Name: | [YOUR NAME] |

Company: | [YOUR COMPANY NAME] |

Department: | Finance |

Date: | [DATE] |

The Administration Financial Protocol provides a consolidated plan of action for a company's financial operations. It is designed to provide a comprehensive and detailed guide for managing the organization's fiscal resources effectively. This protocol ensures that your organization's financial management is handled professionally, effectively, mitigating financial risks.

I. Objective

The Administration Financial Protocol of [Your Company Name] is anchored in a set of core objectives designed to fortify our financial governance and operational integrity. These objectives are critical for fostering a financially robust and ethically compliant organizational culture.

Regulating Financial Activities: Central to our protocol is the commitment to ensuring all financial activities strictly conform to local laws and regulations. This not only mitigates legal risks but also fortifies our reputation in the marketplace. It involves staying abreast of regulatory changes and adapting our practices accordingly to maintain compliance at all times.

Maintaining Consistent Financial Operations: Uniformity in financial operations across all departments ensures that every segment of our organization adheres to the same high standards of financial management. This consistency is pivotal for accurate financial forecasting, reporting, and analysis, enabling strategic decision-making that aligns with our overarching corporate goals.

Protecting the Company's Assets: Implementing robust financial management practices is essential for safeguarding the company's assets. This includes meticulous asset tracking, risk assessment, and the development of preventive strategies against fraud and mismanagement, thereby securing our financial stability and investor confidence.

Increasing Transparency and Accountability: Our protocol emphasizes the importance of transparency and accountability in all financial dealings. By ensuring that financial records are accurate, accessible, and comprehensible, we build trust among stakeholders, including shareholders, employees, and regulatory bodies. This transparency supports ethical business practices and enhances our corporate image.

Streamlining Financial Reporting and Auditing Processes: The efficiency of our financial reporting and auditing processes is crucial for timely and accurate financial disclosures. Streamlining these processes reduces the risk of errors, enhances operational efficiency, and ensures that financial statements reflect our true financial position, supporting informed decision-making at all levels.

II. Protocol Overview

The Administration Financial Protocol provides a comprehensive framework for managing the financial operations of [Your Company Name]. It is meticulously designed to enhance the efficiency and reliability of our financial practices, ensuring that we operate with the utmost integrity and accountability.

