant reduction in the time required for data collection and report generation.

Compliance with Regulatory Standards

Our strict adherence to international and local regulatory standards is a core strength, ensuring minimal legal risks and bolstering our market reputation.

Regular Audits

Regular audits are a key component of our compliance strategy, as shown in the table below:

Audit Type | Frequency | Focus Area |

Internal Audits | Quarterly | Compliance with accounting standards, internal controls |

External Audits | Annually | Adherence to international financial reporting standards (IFRS), local regulations |

Training and Development

Ongoing training and development programs keep our team abreast of the latest standards and best practices.

Strong Financial Analysis and Forecasting

Our reports include detailed financial analysis and forecasts, providing key insights for strategic planning.

Advanced Analytical Techniques

We employ sophisticated models and tools for financial analysis, as detailed in the following table:

Analysis Type | Description |

Revenue and Expense Forecasting | Uses historical data and market trends for accurate predictions |

Cash Flow Analysis | Assesses the liquidity and financial health of the company |

Capital Budgeting | Evaluates the profitability and risk of potential investments |

Stakeholder Communication

Our reports are crafted for clarity and comprehensibility, ensuring effective communication with stakeholders. Regular meetings and discussions foster a transparent and trustful relationship.

Weaknesses

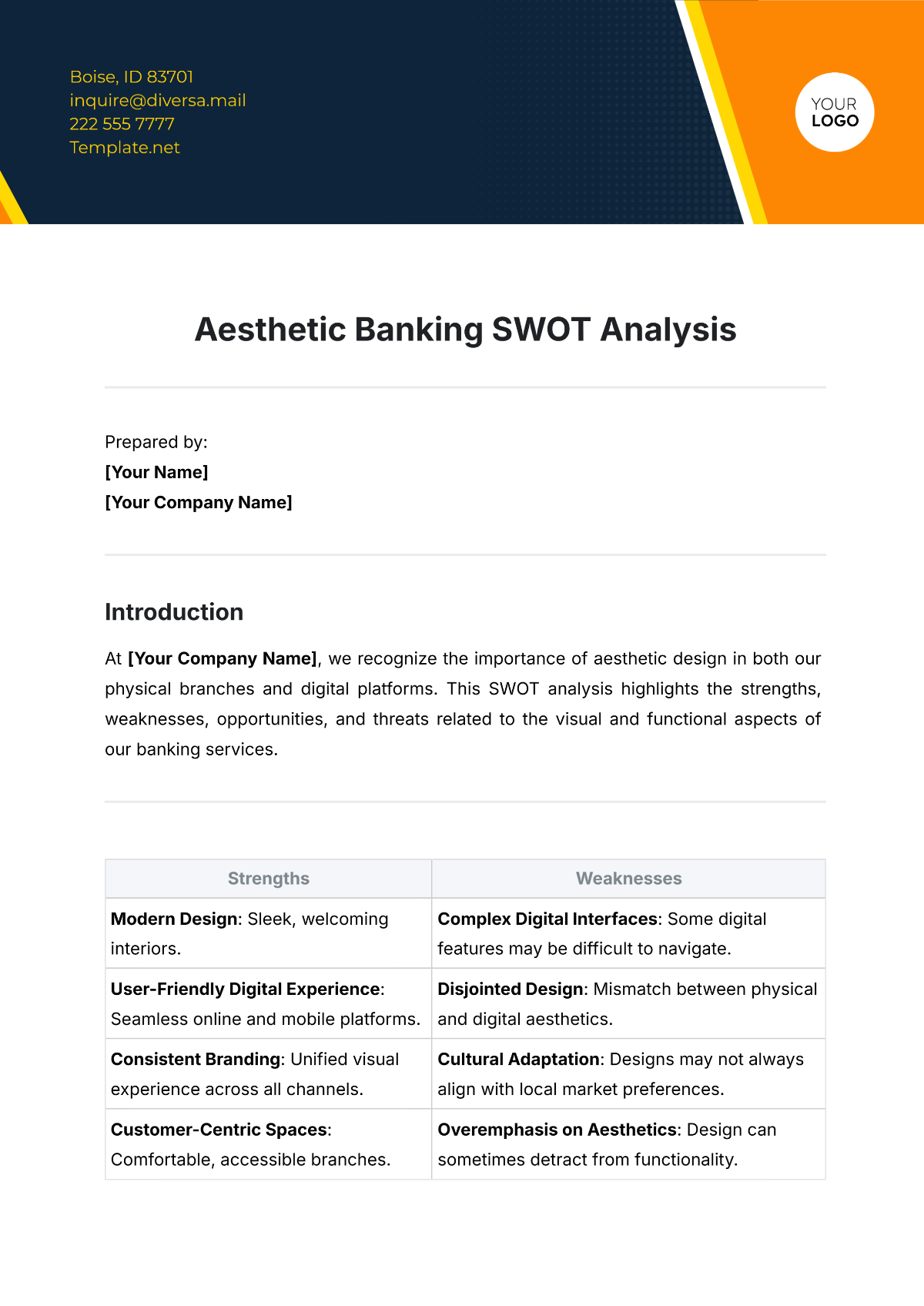

The following table summarizes the main weaknesses and potential improvement actions:

Weakness | Description | Potential Improvement Actions |

Complexity of Reports | Difficult for non-experts to understand | Simplify language, improve data presentation |

Resource Intensiveness | High manpower and time consumption | Automate processes, optimize resource allocation |

Dependence on Specific Software | Over-reliance on certain tools | Diversify software tools, explore alternatives |

Limited Customization | One-size-fits-all reports | Develop customizable templates, assess stakeholder needs |

Data Security Concerns | Risk of data breaches and cyber threats | Implement enhanced security measures, regular audits |

