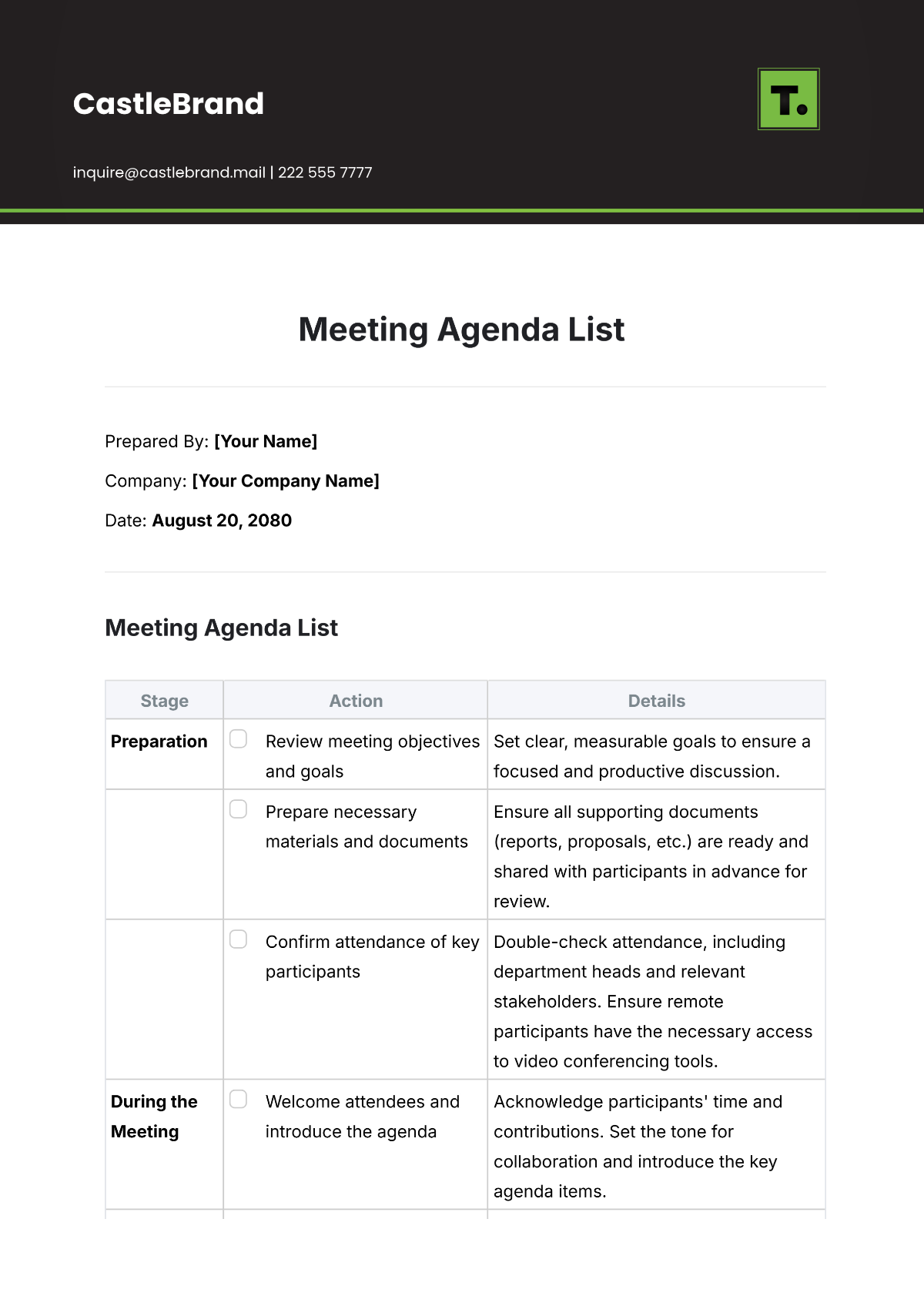

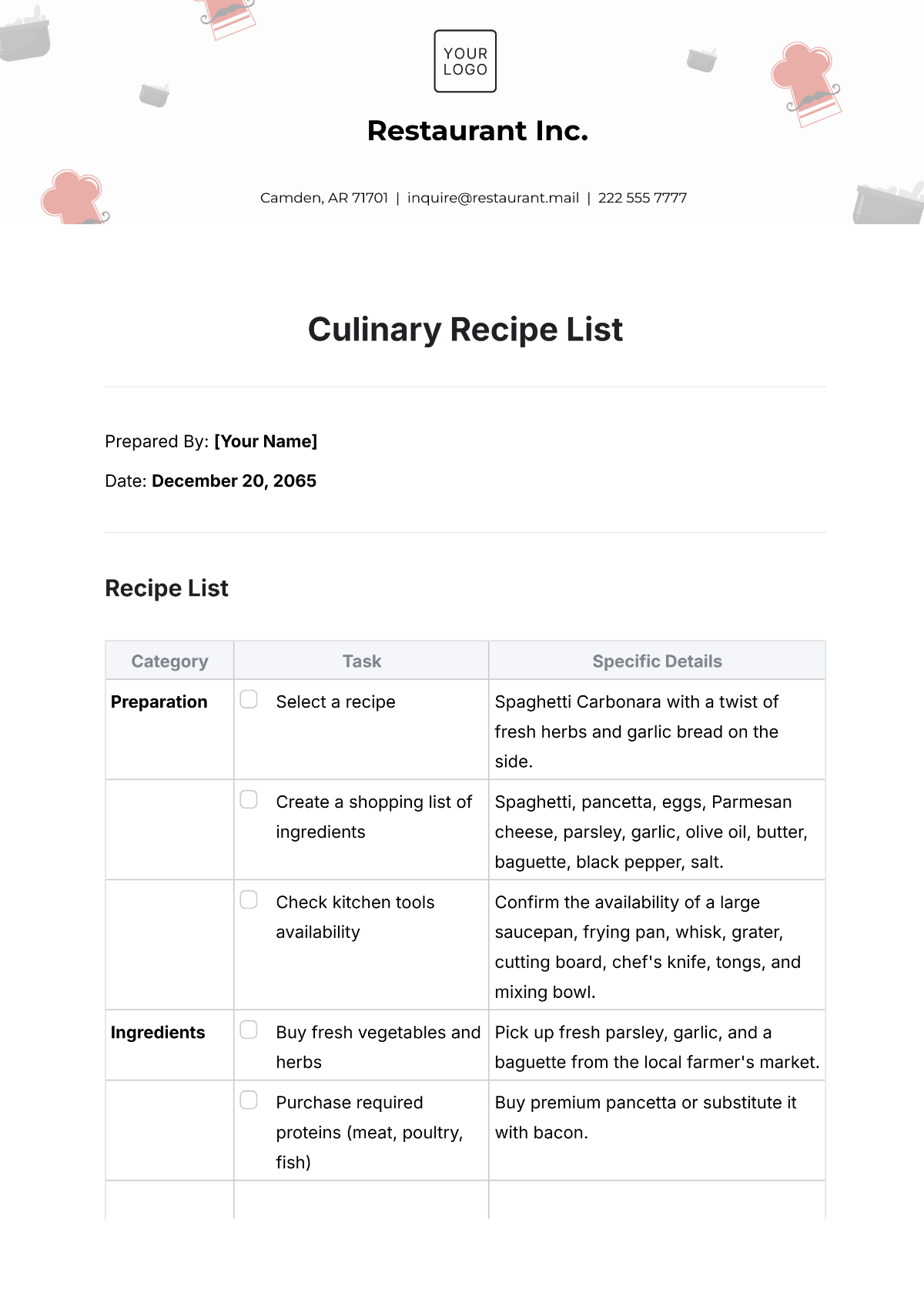

