Startup Financial Audit Protocol

I. Introduction

A. Purpose of the Protocol

At [Your Company Name], the primary goal of our Financial Audit Protocol is to provide a structured framework for conducting meticulous financial audits tailored to our specific operations. By adhering to these guidelines, we aim to achieve a thorough scrutiny of our financial records, fostering a comprehensive evaluation of our fiscal health. This process is integral for instilling confidence in our stakeholders, including investors, creditors, and regulatory bodies.

B. Clarity and Accessibility

Designed with the unique dynamics of [Your Company Name] in mind, our protocol places a strong emphasis on clarity and accessibility. The structure is crafted to offer clear and concise directions, ensuring that auditors and stakeholders involved in the financial audit process have a seamless and transparent experience. This clarity aims to reduce the likelihood of misunderstandings and to facilitate a smoother audit process.

C. Predictability and Risk Mitigation

By following our tailored protocol, [Your Company Name] introduces a heightened level of predictability into our financial audit processes. This standardized approach allows us to anticipate the steps involved, minimizing uncertainties and mitigating the risks associated with potential financial oversights. Predictability is a cornerstone in fostering trust and credibility among our stakeholders.

D. Framework for Consistency

At [Your Company Name], our protocol establishes a robust framework that ensures reliability and consistency in our financial audits. This consistency is crucial for benchmarking and comparing financial performance within our organization. It enables stakeholders to make well-informed decisions based on standardized information, promoting a fair and equitable evaluation of [Your Company Name]'s financial health.

II. Preparation for the Audit

A. Document Gathering

General Ledger

Collate the comprehensive general ledger, encompassing all financial transactions recorded during the specified audit period. This serves as the foundational document for the auditor's scrutiny.

Trial Balance

Assemble the trial balance, meticulously confirming its accuracy and completeness. This document is critical in providing an overview of the company's financial standing.

Financial Statements

Gather all pertinent financial statements, including the Balance Sheet, Income Statement, and Cash Flow Statement, for the designated audit period. These statements offer a holistic view of the company's financial performance.

Tax Return Records

Ensure access to up-to-date tax return records, facilitating a comprehensive examination of the company's compliance with tax regulations. This step is crucial for regulatory adherence.

Third-Party Contracts

Compile all contracts with external entities, providing the auditor with insights into financial obligations, commitments, and potential impacts on the company's financial health.

Banking Information

Provide detailed banking information, including statements and transaction records. This enables to assess cash flows, verify financial transactions, and gain a nuanced understanding of the company's financial liquidity.

B. Understanding Business Operations

Type, Size, and Industry Specifics

Familiarize the company's specific characteristics, including its type, size, and industry specifics. This contextual information shapes the approach to the unique aspects of the company.

Business Processes

Illuminate the day-to-day business operations, highlighting key processes relevant to financial transactions. This insight enables the auditor to align their examination with the company's operational intricacies.

Internal Controls:

Share comprehensive information on existing internal controls. This includes details on asset management, debt management, and income and expenditure processes. This understanding allows the auditor to tailor their scrutiny to critical areas of financial oversight.

C. Communication Protocols

Point of Contact

Designate a primary point of contact for the auditor, streamlining communication channels and ensuring efficient resolution of any queries that may arise during the audit process.

Timeline Expectations

Communicate clear timelines for the audit process, fostering alignment between the company and auditor's expectations. This ensures a structured and timely completion of the audit.

Access to Personnel

Facilitate access to key personnel for the auditor. This includes individuals responsible for financial processes, transactions, and decision-making. In-depth discussions with these personnel enhance understanding of the company's financial intricacies.

III. Internal Control System Evaluation

The following diagram delineate the meticulous evaluation process:

A. Asset Management Assessment

The first step involves a detailed examination of [Your Company Name]'s asset management procedures. This encompasses assessing how assets are acquired, utilized, and disposed of, ensuring that controls are implemented to safeguard against potential mismanagement or unauthorized use. The evaluation aims to guarantee the accuracy of asset records and adherence to established protocols.

B. Debt Management Review

Moving forward, the audit protocol scrutinizes the company's debt management processes. This step involves a thorough review of how debts are incurred, recorded, and managed. The focus is on ensuring the existence of controls that mitigate the risk of discrepancies and errors in debt-related transactions, thereby fostering accuracy and compliance.

C. Income Process Evaluation

The third step centers around reviewing the processes associated with income generation. This includes a comprehensive assessment of controls governing revenue recognition, sales transactions, and cash receipts. The objective is to ensure that these controls are designed to guarantee accuracy and compliance with prevailing accounting standards.

D. Expenditure Process Examination

Continuing the evaluation, this step involves an in-depth examination of processes related to expenditures. This encompasses scrutinizing purchase approvals, invoice processing, and payment disbursement. The aim is to ensure that internal controls are robust, preventing potential fraud, errors, and guaranteeing proper authorization for expenditures.