Complexity of Reports

Despite their accuracy and comprehensiveness, our financial reports are often complex and challenging for non-experts to decipher. This complexity can hinder effective communication with some stakeholders.

Technical Jargon: Reports often contain financial terminology and complex calculations that can be confusing for those without a financial background.

Simplification Strategies: There is a need to develop strategies to simplify the presentation of data without losing critical details.

Resource Intensiveness

The process of generating detailed and compliant financial reports is resource-intensive, both in terms of manpower and time.

Manual Processes: Certain aspects of our reporting process are still manual, leading to inefficiencies and increased time consumption.

Automation Opportunities: Exploring automation opportunities in data collection and report generation could significantly reduce the resource intensity.

Dependence on Specific Software Tools

Our reliance on specific financial software tools, while beneficial for report accuracy, creates a dependency that could be problematic in cases of software downtime or obsolescence.

Single-Point Failure Risk: Over-reliance on particular software tools increases the risk of operational disruption in the event of tool failure.

Alternative Solutions: Investigating and integrating alternative or complementary software solutions can mitigate this risk.

Limited Customization for Different Stakeholders

Our financial reports, while comprehensive, lack customization for different stakeholder groups. Different stakeholders may require varying levels of detail and presentation styles.

Stakeholder Needs Assessment: Conducting regular assessments to understand the unique needs of different stakeholder groups.

Custom Report Templates: Developing customizable report templates to cater to the diverse needs of various stakeholders.

Data Security Concerns

In an era of increasing cyber threats, ensuring the security of sensitive financial data involved in reporting is a growing concern.

Vulnerability Assessments: Regular assessments of our IT infrastructure to identify and address potential vulnerabilities.

Data Encryption and Access Control: Strengthening data encryption and implementing stringent access control measures.