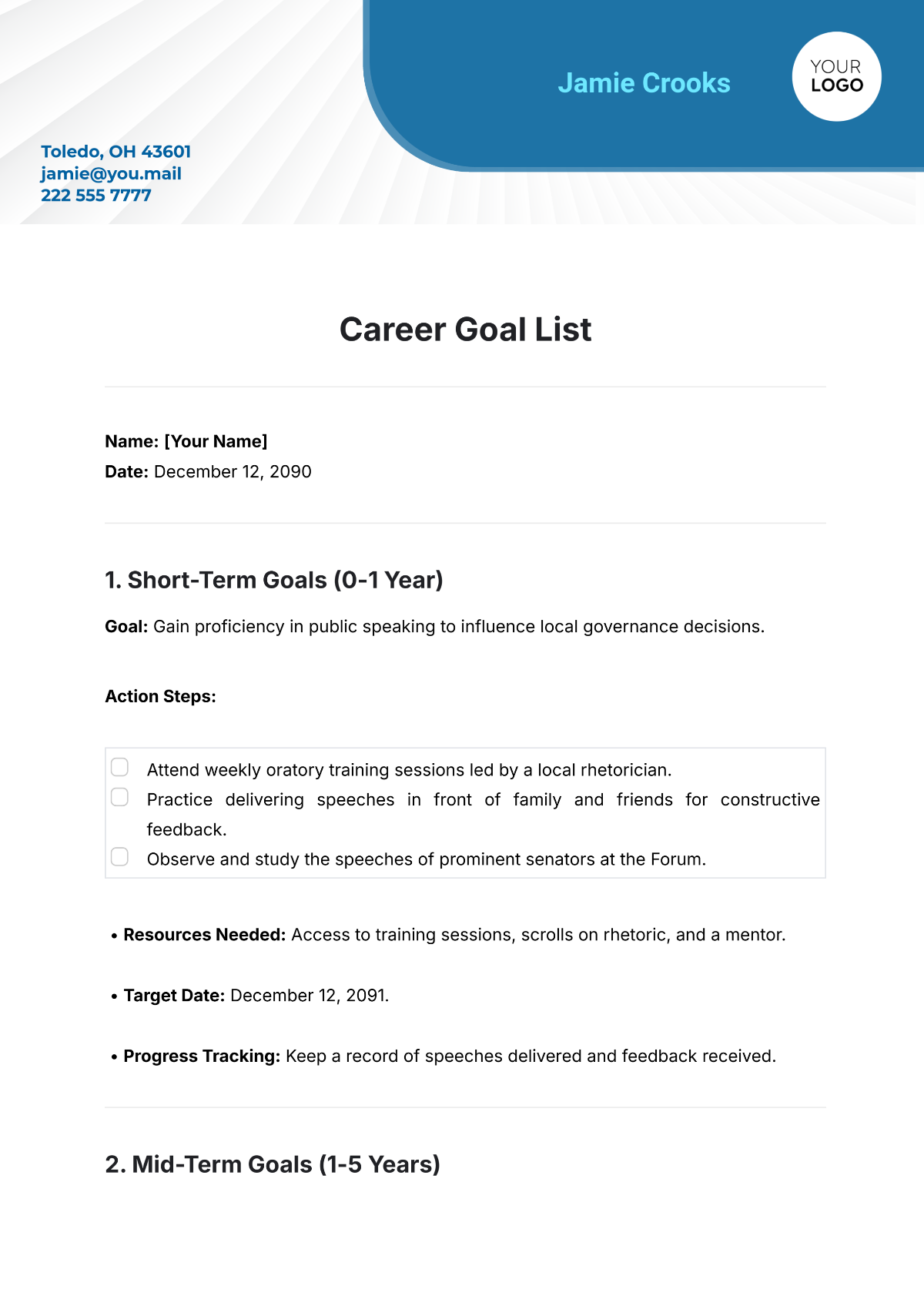

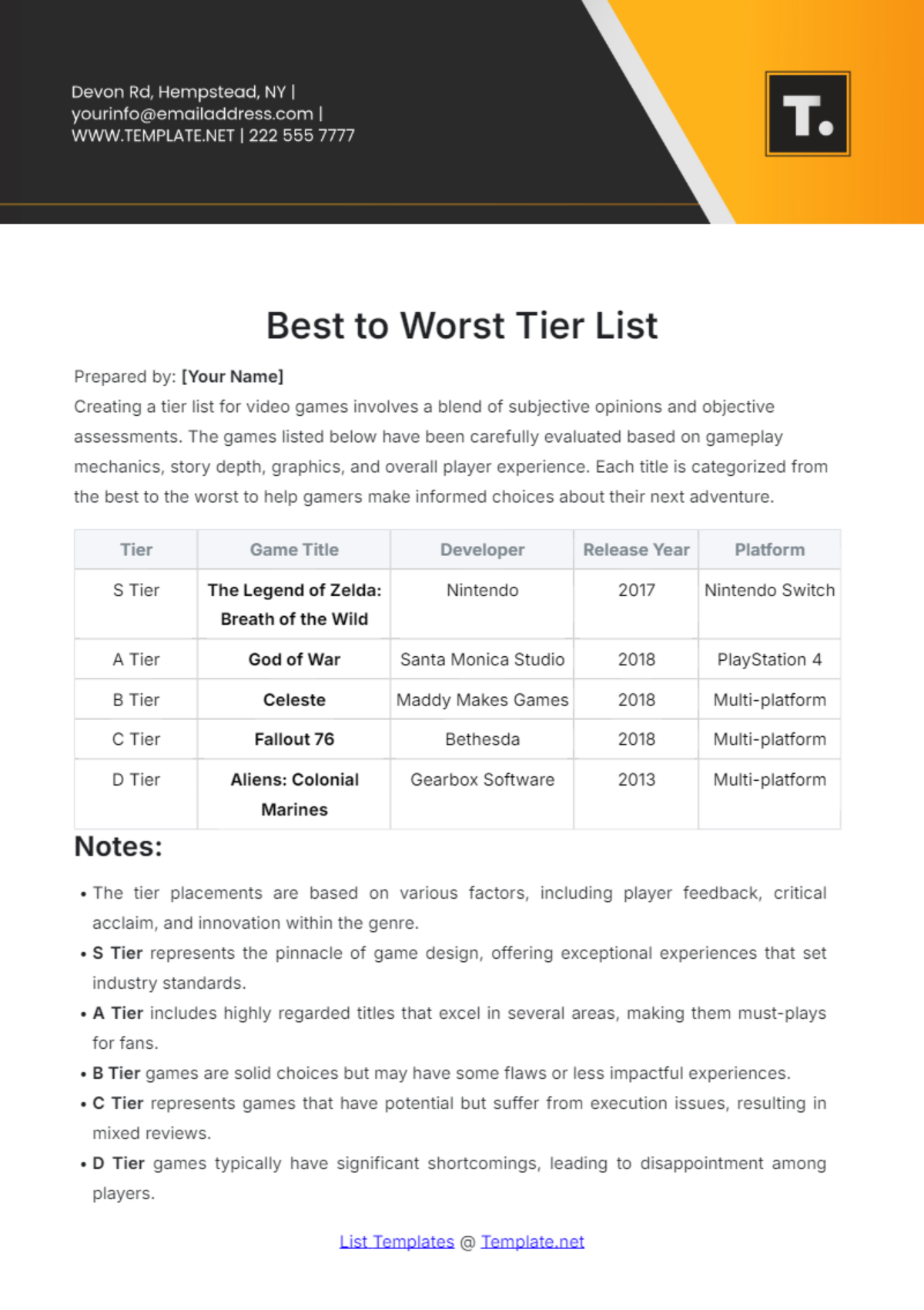

Payroll List

