Startup Investment Case Study

Abstract

This case study conducts a thorough examination of the investment process for [Your Company Name] within emerging markets. It scrutinizes investment patterns, strategies employed by investors, associated risks, and anticipated future trends. This research seeks to unveil the intricacies of startup investment, aiming to enlighten potential investors, the team at [Your Company Name], and policymakers about the critical aspects of financing in these regions.

Introduction

Investment in startups has been crucial in nurturing innovative businesses, particularly in emerging markets characterized by their vast opportunities and inherent challenges. This document explores the investment journey of [Your Company Name] in such markets, focusing on the mechanisms of securing investments, navigating risks, and the prospects of future investment directions. The purpose is to demystify the process of startup investment in emerging markets, thereby assisting [Your Company Name], potential investors, and policymakers in making informed and strategic decisions.

Methodology

Our research methodology was carefully designed to offer an in-depth analysis of the investment environment that [Your Company Name] operates within, focusing on emerging markets. The approach is structured as follows:

Quantitative Data Analysis:

Data Collection and Analysis: This phase focused on gathering comprehensive data sets related to investment trends, transaction volumes, and the overall outcomes of startup funding activities. Through statistical analysis, this step aimed to distill the investment environment into quantifiable metrics, facilitating the identification of significant patterns, trends, and their implications for startup viability and growth.

Surveys and Interviews:

Survey Distribution: Surveys were crafted and disseminated among a wide-ranging group of stakeholders, including investors with diverse portfolios, entrepreneurs at various stages of their venture's lifecycle, and business experts with deep knowledge of emerging markets. The objective was to harvest a broad perspective on the unique set of challenges and opportunities present in these markets, directly impacting investment decisions and strategies.

In-depth Interviews: A carefully selected subset of stakeholders underwent detailed interviews, designed to extract nuanced insights into their personal experiences within the investment sector. This process aimed to complement the broader data collected via surveys, offering rich, qualitative insights into the strategies and approaches that define successful engagements in emerging markets.

Comparative Case Study Analysis:

Success Case Studies: This component involved an analytical review of selected case studies representing successful investment scenarios. The goal was to elucidate the key elements and conditions contributing to successful outcomes, such as strategic alignment, market readiness, and effective execution, providing a blueprint for replicable success in similar contexts.

Unsuccessful Investment Review: Equally important was the examination of case studies where investments did not yield the anticipated returns. This analysis aimed to surface critical risk factors, common obstacles, and missteps, offering a well-rounded perspective on the myriad challenges that can impede success, thereby equipping stakeholders with the foresight to mitigate such risks in future endeavors.

Each element of this methodology contributes to a holistic view of the startup investment scene in emerging markets, tailored to enhance strategic decision-making for [Your Company Name], guide potential investors, and inform policy formulation.

Findings

Our comprehensive analysis unearthed several key insights regarding the dynamics of startup investment in emerging markets. These findings are encapsulated below, supported by illustrative tables that present the data in a structured manner:

Trend of Increasing Investment in Startups: Our research indicates a significant upward trend in the volume of investments directed towards startups in emerging markets over the past decade. Factors contributing to this trend include the allure of rapid market penetration, the high potential for lucrative returns, and the inherent scalability of startup business models.

Attractiveness Factors for Investors: Startups in emerging markets present unique opportunities for investors, driven by the following factors:

Quick Market Penetration: Startups often introduce innovative solutions or services, enabling them to quickly capture market share.

High Return Potential: The untapped market potential in these regions offers the promise of substantial returns on investment.

Scalability: Startups' business models are typically designed to be easily scalable, facilitating rapid growth and expansion.

Risks and Challenges: Despite the attractive investment opportunities, several risks and challenges need careful consideration:

Political Instability: Changes in the political sector can significantly impact business operations and investment security.

Regulatory Unpredictability: Unforeseen changes in regulations can pose challenges to business continuity and growth.

Technological Infrastructure: Variations in technological infrastructure across different markets can affect the stability and operational efficiency of startups.

