Free Marketing New Market Entry Proposal

Executive Summary

A. [Your Company Name] Overview

[Your Company Name] is a leading global provider of innovative technology solutions with a strong track record of success. We are committed to delivering high-quality products and services that cater to our customers' evolving needs.

B. Market Opportunity

The market opportunity for our expansion into Metaverse Infrastructure is substantial. Recent market research indicates that Metaverse Infrastructure is experiencing rapid growth, with a projected market size of $3.2 billion by 2050.

C. Proposed Market Entry Strategy

Our strategy for entering Metaverse Infrastructure is based on extensive market segmentation. We will target specific customer segments based on their unique needs and preferences, ensuring a tailored approach to market penetration.

D. Expected Outcomes

By entering Metaverse Infrastructure , we anticipate achieving a market share of at least 15% within the first three years, resulting in projected annual revenues of $48 million.

Market Analysis

A. Market Research Overview

Our market research for Metaverse Infrastructure involved a combination of primary and secondary data collection. We conducted surveys, interviews, and analyzed industry reports to gain comprehensive insights into the market.

B. Target Audience Analysis

The target audience in Metaverse Infrastructure comprises tech-savvy professionals and businesses seeking cutting-edge solutions to streamline their operations. Our research reveals that 70% of potential customers are looking for innovative software solutions.

C. Competitor Analysis

Key competitors in Metaverse Infrastructure include Robot Nest Technologies, Cloud Vista Innovations, and Cyber Wave Dynamics. We have identified gaps in their offerings that we can capitalize on, such as superior customer support and customizable features.

D. SWOT Analysis

Our SWOT analysis highlights our strengths in technology innovation and a robust customer base. Weaknesses include our limited presence in Metaverse Infrastructure . Opportunities lie in the untapped market potential, while threats include potential regulatory challenges.

Marketing Strategy

A. Product or Service Positioning

Our flagship product, Data Xcel Pro, will be positioned as the most advanced solution in Metaverse Infrastructure . Its features, such as AI-driven automation and real-time analytics, set it apart.

B. Pricing Strategy

To gain a competitive edge, we will initially offer competitive introductory pricing with scalable plans to accommodate the diverse needs of our target customers.

C. Distribution Channels

Our distribution channels will include direct sales through our website, partnerships with local distributors, and online marketplaces.

D. Promotion Strategy

We will launch an integrated marketing campaign that includes online advertising, content marketing, and participation in industry events to build brand awareness.

Operational Plan

A. Supply Chain Management

We will establish a local supply chain network to ensure timely product delivery and reduce logistics costs.

B. Logistics and Distribution

Our distribution centers in Metaverse Infrastructure will be strategically located for efficient product distribution.

C. Manufacturing or Service Delivery

For software products, there will be no manufacturing involved, but we will provide robust customer support and regular software updates.

D. Regulatory Compliance

Our legal team will work closely with local authorities to ensure compliance with all regulatory requirements in Metaverse Infrastructure .

