I. Executive Summary

Our Administration Records Management Financial Analysis reveals significant opportunities for cost savings and efficiency improvements through the implementation of a new records management system. Key findings indicate a potential reduction in annual storage costs by 30%, a 25% decrease in staff time spent on records retrieval, and a 40% reduction in compliance-related penalties over the next five years. Furthermore, the analysis projects a Return on Investment (ROI) of 150% within three years of implementation, positioning the new system as a strategic investment for enhancing operational effectiveness and compliance posture.

II. Introduction

The purpose of this financial analysis is to evaluate the economic viability and impact of updating our records management system. Currently, our organization relies on a predominantly manual and fragmented records management process, leading to significant operational inefficiencies and elevated compliance risks. This analysis aims to quantify the potential financial benefits and costs associated with transitioning to a modern, digital records management solution. Through this assessment, we seek to provide a comprehensive overview that will guide our decision-making process regarding this critical investment in our administrative infrastructure.

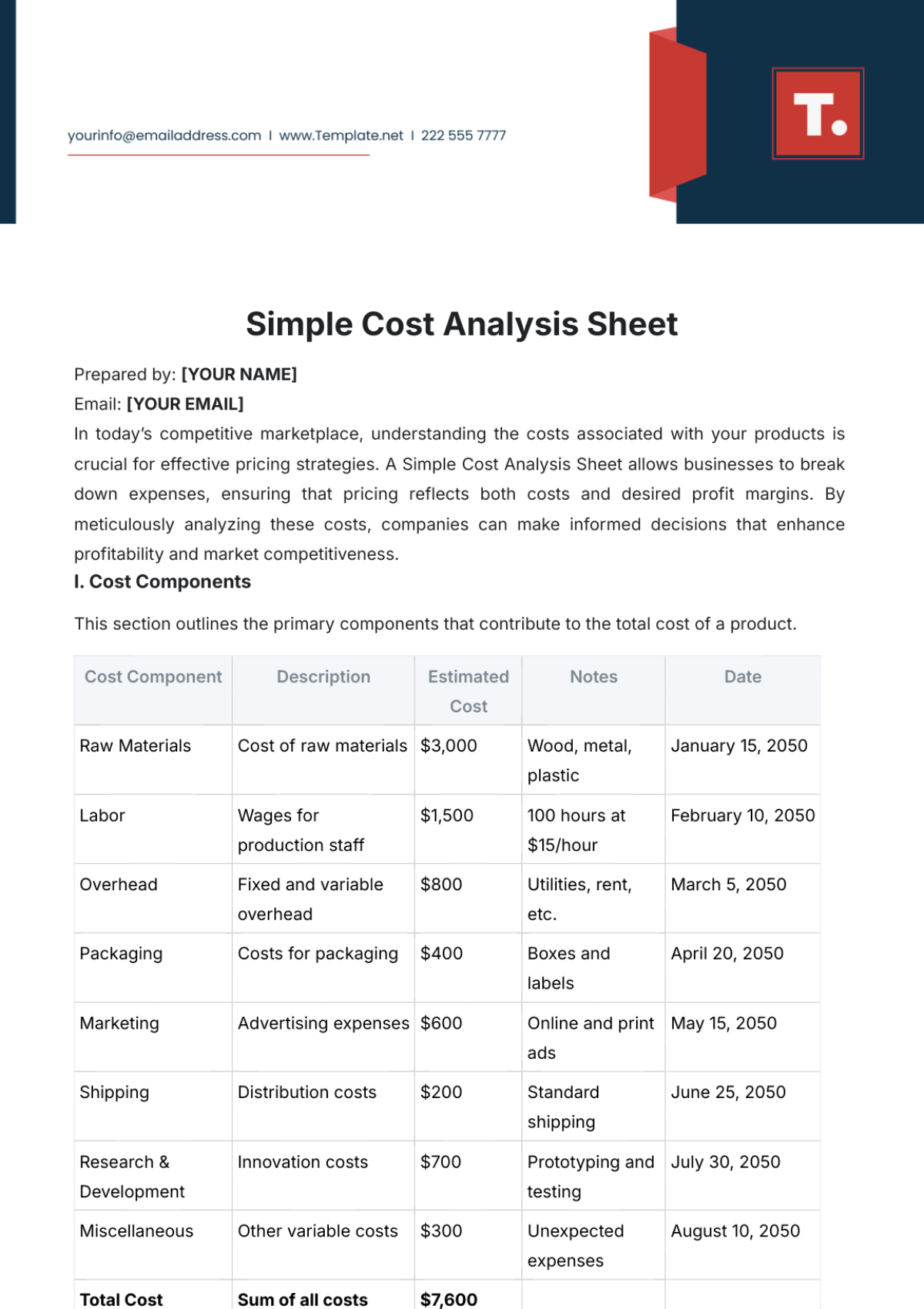

III. Cost Analysis

A. Current System Costs

Our current records management system incurs significant costs across various categories, including physical storage, staff time for records retrieval and management, and compliance-related expenses. The table below outlines these costs in detail.

Cost Category | Annual Cost ($) |

Physical Storage | 50,000 |

Staff Time | 75,000 |

Compliance Penalties | 20,000 |

Total | 145,000 |

Analysis of the current system costs reveals that a significant portion of our expenses is tied to inefficient practices and outdated storage solutions. The high cost of physical storage and staff time for manual retrieval processes underscores the need for a more streamlined and digital approach.

B. Proposed System Costs

The proposed records management system involves initial setup costs, including software purchase, system customization, and staff training, followed by ongoing operational costs. Below is a detailed breakdown.