Opportunities

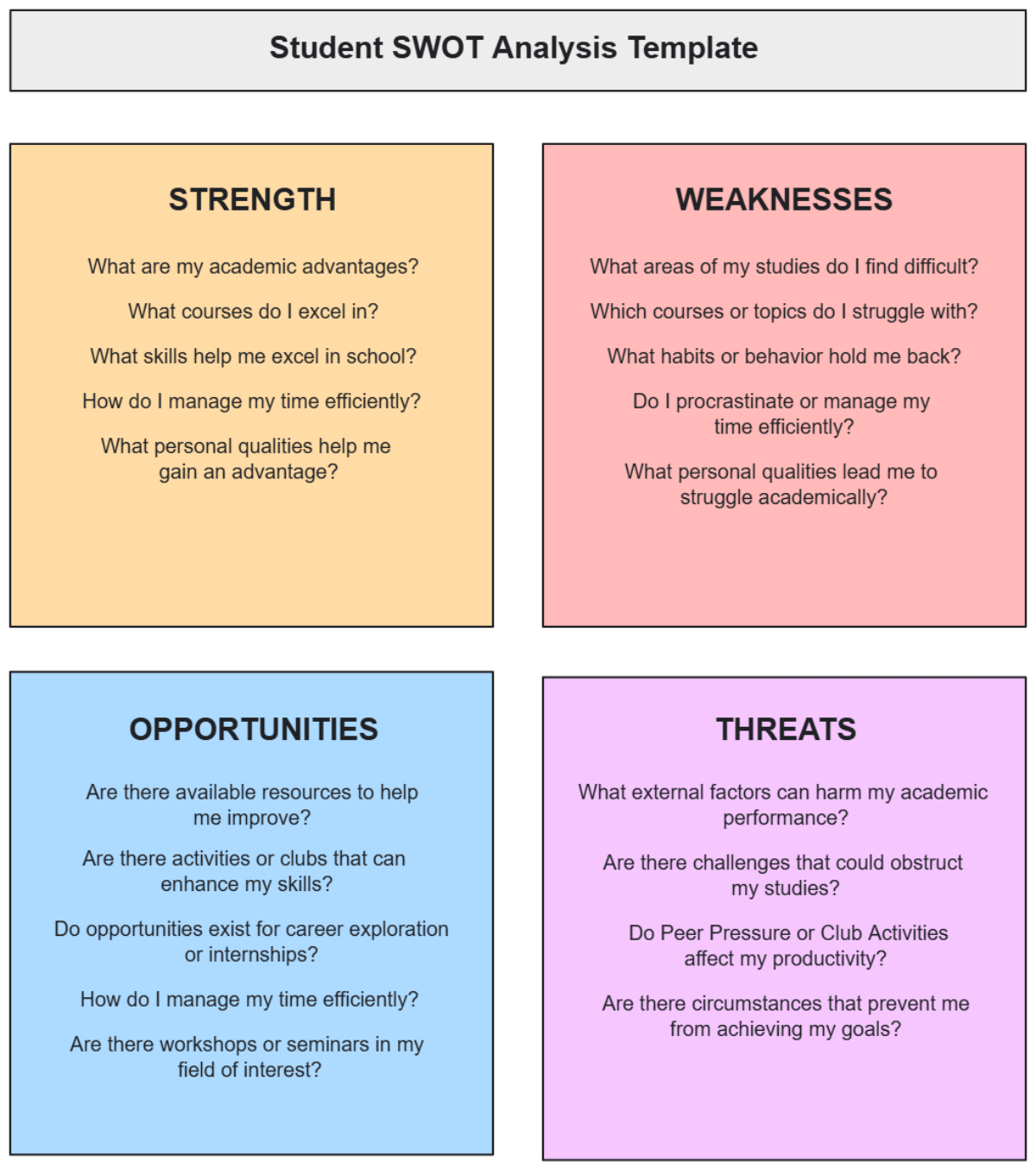

The following table summarizes the main opportunities and potential strategies:

Opportunity | Description | Potential Strategies |

Technological Advancements | Adoption of AI and machine learning | Automate data analysis, improve report efficiency |