Financial Projections and Monitoring

A. Revenue Projections

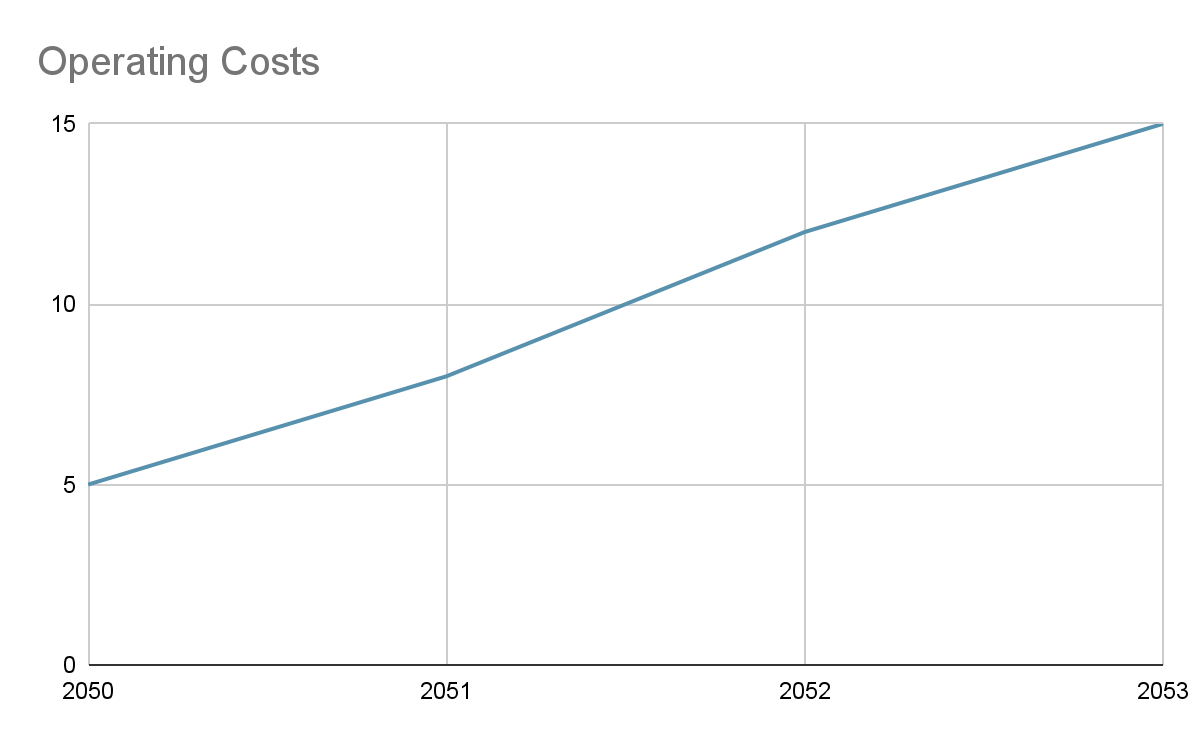

B. Cost Estimations

C. Break-Even Analysis

Our break-even analysis indicates that we will achieve profitability by the end of the second year of operations in Metaverse Infrastructure , with an estimated break-even point of $13 million in revenue.

D. ROI Forecast

Based on our financial projections, we anticipate a return on investment (ROI) of 25% by 2053, demonstrating the financial viability of this market entry.

E. Monitoring and Evaluation

To ensure the financial projections align with our goals, we will establish robust monitoring and evaluation processes:

Key Performance Indicators (KPIs)

We will track the following financial KPIs:

Customer Acquisition Rate: This KPI measures the rate at which we acquire new customers in Metaverse Infrastructure .

Customer Churn Rate: It tracks the percentage of customers who stop using our products or services.

Monthly Revenue Growth: This KPI monitors our revenue growth on a monthly basis.

Return on Investment (ROI): We will continuously assess ROI to ensure that our investments are generating the expected returns.

Risk Assessment

A. Market Risks

The primary market risk is competition from established players. To mitigate this, we will continuously innovate and adapt our product offerings.

B. Regulatory Risks

Regulatory changes in Metaverse Infrastructure could impact our operations. We will maintain a legal team to monitor and comply with any regulatory updates.

C. Financial Risks

Currency fluctuations and economic uncertainties in Metaverse Infrastructure are potential financial risks. We will employ financial hedging strategies to minimize these risks.

D. Mitigation Strategies

We will diversify our product portfolio, stay informed about regulatory changes, and maintain financial reserves to address unexpected financial challenges.

