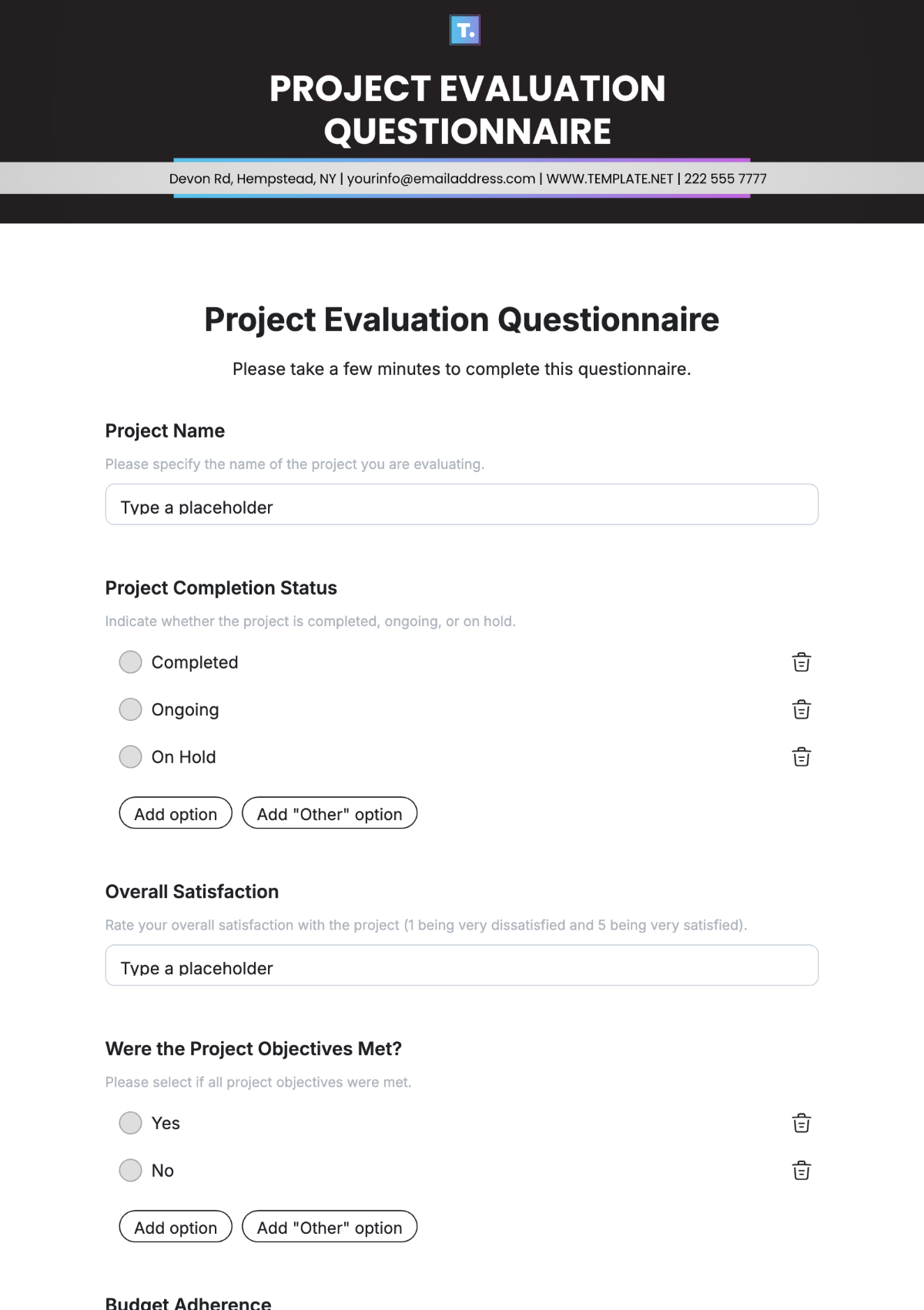

Administration Financial Audit Questionnaire

Please fill out the form with your information below.

Name of the Auditing Company

Please provide the full name of the auditing company.

Audit Year

Indicate the financial year in review.

Email of Company Representative

Provide the email address for any follow-up questions.

Has the company implemented any new accounting systems in the past year?

Select yes or no based on your assessment.

Yes

No

If yes, please specify the systems and the implementation dates.

Detail the systems implemented and their respective dates. Leave blank if not applicable.

List all financial audits conducted in the past three years.

Provide details of each audit conducted over the stated period.

Are there internal controls in place for financial reporting?

Please indicate whether internal controls are established and functioning.

Yes

No

Documentation of Internal Controls

Please upload documentation, if available.

Financial Statements Available for Audit?

Select the financial statements available for audit.

Balance Sheet

Income Statement

Cash Flow Statement

Statement of Equity

Suspected or Unresolved Fraud Issues

Have there been any suspected or unresolved fraud issues in the last year?

Yes

No

If yes, please provide details of the issues.

Describe any fraud issues encountered and their resolution status.

Current Assets Verification

Have all current assets been verified for the audit year?

Yes

No

Are fixed assets revaluated regularly?

Provide information on the regularity of fixed asset revaluation.

Yes

No

Any relevant SAP or ERP system performance reviews conducted?

Specify if there have been performance reviews for key systems.

Yes

No

Final Comments

Provide any additional comments or observations related to the audit.

Please check the box below to proceed

This helps us prevent spam and ensure secure submissions.

Thank you for your submission!

We appreciate you taking the time to submit.

Create free forms at Template.net