Startup SWOT Analysis for Investment

Introduction

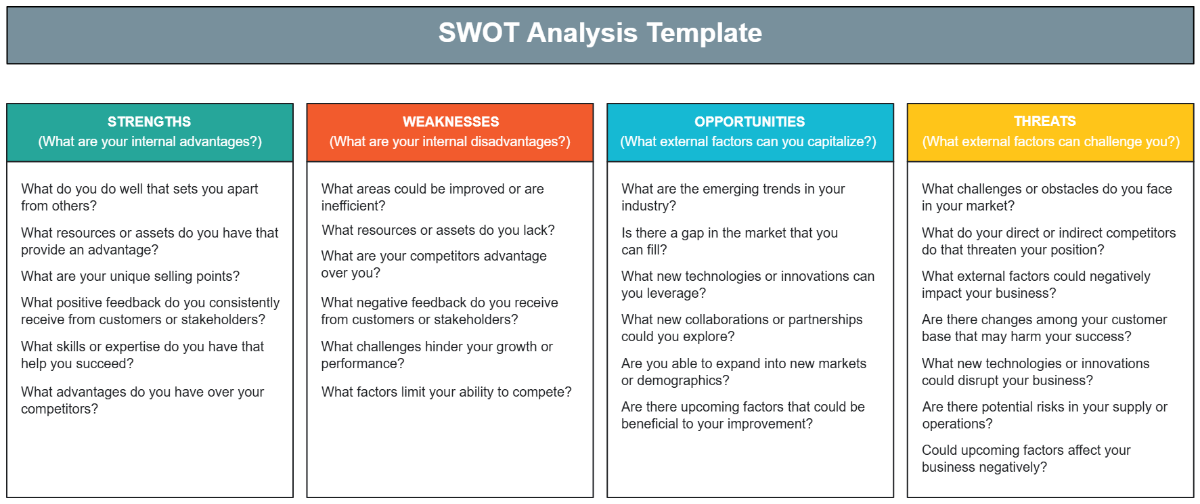

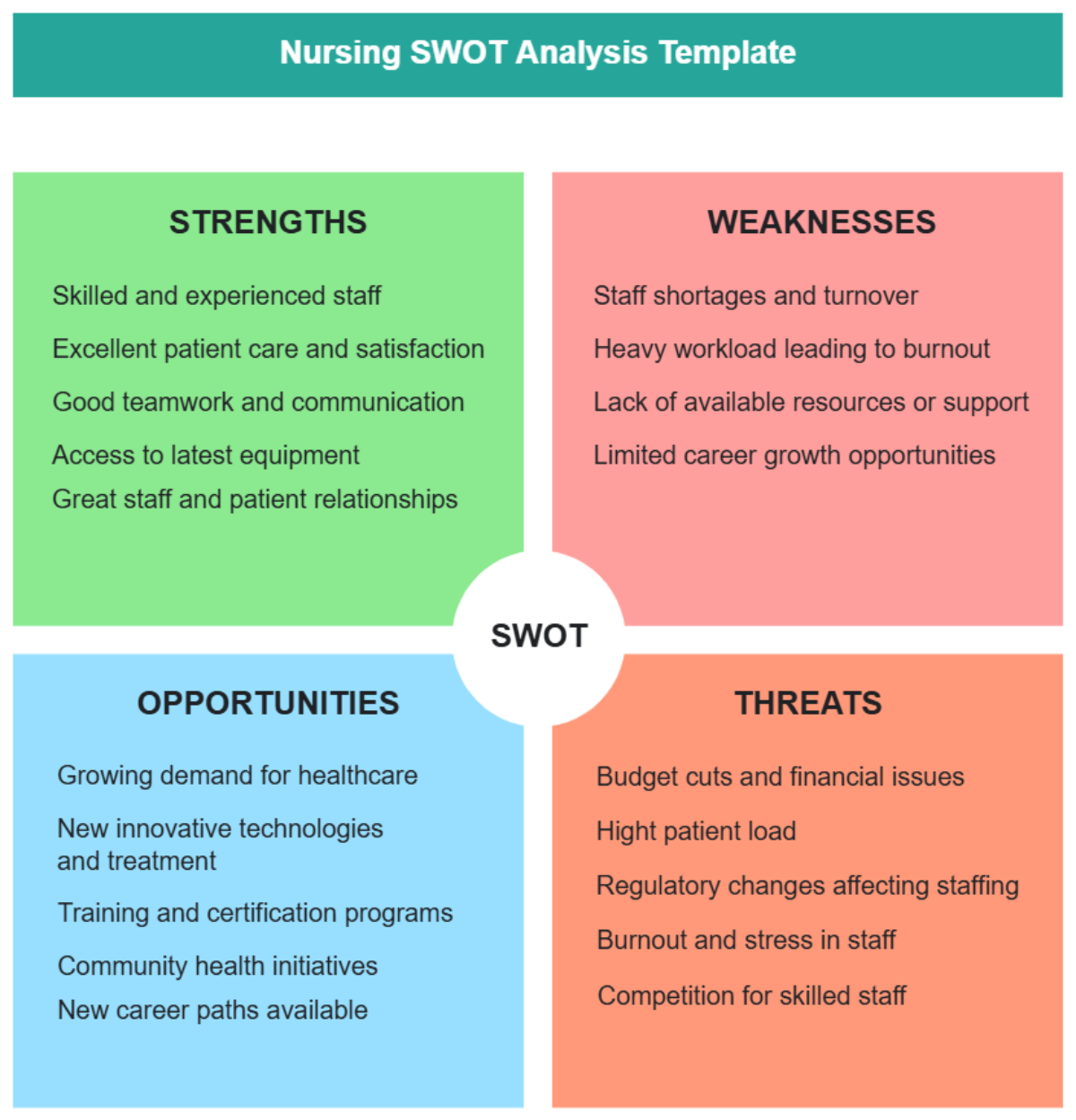

In an ever-evolving business landscape, the decision to invest in a startup requires a nuanced understanding of its potential to navigate challenges and seize opportunities. This analysis, prepared by [Your Name] of [Your Company Name], employs a strategic SWOT framework to dissect the multifaceted nature of [Startup Name], a promising entity in the [specific industry, e.g., technology, healthcare, etc.] sector. By delving into the startup's inherent Strengths and Weaknesses, along with the external Opportunities and Threats it faces, this document aims to provide a holistic view of the startup's investment potential.

The startup under consideration has carved a niche for itself with its innovative product line, protected by patented technology, and steered by a management team whose experience and industry connections are unparalleled. Yet, like any emerging enterprise, it grapples with the typical growing pains associated with limited resources and market presence. The external landscape presents a mixed bag of burgeoning demand for innovative solutions and potential partnerships, juxtaposed with the intense competition and regulatory hurdles typical of the [specific industry] market.

This analysis is designed to serve as a cornerstone for potential investors, offering insights that transcend surface-level evaluations. It is a guide through the intricate dynamics that define [Startup Name]'s current standing and future prospects. By understanding these critical elements, investors can make informed decisions that align with their strategic interests and risk appetites.