Implementation Timeline

Phases and Milestones

Phase | Milestone | Timeline |

Market Research | Data Collection and Analysis | Q1 2050 - Q3 2050 |

Strategy | Development and Approval | Q4 205 |

Product Launch | Product Development and Testing | Q1 2051 - Q2 2051 |

Marketing | Marketing Campaign Launch | Q3 2051 |

Monitoring and Evaluation

A. Key Performance Indicators (KPIs)

Customer Acquisition Rate: This KPI measures the rate at which we acquire new customers in Metaverse Infrastructure . We aim to achieve a steady monthly growth of at least 5% in customer acquisition.

Customer Churn Rate: It tracks the percentage of customers who stop using our products or services. Our goal is to maintain a churn rate below 10%.

Monthly Revenue Growth: This KPI monitors our revenue growth on a monthly basis. We aim for a consistent 8% monthly revenue growth rate.

Return on Investment (ROI): We will continuously assess ROI to ensure that our investments are generating the expected returns. Our target is to maintain an ROI of at least 20% annually.

Data Collection Methods

Data for these KPIs will be collected through various means, including:

Customer surveys: We will conduct quarterly surveys to gauge customer satisfaction and identify areas for improvement.

Sales reports: Our sales team will provide detailed reports on revenue, customer acquisition, and churn.

Website analytics: Our digital marketing team will monitor online customer behavior and conversion rates, providing insights for optimization.

Progress Reports

We will generate monthly progress reports for internal use and quarterly reports for stakeholders. These reports will provide a transparent view of our financial performance and market traction. They will also include actionable recommendations based on the KPI data.

A. Adjustments and Improvements

The data collected through KPIs and progress reports will guide us in making necessary adjustments and improvements to our financial strategies and operations in Metaverse Infrastructure . This iterative approach will help us optimize our financial performance over time.

B. Monthly Progress Reports

Content: Monthly reports will include a detailed analysis of our financial performance for the preceding month. This encompasses revenue figures, costs, and KPIs related to customer acquisition, churn, and revenue growth.

Purpose: The primary purpose of monthly reports is to enable our internal teams to stay updated on our progress and make real-time adjustments when necessary. These reports will facilitate data-driven decision-making, helping us respond swiftly to market dynamics.

Distribution: Monthly reports will be shared with key departments such as finance, marketing, and sales. These reports will aid department heads in aligning their strategies with the overall market entry plan.

C. Quarterly Progress Reports (Stakeholders)

Content: Quarterly reports are designed for our stakeholders, including executives, investors, and board members. They will provide a more comprehensive overview of our market entry progress. These reports will cover financial performance, KPI trends, and a narrative on our strategic achievements and challenges.

Purpose: Quarterly reports are critical for transparency and accountability. They allow stakeholders to assess the effectiveness of our market entry strategy, identify potential risks, and offer guidance and support where needed.

Distribution: Quarterly reports will be distributed to stakeholders through secure channels. They will be accompanied by presentations and discussions to ensure a complete understanding of our progress and strategic direction.

D. Key Elements of Progress Reports

Financial Performance: Detailed breakdown of revenue, costs, and profitability, including a comparison to the previous reporting period.

KPI Trends: Analysis of key performance indicators, highlighting areas of improvement and potential challenges.

Strategic Achievements: Narrative on milestones achieved and progress made in implementing the market entry plan.

Challenges and Mitigations: Identification of challenges encountered and strategies in place to mitigate them.

Actionable Recommendations: Suggestions for adjustments and improvements based on data and market dynamics.

Conclusion

A. Summary of the Proposal

In conclusion, our entry into Metaverse Infrastructure is strategically planned to capitalize on the market opportunity. With a robust financial strategy backed by clear monitoring and evaluation processes, we are confident in the success of this venture.

B. Call to Action

We invite you to join us on this exciting journey into Metaverse Infrastructure . Together, we can achieve mutual success and growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Forge successful market entries with the Marketing New Market Entry Proposal Template from Template.net. This editable and customizable proposal ensures a strategic approach for expansion. Tailor it effortlessly with our AI Editor Tool, providing seamless customization. Elevate your proposals with this dynamic, editable, and customizable template for a compelling market entry strategy.

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal