Startup Exit Strategy and Succession Planning

Executive Summary

This comprehensive document serves as a roadmap for startups across various industries to navigate the complexities of developing a robust exit strategy and succession plan. By outlining key considerations and best practices, it aims to empower businesses to proactively plan for the future and optimize outcomes for all stakeholders involved. From understanding market dynamics to implementing effective communication strategies, this document provides actionable insights to guide startups through the process of transitioning leadership and exiting the business successfully.

Introduction

In the dynamic landscape of startups, where innovation and growth often take precedence, it's easy to overlook the importance of planning for the future. However, as businesses mature, it becomes increasingly crucial to have a clear exit strategy and succession plan in place. This introduction sets the stage by emphasizing the significance of proactive planning and strategic foresight in ensuring the long-term viability and sustainability of startups. By laying the groundwork for thoughtful consideration and deliberate action, this document aims to empower startups to navigate transitions with confidence and agility, ultimately driving continued success in an ever-evolving business environment.

Exit Strategy Options

Exit Strategy | Description |

|---|---|

Acquisition | Being acquired by a larger company offers rapid growth, access to new markets, and substantial returns. However, cultural fit, integration challenges, and changes to the product or service post-acquisition must be considered. |

Merger | Merging with another company provides synergistic benefits, such as combining technologies and expanding market reach. Mergers can be strategic alliances or full-scale integrations, requiring careful planning to ensure success. |

Initial Public Offering (IPO) | Going public through an IPO offers access to public capital markets, increased visibility, and liquidity for shareholders. However, it requires significant preparation, including financial audits, regulatory compliance, and investor relations. |

Liquidation | Liquidating the company involves selling off assets, paying debts, and distributing remaining proceeds to shareholders. While it may result in closure, it provides a clean break and recoups some investment. |

Strategic Partnerships or Joint Ventures | Collaborating with partners or forming joint ventures accelerates growth and accesses resources. It may lead to acquisition or merger opportunities, providing a natural transition. |

