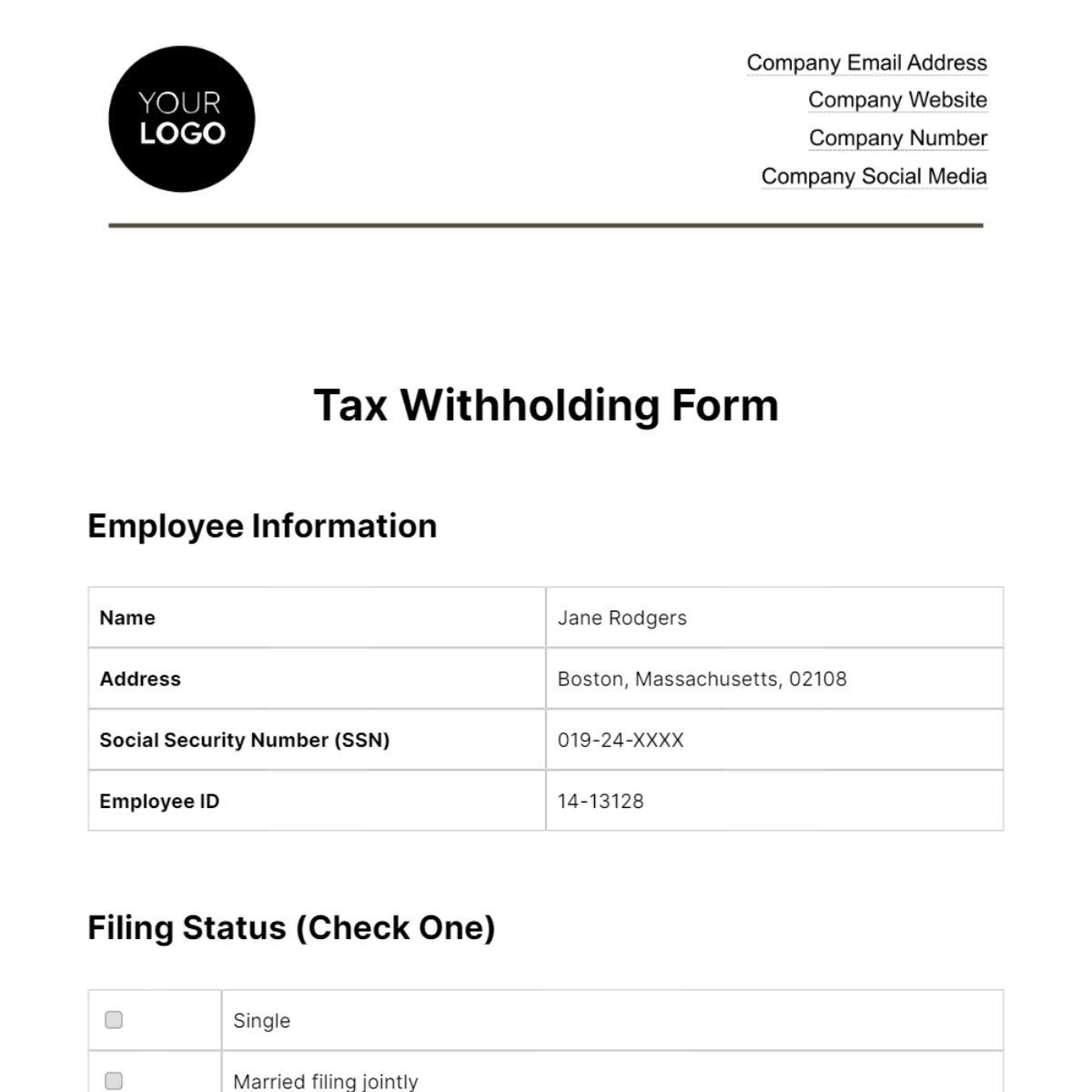

Tax Withholding Form

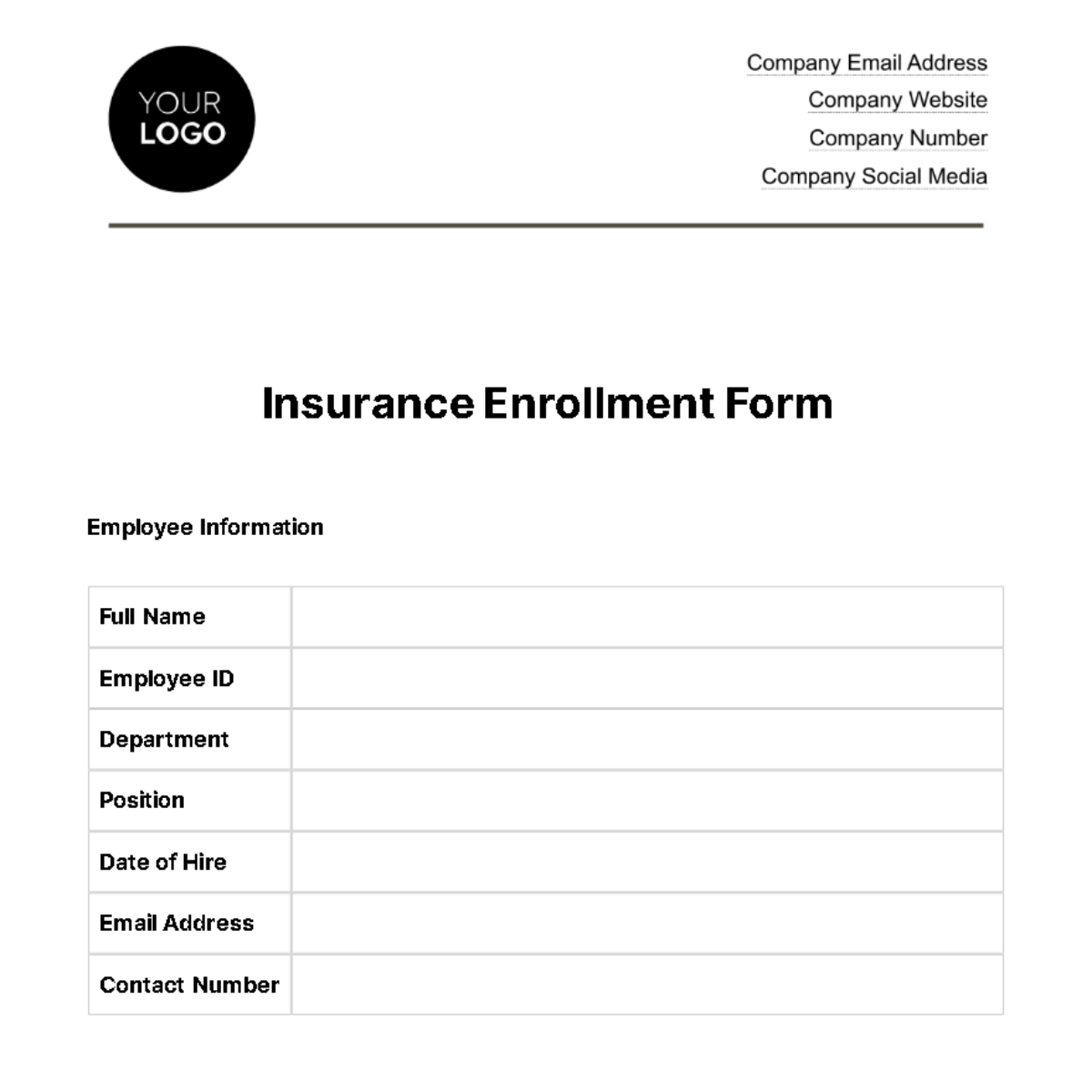

Employee Information

Name | Jane Rodgers |

Address | Boston, Massachusetts, 02108 |

Social Security Number (SSN) | 019-24-XXXX |

Employee ID | 14-13128 |

Filing Status (Check One)

Single | |

Married filing jointly | |

Married filing separately | |

Head of household | |

Qualifying widow(er) with dependent child |

Number Of Allowances (Enter the number of allowances you are claiming):

3 allowances

Additional Withholding (Optional)

If you want to request additional withholding, please specify the additional amount per pay period: [Amount]

Exemption From Withholding (If applicable)

I claim exemption from withholding because I had no tax liability last year and expect none this year. (If you meet these conditions, write "Exempt" here: )

[Signature]

Date: [MM/DD/YYYY]

Employee's Certification

I [Employee Name] certify that the information provided on this form is accurate to the best of my knowledge, and I understand that providing false information may result in penalties.

[Signature]

Date: [MM/DD/YYYY]

Employer Use Only

Tax Filing Status: | Married filing separately |

Number of Allowances Claimed: | |

Additional Withholding: |

[Signature]

Date: [MM/DD/YYYY]

Please return this completed form to the Payroll Department by [Month Day, Year]. If you have any questions or need assistance, please contact the HR Department.

[Your Company Name]

[Your Company Address]

[Your Company Number]

[Your Company Email]

[Your Company Website]