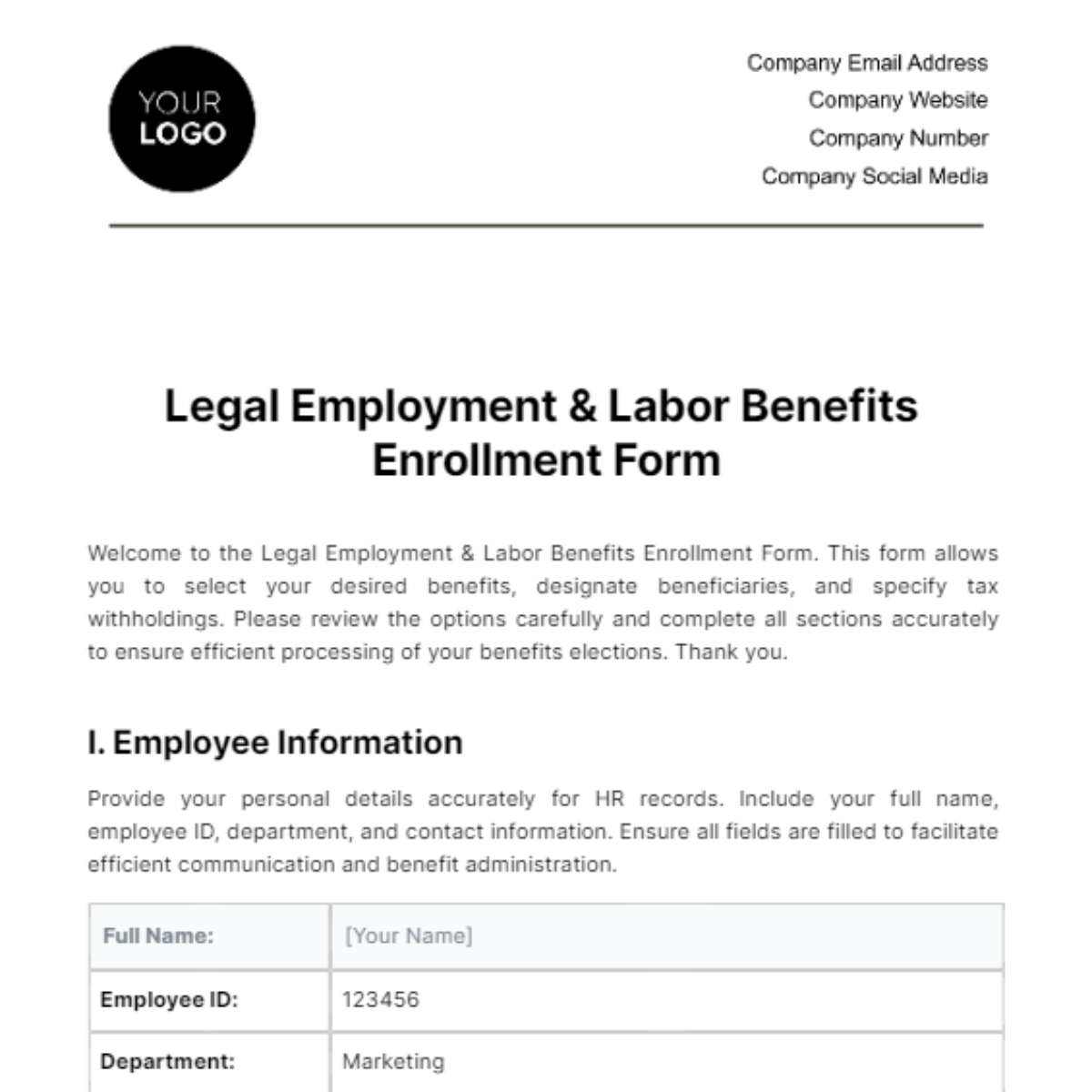

Free Legal Employment & Labor Benefits Enrollment Form

Welcome to the Legal Employment & Labor Benefits Enrollment Form. This form allows you to select your desired benefits, designate beneficiaries, and specify tax withholdings. Please review the options carefully and complete all sections accurately to ensure efficient processing of your benefits elections. Thank you.

I. Employee Information

Provide your personal details accurately for HR records. Include your full name, employee ID, department, and contact information. Ensure all fields are filled to facilitate efficient communication and benefit administration.

Full Name: | [Your Name] |

|---|---|

Employee ID: | 123456 |

Department: | Marketing |

Position: | Senior Marketing Specialist |

Date of Hire: | [Month Day, Year] |

Contact Info: | [Your Address] |

[Your Number] | |

[Your Email] |

II. Benefit Plan Options

Select desired benefit plans and coverage levels. Review premium costs carefully. Indicate choices by marking checkboxes or filling in relevant information. Contact HR for clarification on plan options if needed.

Benefit | Plan Options | Coverage Levels | Premium Costs |

|---|---|---|---|

Health Insurance | Plan A, Plan B | Individual, Family | Employee: $50/month |

Employer: $200/month | |||

Retirement Plans | 401(k) | 5% contribution | Employer matches 50% |

Life Insurance | Basic Life, Supplemental Life | $50,000 coverage | Employee: $10/month |

Disability Insurance | Short-Term Disability | 60% of salary | Employee: $20/month |

Flexible Spending | Healthcare FSA, Dependent Care FSA | N/A | Employee: N/A |

Vision Insurance | Basic, Enhanced | Individual, Family | Employee: $15/month |

Dental Insurance | Basic, Comprehensive | Individual, Family | Employee: $20/month |

III. Benefit Elections

Check the boxes next to selected benefits and indicate any waivers. Sign and date the form to confirm your benefit choices. Ensure accuracy to avoid processing delays and ensure proper enrollment.

Health Insurance: Plan A

Retirement Plan: 401(k) - 5% contribution

Life Insurance: Basic Life - $50,000 coverage

Disability Insurance: Short-Term Disability

Vision Insurance: Basic - Individual

Dental Insurance: Comprehensive - Individual

IV. Beneficiary Designations

Name primary and contingent beneficiaries for insurance policies and retirement accounts. Include full names, relationships, and percentage allocations. Double-check information for accuracy and update as necessary.

Primary Beneficiary

Full Name: [Name]

Relationship: Spouse

Percentage Allocation: 100%

Contingent Beneficiary

Full Name: [Name]

Relationship: Child

Percentage Allocation: 100%

V. Tax Withholding Elections

Specify federal and state income tax withholdings. Choose appropriate filing status and exemptions. Consult tax advisors if unsure. Complete all relevant fields accurately to ensure correct tax withholdings from your paycheck.

Federal Income Tax: Single

State Income Tax: Exempt

Local Taxes: N/A

VI. Acknowledgment and Consent

I acknowledge that the benefit choices indicated above are accurate and understand that my elections may affect my payroll deductions. I also consent to the terms and conditions of the benefit plans selected.

[Month Day, Year]

Employer Use Only

HR Review and Approval:

Reviewed and Approved

Requires Additional Information

Rejected

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate solution for streamlining benefits enrollment with the Legal Employment & Labor Benefits Enrollment Form Template from Template.net. This editable and customizable template offers unparalleled convenience, allowing HR professionals to effortlessly tailor it to their organization's needs. With the innovative AI Editor Tool, simplify the process and ensure accurate documentation every time.