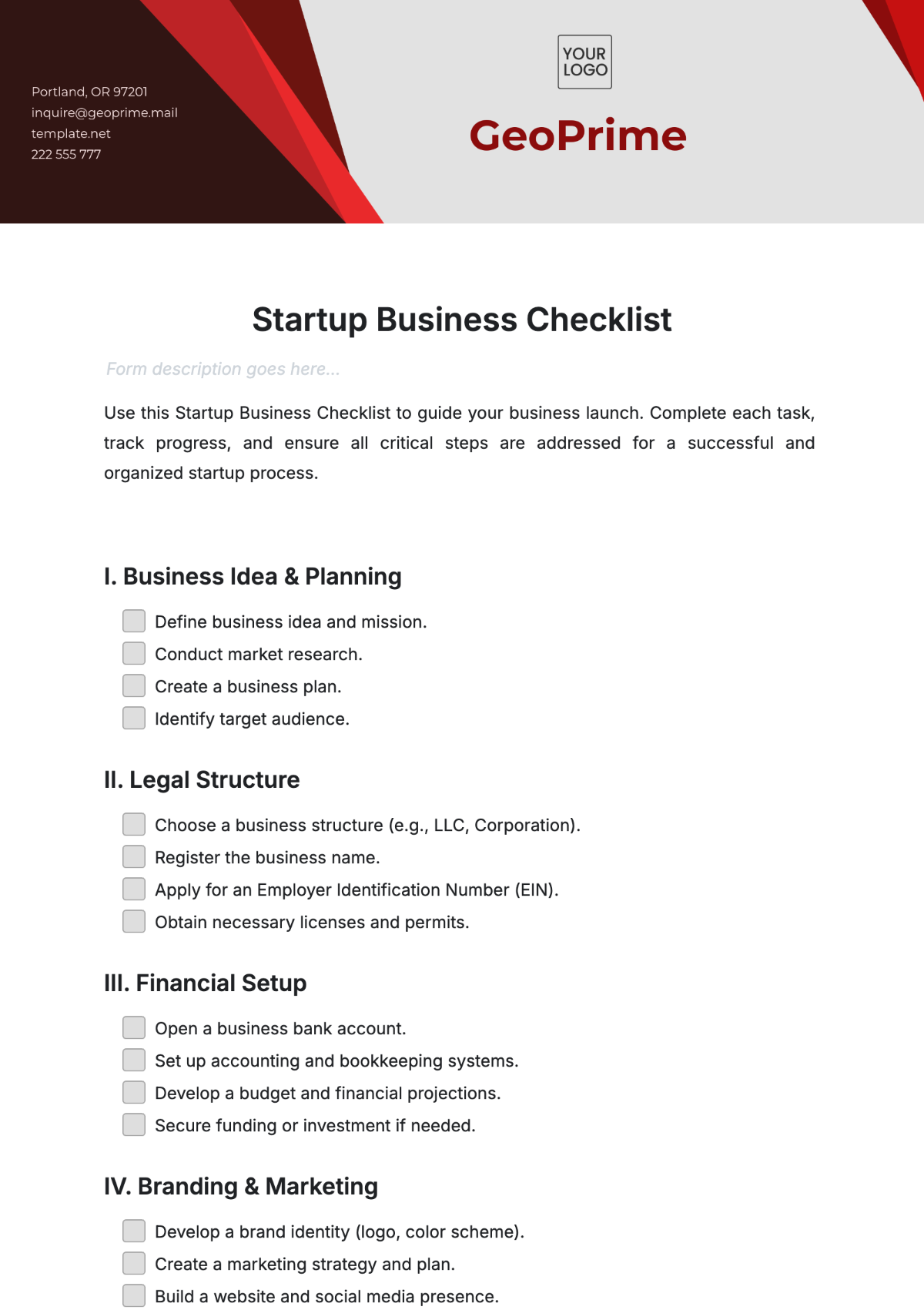

Succession Planning

Succession planning involves identifying potential successors within the organization and developing strategies to prepare them for future leadership roles. Startups should evaluate current employees based on their skills, experience, and potential for growth. This process may include:

Talent Assessment: Conducting assessments to identify high-potential employees who demonstrate leadership qualities and align with the company's values and goals.

Leadership Development: Implementing training programs, mentorship initiatives, and stretch assignments to develop key competencies and groom future leaders.

Career Pathing: Providing clear pathways for career advancement and succession, including opportunities for lateral moves, promotions, and cross-functional experiences.

Knowledge Transfer: Facilitating knowledge transfer from senior executives to potential successors through shadowing, coaching, and knowledge-sharing sessions.

Performance Management: Establishing performance metrics and accountability measures to track the progress of potential successors and provide feedback for improvement.

Continuity Planning: Developing contingency plans to ensure business continuity in the event of unexpected leadership changes, such as sudden departures or incapacitation.