Name: | [Your Name] |

Company: | [Your Company Name] |

Date: | [Date] |

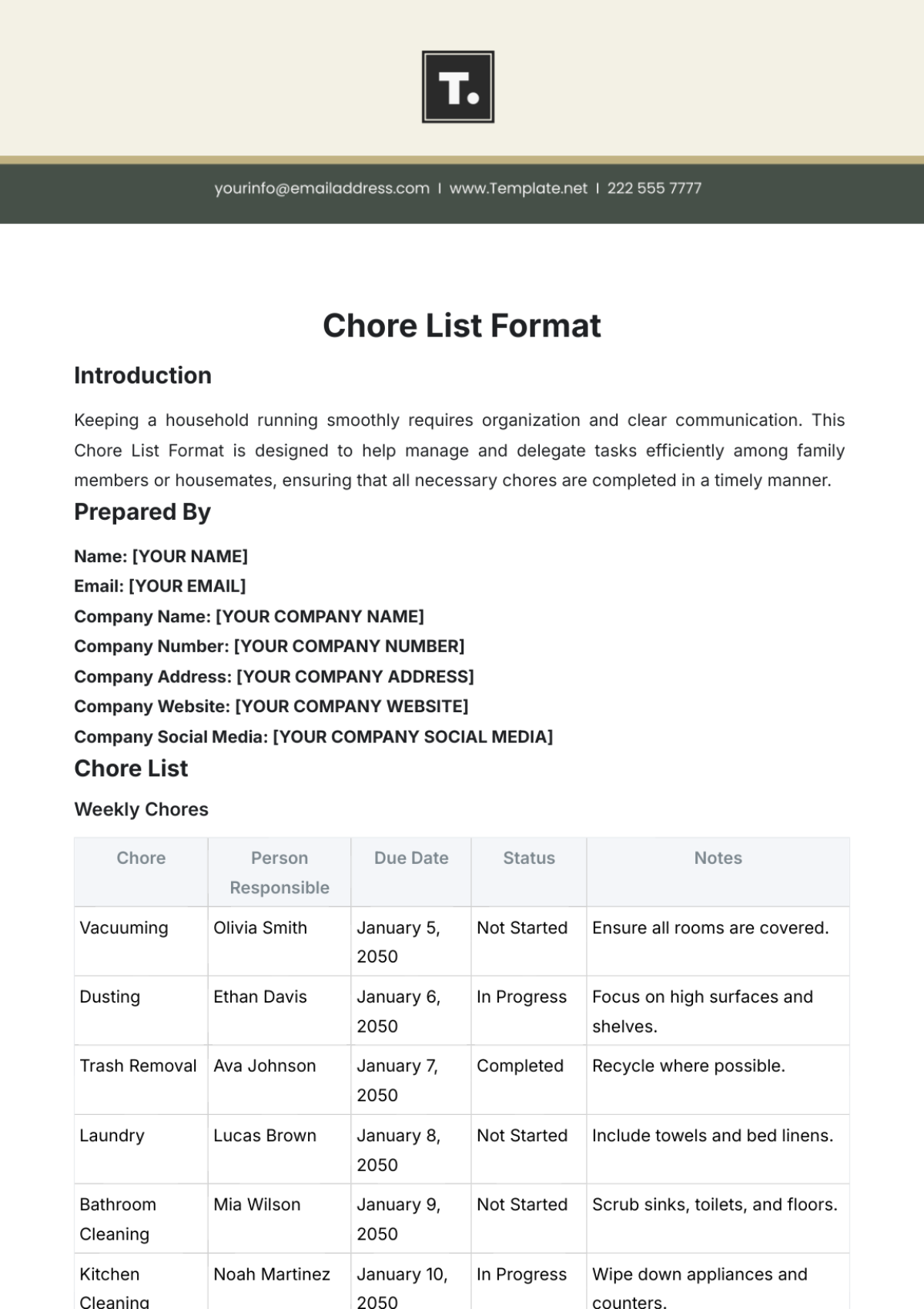

