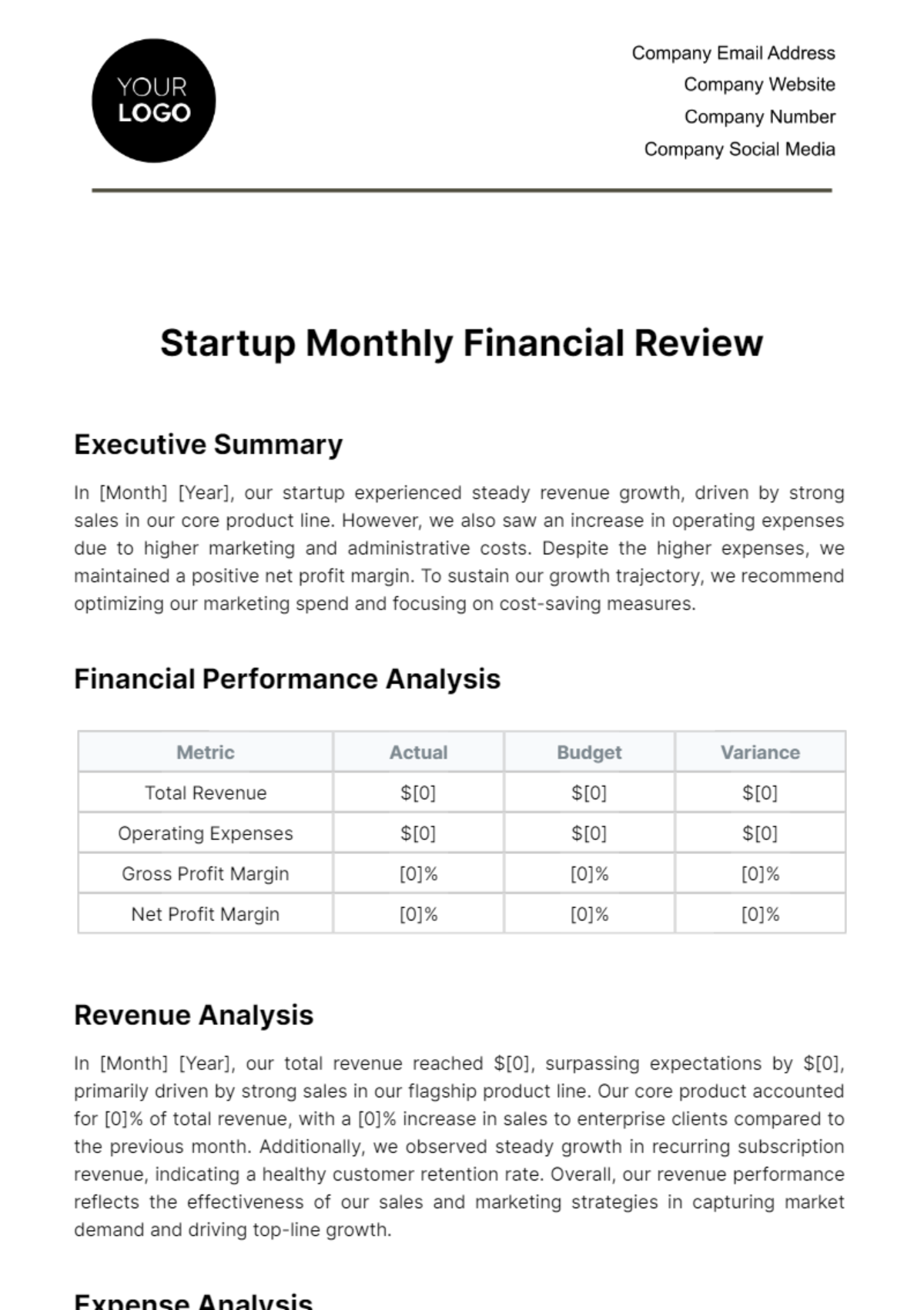

Startup Monthly Financial Review

Executive Summary

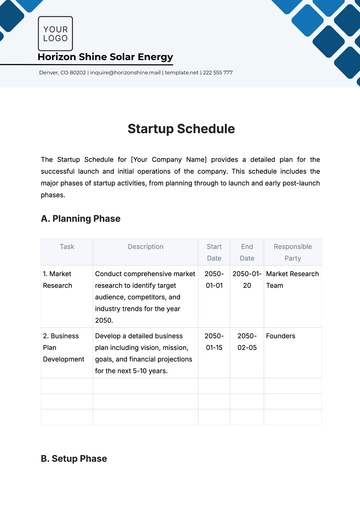

In [Month] [Year], our startup experienced steady revenue growth, driven by strong sales in our core product line. However, we also saw an increase in operating expenses due to higher marketing and administrative costs. Despite the higher expenses, we maintained a positive net profit margin. To sustain our growth trajectory, we recommend optimizing our marketing spend and focusing on cost-saving measures.

