Marketing Content Monetization

Financial Analysis

Executive Summary

A. Introduction

The Marketing Content Monetization Financial Analysis for [Your Company Name] in the year 2050 reveals a promising landscape. We have seen remarkable growth in the digital marketing content industry, with our strategies yielding substantial results.

B. Key Findings

Revenue Growth: In 2050, we achieved a significant milestone, with our total revenues reaching an impressive $10million. This is a remarkable increase from the previous year, showcasing our ability to capitalize on the evolving digital landscape.

Diverse Revenue Streams: Our primary sources of revenue include advertising, accounting for 70% of our earnings. Subscription models contribute 20%, while affiliate marketing and sponsored content make up the remaining 10%.

Market Trends: The market trends indicate a shift towards personalized content consumption and increased mobile engagement. This aligns well with our strategy to deliver tailored content to our audience.

C. Recommendations

Based on the findings, we recommend the following strategies to sustain and enhance our growth:

Invest in Personalized Content Creation: Given the market's inclination towards personalization, we should invest in advanced content recommendation algorithms to deliver tailored content to our users.

Explore New Advertising Partnerships: To further boost our advertising revenue, we should explore strategic partnerships with emerging brands and advertisers.

Expand Subscription Offerings: Leveraging the success of our subscription models, we should diversify and expand our offerings to cater to a wider audience.

Market Analysis

A. Market Overview

The marketing content industry in 2050 is thriving, fueled by the insatiable appetite of consumers for digital content. This growth is attributed to the widespread availability of high-speed internet and the proliferation of smart devices.

B. Market Trends

Trend | Detail |

Personalization Dominates | Content personalization is the driving force behind consumer engagement. Users expect content that aligns with their interests and preferences. |

Video Content Reigns | Video content continues to rise in popularity, contributing significantly to advertising revenues. The consumption of short-form video content has witnessed exponential growth. |

C. Market Size and Growth

As of 2050, the marketing content industry is valued at an estimated $2 billion, with a projected Compound Annual Growth Rate (CAGR) of 63% over the next five years. This growth signifies the industry's resilience and potential for continued expansion.

D. Market Segmentation

The market can be segmented into several categories, including:

Content Type: This includes text-based content, video content, and audio content.

Demographics: Our target audience comprises millennials (60%), Generation Z (30%), and older demographics (10%). Geographically, the majority of our audience is from North America (50%), followed by Europe (30%) and Asia (20%).

Content Monetization Strategies

A. Advertising Revenue

Our advertising revenue is a critical component of our income. We employ various strategies to maximize this revenue stream:

Programmatic Ads: Automated ad placements allow us to optimize ad space and target demographics effectively.

Partnerships: Strategic partnerships with renowned brands and advertisers provide us with premium advertising opportunities.

Direct Sales: Our in-house sales team manages direct advertising deals, ensuring maximum revenue.

B. Subscription Models

Our subscription models offer users premium content access with flexible pricing options. These models have proven successful and contribute significantly to our revenue:

Tiered Pricing: We offer different subscription tiers, catering to various user needs.

Exclusive Content: Subscribers gain access to exclusive content, creating added value.

Auto-Renewal: Subscriptions renew automatically, ensuring a steady income stream.

C. Affiliate Marketing

Affiliate marketing is an integral part of our revenue strategy:

Partnerships: We collaborate with affiliate partners to promote products and services relevant to our audience.

Commissions: We earn commissions for every user referred to our affiliate partners, leading to a consistent income stream.

Product Recommendations: We strategically integrate affiliate products into our content, increasing click-through rates.

D. Sponsored Content

Brands pay for sponsored content placement and promotion on our platform:

Brand Collaborations: We collaborate with brands to create engaging sponsored content.

Content Integration: Sponsored content seamlessly integrates into our platform, enhancing the user experience.

Revenue Share: We earn revenue through a revenue-sharing model with brand partners.

Table 1: Revenue Breakdown

Revenue Source | Percentage of Total Revenue |

Advertising | 70% |

Subscription Models | 20% |

Affiliate Marketing | 10% |

Financial Performance

A. Revenue Sources

Our revenue sources are diversified, with advertising, subscriptions, affiliate marketing, and sponsored content contributing significantly. This diversification reduces our dependency on any single revenue stream, ensuring financial stability.