Financial Considerations

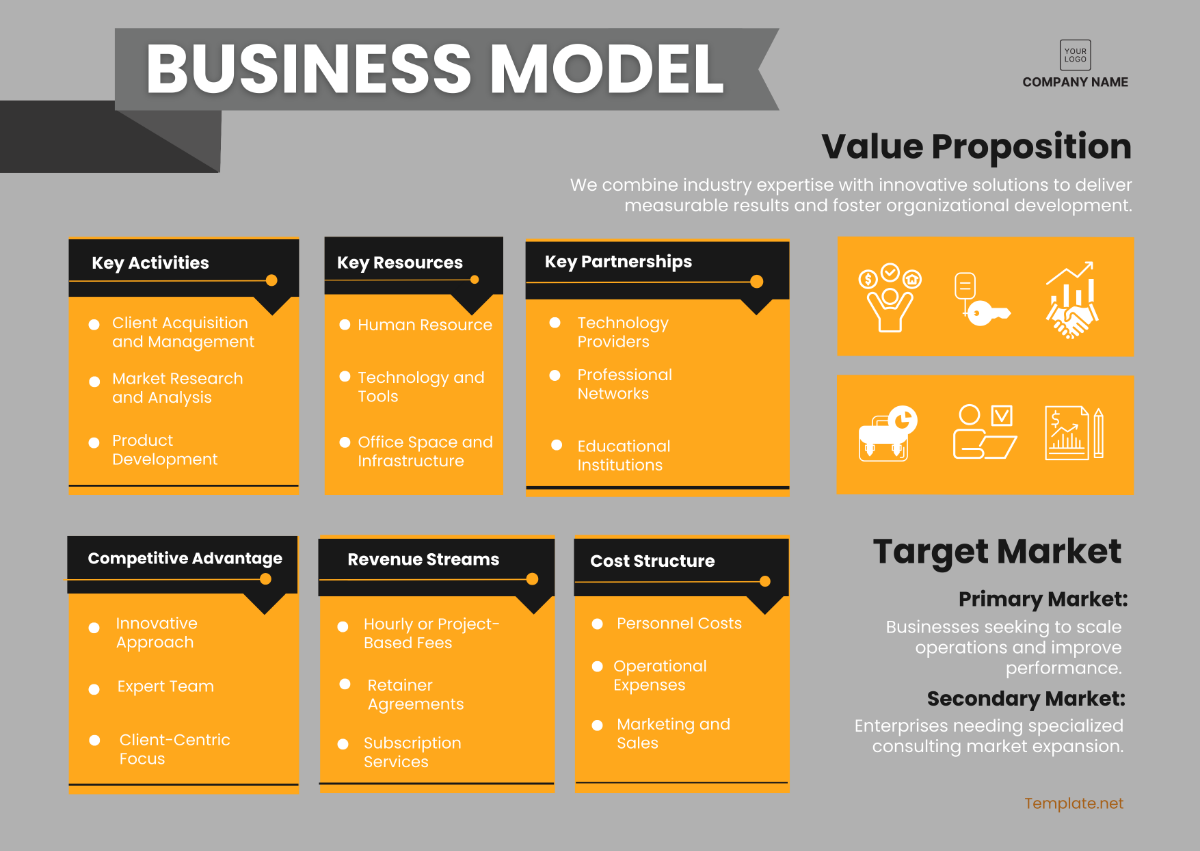

Financial considerations play a crucial role in determining the feasibility and attractiveness of different exit strategies for startups. Key aspects to consider include:

Business Valuation: Determining the fair market value of the startup based on factors such as revenue, profitability, growth potential, intellectual property, and market comparables.

Valuation Methods: Employing various valuation methods, including discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions, to assess the company's worth accurately.

Tax Implications: Understanding the tax implications associated with different exit strategies, such as capital gains tax, corporate tax, and transfer pricing, to optimize tax efficiency and minimize liabilities.

Due Diligence: Conducting thorough due diligence to identify potential financial risks, liabilities, and contingencies that may impact the valuation and negotiation process.

Negotiation Strategies: Developing negotiation strategies to maximize value and mitigate risks during the exit process, including setting clear objectives, establishing leverage points, and engaging with potential buyers or investors.

Financial Planning: Creating financial forecasts and projections to assess the potential impact of the exit strategy on the company's cash flow, balance sheet, and financial performance over the short and long term.

Legal and Regulatory Compliance

Startups must ensure compliance with a myriad of legal and regulatory requirements when executing an exit strategy. This entails a thorough review of contracts, licenses, permits, and intellectual property rights to identify any potential obstacles or liabilities. Additionally, startups should assess tax implications and seek legal counsel to navigate complex legal frameworks. By proactively addressing compliance issues, startups can mitigate risks and maximize the value of their exit.

Communication Strategy

A well-defined communication strategy is essential for maintaining transparency and trust during the execution of an exit strategy. Startups must communicate effectively with internal and external stakeholders, including employees, investors, customers, suppliers, and regulatory agencies. This involves crafting clear and consistent messaging that outlines the rationale behind the exit, the timeline for transition, and the expected impact on stakeholders. Regular updates and channels for feedback should be established to address concerns and maintain engagement throughout the process. By prioritizing open communication, startups can minimize uncertainty and facilitate a smooth transition for all parties involved.