Financial Performance Analysis

Metric | Actual | Budget | Variance |

|---|

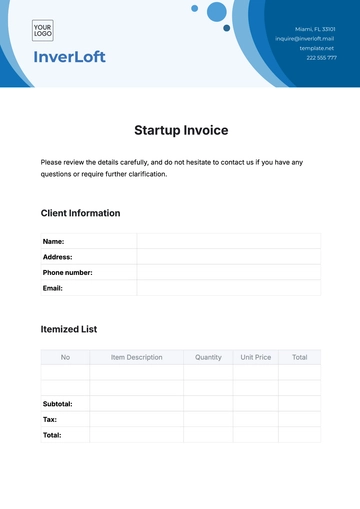

Total Revenue | $[0] | $[0] | $[0] |

Operating Expenses | $[0] | $[0] | $[0] |

Gross Profit Margin | [0]% | [0]% | [0]% |

Net Profit Margin | [0]% | [0]% | [0]% |

Revenue Analysis

In [Month] [Year], our total revenue reached $[0], surpassing expectations by $[0], primarily driven by strong sales in our flagship product line. Our core product accounted for [0]% of total revenue, with a [0]% increase in sales to enterprise clients compared to the previous month. Additionally, we observed steady growth in recurring subscription revenue, indicating a healthy customer retention rate. Overall, our revenue performance reflects the effectiveness of our sales and marketing strategies in capturing market demand and driving top-line growth.

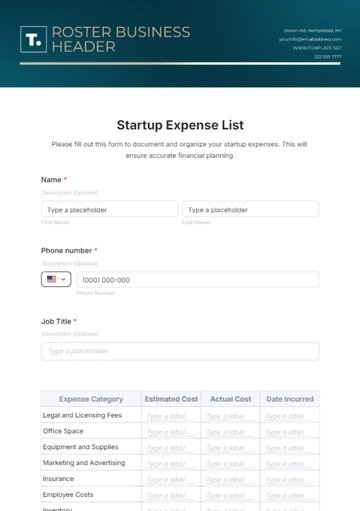

Expense Analysis

Operating expenses for [Month] [Year] totaled $[0], exceeding the budget by $[0]. The increase in expenses was mainly attributed to higher-than-anticipated marketing expenditures, driven by investments in digital advertising campaigns to expand our customer base. Additionally, administrative expenses were higher than budgeted, primarily due to increased software subscription costs associated with scaling our operations. While these expenses contributed to revenue growth, there is a need to closely monitor and optimize spending to maintain profitability and operational efficiency.

Cash Flow Analysis

Our cash flow remained positive in [Month] [Year], with operating cash flow at $[0], providing adequate liquidity for day-to-day operations. Investing cash flow was minimal, reflecting our focus on optimizing existing resources rather than making significant capital expenditures. Financing cash flow remained stable, with no new debt or equity financing activities during the month. Overall, our strong cash position enables us to support growth initiatives and weather any short-term financial challenges.

Variance Analysis

The positive revenue variance of $[0] was driven by higher-than-expected sales volume and average transaction value, indicating strong customer demand for our products. However, the expense variance of $[0] was primarily due to higher marketing and administrative costs, resulting in a lower-than-anticipated gross profit margin. While the revenue growth outpaced expenses, it is essential to address cost drivers and improve operational efficiency to enhance overall profitability and financial performance.

Key Performance Indicators (KPIs) Tracking

Our KPIs for [Month] [Year] demonstrate positive trends, with a customer acquisition cost (CAC) of $[0] per new customer and a customer lifetime value (CLV) of $[0] per customer over [0] months. Our burn rate remained stable at $[0] per month, providing a clear indication of our operational sustainability. With a runway of [0] months based on current cash reserves, we have sufficient resources to support our growth trajectory and strategic initiatives.

Key Insights and Observations

Despite the strong revenue performance, we must remain vigilant in managing expenses to maintain profitability and preserve cash flow. Opportunities for strategic partnerships could accelerate market penetration and drive additional revenue streams, while ongoing monitoring of market dynamics and competition is critical to sustaining our competitive advantage. Additionally, investing in technology and process improvements can enhance operational efficiency and scalability, positioning us for long-term success in a rapidly evolving market landscape.

Actionable Recommendations

To optimize financial performance, we recommend reassessing our marketing spend allocation to focus on high-ROI channels and campaigns. Implementing cost-control measures, such as renegotiating vendor contracts and streamlining administrative processes, can help mitigate expense overruns and improve profitability. Exploring strategic partnerships with complementary businesses or industry leaders can expand our market reach and drive revenue diversification. Additionally, investing in automation and technology solutions to enhance operational efficiency can unlock productivity gains and support sustainable growth.

Conclusion

In conclusion, [Month] [Year] was a month of significant growth and operational achievements for our startup. While our revenue exceeded expectations, we recognize the importance of prudent expense management and strategic planning to ensure long-term financial sustainability. By leveraging our strengths, addressing areas for improvement, and executing on actionable recommendations, we are well-positioned to capitalize on emerging opportunities and drive continued success in the months ahead.

Startup Templates @ Template.net