Free Merit Pay Compliance Document HR

Purpose

This document outlines the guidelines and procedures for the administration of the Merit Pay Program at [Your Company Name]. It is essential to ensure that merit pay decisions are made in compliance with all applicable laws and regulations. This document serves as a reference guide for HR managers, supervisors, and employees involved in the merit pay process.

Introduction

Merit pay is a key component of our compensation strategy at [Your Company Name]. It is designed to recognize and reward employees for their outstanding performance, contributions, and achievements within the organization. The purpose of this document is to ensure that merit pay decisions are made fairly, consistently, and in accordance with legal requirements.

Eligibility

All regular full-time and part-time employees of [Your Company Name] are eligible for consideration for merit pay. Temporary, contract, and intern employees are not eligible for merit pay.

Merit Pay Allocation Process

Merit pay decisions are made based on the following principles:

Performance Evaluation: Merit pay decisions are closely tied to the performance evaluation process. Employees' performance is evaluated annually, and these evaluations serve as the basis for merit pay recommendations.

Performance Ratings: Merit pay is determined based on performance ratings assigned during the performance appraisal process. Performance ratings are communicated to employees during the annual performance review.

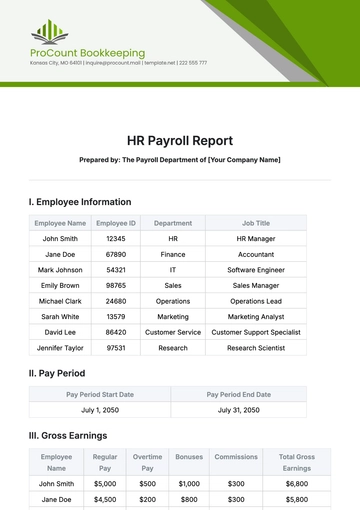

Merit Pay Budget: The total merit pay budget is determined by the organization's financial performance and compensation strategy. It is typically a percentage of the company's payroll expenses.

Individual Merit Awards: Individual merit pay awards are determined based on the employee's performance rating and their position within the salary range for their job.

Supervisor Recommendations: Supervisors provide recommendations for merit pay increases for their respective team members based on their performance evaluations.

Merit Pay Distribution

Merit pay increases are typically distributed once a year, following the completion of the annual performance review process. The following guidelines are followed:

Budget Allocation: The HR department and senior management determine the total merit pay budget for the organization.

Allocation of Budget: The HR department works with supervisors to allocate the merit pay budget among different departments and teams based on performance ratings and organizational priorities.

Merit Pay Notification: Employees are informed of their merit pay increase in writing, typically during their performance review discussion.

Compliance with Legal Requirements

[Your Company Name] is committed to complying with all applicable federal, state, and local laws and regulations related to merit pay and compensation. This includes, but is not limited to:

Equal Pay Act: Ensuring that employees performing substantially similar work are compensated equally, regardless of gender.

Fair Labor Standards Act (FLSA): Complying with minimum wage and overtime pay requirements.

Age Discrimination in Employment Act (ADEA): Prohibiting age-based discrimination in merit pay decisions.

Title VII of the Civil Rights Act: Prohibiting discrimination based on race, color, religion, sex, or national origin in merit pay decisions.

Appeals Process

Employees who believe that their merit pay increase is not in line with their performance evaluation or violates company policies may utilize the company's established grievance and appeals process to seek resolution.

Confidentiality

All merit pay decisions are confidential and should not be discussed with other employees. This information is shared on a need-to-know basis only.

Document Retention

All documentation related to merit pay decisions, including performance evaluations and merit pay recommendations, should be retained in accordance with the company's record retention policies.

Review and Updates

This Merit Pay Compliance Document will be reviewed periodically to ensure its continued relevance and compliance with laws and regulations. Any updates or revisions will be communicated to all relevant parties.

By signing below, you acknowledge that you have read and understand this Merit Pay Compliance Document and agree to comply with its provisions.

I, [Ruth Kindle], acknowledge that I have read and understand the Merit Pay Compliance Document and agree to comply with its provisions.

Signature: ___________________________

Date: [October 1, 2050]

I, [Your Name], confirm the acknowledgment of the employee and certify that they have received and understood the Merit Pay Compliance Document.

Signature: ___________________________

Date: [October 1, 2050]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure adherence to merit pay policies with the Merit Pay Compliance Document HR Template available on Template.net. This editable and customizable template, accessible in our Ai Editor Tool, simplifies the process of outlining and communicating merit-based compensation guidelines within your organization. Maintain transparency and consistency in reward allocation while aligning with regulatory requirements effortlessly.