Free Account Financial Planning Document

In the upcoming fiscal year, our organization aims to achieve financial stability, growth, and sustainability. This comprehensive financial planning document outlines key strategies to optimize revenue, manage expenses, and make informed investment decisions, ensuring alignment with our mission and vision.

Financial Goals and Objectives

Financial Goals

Increase Revenue: Implement targeted marketing campaigns and explore new customer segments to achieve a [x]% increase in overall revenue.

Expense Reduction: Streamline operational processes, negotiate favorable contracts with suppliers, and implement cost-saving technologies to realize a [x]% reduction in operating expenses.

Net Profit Margin: Enhance operational efficiency and implement cost controls to achieve a net profit margin of [x]%.

Objectives

Product Innovation: Launch two new products in response to market demands, contributing to revenue growth and market expansion.

Market Expansion: Develop strategies to enter new geographical markets and increase market share by [x]% through targeted marketing initiatives.

Customer Retention: Introduce a customer loyalty program to improve retention rates by providing added value and personalized services.

Revenue Forecasting

Analysis

Product Sales: Analyze historical sales data and market trends to project a [x]% increase in product sales through the introduction of innovative features and targeted marketing.

Subscription Revenue: Utilize customer feedback and market research to forecast a [x]% growth in subscription revenue through the introduction of enhanced subscription packages.

Licensing: Explore new licensing opportunities and partnerships to diversify revenue streams and mitigate dependence on a single source.

Opportunities

Strategic Partnerships: Identify potential partners for joint ventures or collaborations to tap into new markets and customer bases.

Upselling: Develop upselling strategies to encourage existing customers to upgrade their subscriptions, thereby increasing average transaction values.

Market Expansion: Investigate opportunities for entering emerging markets or niche segments to diversify and expand revenue sources.

Expense Planning

Budget Allocation Table

Expense Category

Budget Allocation ($)

% of Total Budget

Research and Development

$[x]

[x]%

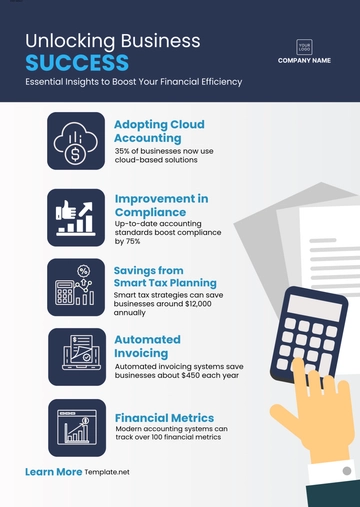

Cost-saving: Implement technology solutions to streamline operations, reducing overall operational costs. Initiatives include the adoption of cloud-based tools to optimize workflow, reducing manual processes, and investing in energy-efficient technologies to cut utility expenses. These measures aim to achieve a targeted [x]% reduction in overall operating expenses, contributing to improved profitability.

Capital Budgeting

Investments: Allocate funds for upgrading IT infrastructure and launching a new marketing campaign. The IT infrastructure upgrade is budgeted at $[x] to enhance system capabilities, security, and overall efficiency. The marketing campaign, with a budget of $[x], will focus on digital platforms, influencer partnerships, and targeted advertising to expand market reach and drive product awareness.

Impact: Anticipate a [x]% increase in productivity and a [x]% growth in customer acquisition through strategic capital investments. The IT infrastructure upgrade is projected to increase operational efficiency, resulting in a productivity boost. The marketing campaign aims to elevate brand visibility, capturing a larger share of the market and contributing to the overall growth targets. These capital investments align with the organization's strategic goals for the fiscal year.

Cash Flow Management

Projections: Monthly cash flow projections have been meticulously prepared to provide a clear understanding of the expected inflows and outflows. This involves detailed assessments of accounts receivable, accounts payable, and other cash-related transactions. The projections are crucial for maintaining a healthy cash flow position, allowing the organization to meet its financial obligations and seize strategic opportunities.

Strategies: In order to ensure positive cash flow, we are implementing several strategic measures. Negotiating favorable payment terms with suppliers will help extend payment deadlines, providing more flexibility in managing cash outflows. Additionally, the establishment of a cash reserve will act as a financial buffer, mitigating the impact of unexpected expenses or fluctuations in revenue. These strategies aim to enhance liquidity and foster financial resilience.

Risk Management

Risks: A comprehensive risk assessment has been conducted to identify potential challenges and uncertainties that may impact the organization's financial stability. This includes analysis of economic trends, geopolitical factors, and supply chain vulnerabilities. Understanding these risks is crucial for developing effective risk management strategies.

Mitigation: To mitigate identified risks, the organization is implementing proactive measures. Diversification of suppliers is being pursued to reduce dependency on a single source and minimize supply chain disruptions. Additionally, maintaining a financial buffer allows for swift responses to unforeseen events. The organization is committed to continuous monitoring and adjustment of risk management strategies to adapt to changing circumstances and ensure long-term financial sustainability.

Investment Strategy

Analysis: In-depth analysis of potential investment opportunities will involve evaluating emerging technologies, market trends, and the competitive landscape. This includes assessing the risk-return profile of each investment to ensure alignment with the organization's risk tolerance and long-term objectives.

Diversification: Recognizing the importance of diversification, the investment strategy will encompass spreading investments across different asset classes, industries, and geographical regions. This approach aims to mitigate risks associated with concentration and optimize the overall portfolio's resilience to market fluctuations.

Monitoring and Evaluation: A robust monitoring and evaluation framework will be established to track the performance of investments against predetermined benchmarks. Regular reviews will allow for timely adjustments, ensuring the portfolio remains aligned with dynamic market conditions and organizational goals.