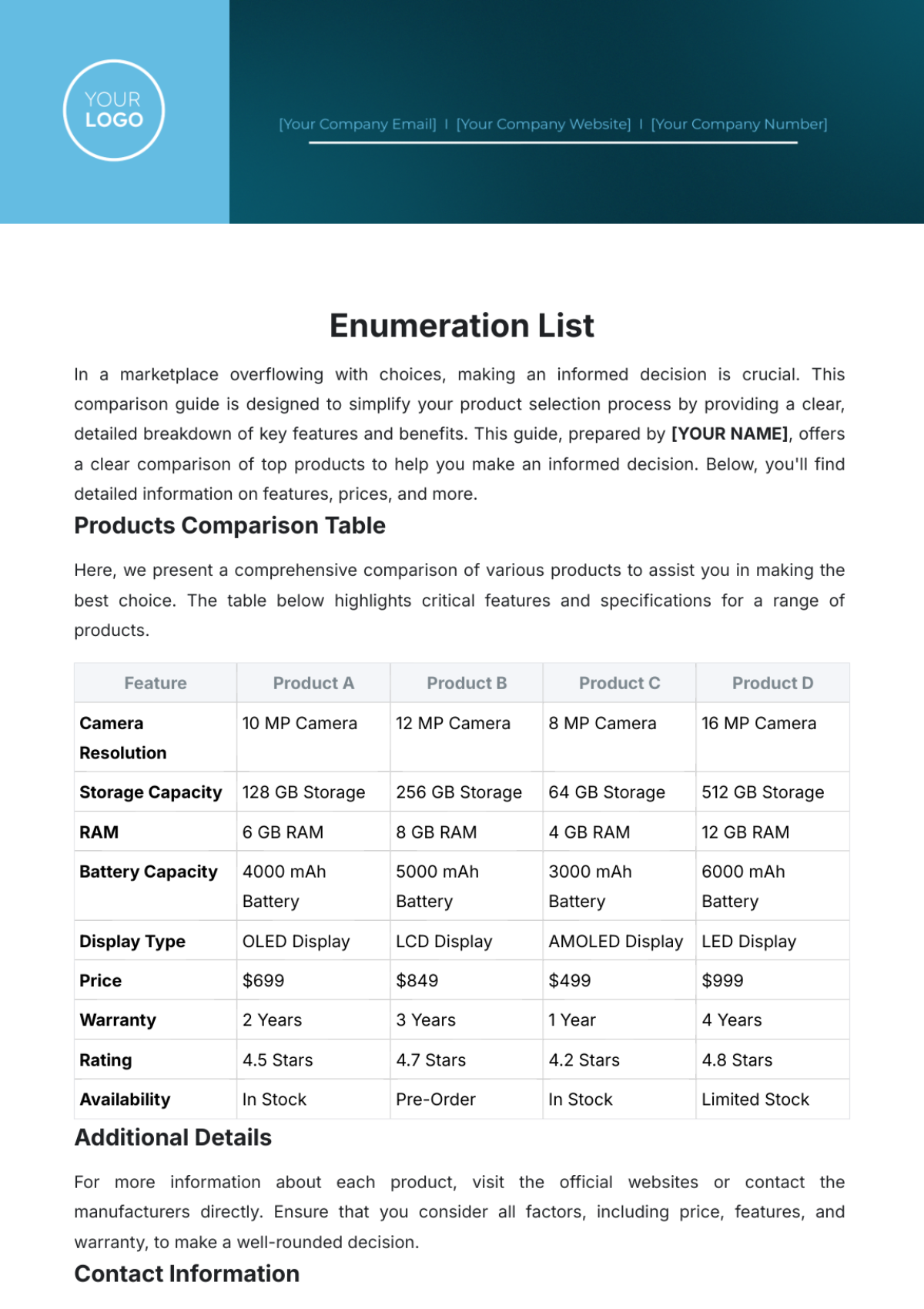

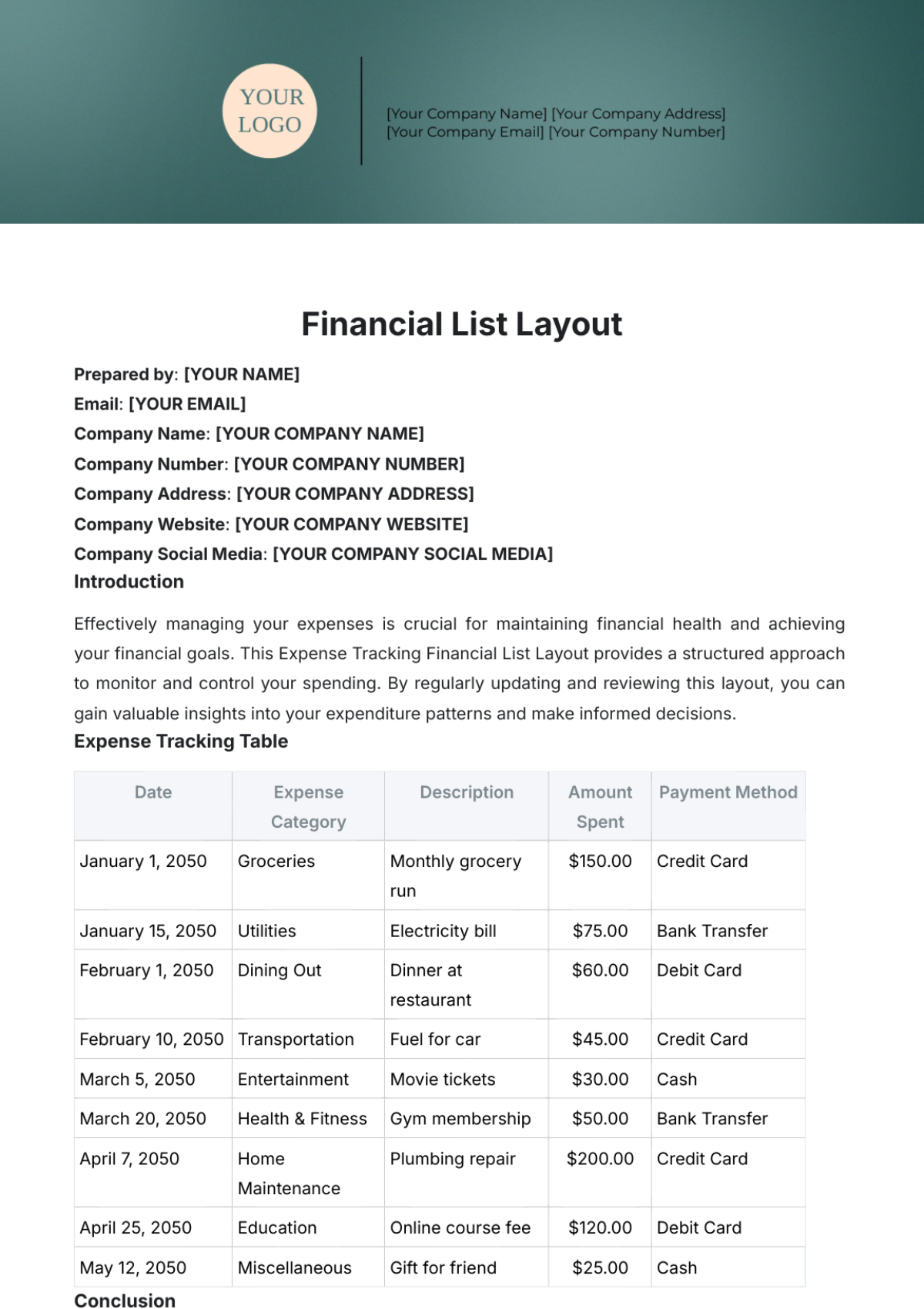

This list includes comprehensive details regarding employee payroll processing. It stipulates the necessary parameters to ascertain fair compensation including basic details, pay records, salary adjustments, additional earnings, and important notes to ensure accuracy and transparency.