Expanding Regulatory Compliance | Adapting to changing regulations | Ongoing training, use compliance as a market differentiator |

Adoption of Cloud-Based Solutions | Utilizing cloud technology for reporting | Enhance accessibility and scalability, reduce costs |

Enhancing Stakeholder Engagement | Improving report interactivity and accessibility | Use digital platforms, gather stakeholder feedback |

Sustainability Reporting | Integrating ESG factors into reports | Position as a market differentiator, appeal to conscious investors |

Technological Advancements

The field of financial reporting is rapidly evolving with technological innovations. Embracing these advancements presents significant opportunities for improving our reporting processes and outputs.

Expanding Regulatory Compliance

The constantly changing landscape of financial regulations offers an opportunity to establish our company as a leader in compliance and set new industry standards.

Adoption of Cloud-Based Solutions

Moving towards cloud-based financial reporting systems can enhance accessibility, scalability, and collaboration across the organization.

Enhancing Stakeholder Engagement

There is a significant opportunity to enhance engagement with stakeholders through more interactive and user-friendly reporting formats.

Sustainability Reporting

As corporate responsibility and sustainability become increasingly important, there is an opportunity to integrate sustainability reporting into our financial reports.

Incorporation of ESG Factors: Including environmental, social, and governance (ESG) factors in our reporting to provide a more holistic view of our company's performance.

Market Differentiation: Leveraging sustainability reporting as a means to differentiate in the market and appeal to socially conscious investors.