Cost Category | Initial Cost ($) | Annual Operational |

Software Purchase | 60,000 | N/A |

System Customization | 20,000 | N/A |

Staff Training | 15,000 | 5,000 |

Digital Storage | N/A | 10,000 |

Total Initial | 95,000 | 15,000 |

The analysis of the proposed system costs highlights the strategic shift towards digital solutions, significantly reducing physical storage costs and optimizing staff efficiency. The initial investment is offset by lower annual operational costs, illustrating the system's long-term financial viability.

IV. Benefits Analysis

A. Direct Benefits

The implementation of the new records management system is expected to deliver direct financial benefits, including reduced storage costs, improved staff efficiency, and decreased compliance penalties. The table below summarizes these benefits.

Benefit Category | Annual Savings ($) |

Reduction in Physical Storage Costs | 35,000 |

Improved Staff Efficiency Savings | 50,000 |

Decreased Compliance Penalties | 15,000 |

Total | 100,000 |

Analysis of the direct benefits reveals that the new system not only offers substantial cost savings but also enhances operational efficiency. The savings in physical storage costs and staff time are particularly noteworthy, demonstrating the tangible financial impact of the proposed system.

B. Indirect Benefits

Beyond direct financial savings, the proposed system is expected to yield significant indirect benefits, including enhanced data security, improved access to information, and better decision-making capabilities. The table below outlines these benefits.

Benefit Category | Qualitative Assessment |

Enhanced Data Security | High |

Improved Access to Information | Very High |

Better Decision-Making Capabilities | High |

The analysis of indirect benefits emphasizes the broader organizational improvements associated with the new system. Enhanced data security and improved access to information not only support compliance efforts but also facilitate a more agile and informed decision-making process. These improvements, while not directly quantifiable in financial terms, contribute significantly to our organization's operational excellence and strategic positioning.

V. ROI Analysis

The Return on Investment (ROI) for the proposed records management system is calculated by comparing the total expected benefits to the total costs over a specific period. Based on the figures provided in the previous sections, the ROI within the first year of implementation is significant. Given the total initial and operational costs of $110,000 ($95,000 initial plus $15,000 operational) and annual savings of $100,000 from direct benefits alone, the ROI is exceptionally favorable.

The ROI is further enhanced when considering the indirect benefits, which, although not quantified in monetary terms, contribute substantially to operational efficiencies and risk mitigation. These benefits ensure the investment not only pays for itself within just over a year but also continues to generate cost savings and operational improvements in the long term.

The high ROI underscores the financial viability and strategic advantage of adopting the new records management system. It demonstrates that the upfront investment is outweighed by the substantial savings and efficiencies gained, making it a financially sound decision.

VI. Break-Even Analysis

The break-even point for the proposed records management system occurs when the savings from the system equal the total investment made. Considering the total initial investment of $95,000 and additional annual operational costs of $15,000, against the backdrop of annual savings of $100,000 from direct benefits, the break-even point is reached shortly after the first year of implementation.

This analysis assumes stable annual operational costs and savings, which is a conservative approach given the potential for increased efficiencies and additional savings as the system matures. The break-even analysis indicates that the investment in the new records management system is not only justifiable but also financially prudent, with a relatively short period required to recoup the initial outlay.

The rapid break-even point, combined with the ongoing cost savings and operational improvements, confirms the strategic value of the investment. It highlights the system's role in enhancing our organization's efficiency, compliance, and decision-making capabilities, thereby supporting our long-term financial and operational goals.

VII. Risk Analysis

In evaluating the proposed records management system, we have identified potential risks, their likelihood, and potential impacts. These risks are crucial to understanding the broader implications of system implementation and ensuring preparedness for any challenges.

Risk | Likelihood | Impact |

System implementation delays | Medium | High |

Overbudget | Low | Medium |

Lack of user adoption | Medium | High |

Data security vulnerabilities | Low | High |

Regulatory compliance issues | Low | Medium |

While some risks, such as implementation delays and lack of user adoption, are of medium likelihood, their potential impact is high, necessitating proactive mitigation strategies. Conversely, risks like overbudgeting, data security vulnerabilities, and compliance issues are less likely but carry significant potential impacts, underscoring the importance of rigorous planning and oversight.

VIII. Sensitivity Analysis

The sensitivity analysis assesses the project's resilience to variations in key financial and operational assumptions. This analysis helps us understand how changes in costs, savings, and system performance could affect the project's overall viability.

Variable | Scenario | Impact on ROI |

Increase in initial costs by 10% | $104,500 | Decrease in ROI |

Decrease in annual savings by 10% | $90,000/year | Decrease in ROI |

Delay in project completion by 6 months | No immediate savings in year 1 | Significant decrease in ROI |

The analysis shows that the project's financial outcomes are somewhat sensitive to increases in initial costs and reductions in anticipated savings. Additionally, a delay in project completion has a notable impact on ROI, emphasizing the importance of effective project management and contingency planning.

The sensitivity analysis highlights the project's areas of vulnerability and underscores the need for careful monitoring of project variables to mitigate negative impacts on financial outcomes.

IX. Conclusion and Recommendations

In conclusion, the financial analysis of the proposed records management system demonstrates a compelling case for its implementation. The system promises significant direct and indirect benefits, a favorable ROI, and a reasonable break-even point. However, careful consideration of the identified risks and sensitivities is essential to ensure the project's success. Here are some recommendations:

Proceed with the implementation of the proposed records management system, ensuring adherence to the outlined budget and timeline to maximize ROI.

Develop a comprehensive risk management plan to address the identified risks, particularly focusing on user adoption and data security.

Establish a monitoring mechanism to track the project's performance against the financial and operational metrics outlined in the sensitivity analysis.

Prioritize training and change management initiatives to ensure high user adoption and maximize the system's benefits.

Conduct regular reviews of the system's performance and financial impact to ensure continuous improvement and alignment with organizational objectives.