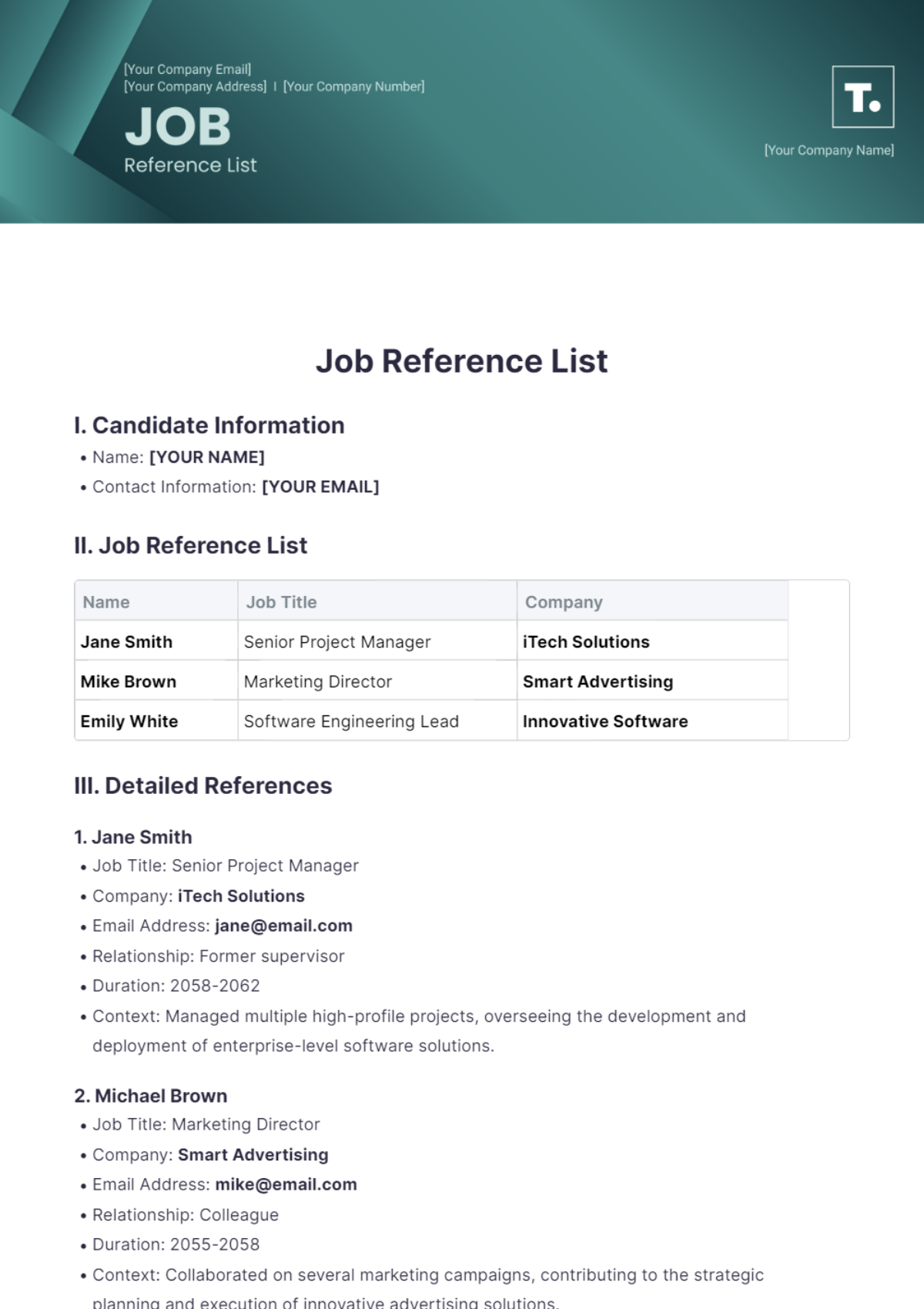

Employee Details

Employee Name | Employee ID | Job Title | Department |

|---|---|---|---|

John Smith | 123456 | Sales Associate | Sales |

Emily Johnson | 789012 | Marketing Specialist | Marketing |

David Lee | 345678 | Customer Service Representative | Customer Service |

Sarah Adams | 901234 | Accountant | Finance |

Michael Brown | 567890 | IT Technician | Information Technology |

Payroll Details

Employee Name | Hours Worked | Hourly Rate | Total Earnings | Fixed Monthly Salary |

|---|---|---|---|---|

John Smith | 40 | $20 | $800 | $3,000 |

Emily Johnson | 35 | $25 | $875 | $3,500 |

David Lee | 45 | $18 | $810 | $3,200 |

Sarah Adams | 38 | $22 | $836 | $3,000 |

Michael Brown | 40 | $30 | $1,200 | $3,500 |

Additional Earnings and Notes

Employee Name | Additional Earnings | Notes |

|---|---|---|

John Smith | $200 | Completed training course |

Emily Johnson | $150 | Sales commission |

David Lee | $100 | Performance bonus |

Sarah Adams | $50 | Shift differential |

Michael Brown | $75 | On-call allowance |

Additional Reminders:

Ensure accuracy in payroll processing by double-checking calculations.

Review overtime hours and rates for eligible employees.

Consider bonuses, commissions, or allowances for accurate pay calculation.

Communicate changes or updates in pay rates or salary adjustments promptly to employees.

Maintain organization and confidentiality in payroll records for data security and privacy.