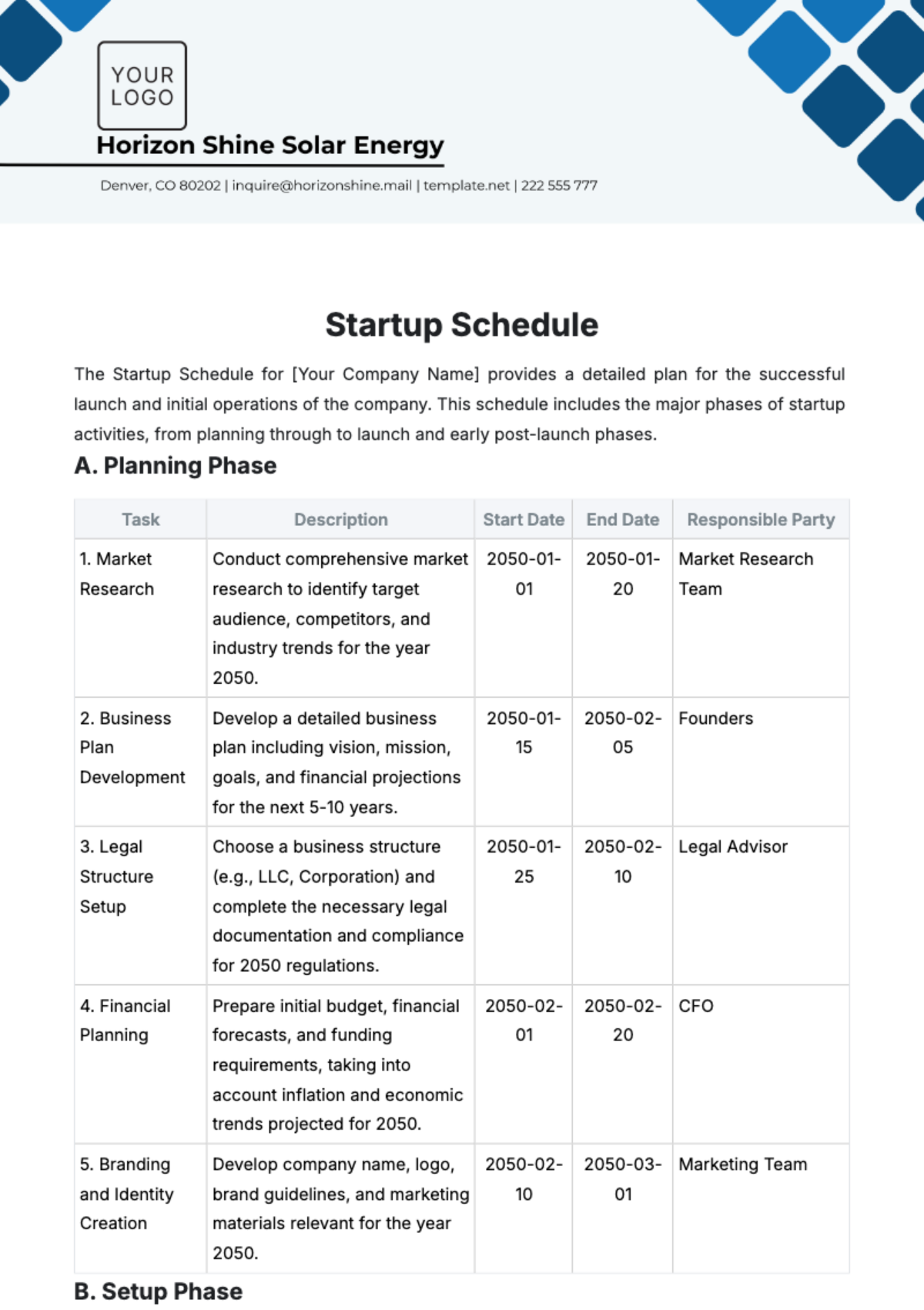

Implementation Timeline

Establishing a clear and realistic implementation timeline is vital for the successful execution of the exit strategy and succession plan. Startups should break down the process into actionable steps and assign specific timelines for each task. This ensures accountability and facilitates effective coordination among team members. Additionally, consider factors such as regulatory requirements, market conditions, and stakeholder expectations when drafting the timeline. Regularly review and update the timeline as needed to accommodate any changes or unforeseen circumstances that may arise during the implementation process.

Timeline Step | Description |

|---|---|

Month 1 | Conduct initial assessment of company's current status and future goals |

Month 2 | Research and evaluate potential exit strategies and succession planning options |

Month 3 | Develop a comprehensive exit strategy and succession plan |

Month 4 | Review and finalize legal and regulatory compliance requirements |

Month 5 | Communicate the plan to stakeholders and gather feedback |

Month 6-8 | Implement leadership development programs for potential successors |

Month 9-12 | Execute the exit strategy according to the established timeline |

Ongoing | Monitor progress, make adjustments as needed, and address any challenges |

Contingency Planning

While careful planning can mitigate many risks, startups must also prepare for unexpected challenges that may arise during the execution of the exit strategy and succession plan. Develop a comprehensive contingency plan that identifies potential obstacles and outlines alternative courses of action to address them. This may include scenarios such as a sudden market downturn, key personnel leaving the company, or unforeseen legal issues. By proactively identifying potential risks and developing contingency measures, startups can minimize disruptions and maintain momentum towards achieving their exit goals. Regularly review and update the contingency plan to ensure it remains relevant and effective in addressing emerging threats or challenges. Additionally, communicate the contingency plan to relevant stakeholders to ensure everyone is prepared to respond effectively in case of emergencies.

Monitoring and Evaluation

Continuous monitoring and evaluation are essential for assessing the effectiveness of the exit strategy and succession plan. Startups should establish key performance indicators (KPIs) related to financial performance, employee retention, customer satisfaction, and market share. Regularly tracking these metrics allows businesses to identify trends, measure progress, and make informed decisions. Additionally, conducting periodic reviews and evaluations enables startups to adjust strategies in response to changing market conditions, emerging opportunities, or unforeseen challenges. By maintaining a proactive approach to monitoring and evaluation, startups can maximize the likelihood of achieving their objectives and optimizing outcomes during the execution of the exit strategy and succession plan.

Conclusion

In conclusion, the development and implementation of a comprehensive exit strategy and succession plan are critical for startups to navigate transitions effectively and achieve long-term success. By prioritizing proactive planning, transparent communication, and continuous evaluation, businesses can mitigate risks, capitalize on opportunities, and maximize value for stakeholders throughout the exit process. While the journey may present challenges and uncertainties, a well-crafted plan provides a roadmap for navigating complexities, fostering continuity, and preserving the legacy of the startup. Ultimately, by embracing strategic foresight and adaptability, startups can position themselves for sustainable growth, innovation, and success in the ever-evolving business landscape.