E. Internal Policies Validation

The penultimate step focuses on validating the effectiveness of internal policies governing financial processes. This involves assessing the design, communication, and consistent application of these policies throughout the organization. By ensuring the alignment of internal policies with industry best practices, [Your Company Name] aims to enhance the overall efficacy of its internal control environment.

F. Documentation of Control Weaknesses

The final step involves the identification and documentation of any weaknesses or gaps in the internal control system. This comprehensive evaluation recognizes areas where controls may be lacking or require enhancement to fortify [Your Company Name]'s financial processes. This documentation serves as a foundation for implementing corrective measures and strengthening the organization's overall financial control landscape.

IV. Transaction Testing

A. Source Documentation Review

Comprehensive Examination

Conduct a comprehensive review of all source documentation associated with financial transactions. This encompasses invoices, receipts, contracts, and any other relevant documents supporting the recorded financial entries.

Verification of Authenticity

Rigorously validate the authenticity of source documents to guarantee that the recorded transactions are legitimate, reflecting the actual financial activities undertaken by the company.

B. Mathematical Accuracy Validation

Arithmetic Precision

Scrutinize the mathematical accuracy of financial transactions, ensuring that calculations are precise, error-free, and align with the company's accounting principles.

Reconciliation Checks

Perform meticulous reconciliation checks between source documents and recorded entries to promptly identify and rectify any discrepancies, maintaining the integrity of the financial data.

C. Verification of Posting Accuracy

Appropriate Account Allocation

Confirm the accuracy of posting by verifying that financial entries are correctly allocated to the appropriate accounts within the general ledger. This ensures a precise representation of the financial landscape.

Cross-Referencing

Cross-reference posted transactions with source documents, adding an additional layer of scrutiny to ensure the correctness of recorded entries and identify any anomalies.

D. Compliance with Accountancy Standards

Adherence to Standards

Scrutinize each transaction against accepted accountancy standards, ensuring strict compliance with regulatory requirements and industry best practices. This step is fundamental to maintaining the company's financial integrity.

Documentation of Deviations

Document any identified deviations from accountancy standards, providing clear and transparent insights into areas that may require corrective actions or further investigation.

E. Systematic Sampling Approach

Random Sampling Method

Implement a systematic sampling approach to select a representative sample of transactions for in-depth examination. This method ensures a comprehensive and unbiased assessment of the overall quality and accuracy of financial transactions.

Statistical Significance

Guarantee that the sampled transactions hold statistical significance, offering a reliable representation of the overall quality and accuracy of [Your Company Name]'s financial transactions.