Debt Management

Assessment: A thorough assessment of existing debts will involve analyzing interest rates, repayment terms, and overall debt levels. This evaluation will provide insights into opportunities for refinancing or consolidating debts, potentially reducing interest expenses and optimizing the overall debt structure.

Reduction: A strategic debt reduction plan will be formulated, emphasizing a balance between debt repayment and maintaining financial flexibility. This may involve prioritizing higher-interest debts for early repayment while considering the organization's cash flow and liquidity requirements.

Responsible Debt Management: The organization will adopt a responsible approach to debt management, ensuring that any new debt incurred aligns with strategic initiatives and provides a positive return on investment. The goal is to leverage debt as a tool for growth while minimizing unnecessary financial burdens.

Financial Reporting and Analysis

Reporting Procedures:

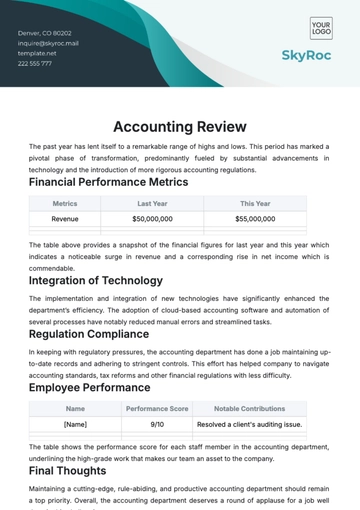

Monthly Financial Reports: Detailed reports outlining revenue, expenses, and key financial metrics on a monthly basis.

KPI Tracking: Monitor key performance indicators, such as customer acquisition cost, customer lifetime value, and return on investment.

Analysis:

Trend Identification: Conduct thorough analysis to identify trends in revenue, expenses, and overall financial performance.

Variance Analysis: Regularly compare actual financial results to budgeted figures, investigating and explaining any significant variances.

Forecasting:

Rolling Forecasts: Implement a rolling forecast model to continuously update projections based on current financial trends.

Scenario Analysis: Conduct scenario analysis to assess the impact of different economic conditions on financial outcomes.

Communication:

Internal Communication: Regularly communicate financial updates to all relevant departments, ensuring alignment with organizational goals.

Decision Support: Provide financial insights to support decision-making across departments, fostering a data-driven culture.

Contingency and Emergency Planning

Contingency Plans:

Scenario Identification: Identify potential scenarios that could impact the organization, such as economic downturns, supply chain disruptions, or changes in regulations.

Response Strategies: Develop detailed contingency plans for each identified scenario, outlining specific actions to be taken in response.

Emergency Fund:

Purpose: Establish a dedicated emergency fund to address immediate financial needs in unforeseen circumstances.

Fund Allocation: Allocate a percentage of the budget to the emergency fund, with clear guidelines on when and how to utilize these resources.

Crisis Communication:

Communication Plan: Develop a comprehensive communication plan to address stakeholders in the event of a crisis.

Transparency: Maintain open and transparent communication with internal and external stakeholders to build trust and manage expectations.

Regular Review:

Continuous Monitoring: Regularly monitor the effectiveness of contingency plans, updating them as needed based on changes in the business environment.

Learning from Experience: Conduct post-crisis reviews to learn from experiences and improve future contingency planning.

Insurance and Risk Mitigation:

Insurance Coverage: Ensure appropriate insurance coverage for potential risks, minimizing financial exposure.

Risk Mitigation Strategies: Continuously assess and implement strategies to mitigate identified risks, reducing the likelihood and impact of potential crises.

Communication Strategy

Internal Communication:

Monthly Financial Meetings: Conduct monthly financial meetings with department heads to review budget performance, discuss any challenges, and align strategies.

Team Training: Provide financial literacy training sessions for all employees to enhance understanding of financial goals and the impact of their roles on the organization's financial health.

Open Feedback Channels: Establish open channels for employees to share ideas, concerns, and suggestions related to financial planning, fostering a collaborative culture.

External Communication:

Quarterly Investor Reports: Prepare detailed quarterly reports for investors, outlining financial performance, key achievements, and future plans.

Stakeholder Updates: Regularly communicate with key stakeholders, including clients, suppliers, and partners, to maintain transparency and address any concerns promptly.

Annual General Meeting: Host an annual general meeting to provide a comprehensive overview of the financial strategy, inviting stakeholders to engage in discussions and ask questions.

Conclusion

Summary: In conclusion, this financial planning document serves as a comprehensive guide for [Your Company Name], outlining strategic financial goals and plans for the upcoming fiscal year. The outlined strategies are designed to enhance financial performance, foster sustainability, and position the organization for long-term success.

Adaptability and Continuous Improvement: Acknowledge the dynamic nature of the business environment and emphasize the need for adaptability. Encourage a culture of continuous improvement, where feedback is actively sought and implemented to refine financial strategies as the fiscal year progresses.

Collaboration and Feedback: Emphasize the importance of collaboration among different departments and teams to achieve financial goals collectively. Invite feedback from all stakeholders, fostering a collaborative environment that ensures diverse perspectives contribute to the organization's financial success. Regularly solicit input through surveys, town hall meetings, and other forums to gather insights for ongoing improvement.

Forward-Looking Vision: Conclude with a forward-looking vision, expressing the organization's commitment to financial prudence, innovation, and growth. Reinforce the idea that effective financial planning is a shared responsibility, and by working together, the organization can navigate challenges and capitalize on opportunities in the ever-evolving business landscape.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your financial strategy with Template.net's Account Financial Planning Document Template. This editable and customizable tool ensures precision in tailoring financial plans to your organization's needs. Utilize our online AI Editor Tool to effortlessly modify and adapt the document, empowering you to navigate fiscal challenges with ease. Start now!