Market Maturity: The level of market maturity can influence startup success rates, with nascent markets presenting higher risks but potentially higher rewards

Investment Volume Trends in Emerging Markets:

Year | Investment Volume |

|---|---|

2050 | $50,000,000 |

Factors Influencing Startup Attractiveness to Investors:

Factor | Description |

|---|---|

Quick Market Penetration | Startups' ability to swiftly capture market share with innovative solutions. |

High Return Potential | The significant returns investors can expect due to the untapped potential of emerging markets. |

Scalability | The ease with which startups can expand their operations and grow. |

Risks Associated with Startup Investment in Emerging Markets:

Risk Factor | Impact Description |

|---|---|

Political Instability | Changes in political climate can affect business operations and investment security. |

Regulatory Unpredictability | Sudden regulatory changes can disrupt business models and growth strategies. |

Technological Infrastructure | Variations in infrastructure can limit operational efficiency and scalability. |

Market Maturity | The stage of market development can influence risk and reward, with newer markets being riskier. |

These findings offer a perspective on the opportunities and challenges associated with startup investment in emerging markets, providing valuable insights for investors, policymakers, and entrepreneurs.

Discussion

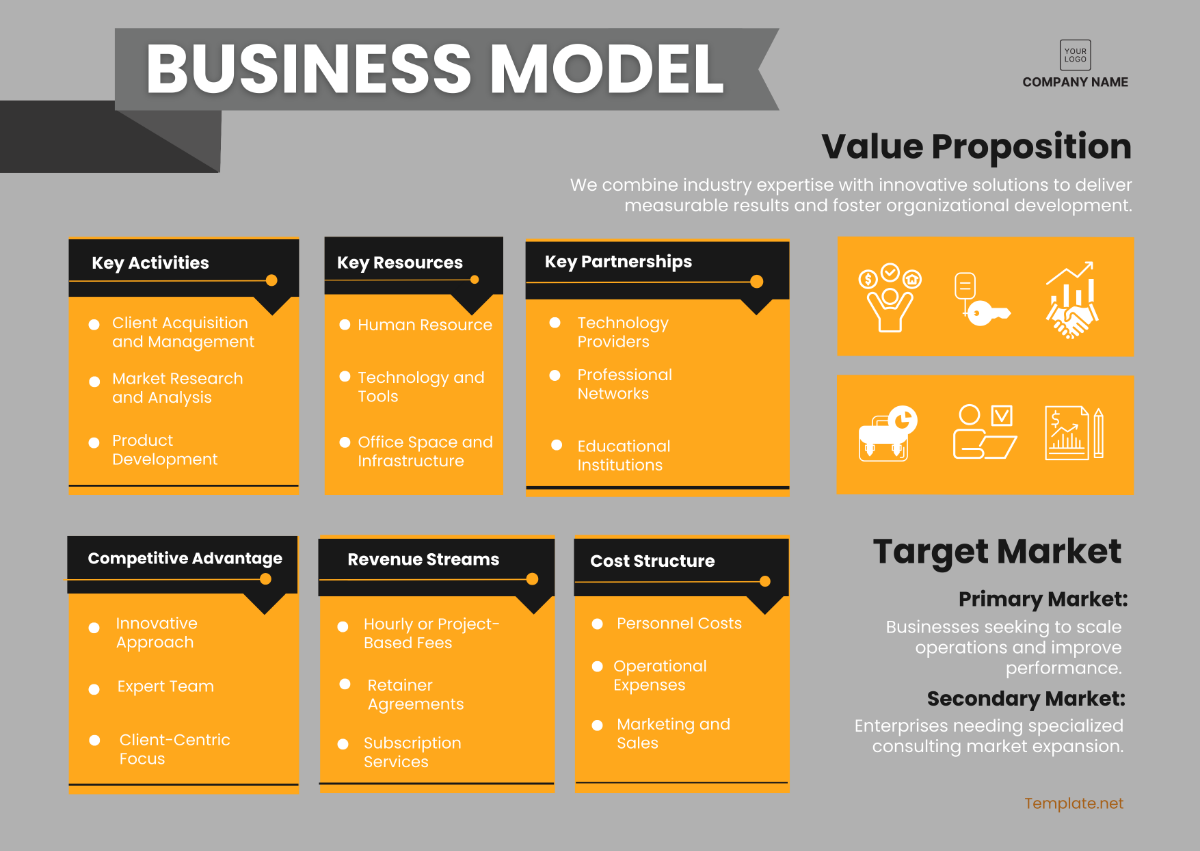

This section delves into the strategic considerations and preferences that guide investors' decisions in these markets. By examining the merits of portfolio diversification, the emphasis on innovative solutions to local problems, and the value inherent in addressing these localized challenges, we aim to highlight on the strategies that can lead to successful investment outcomes.

Portfolio Diversification

Investors navigating the complexities of startup investment in emerging markets typically employ a strategy of portfolio diversification. This tactic involves spreading investments across multiple startups, sectors, and geographical regions to mitigate the risk of loss. Diversification allows investors to manage the potential volatility associated with political and market uncertainties, thereby balancing the risk-reward ratio more effectively. By investing in a broad array of ventures, investors can cushion the blow of any single venture's failure while still capitalizing on the successes of others, optimizing their overall investment returns.

Focus on Innovative Solutions

A distinct trend observed in the investment patterns is the preference for startups that offer innovative solutions to local problems. These startups tend to attract more investments due to their direct impact on fulfilling unmet market needs, demonstrating clear demand, potential for rapid market penetration, and scalability. Startups with a deep understanding of local market dynamics, consumer preferences, and regulatory challenges are better positioned to minimize entry and scalability risks. Their innovative approaches to solving local issues not only make them more attractive to investors but also increase their chances of achieving long-term success and sustainability.

The Value of Local Problem-Solving

Investors show a pronounced inclination towards startups that are deeply ingrained in solving local challenges within emerging markets. These ventures stand out for their ability to tailor solutions to the specific needs and challenges of the region, from improving access to basic services to bridging financial and digital gaps. This focus on local problem-solving not only drives innovation but also contributes significantly to the socio-economic development of the area. Consequently, startups that are adept at addressing such localized challenges are more likely to secure funding, demonstrating the critical role of market-specific innovations in attracting investment and fostering a virtuous cycle of growth and development.

The strategy of portfolio diversification, combined with a focus on startups that innovate in response to local challenges, forms the cornerstone of successful investment in emerging markets. These approaches underscore the importance of a nuanced understanding of the market, enabling investors to make informed decisions that balance risks with the potential for high returns.

Market Opportunities and Risks Analysis

This section aims to provide a detailed examination of the opportunities and risks associated with startup investments in emerging markets, complemented by data-driven insights. The analysis is segmented into two parts: market opportunities that highlight the sectors with high growth potential and a risk assessment that outlines the major challenges facing investors.

High Growth Potential Sectors in Emerging Markets:

Sector | Key Drivers |

|---|---|

FinTech | Digital payment adoption, underbanked population |

Health Tech | Healthcare accessibility, pandemic response technologies |

EdTech | Remote learning, digital education platforms |

Agriculture Tech | Sustainable farming, food security technologies |

Renewable Energy | Environmental sustainability, energy independence |

Investment Risks in Emerging Markets:

Risk Category | Mitigation Strategies |

|---|---|

Political Instability | Diversify investments across different regions to spread risk. |

Economic Fluctuations | Invest in sectors with inherent demand, such as healthcare and education. |

Regulatory Challenges | Engage with local experts and legal advisors to navigate regulatory landscapes. |

Market Competition | Focus on startups with a strong competitive advantage and unique value propositions. |

Technological Infrastructure | Prioritize investments in startups that address or adapt to these infrastructural challenges. |

These tables synthesize critical data regarding the sectors poised for rapid growth and the spectrum of risks that accompany investments in emerging markets. By grounding investment strategies in this comprehensive analysis, investors can make more informed decisions, balancing the pursuit of high returns with a calculated approach to risk management.

Leveraging Technology for Strategic Advantage

The pivotal role of technology in shaping the success trajectories of startups, especially within emerging markets, cannot be overstated. This section explores the strategic importance of leveraging technology to enhance operational efficiencies, drive innovation, and secure a sustainable competitive edge in the marketplace. The integration of technological advancements is not merely a facilitator of business processes but a critical determinant of market penetration, customer engagement, and investment appeal.

The Catalyst for Innovation and Efficiency: Technology serves as a catalyst for innovation, enabling startups to develop novel solutions that address complex market needs. By adopting cutting-edge technologies, startups can streamline their operations, reduce costs, and improve service delivery. Technologies such as cloud computing, artificial intelligence, and blockchain offer transformative potential, enabling startups to operate with greater agility and responsiveness to market dynamics.

Enhancing Market Reach and Engagement: Digital platforms and mobile technologies have revolutionized the way businesses interact with their customers. Startups that effectively utilize these technologies can significantly enhance their market reach and engagement levels. In regions with high mobile penetration, leveraging mobile platforms for marketing, sales, and customer service can open up vast opportunities for growth and customer loyalty.