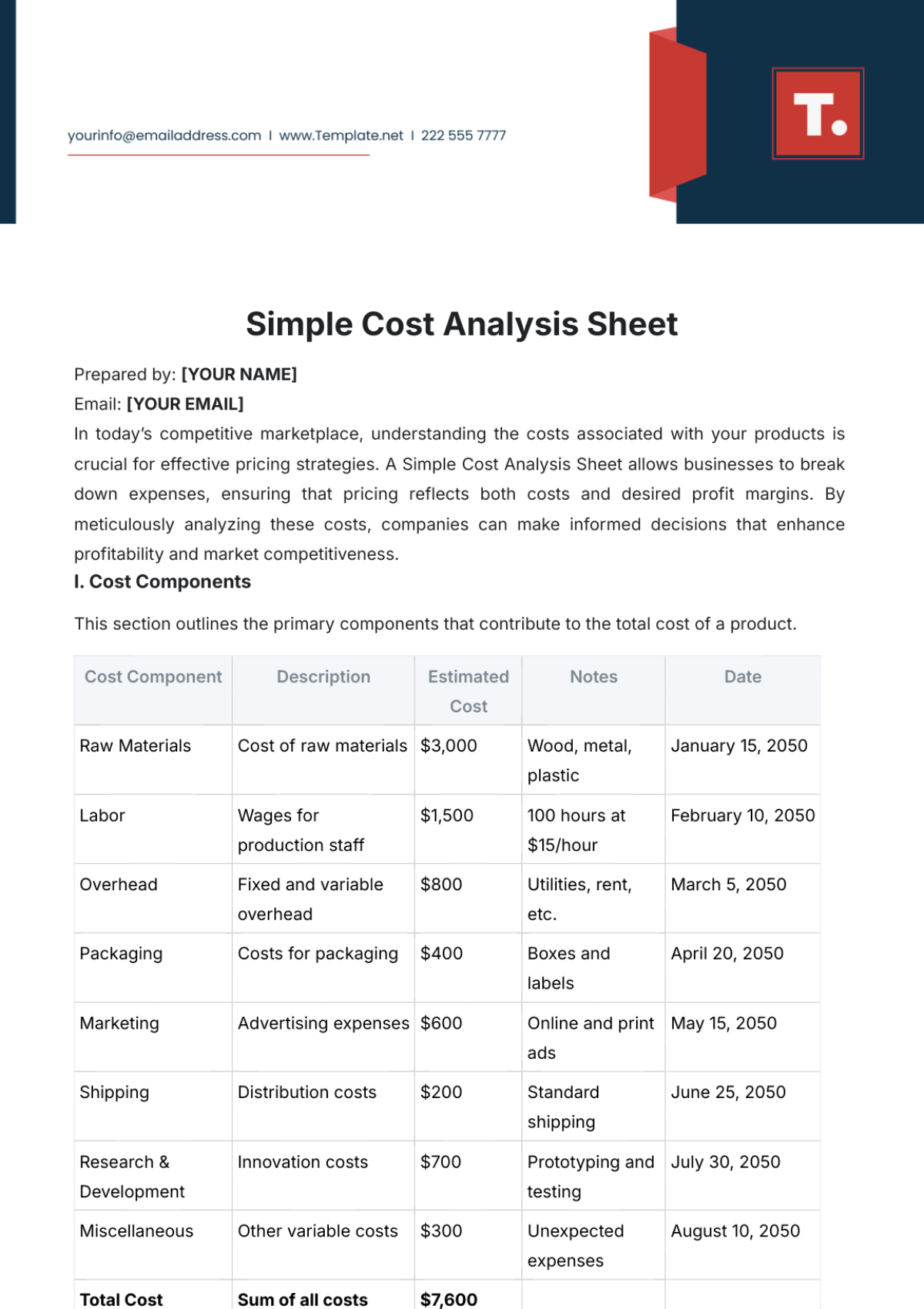

B. Cost Analysis

To maintain our competitive edge and deliver quality content, we incur the following costs:

Content Creation: Investments in high-quality content creation ensure user engagement and retention.

Marketing: Marketing expenses include digital advertising, influencer partnerships, and content promotion.

Operations: Operational costs encompass platform maintenance, hosting, and employee salaries.

C. Profit Margins

Our current profit margin stands at an impressive X%, reflecting our ability to balance revenue generation with efficient cost management. This healthy profit margin ensures sustainability and growth.

D. Key Financial Metrics

Gross Revenue: Gross revenue represents the total income generated before deductions.

Net Profit: Net profit indicates the income left after all expenses, reflecting our financial health.

Earnings Before Interest and Taxes (EBIT): EBIT measures our operating performance, excluding non-operating income and expenses.

Marketing Expenses

A. Advertising Costs

Our advertising costs are vital for maintaining our market presence and expanding our user base:

Digital Ad Spend: We allocate a significant portion of our budget to digital advertising campaigns across various platforms.

