Free Startup Investment Terms Negotiation Guide Template

Startup Investment Terms Negotiation Guide

1. Introduction

Startup investment negotiations is a formidable challenge that many founders face. This journey, marked by its complexity and high stakes, demands not only a deep understanding of one's own business but also the ability to engage with potential investors on a level that aligns mutual interests and visions for the future. The purpose of this guide is to demystify the negotiation process, offering founders a clear, step-by-step blueprint to follow. It's designed to arm you with effective negotiation strategies that can significantly influence the outcome, positioning your startup for enhanced growth prospects and maximizing its inherent value.

In the world of startups, where innovation meets opportunity, the ability to secure favorable investment terms is a critical determinant of a company's trajectory. This guide acknowledges the diverse challenges founders encounter, from valuation complexities to structuring deals that accommodate future growth while preserving founder equity and control. Through a structured approach, founders can navigate these negotiations with confidence, ensuring that they not only secure the necessary capital but also establish partnerships that are conducive to long-term success.

2. Getting Started

The foundation of a successful negotiation lies in thorough preparation. Before you even set foot in the negotiation room, there are crucial elements of your business and potential investment partners that you need to understand in depth. This preparatory phase is about equipping yourself with knowledge and insights that will inform your negotiation stance and strategy.

Understanding Your Business Valuation

The valuation of your startup is a pivotal element in investment discussions. It encapsulates the monetary worth of your business in the market, serving as a benchmark for negotiating investment terms. A realistic and well-substantiated valuation is your leverage in discussions, as it justifies the amount of equity you are willing to exchange for capital. To arrive at a credible valuation, consider various methodologies such as the Cost-to-Duplicate approach, the Market Multiples method, the Discounted Cash Flow (DCF) analysis, or more startup-friendly models like the Berkus Method or the Risk Factor Summation Method.

It's essential to understand the nuances of these valuation techniques and to be able to articulate the rationale behind your valuation to potential investors. This involves a deep dive into your financials, market potential, existing assets, intellectual property, and any unique competitive advantages your startup may possess. Being able to defend your valuation with concrete data and forecasts is crucial in establishing a strong negotiating position.

Knowing Your Preferred Financial Structure

The structure of the investment deal is another cornerstone of the negotiation process. It defines how capital will be injected into your startup and on what terms, significantly impacting your company's future. A critical decision here is the balance between equity and debt financing. Equity involves selling a portion of your company's ownership in exchange for capital, while debt financing means borrowing money that needs to be repaid with interest.

Each of these options has its implications for control, ownership, and financial health. Equity financing, for example, may dilute your ownership but doesn't burden your startup with debt repayments, allowing more cash flow for growth. Debt financing keeps your equity intact but adds the pressure of repayments. Hybrid instruments like convertible notes or SAFE (Simple Agreement for Future Equity) agreements might also be worth considering, offering a blend of debt's low initial impact on ownership with the potential for conversion into equity.

Deciding on the preferred financial structure involves assessing your startup's current needs, growth trajectory, and how much control you wish to retain over decision-making. This decision will significantly influence your negotiation strategy, as it sets the parameters for what you're willing to offer and accept in the investment deal.

Researching Your Potential Investors

Every investor brings a unique set of expectations, experiences, and strategic value to the table. Understanding the profiles of potential investors — their investment thesis, history, portfolio companies, and strategic goals — can provide invaluable context for your negotiations. This research can uncover alignment between your startup's objectives and the investor's goals, creating a foundation for mutually beneficial discussions.

Look into the sectors and stages the investors typically engage with, their preferred deal structures, and their involvement level post-investment. Some investors bring more than just capital; they offer mentorship, industry connections, and operational expertise that can be pivotal for your startup's growth. Aligning with investors who share your vision and can contribute strategically beyond capital can enhance the value they bring to your startup.

In sum, entering the negotiation process well-prepared is paramount. Understanding your startup's valuation, being clear on your preferred financial structure, and having a deep insight into your potential investors' backgrounds and strategies will position you to negotiate from a place of strength. This foundation not only facilitates more productive discussions but also increases the likelihood of securing an investment deal that aligns with your startup's long-term growth and value aspirations.

3. Step-by-Step Instructions

Negotiating investment terms is a pivotal moment for startups, requiring careful planning and strategic execution. Here's a detailed approach to navigating these negotiations effectively:

Assemble a Strong Negotiation Team

A diverse and skilled negotiation team is your first line of defense and strategy in investment discussions. This team should include:

Financial Expert: Someone who deeply understands your startup's numbers, can forecast future financials, and can analyze the implications of different investment structures.

Legal Advisor: A legal professional with experience in startup financing who can navigate the complexities of investment agreements and protect your interests.

Industry Expert: A team member or advisor with extensive experience in your startup's industry can offer insights into market trends, valuation standards, and strategic partnerships.

Founder/CEO: The person with the vision and passion for the startup, who can effectively communicate the company's potential and build a rapport with investors.

This team should work cohesively, each bringing their expertise to bear on the negotiation process, ensuring that all bases are covered from financial implications to legal protections and industry-specific nuances.