Driving Sustainable Competitive Advantages: In increasingly crowded marketplaces, the strategic use of technology can provide startups with a sustainable competitive advantage. Whether through the development of proprietary technology solutions or the innovative application of existing technologies, startups can distinguish themselves from competitors. This differentiation is crucial in attracting investment, as investors are keenly aware of the value that technology-driven innovations bring to the table.

Attracting Investment: Investors are consistently on the lookout for startups that not only promise high returns but also demonstrate a forward-thinking approach to technology adoption and innovation. Startups that are adept at leveraging technology to enhance their value proposition are more likely to attract funding. This is particularly true in emerging markets, where technological solutions can address long-standing challenges and unlock new growth avenues.

Expanding Access to Global Markets: Technology serves as a bridge that connects startups in emerging markets with the global economy, offering unprecedented opportunities for expansion and growth. The internet, e-commerce platforms, and digital marketing tools have democratized access to global markets, allowing even small startups to reach international customers with relative ease. By leveraging these technologies, startups can transcend geographical boundaries, accessing new customer segments and diversifying their market presence. For investors, startups with a clear strategy for leveraging technology to access and expand in global markets represent attractive investment opportunities due to their scalability and potential for higher returns.

Enhancing Customer Experience and Personalization: Technology empowers startups to meet and exceed these expectations through the use of data analytics, artificial intelligence, and machine learning. These tools enable startups to understand customer preferences and behaviors in-depth, allowing for the delivery of customized products, services, and communications. Personalization not only strengthens customer engagement and loyalty but also provides startups with a competitive advantage in crowded markets.

The strategic integration of technology is essential for startups operating in emerging markets. It not only facilitates operational efficiencies and innovation but also serves as a key differentiator in attracting investment. As the digital economy continues to evolve, the ability of startups to harness the power of technology will increasingly become a critical factor in their success and sustainability.

Recommendations

As we contemplate the future of startup investments in emerging markets, it is imperative to outline strategic recommendations that can guide investors, policymakers, and entrepreneurs toward optimized outcomes. The following recommendations are derived from the insights gathered through this study, aiming to enhance the efficacy and success rates of startup investments in these markets.

Enhanced Due Diligence: Investors should employ rigorous due diligence processes that go beyond financial metrics to include geopolitical, social, and environmental risk assessments. Understanding the broader context in which startups operate can illuminate potential challenges and opportunities, leading to more informed investment decisions.

Strategic Partnerships: Cultivating partnerships with local entities, including governments, NGOs, and established businesses, can provide valuable insights into market nuances and facilitate smoother entry and expansion processes. These collaborations can also offer protective measures against regulatory and operational uncertainties.

Technology and Innovation Focus: Given the rapid technological advancements and their transformative impact on emerging markets, investors should prioritize startups that leverage technology to address significant market gaps.

Sustainability and Social Impact: Aligning investments with ventures that not only promise financial returns but also contribute positively to social and environmental objectives can enhance long-term sustainability. Startups that drive social impact are increasingly appealing to a broader base of stakeholders, including consumers, thereby bolstering their potential for success.

Adaptive Investment Models: Developing flexible and adaptive investment models that can accommodate the fluid nature of emerging markets is crucial. This may include convertible loans, equity investments with milestone-based tranches, or other innovative financing mechanisms that can adjust to the evolving startup and market dynamics.

Capacity Building and Support: Beyond financial investment, offering mentorship, technical support, and access to international networks can significantly impact the growth trajectory of startups. Investing in the development of entrepreneurial skills and business acumen is vital for fostering a resilient and innovative startup ecosystem.

By implementing these recommendations, stakeholders can better navigate the complexities of emerging markets, maximizing the impact and returns of their startup investments. The future of startup investment in these regions is promising, with ample opportunities for those who approach it with a strategic, informed, and adaptable mindset.

Conclusion

Despite the inherent risks associated with startup investments in emerging markets, the sustained allure for potentially high returns decisively maintains investor interest. This steadfast attraction is further bolstered by the prevailing global economic trends and the rapid pace of technological advancement. Consequently, the outlook for startup investment in emerging markets remains robust, with the anticipation of lucrative returns driving informed and strategic engagement. This authoritative stance underscores a profound confidence in the transformative potential of such investments, affirming [Your Company Name]'s critical role in the broader investment process.