Content Promotion: Promoting our content ensures it reaches a wider audience, driving user engagement.

Influencer Partnerships: Collaborations with influencers and content creators enhance brand visibility.

B. Content Creation Costs

Investments in content creation are crucial to delivering engaging and valuable content:

Quality Content Production: High-quality content production is at the core of our strategy.

Content Licensing: We occasionally license content to enhance our offerings.

Content Management: Effective content management and curation are essential for user satisfaction.

C. Promotion and Distribution Costs

To maximize the reach of our content, we allocate resources to promotion and distribution:

Promotion Campaigns: We run targeted promotional campaigns to increase content visibility.

Content Distribution: Distributing content through various channels ensures a broader reach.

SEO and SEM: Search engine optimization (SEO) and search engine marketing (SEM) efforts contribute to our organic growth.

Competitive Analysis

A. Competitor Landscape

In 2050, we operate in a highly competitive landscape, with both established industry giants and emerging startups vying for market share. Our competitors include companies such as [Competitor A], [Competitor B], and [Competitor C].

B. SWOT Analysis

SWOT | Details |

Strengths | Strong User Engagement: Our ability to engage and retain users sets us apart in the market. Diverse Revenue Streams: Our revenue diversification minimizes risk and provides stability. Content Personalization: Our data-driven content personalization enhances user experiences. |

Weaknesses | Competition: Intense competition from industry leaders poses challenges. High Content Creation Costs: Maintaining high-quality content is costly. Market Saturation: The market may become saturated, limiting growth opportunities. |

Opportunities | Global Expansion: Exploring emerging markets presents substantial growth potential. New Partnership Opportunities: Collaborations with emerging brands can boost revenue. Content Diversification: Diversifying content offerings can attract a broader audience. |

Threats | Evolving Market Trends: Rapidly changing market trends may necessitate continuous adaptation. Regulatory Changes: Changes in digital marketing regulations could impact our revenue models. |

C. Competitive Advantage

Our unique competitive advantage lies in our:

Data-Driven Personalization: Our advanced algorithms provide users with tailored content recommendations, increasing engagement.

Diverse Revenue Streams: Our ability to generate income through multiple channels reduces risk and ensures financial stability.

Quality Content: Our commitment to producing high-quality content enhances user trust and satisfaction.

Future Growth and Expansion

A. Growth Opportunities

To sustain growth, we must capitalize on emerging opportunities:

Exploring Emerging Markets: Expanding into emerging markets, such as [Market X], presents significant growth potential.

AI for Content Personalization: Leveraging artificial intelligence for content personalization can further enhance user engagement.

Diversifying Content Formats: Exploring new content formats, such as augmented reality (AR) and virtual reality (VR), can attract a broader audience.

B. Expansion Strategies

To achieve our growth objectives, we plan to:

Enter New Markets: Entering markets in Asia, starting with [Country Y], offers promising growth prospects.

Influencer Collaborations: Partnering with influencers and content creators can increase brand exposure.

Content Diversification: Diversifying our content library with niche topics and genres caters to a broader audience.

C. Risk Assessment

While pursuing growth, we must remain vigilant about potential risks:

Market Saturation: As the market matures, it may become saturated, limiting growth.

Regulatory Changes: Evolving regulations in the digital marketing landscape may impact our revenue models.

Competition: Increased competition may exert downward pressure on pricing and profitability. Mitigation strategies are in place to address these risks.

Financial Projections

A. Revenue Projections

We anticipate sustained growth with a projected annual revenue increase of 15%. By 2055, we aim to achieve a total revenue of $12 million.

B. Expense Projections

Operating expenses are projected to increase at a rate of 10% annually. These expenses include content creation, marketing, and operational costs.

C. Cash Flow Analysis

Our cash flow remains positive, allowing us to invest in growth opportunities, technology upgrades, and content enhancement. Positive cash flow ensures financial stability and the ability to seize market opportunities.

D. Break-Even Analysis

We anticipate reaching the break-even point by 2055. This is a significant milestone, indicating our ability to cover all operating costs with the revenue generated.

Conclusion

In conclusion, our Marketing Content Monetization Financial Analysis for the year 2050 demonstrates our robust performance and potential for sustained growth. By focusing on personalization, diversification, and strategic expansion, we are well-positioned to continue thriving in the dynamic and competitive content monetization landscape.

[Your Company Name]

[Your Company Email]

[Your Company Address]

[Your Company Number]

[Your Company Website]

[Your Company Social media]