Prepare a Comprehensive Pitch

Your pitch to potential investors is more than just a presentation; it's a narrative about your startup's journey, its potential for growth, and how the investment will catalyze reaching new milestones. Key elements include:

Vision and Mission: Clearly articulate your startup's purpose, the problem it solves, and the impact you envision.

Market Opportunity: Provide data-driven insights into the size of your market, growth trends, and your startup's position within this landscape.

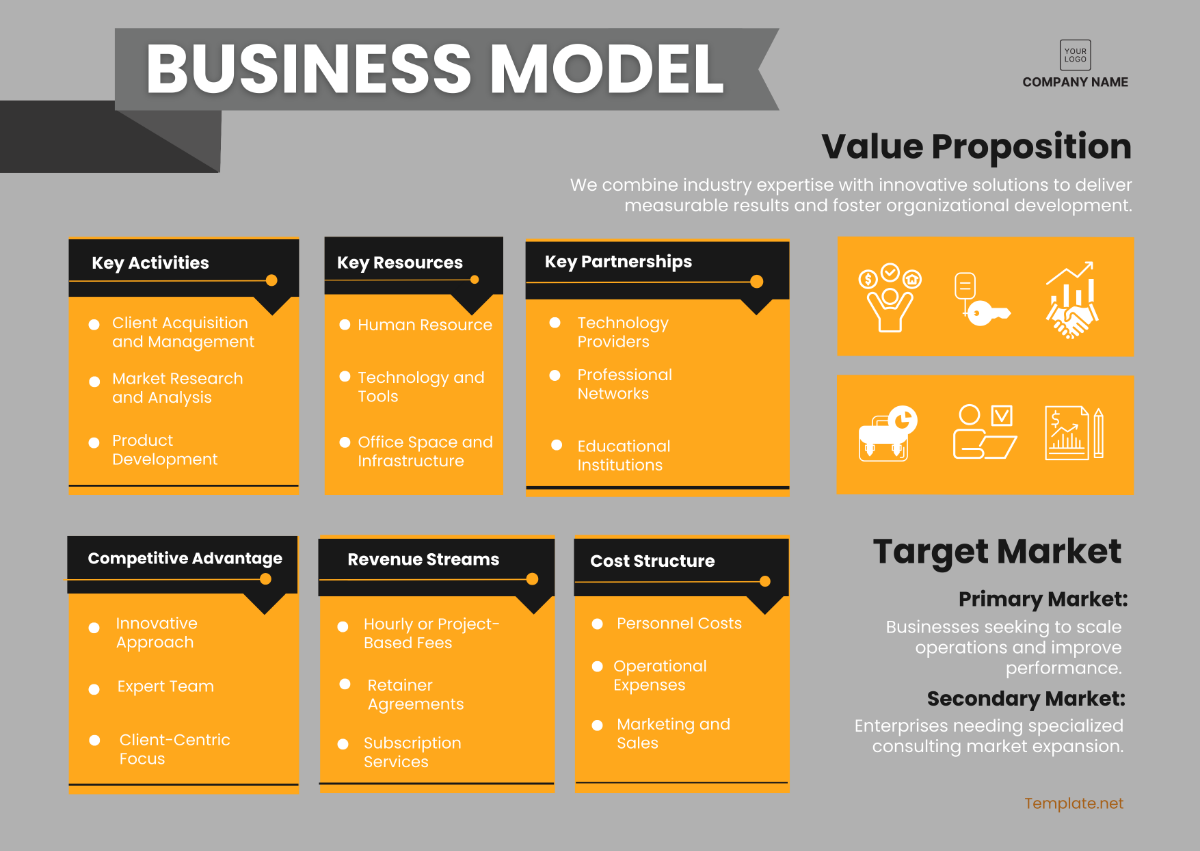

Business Model: Explain how your startup generates revenue, your cost structures, and your strategies for scaling.

Growth Projections: Present realistic, data-backed forecasts of your growth, including how the investment will be utilized to achieve these goals.

Team: Highlight the strengths and expertise of your team, underscoring why they are the right people to drive the startup's success.

This pitch should not only be compelling and well-researched but also transparent, addressing potential risks and how you plan to mitigate them.

Clarify Details in the Term Sheet

The term sheet is a critical document that lays the groundwork for your investment agreement. It outlines the key terms and conditions of the investment, including valuation, investment amount, equity stake, voting rights, liquidation preferences, and anti-dilution provisions. Ensuring clarity and mutual understanding of each term is crucial. Key considerations include:

Valuation and Equity: Understand how the valuation was determined and what it means for your equity distribution post-investment.

Control and Decision-Making: Clarify what control investors will have over business decisions, including board composition and voting rights.

Economic Rights: Discuss the distribution of economic rights, such as dividends and liquidation preferences, to understand how returns will be shared among stakeholders.

This stage may involve several iterations as both parties negotiate terms that align with their interests and expectations.

Engage in Negotiation

Negotiation is an art that involves balancing firmness with flexibility. Key strategies include:

Prioritize Key Terms: Understand which terms are non-negotiable for you and where you can afford to be flexible.