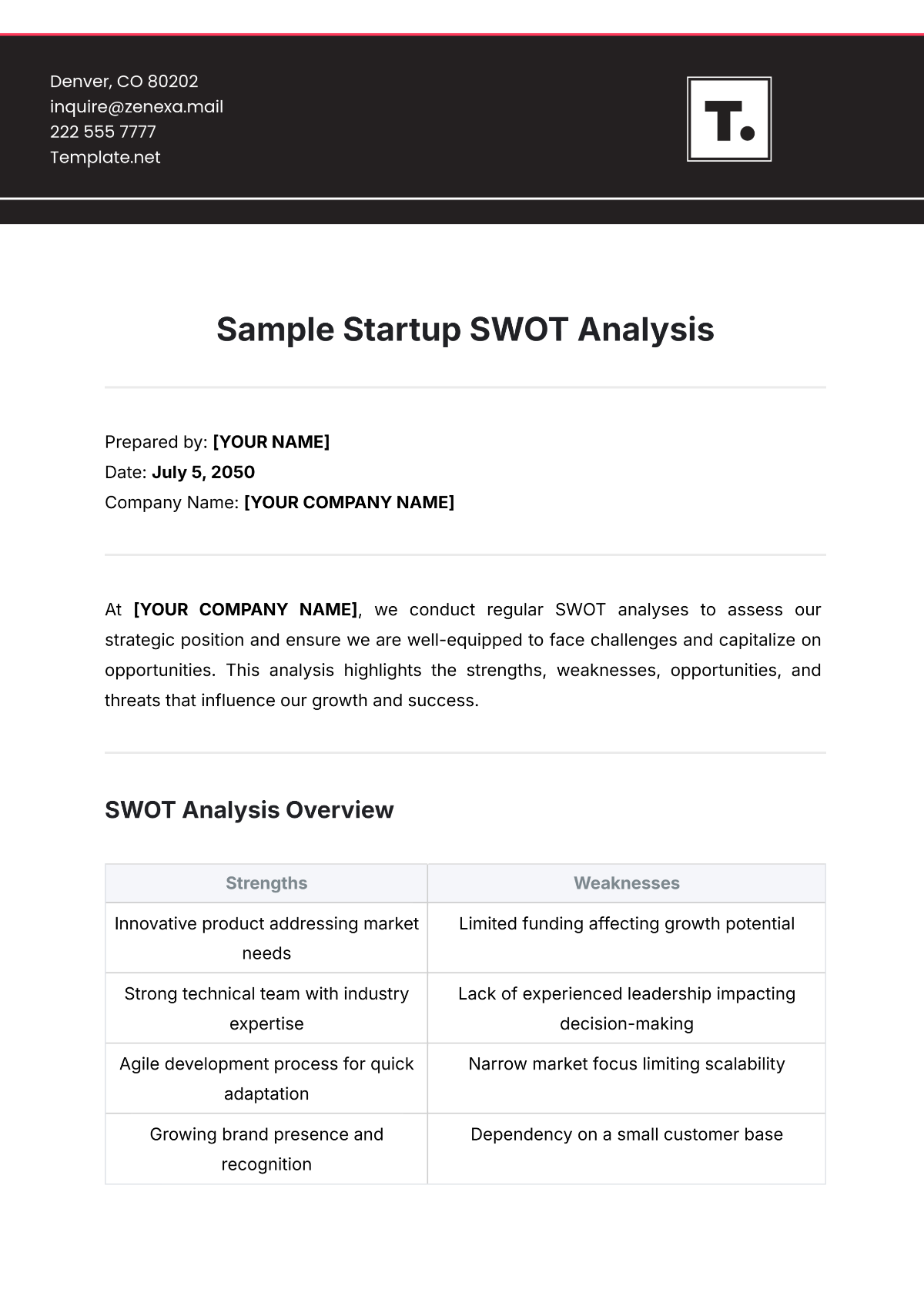

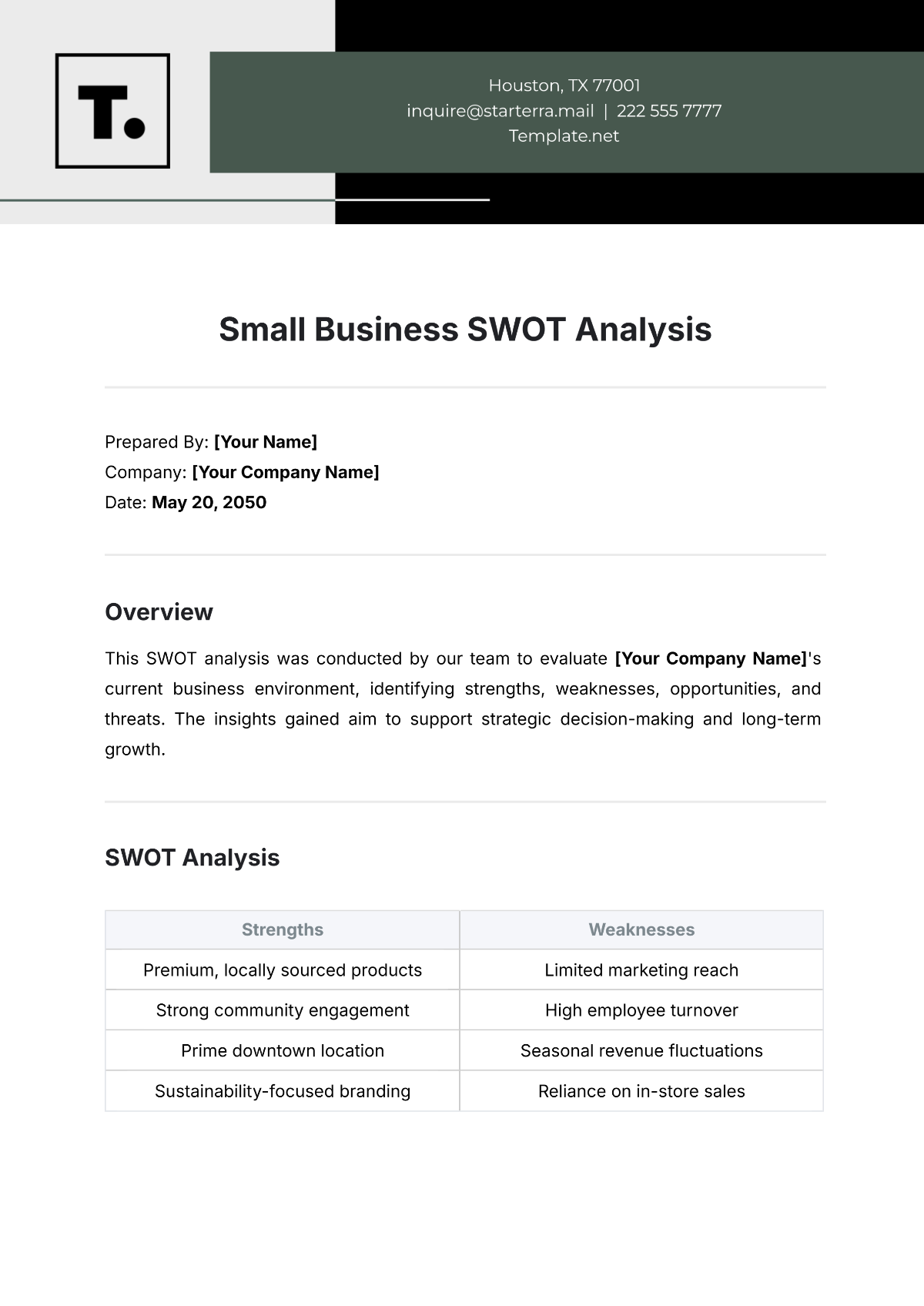

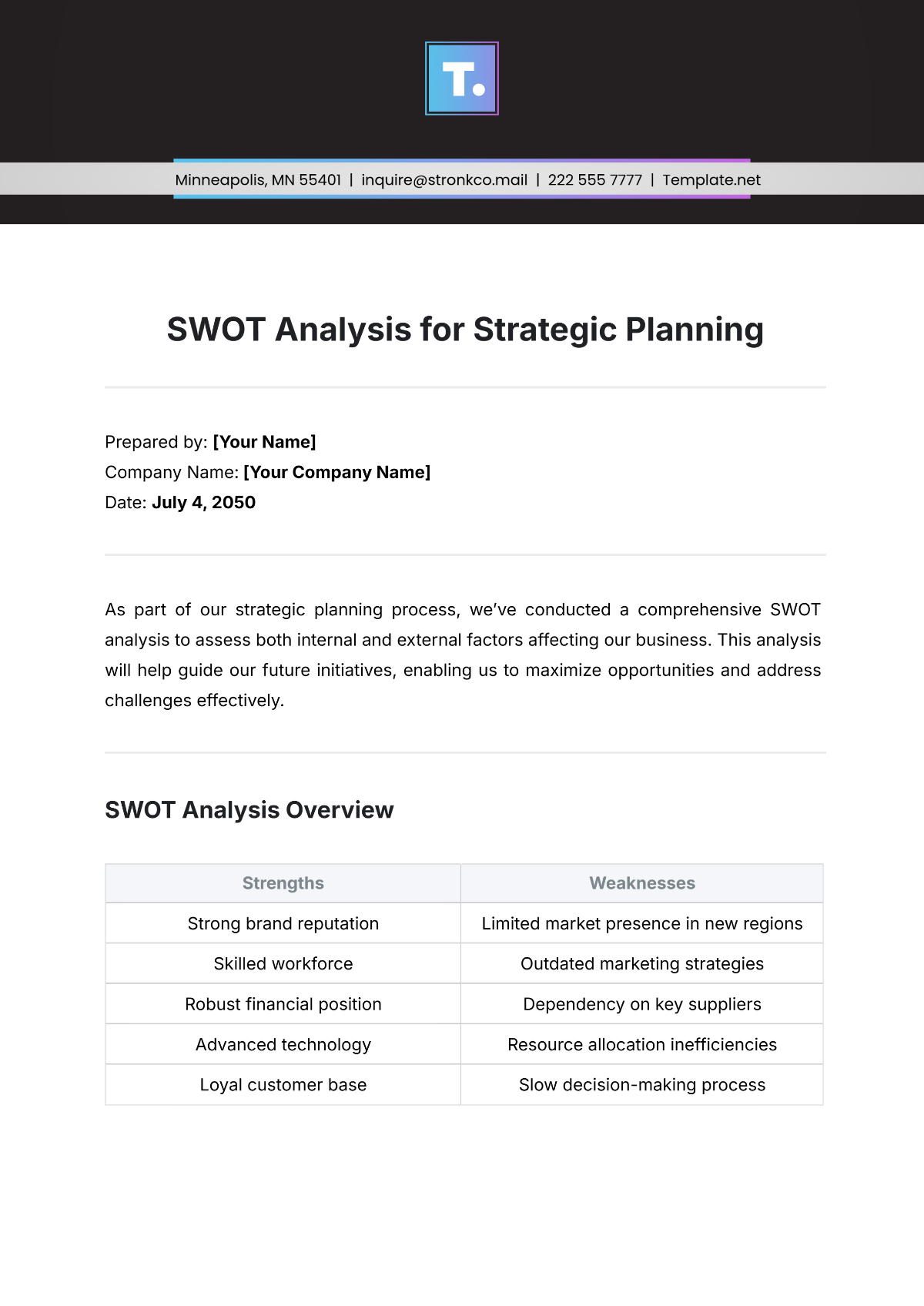

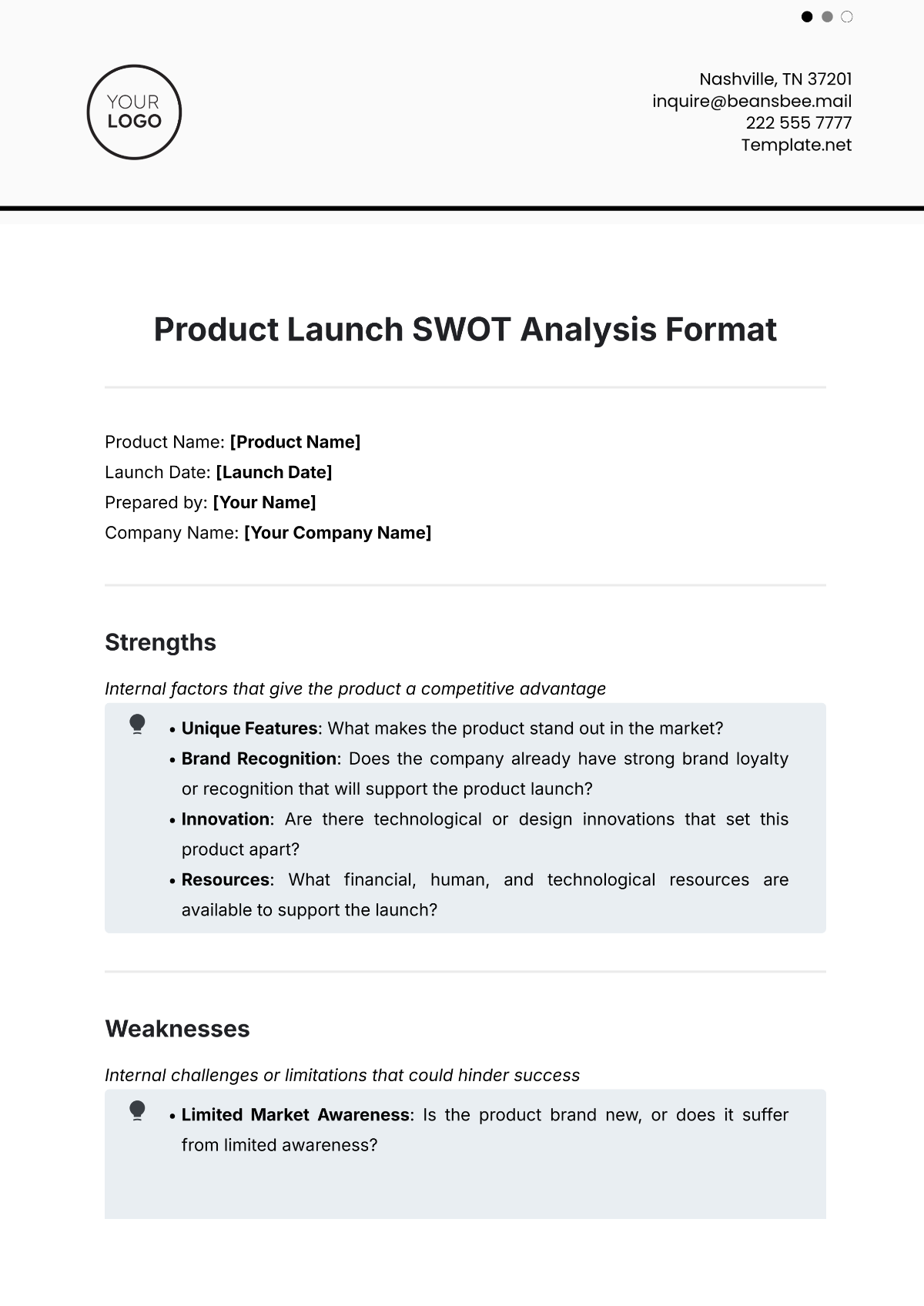

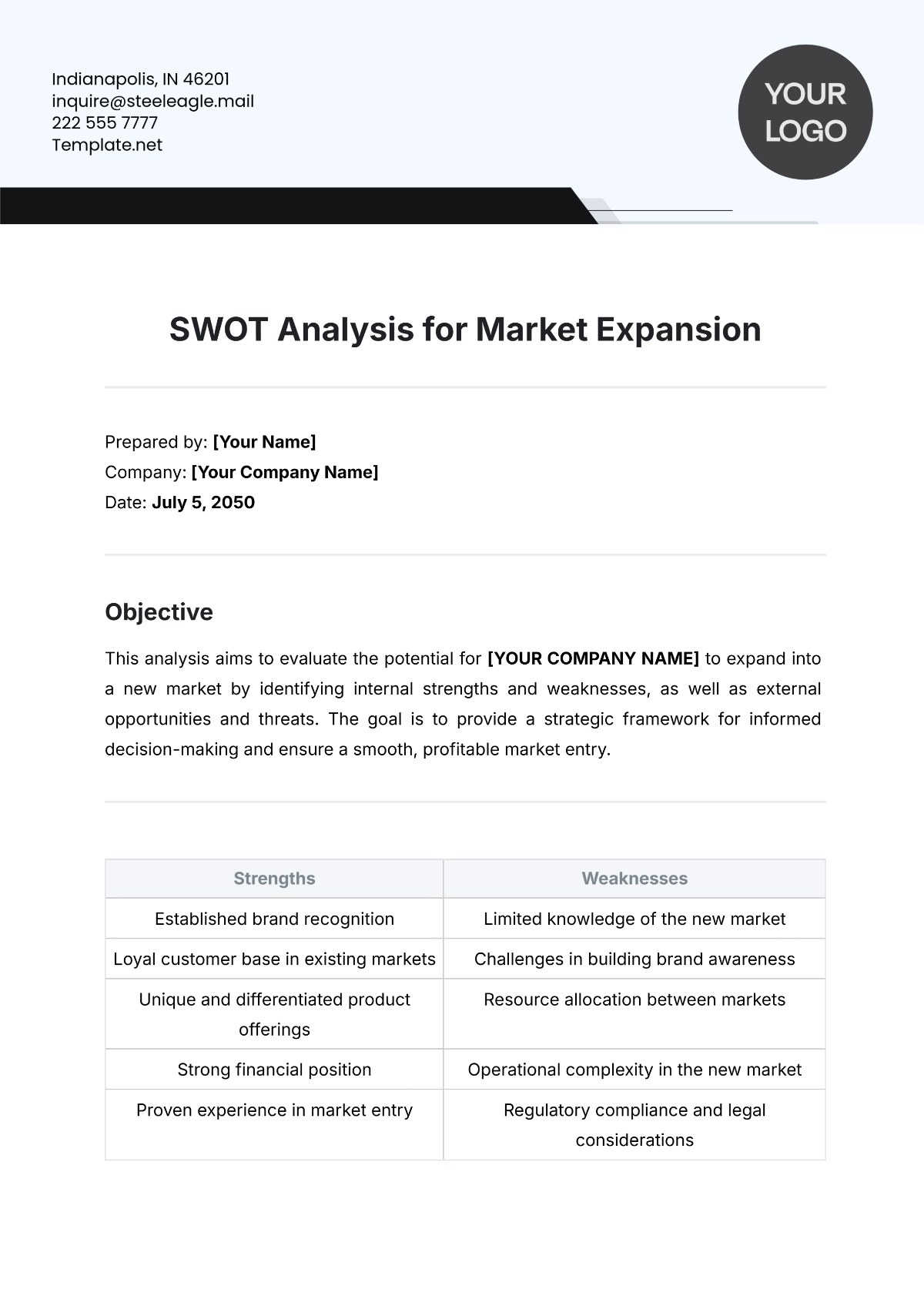

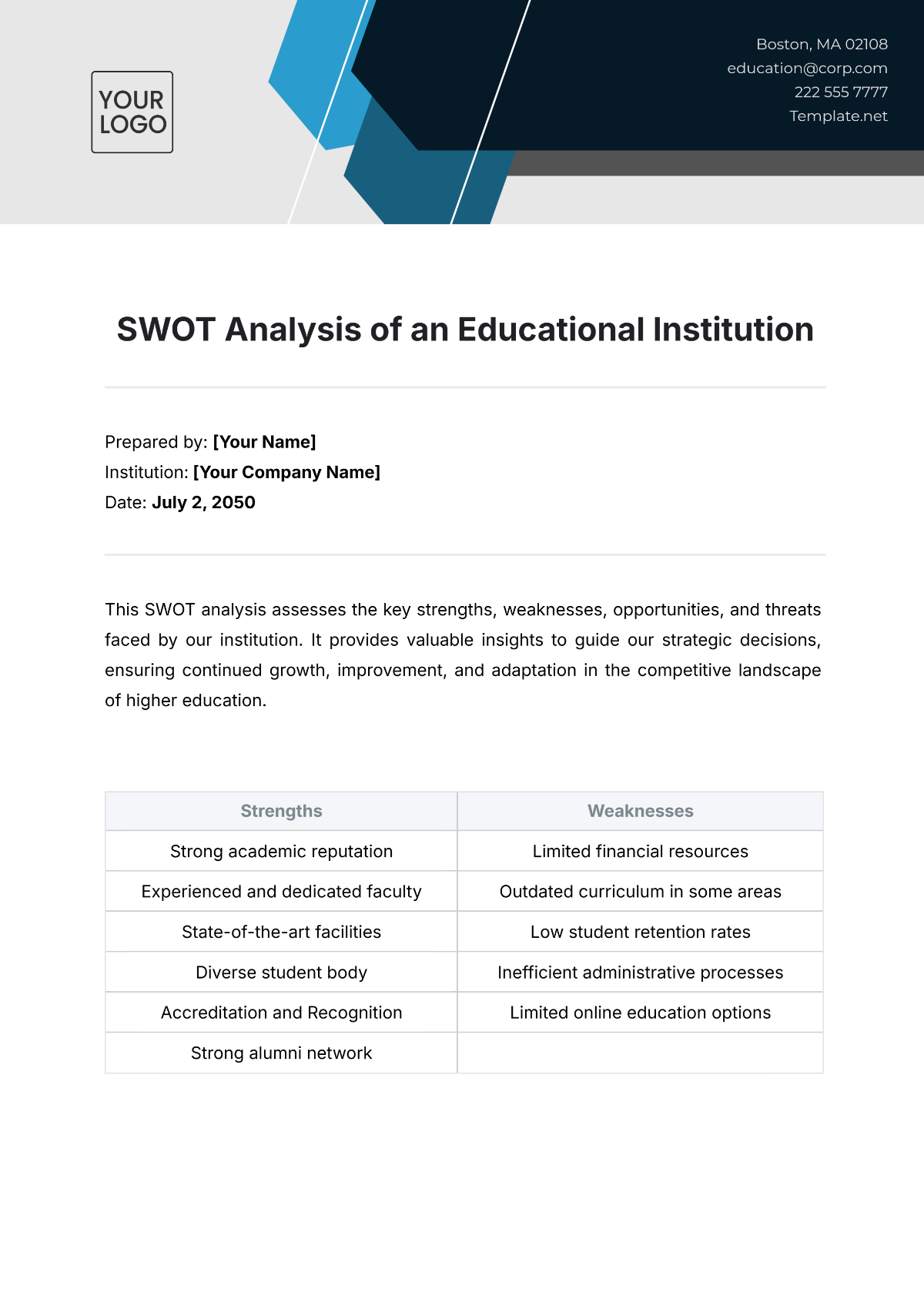

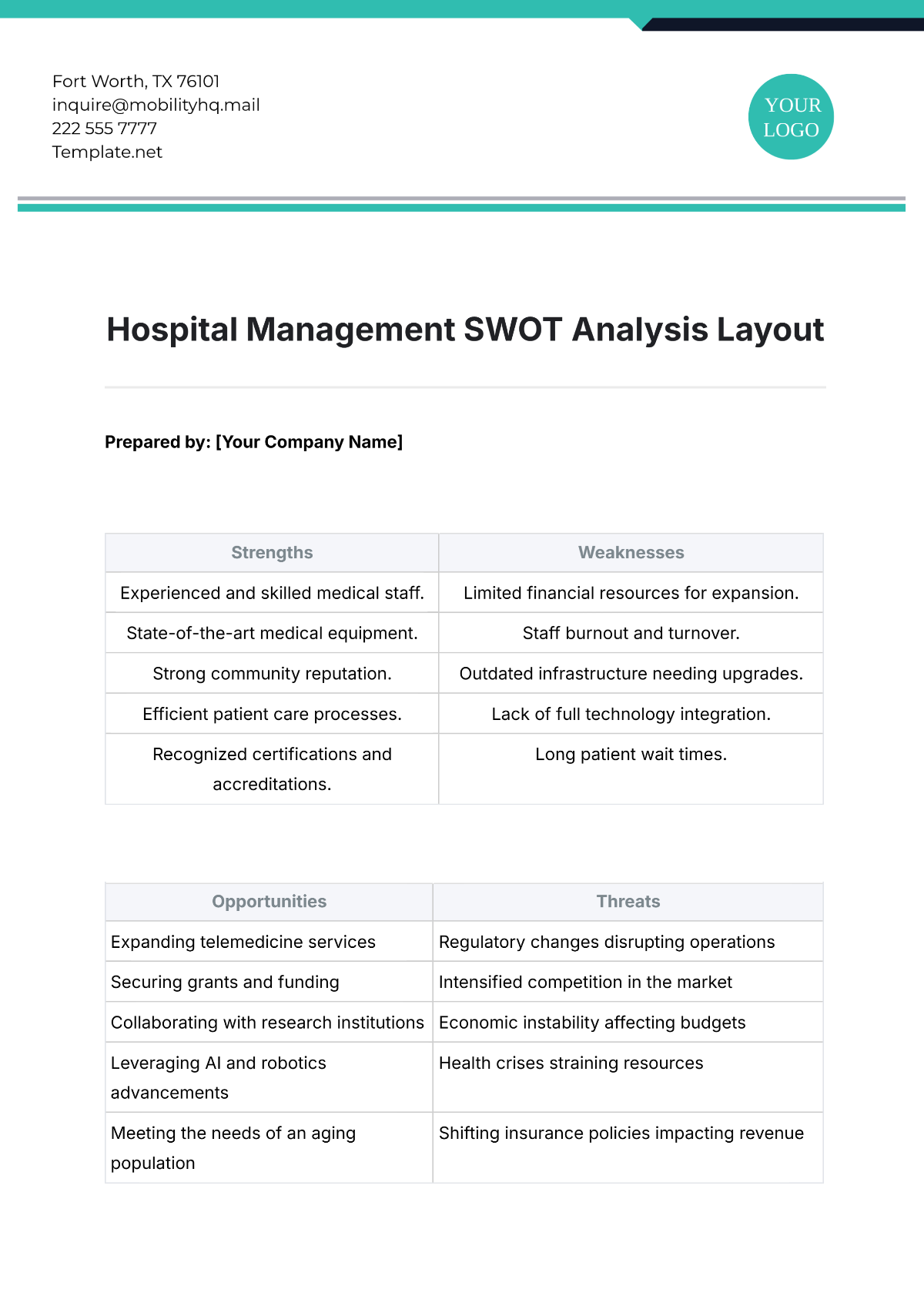

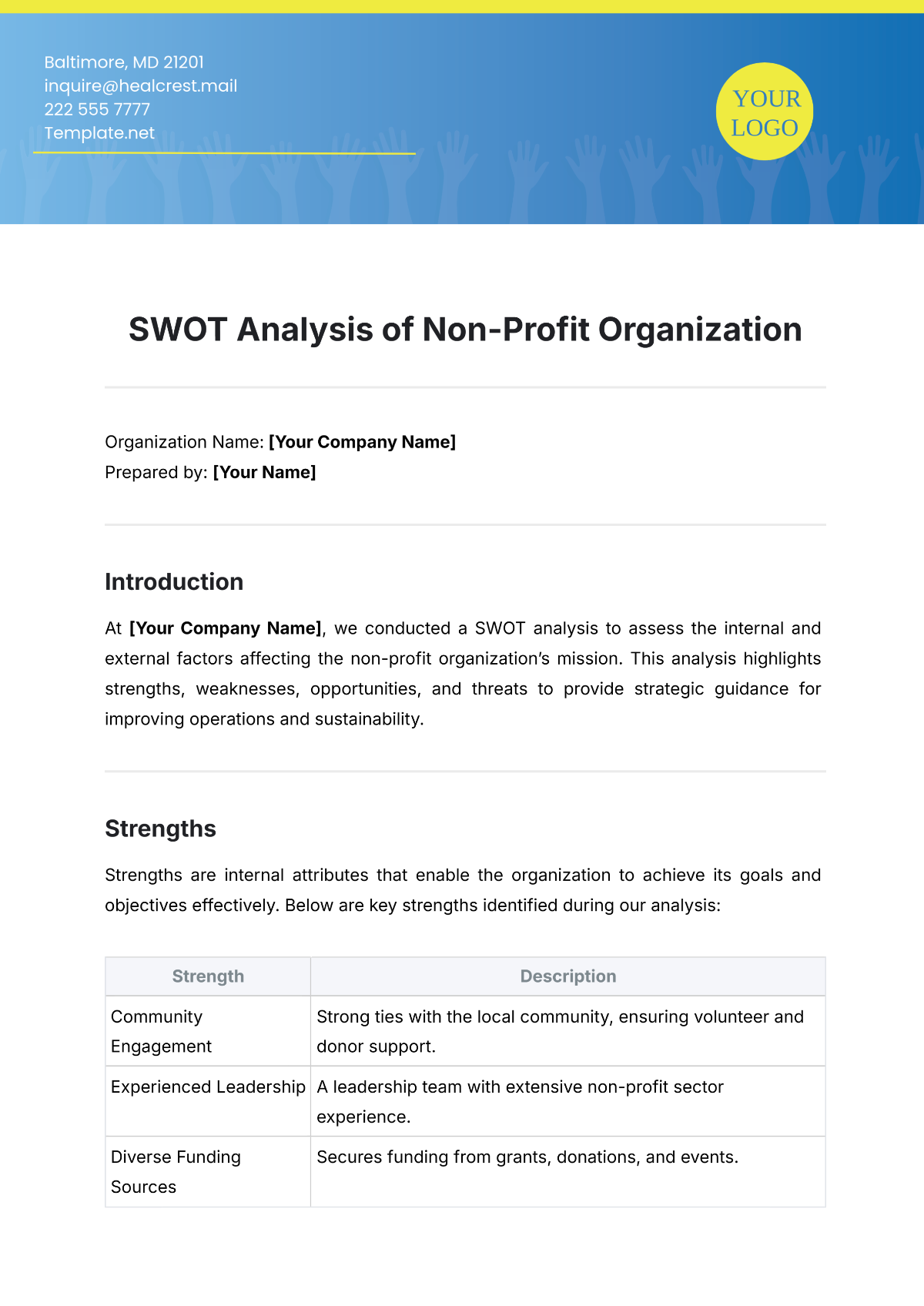

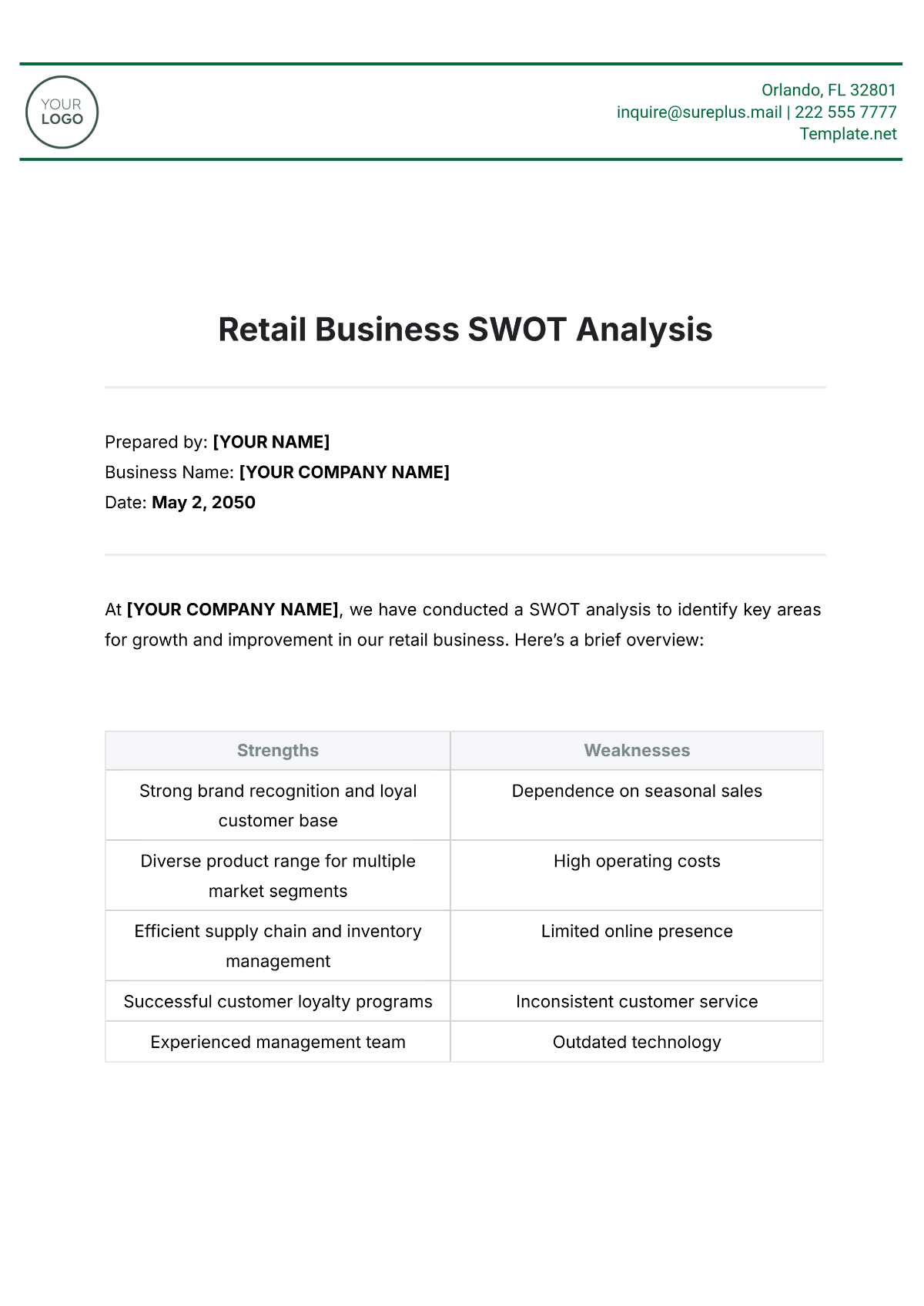

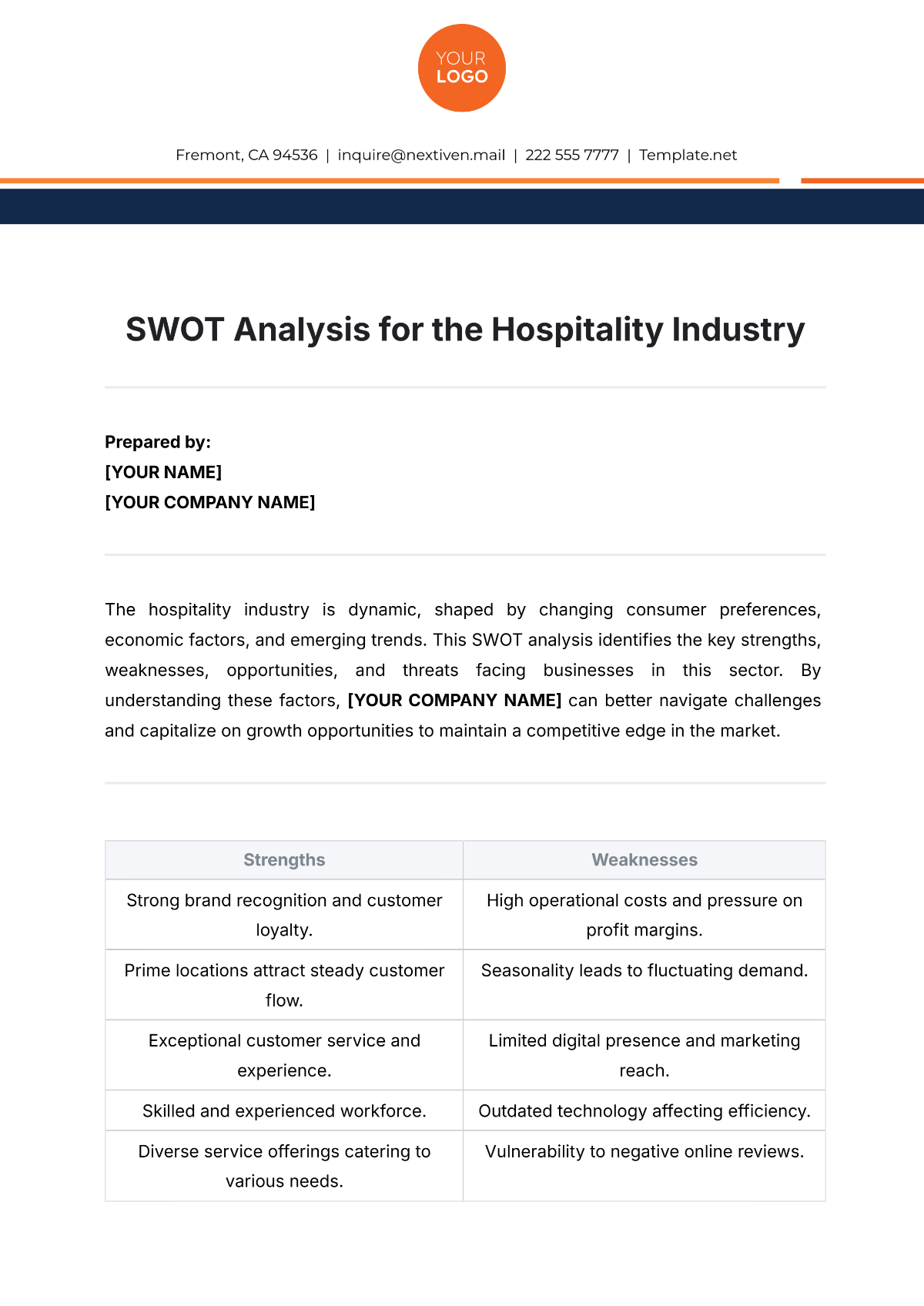