Threats

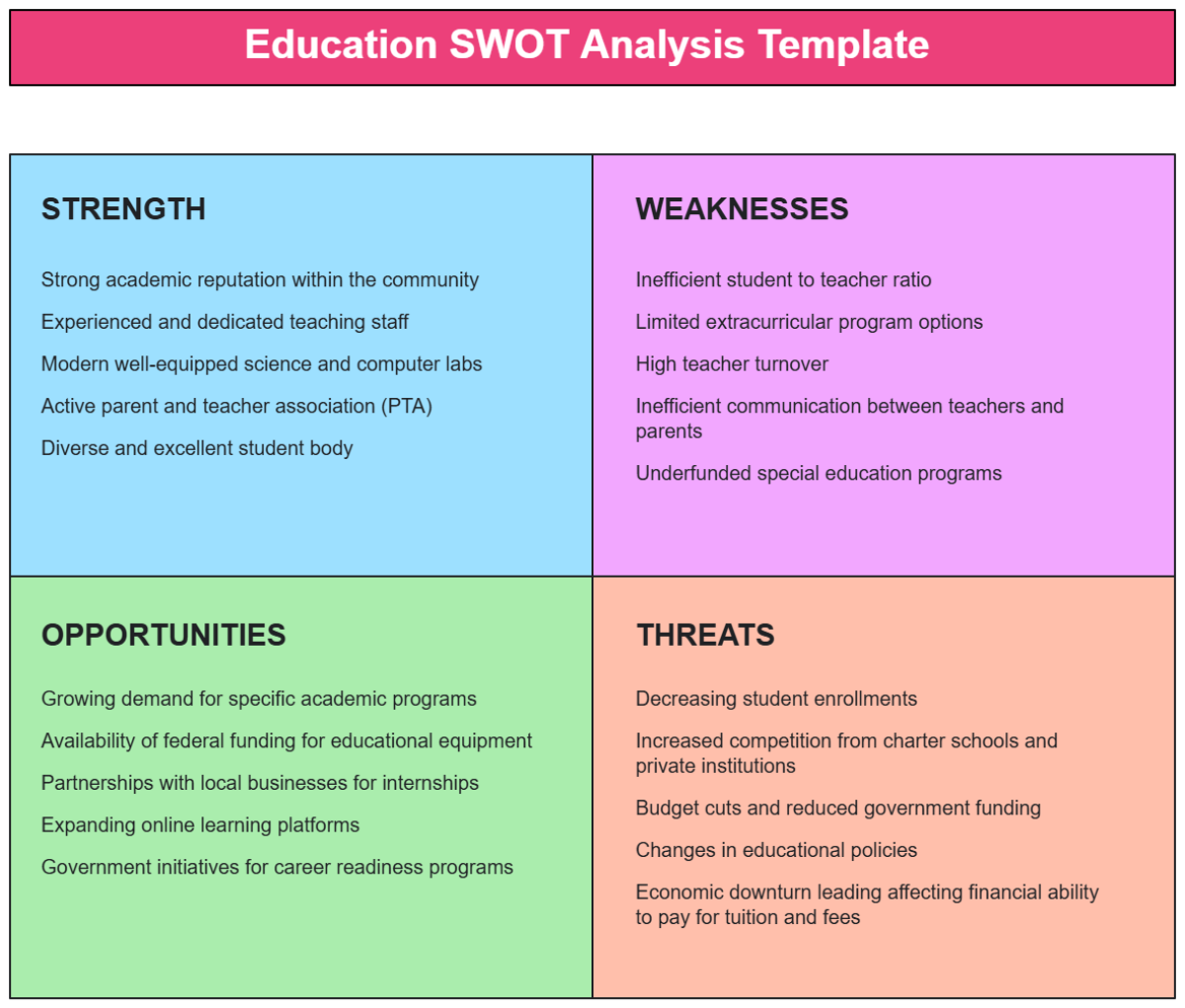

The following table summarizes the main threats and potential mitigation strategies:

Threat | Description | Mitigation Strategies |

Evolving Regulatory Standards | Frequent changes in regulations | Stay updated, allocate resources for compliance |

Technological Disruption | New tech disrupting traditional methods | Invest in technology and training, embrace innovation |

Cybersecurity Risks | Increased risk of data breaches | Implement strong cybersecurity measures, conduct audits |

Economic Volatility | Uncertainty impacting forecasts and risks | Develop diverse economic scenarios, diversify revenue |

Competition in Financial Reporting | Increasing quality and innovation competition | Benchmark, innovate, and tailor reports |

Evolving Regulatory Standards

The rapidly changing standards of international accounting and financial reporting standards presents a significant challenge. Staying compliant with these evolving standards is essential but demanding.

Technological Disruption

The financial sector is increasingly influenced by technological innovations. New fintech solutions and reporting technologies could potentially disrupt traditional financial reporting methods.

Cybersecurity Risks

As financial reporting becomes more reliant on digital technologies, the risk of cyber threats increases. Protecting sensitive financial data is paramount.

Economic Volatility

Economic uncertainty and volatility can impact financial reporting, especially in terms of forecasting and risk assessment.

Scenario Analysis: Developing multiple financial scenarios to prepare for various economic conditions.

Diversification Strategies: Diversifying investments and revenue streams to mitigate the impact of economic downturns.

Competition in Financial Reporting

As more companies invest in improving their financial reporting, the competition in terms of reporting quality and innovation increases.

Benchmarking and Innovation: Regularly benchmarking against industry leaders and innovating our reporting processes to stay competitive.

Tailored Reports: Creating more tailored, user-friendly reports to stand out in the market.

Conclusion

The SWOT analysis of our company's Financial Reporting has provided valuable insights into our current standing and potential areas for growth and improvement. Our strengths like accurate and timely reporting, compliance with regulatory standards, and strong financial analysis lay a solid foundation. However, addressing weaknesses such as report complexity and resource intensiveness is essential for further progress.

Opportunities in technological advancements, regulatory compliance, and stakeholder engagement present pathways for innovation and improvement. Meanwhile, threats like evolving regulatory standards, technological disruptions, and cybersecurity risks require vigilant management and strategic planning. By proactively addressing these areas, we can enhance our financial reporting processes, maintain compliance, and strengthen our position in the industry.

Finance Templates @ Template.net