Build Rapport: Establishing a positive relationship with investors can facilitate a more collaborative negotiation process.

Use Data to Support Your Position: Arm yourself with market data, financial projections, and precedents to justify your stance on various terms.

Remember, negotiation is a two-way process; it's about finding a mutually beneficial agreement, not winning at all costs.

Finalize the Investment Agreement

Once you've reached an agreement on the term sheet, the next step is to draft and finalize the investment agreement. This comprehensive legal document will detail all the terms of the investment, and it's crucial to have your legal team thoroughly review it before signing. This review ensures that all agreed-upon terms are accurately reflected and that there are no clauses that could be detrimental to your startup's future.

4. Troubleshooting

Stalled Negotiations

If negotiations hit an impasse, take a step back to reassess your terms and strategy. Consult with your advisors or mentors who can offer a fresh perspective or alternative solutions. Sometimes, a temporary break from negotiations can provide both parties with the space to reassess their positions and priorities.

Preventing Misunderstandings

Clear and concise communication is key to preventing misunderstandings. Ensure that all discussions, changes, and agreements are documented in writing, and confirm that there's mutual understanding of all terms before proceeding. Regular summaries of discussions can also help keep everyone on the same page.

Investor Withdrawal

Investor withdrawal, though unfortunate, is not the end of the road. Maintain a professional demeanor and seek to understand the reasons behind their decision, as this can provide valuable insights for future negotiations. Meanwhile, keep the lines of communication open with other potential investors, and don't hesitate to re-engage with your network to explore alternative funding sources.

Negotiating investment terms is a nuanced process that requires preparation, strategic thinking, and effective communication. By following these steps and being prepared to troubleshoot common challenges, founders can navigate these negotiations more confidently and successfully secure investments that align with their startup's growth trajectory and values.

5. FAQs

Q: How do I determine the right valuation for my startup during negotiations?

A: Determining the right valuation involves considering various factors including your startup's financial performance, market potential, competitive landscape, and growth prospects. Utilize valuation methods such as the Comparable Companies Analysis, Discounted Cash Flow, or the Berkus Method, tailored to early-stage companies. It's also beneficial to look at recent valuations of similar startups in your industry.

Q: What's the best way to structure my negotiation team?

A: Your negotiation team should be a mix of individuals with complementary skills and expertise. This typically includes a financial advisor or CFO who understands the numbers, a legal advisor familiar with investment agreements, an industry expert who can speak to the market and competition, and a key company executive (often the CEO or founder) who shares the vision and passion of the startup.

Q: How important is the term sheet, and what should I focus on?

A: The term sheet is crucial as it sets the framework for your investment agreement. Key areas to focus on include valuation and equity stake, investor rights and protections, governance and control provisions (like board composition), and exit strategies. Ensure each term is clear and aligns with your startup's long-term goals.

Q: What negotiation tactics can help me secure a favorable investment?

A: Effective tactics include doing your homework to understand the investor's interests, being clear about your non-negotiables, using data to back up your valuation and growth projections, and building a rapport with investors. Being open to compromise on less critical issues can also facilitate a more amicable negotiation.

Q: How can I prevent misunderstandings during the negotiation process?

A: Clear, consistent, and documented communication is key. Ensure all verbal agreements are promptly followed up with written confirmations. Regularly summarize key discussion points and agreements to make sure both parties have the same understanding.

Q: What should I do if an investor wants more control than I'm comfortable giving?

A: It's important to balance investor input with maintaining the founder's vision and control. Clearly communicate your concerns and the rationale behind them. Consider proposing alternative structures that offer protections and assurances to the investor without compromising your control, such as vesting schedules, advisory roles, or performance-based milestones.

Q: How can I effectively use my pitch to influence negotiations?

A: Your pitch should not only showcase your startup's potential but also directly address how the investment will be utilized to achieve specific milestones. Highlighting past successes, presenting a clear growth strategy, and showing a deep understanding of your market can strengthen your position in negotiations.

Q: What do I do if negotiations stall?

A: If negotiations stall, take a step back to reassess both parties' positions and concerns. It may be helpful to seek external advice or consider alternative negotiation strategies. Sometimes, introducing a new term or adjusting existing ones can reinvigorate discussions.

Q: What happens if an investor pulls out after agreeing on terms?

A: While disappointing, investor withdrawal is not uncommon. Maintain professionalism and seek to understand their reasons. Use this as a learning experience to strengthen future pitches and negotiations. Keep engaging with other potential investors and consider revisiting previously interested parties with updates on your progress.

Q: How can I ensure the final investment agreement reflects the negotiated terms accurately?

A: Before signing, conduct a thorough review of the investment agreement with your legal advisor to ensure all negotiated terms are accurately reflected. Don't hesitate to clarify and revise any discrepancies or ambiguous language to avoid future disputes.

6. Conclusion

Negotiating startup investment terms is a critical process in the growth of your company. The suggested steps in this guide can position your startup for better agreements with investors. Always remember these important tips:

Preparation is key. The more informed you are, the better.

Assemble a strong team to support you through the negotiation process.

Keep your communication clear and prompt. Mistakes can often be avoided through simple, clear exchanges of information.