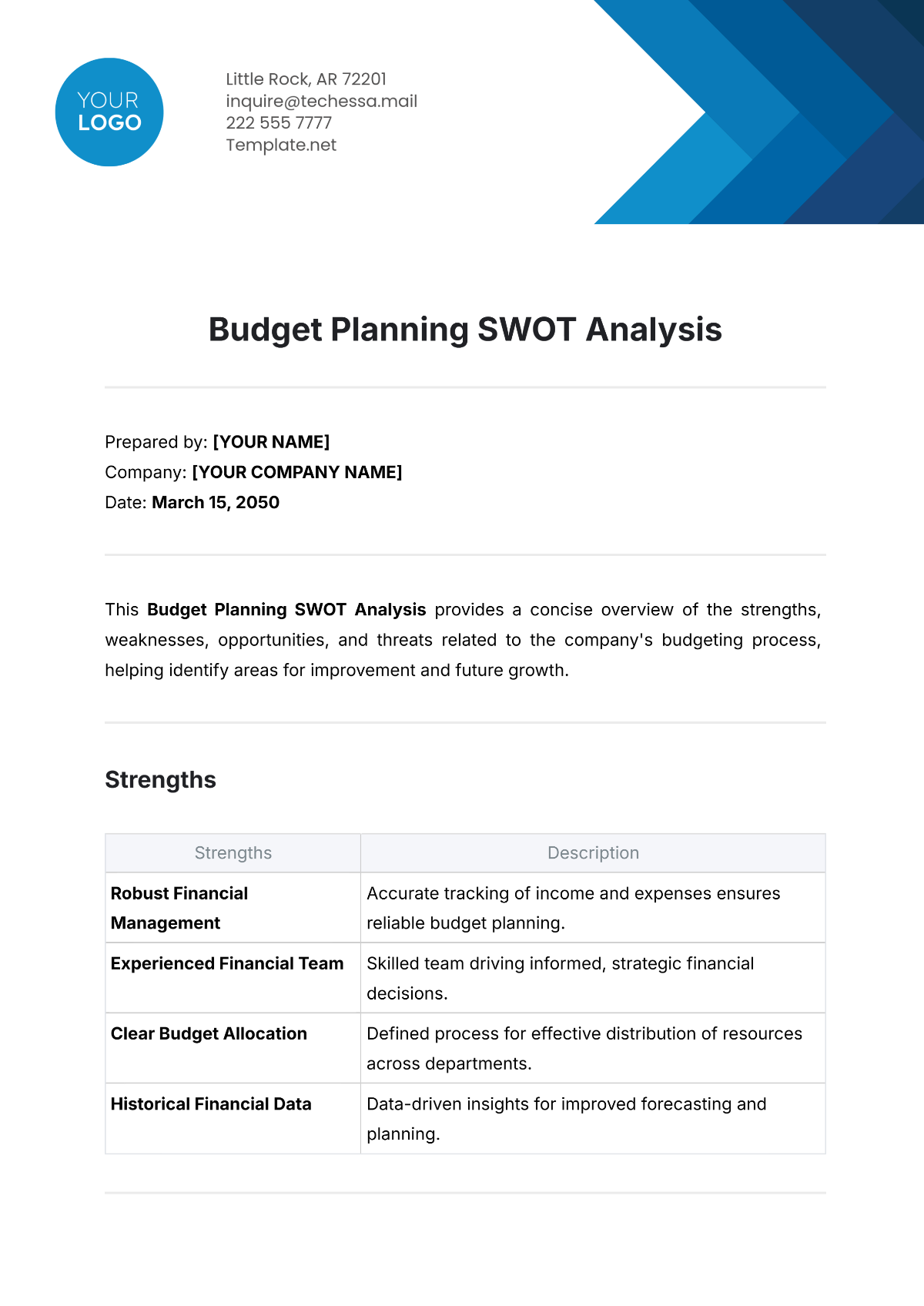

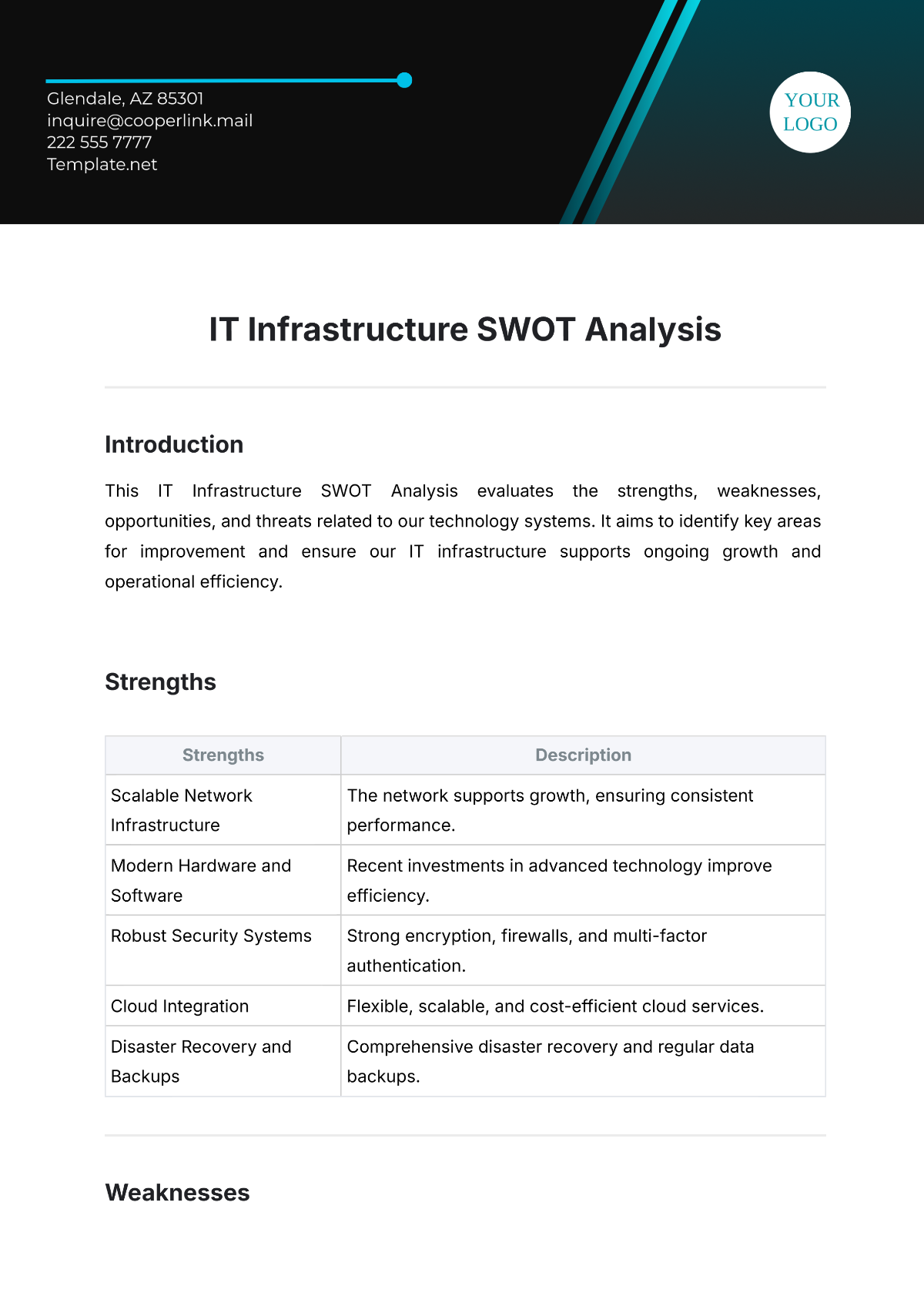

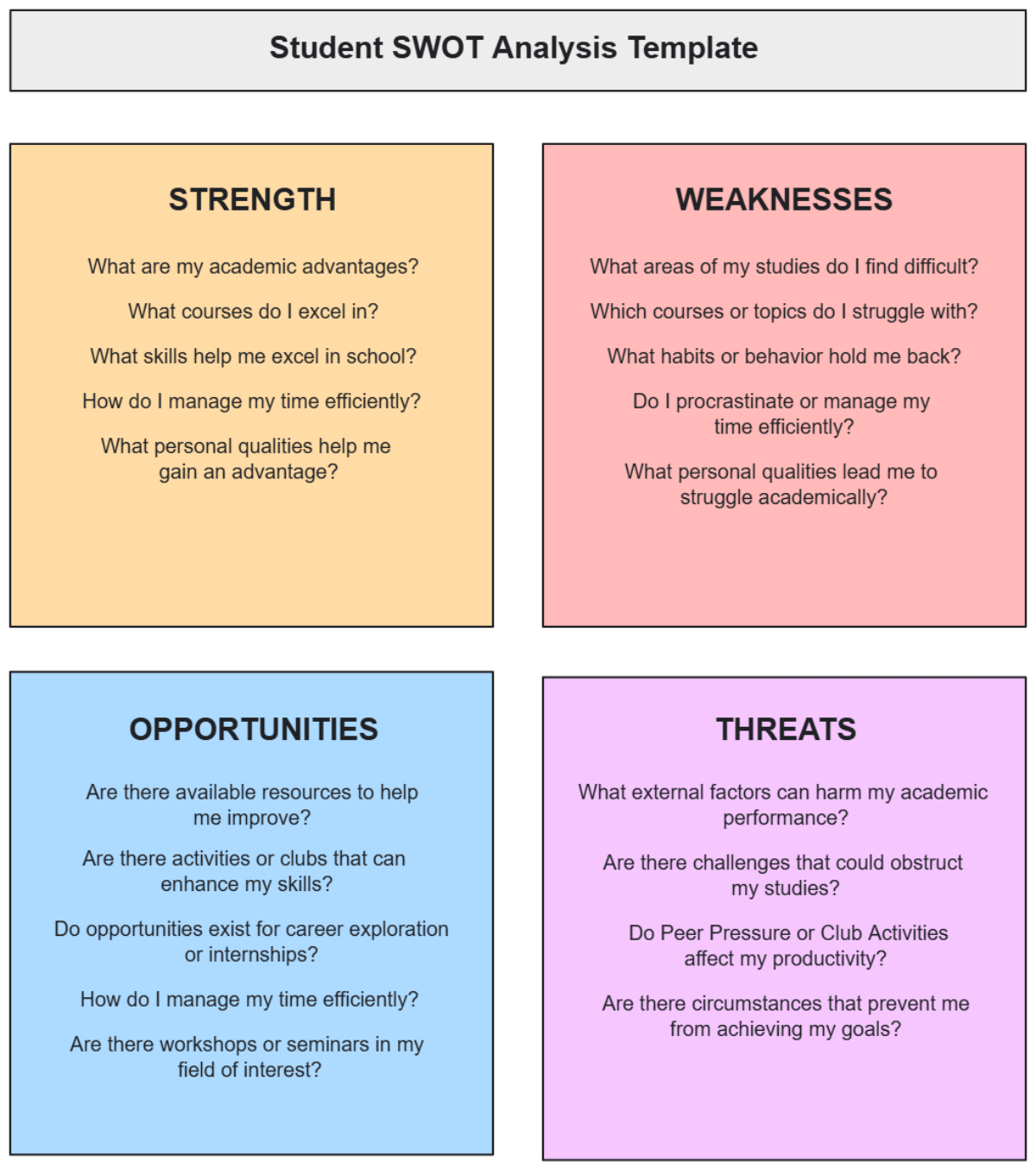

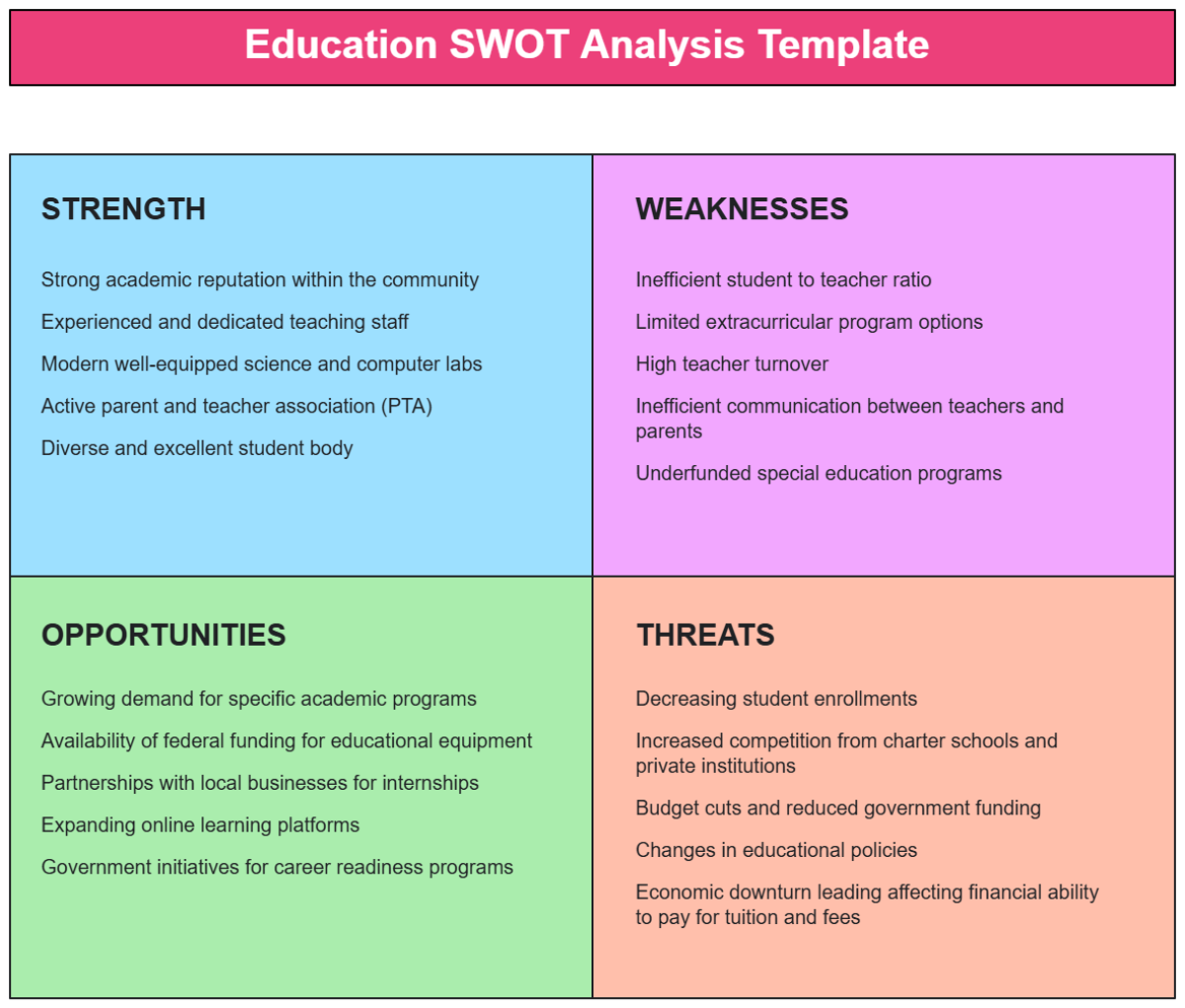

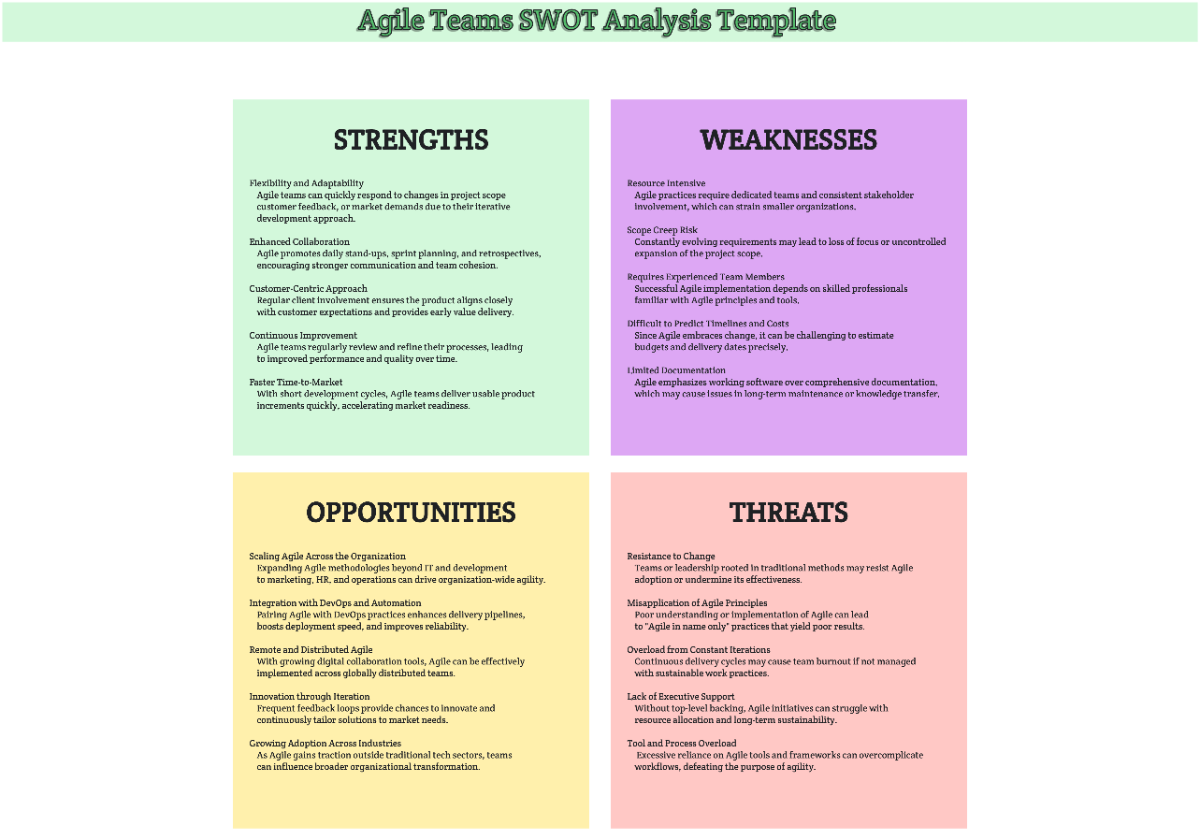

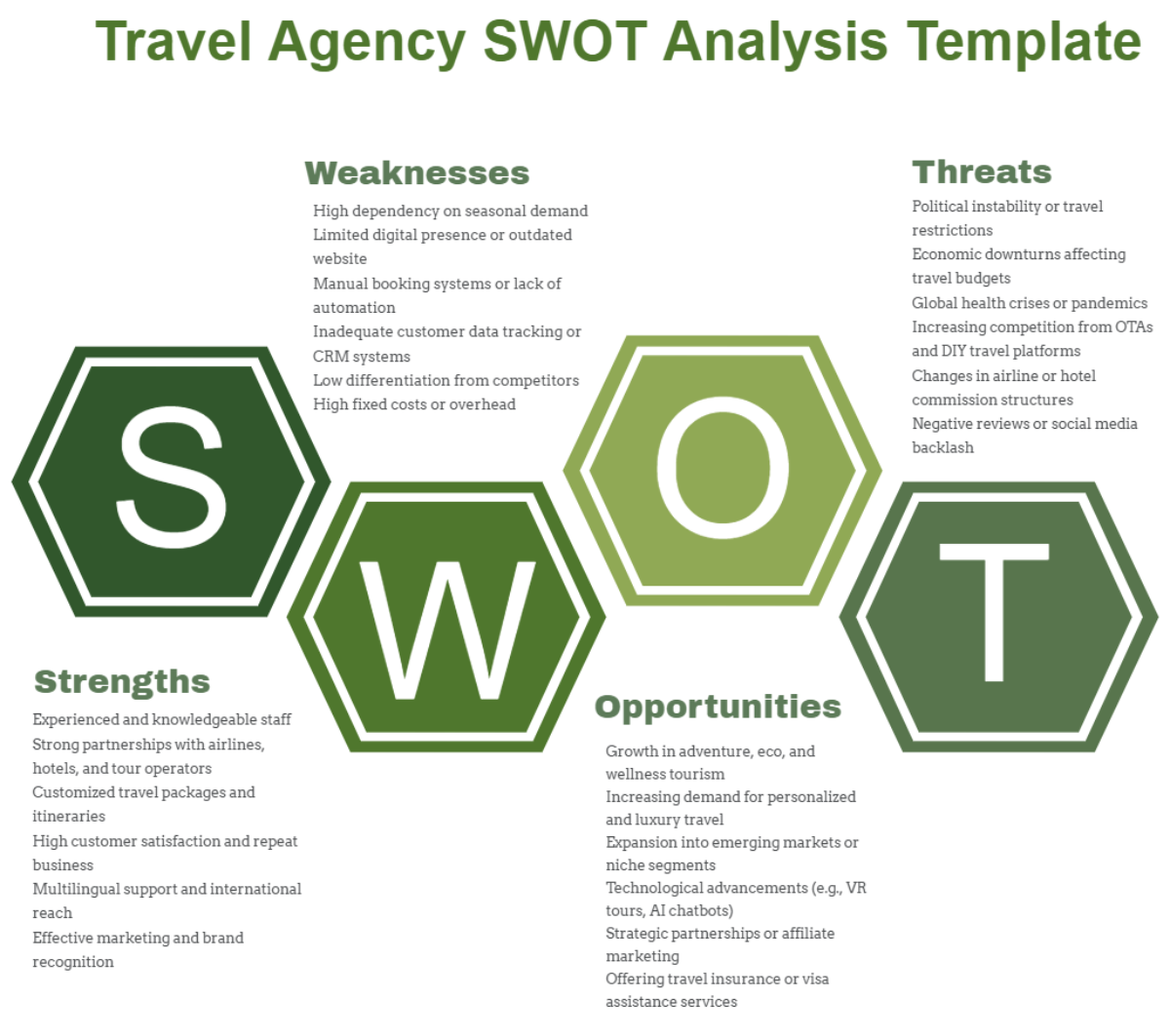

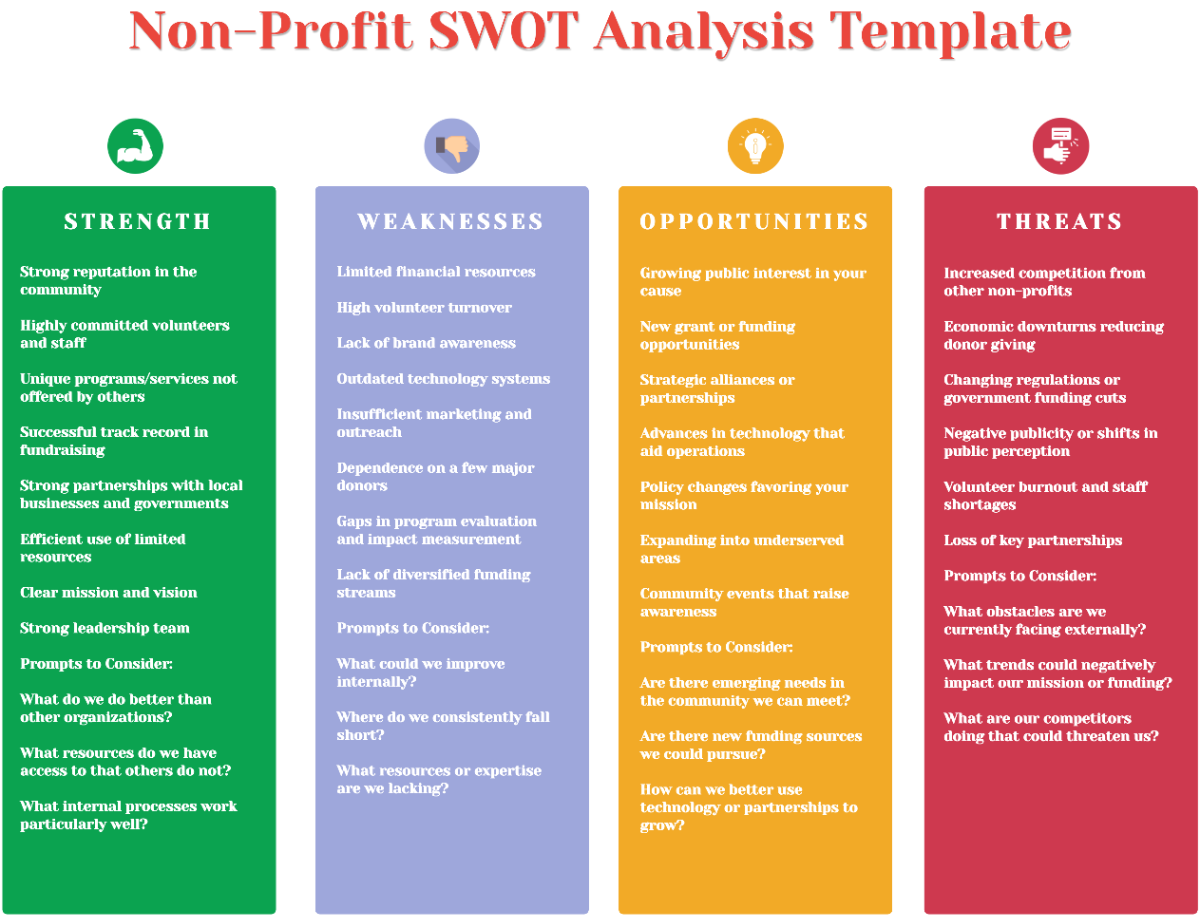

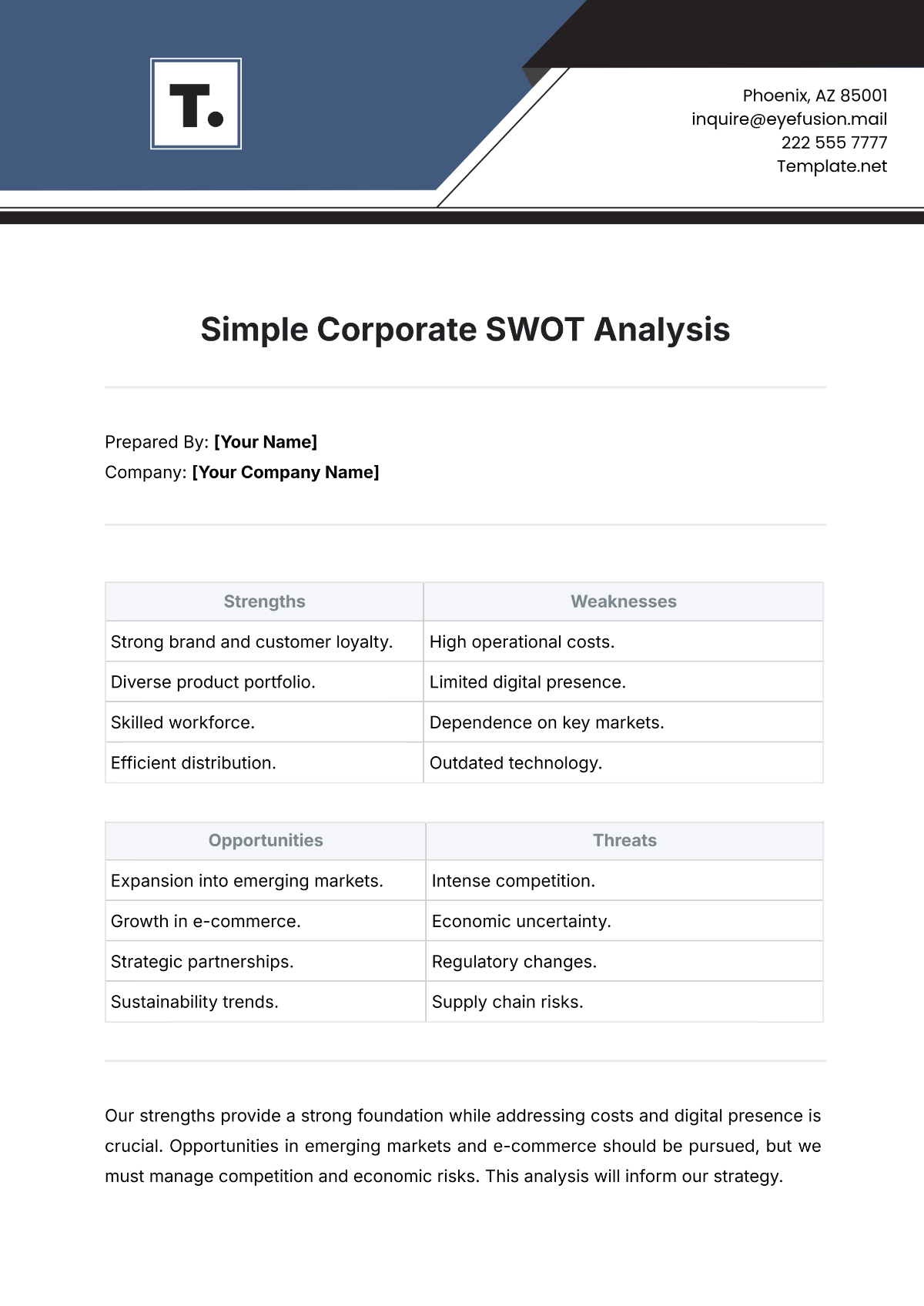

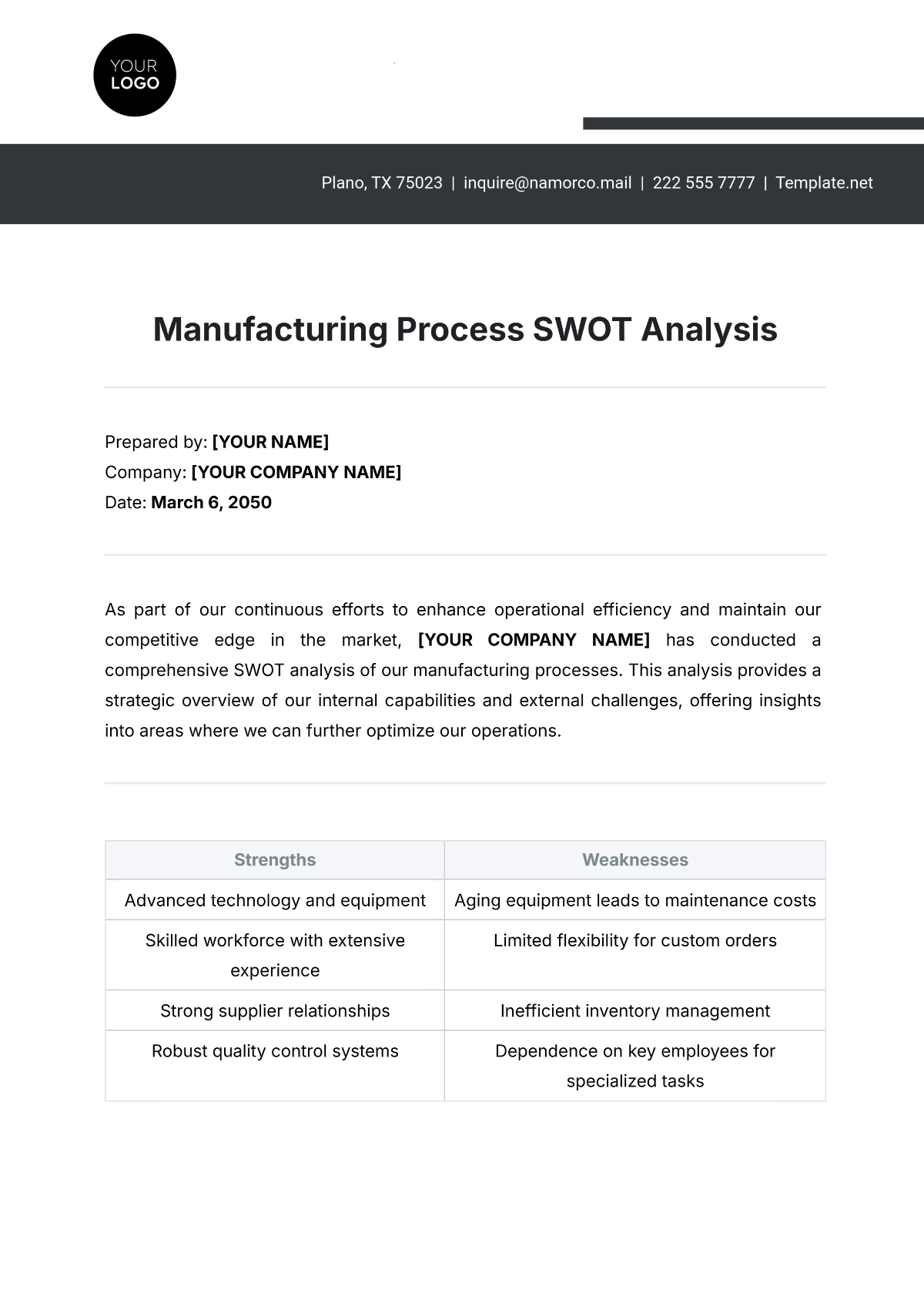

2. Strengths

[Your Company Name]'s strengths highlights the startup's internal advantages, which can be leveraged to achieve its objectives:

Innovative Product Line with Patented Technology: This suggests the startup has unique offerings that are legally protected, providing a competitive edge. Expanding on this could involve detailing the innovation's market relevance, potential applications, and how the patents provide a barrier to entry for competitors.

Experienced Management Team with a Robust Network in the Industry: This indicates leadership with a proven track record and valuable industry connections. Further elaboration might include the management team's specific accomplishments, their roles in previous successful ventures, and how their network can facilitate strategic partnerships or customer acquisition.

Solid Business Model with a Detailed Roadmap for Growth: A well-defined business model and growth plan are critical for scalability and sustainability. An expanded analysis could outline the revenue streams, customer acquisition strategies, and key milestones in the growth roadmap, demonstrating the startup's preparedness for expansion.

3. Weaknesses

These weaknesses are internal factors that could hinder [Your Company Names]'s ability to meet its objectives:

Limited Resources and Operational Capacity: This common startup challenge can impact the ability to scale. An in-depth analysis might discuss specific resource gaps (financial, human, technological) and operational constraints, along with potential strategies for resource optimization and capacity building.