V. Financial Statements Audit

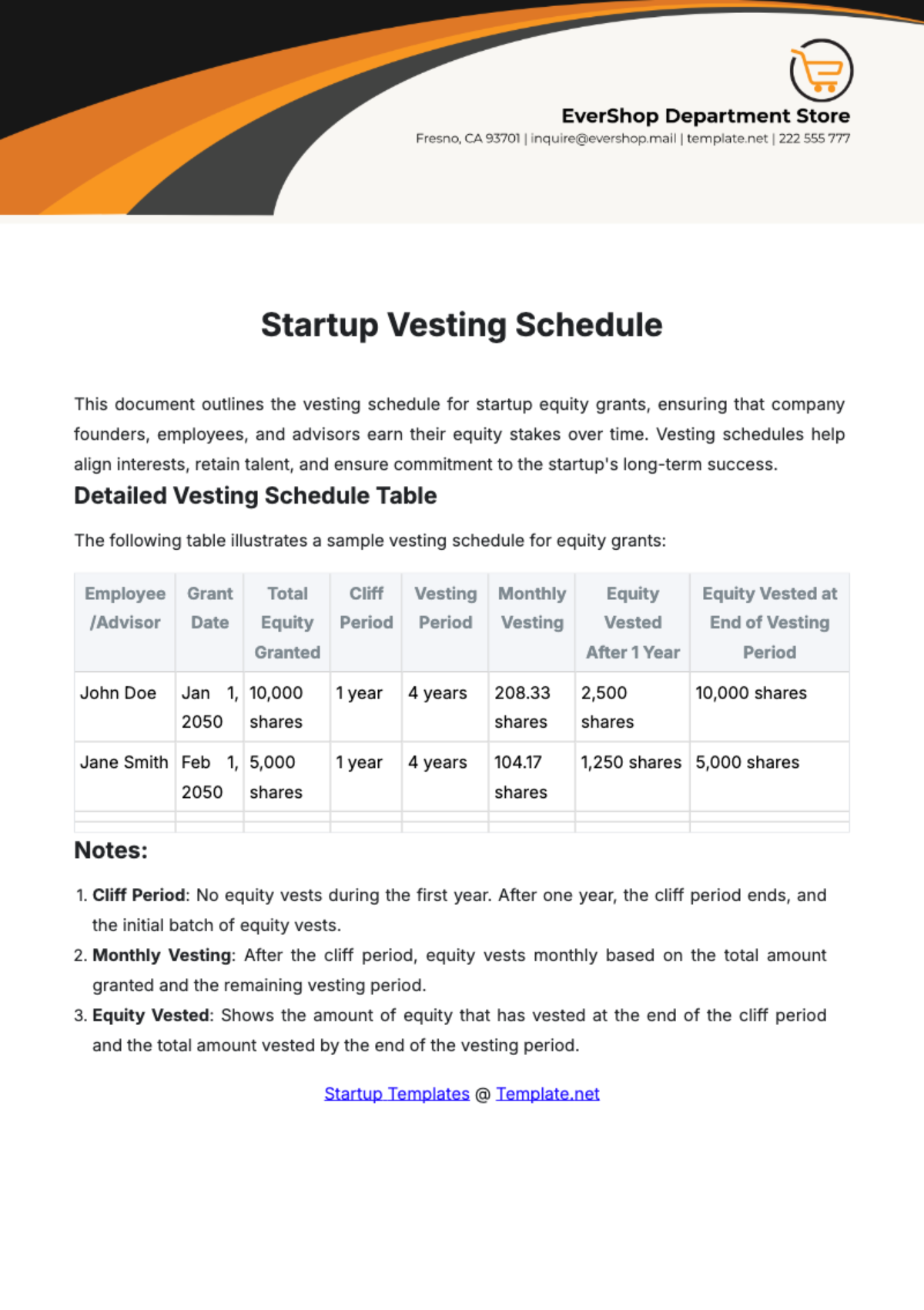

In this phase, a meticulous evaluation of [Your Company Name]'s financial statements takes place. The table below outlines the key components and criteria used to ensure the accuracy, completeness, and compliance of the Balance Sheet, Income Statement, and Cash Flow Statement:

Financial Statement | Criteria | Evaluation Process |

|---|---|---|

Balance Sheet | Accuracy of Asset Valuation | Conduct detailed review of asset valuation methods and data. |

Income Statement | ||

Cash Flow Statement |

The Accuracy of Asset Valuation criterion in the Balance Sheet evaluation involves a comprehensive examination of the methods and data used to determine the value of assets on [Your Company Name]'s financial statements. This includes scrutinizing the valuation methods employed, such as historical cost or fair market value, and ensuring that the data used accurately reflects the current value of assets. A compliant status indicates that the company's asset valuation methods align with accounting standards, providing stakeholders with a reliable representation of the company's financial position. In the sample detail provided, the accuracy of asset valuation is deemed compliant, suggesting that [Your Company Name] employs sound practices in determining the value of its assets.

VI. Audit Conclusions and Reporting

A. Compilation of Findings

Thorough Examination

After completing the audit checks, auditors conduct a thorough compilation of their findings.

This involves reviewing all assessed aspects, from financial transactions to internal controls, to ensure a comprehensive understanding.

Cross-Verification

Cross-verify findings against the established protocols and benchmarks, ensuring that the audit process aligns with the predefined standards.

B. Drawing Conclusions

Financial Status Assessment

Assess the financial status of [Your Company Name], taking into account the audited financial statements, internal controls, and transaction testing outcomes.

This comprehensive evaluation provides a holistic view of the company's fiscal health.

Identification of Risks

Identify and delineate any financial management risks or potential issues that may impact [Your Company Name]'s financial stability.

This proactive approach allows for targeted strategies to address and mitigate potential challenges.

C. Preparation of Comprehensive Audit Report

Clear Articulation

Articulate clear and concise conclusions within the audit report, providing stakeholders with an easily comprehensible overview of [Your Company Name]'s financial position.

Incorporation of Recommendations

Include recommendations for improvements or corrective actions based on identified risks or issues.

This forward-looking aspect enhances the practical value of the audit report.

D. Transparent Communication

Stakeholder Engagement

Engage with key stakeholders, including management and board members, to communicate audit findings, conclusions, and recommendations transparently.

This fosters open communication channels and facilitates a mutual understanding of the audit outcomes.

Q&A Session

Organize a question-and-answer session to address any queries or concerns raised by stakeholders.

This interactive approach ensures that stakeholders are well-informed and allows for clarifications on audit-related matters.

E. Timely Submission

Adherence to Timeline

Adhere to the agreed-upon timeline for submitting the audit report.

Timely submission enhances the relevance and usefulness of the audit findings for decision-makers.

Accessibility of Report

Ensure that the audit report is accessible to all relevant stakeholders.

This promotes transparency and accountability within [Your Company Name].