Lack of Brand Recognition and Foothold in the Market: Establishing a brand in a crowded market is daunting. Expanding on this weakness could include current market positioning efforts, brand development strategies, and customer engagement plans to build brand equity.

Susceptibility to Financial Instability in the Initial Stages: Financial risks are inherent to startups. A detailed examination could cover the startup's funding sources, cash flow management, and contingency plans to address financial uncertainties.

4. Opportunities

These opportunities are the external factors available that your startup can capitalize on to grow:

Increase in Demand for Innovative Technology Solutions: This suggests a favorable market trend. An expanded view could analyze market segments exhibiting this demand, potential customer demographics, and how the startup's offerings align with market needs.

Opportunity to Establish Partnerships with Industry Leaders: Strategic partnerships can accelerate growth. Further details might include potential partners, the mutual benefits of such partnerships, and strategies to engage and collaborate with these industry leaders.

Potential for International Expansion: Global markets offer new revenue streams. An elaboration could explore target international markets, entry strategies, and considerations for adapting the product or service to different cultural and regulatory environments.

5. Threats

These threats are existing external challenges that could pose risks to your startup's success:

High Competition in the Technology Sector: The tech industry is notoriously competitive. A deeper analysis could identify key competitors, their market strategies, and how the startup plans to differentiate itself in the marketplace.

Regulatory Challenges and Compliance Issues: Navigating legal requirements is critical. Expanding on this threat could entail outlining the specific regulations affecting the startup, potential compliance challenges, and strategies for ensuring regulatory adherence.

Chaotic Market Conditions Due to Economic Instability: Economic fluctuations can impact market stability. A more detailed assessment might discuss the startup's resilience and adaptability to economic changes, including diversification strategies and financial risk management.

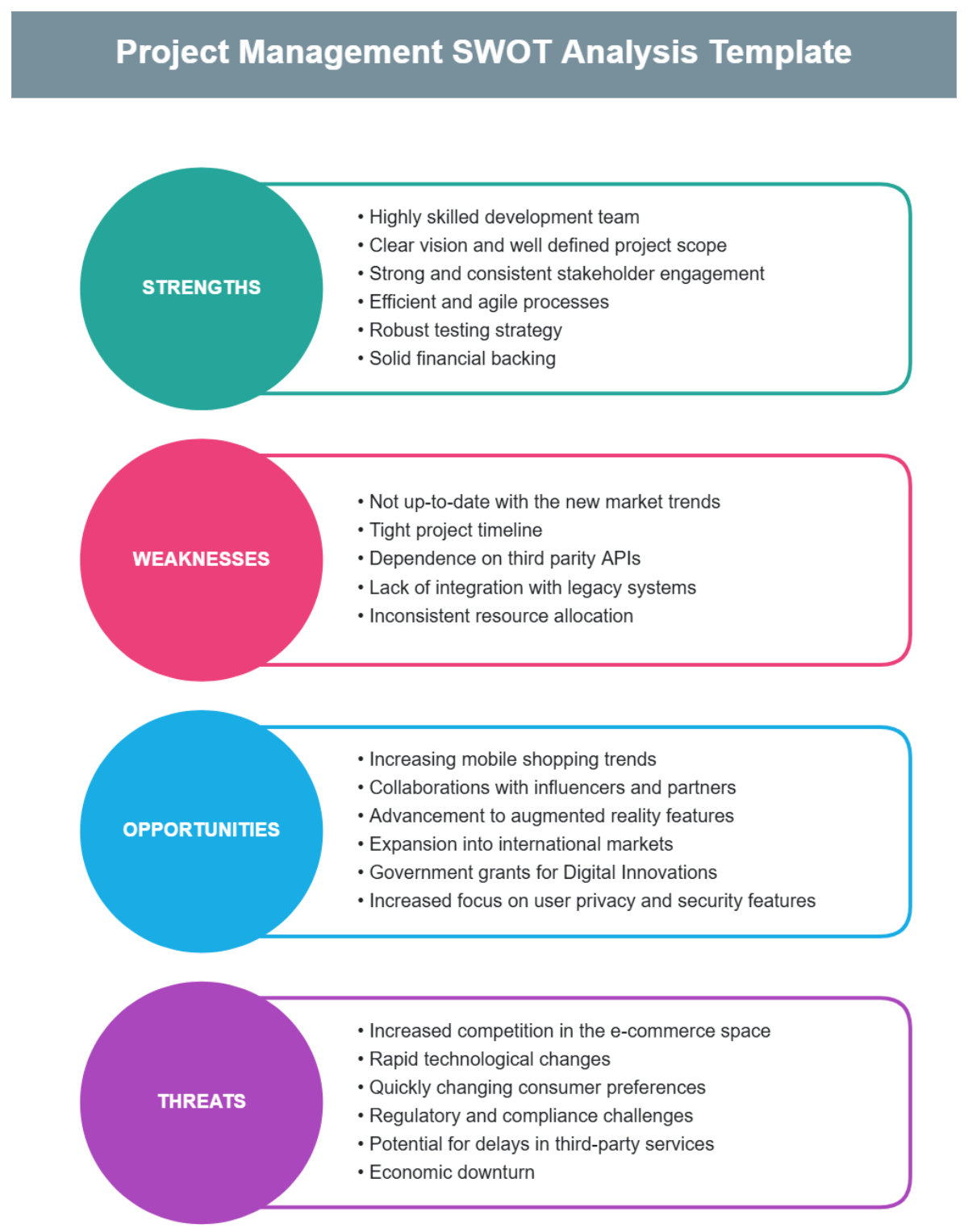

6. Action Items

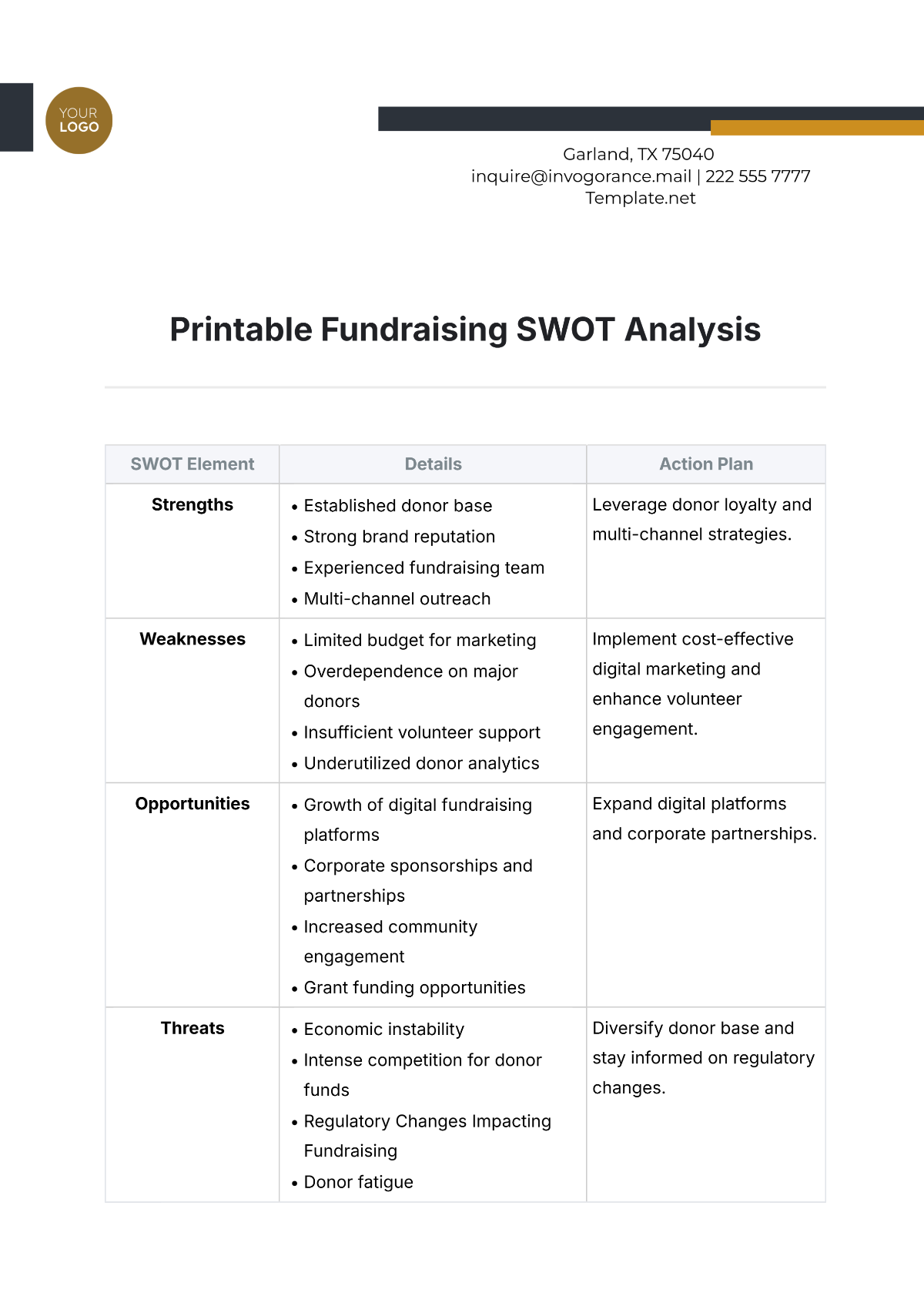

Following the comprehensive SWOT analysis, we have distilled a set of strategic action items designed to leverage [Startup Name]'s strengths and opportunities, while addressing its weaknesses and mitigating potential threats. This table serves as a practical roadmap for guiding the startup's strategic decisions and operational improvements, ensuring that [Startup Name] not only capitalizes on its current advantages but also fortifies its position against the challenges it faces in the [specific industry] sector.

Action Items Table

Area | Action Items |

|---|---|

Strengths | Leverage patented technology to secure market position Utilize management's network for strategic partnerships Highlight the solid business model in investor communications |

Weaknesses | Seek additional funding or strategic partnerships to bolster resources Implement a targeted marketing strategy to build brand recognition Develop financial stability through diversified revenue streams |

Opportunities | Capitalize on the growing demand by expanding product lines Pursue partnerships with industry leaders to enhance market presence Explore international markets for expansion opportunities |

Threats | Differentiate from competitors through innovation and quality Stay abreast of regulatory changes and ensure compliance Develop a contingency plan to navigate economic instability |

7. Conclusion

The SWOT analysis of [Startup Name] elucidates a dynamic landscape where the startup's innovative prowess and strategic management acumen position it well for capitalizing on the burgeoning opportunities within the [specific industry]. However, the inherent challenges of limited resources, market competition, and regulatory complexities necessitate a proactive and strategic approach to ensure sustained growth and stability.

For potential investors, the key lies in balancing the enticing prospects offered by [Startup Name]'s strengths and opportunities against the prudent management of its weaknesses and threats. The action items outlined above serve as a roadmap for not only mitigating risks but also for harnessing the startup's full potential. As [Startup Name] continues to navigate the [specific industry] landscape, its ability to adapt, innovate, and strategically align with industry trends will be pivotal in its journey towards achieving long-term success and delivering substantial returns on investment.

In summary, this SWOT analysis reaffirms [Startup Name]'s position as a compelling investment opportunity, provided that the outlined strategic actions are effectively implemented. For investors, engaging with [Startup Name] presents a chance to be part of a forward-thinking venture poised for significant impact within the [specific industry], promising both challenges to overcome and substantial rewards to reap.