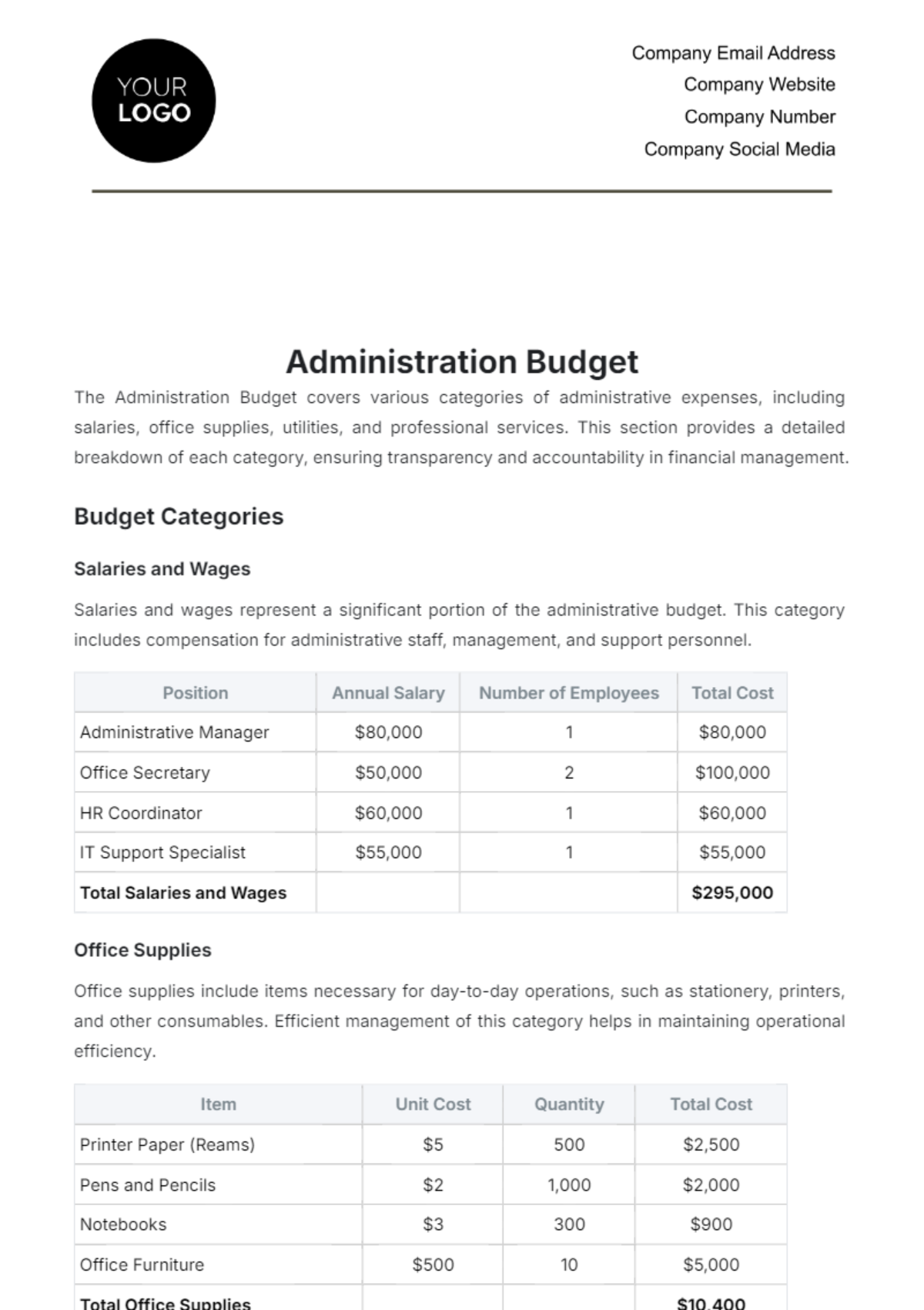

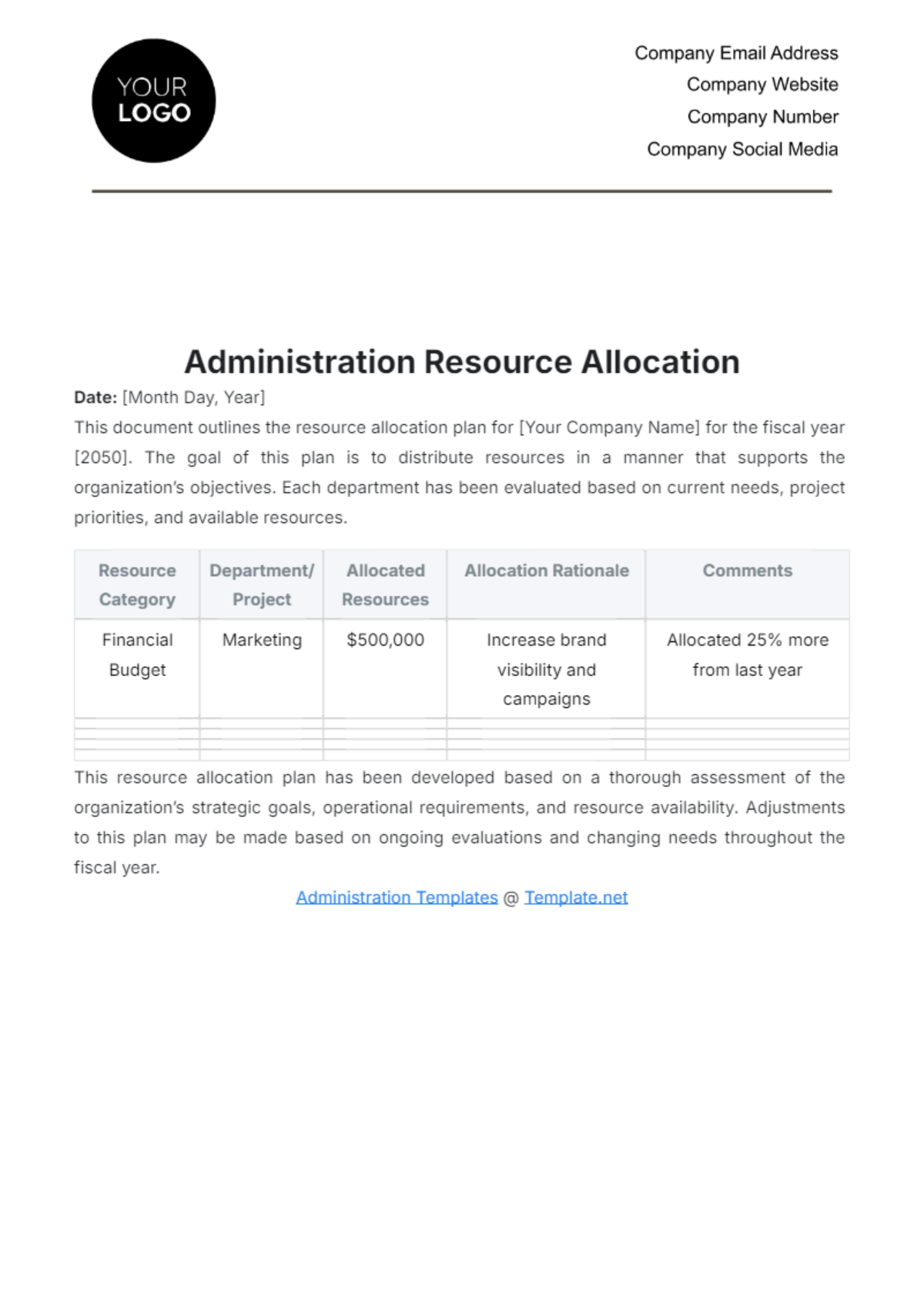

Budget Allocation and Control: Our protocol establishes stringent guidelines for budget preparation, review, approval, and adjustments. This ensures that financial resources are allocated in alignment with strategic priorities, optimizing the use of funds to achieve the best possible outcomes.

Cash Flow Management: Effective cash flow management is vital for maintaining liquidity and operational flexibility. Our protocol outlines procedures for monitoring, forecasting, and managing cash flow to ensure that we can meet our financial obligations on time and invest in growth opportunities.

Expenditure Handling: Controlling expenditures is essential for financial discipline. The protocol specifies approval hierarchies, procurement policies, and expense tracking mechanisms to prevent overspending and ensure expenditures deliver value for the company.

Asset Management: Our approach to asset management is systematic and rigorous, involving regular asset inventories, valuation, and depreciation accounting. This ensures that our assets are correctly recorded, maintained, and disposed of, reflecting their true value and condition.

Internal Controls: We place a strong emphasis on internal controls to prevent and detect errors, fraud, and non-compliance. Our protocol includes checks and balances, segregation of duties, and regular internal audits to maintain financial integrity.

Financial Reporting and Auditing: The protocol mandates regular financial reporting and auditing to provide an accurate and comprehensive view of our financial status. This includes detailed guidelines for preparing financial statements, conducting audits, and addressing audit findings to ensure compliance and transparency.

III. Materials and Equipment

To effectively implement the Administration Financial Protocol, [Your Company Name] relies on a suite of sophisticated tools and documents. These resources are integral to our financial operations, supporting accuracy, efficiency, and compliance.

Advanced Accounting Software: Utilizing state-of-the-art accounting software enables us to automate many financial processes, reduce the risk of human error, and generate real-time financial reports. This software supports everything from transaction processing and ledger maintenance to financial analysis and reporting.

Comprehensive Financial Records: Maintaining detailed financial records is essential for accurate reporting and auditing. Our protocol requires that all financial transactions be documented and stored securely, facilitating audit trails and historical analysis.

Detailed Budget Reports: Budget reports are prepared and reviewed periodically to monitor financial performance against plans. These reports are crucial for managing resources effectively, identifying variances, and making necessary adjustments to stay on track.

Accurate Cash Flow Statements: Cash flow statements provide insights into the liquidity and financial health of the company. They are essential for forecasting cash needs, managing working capital, and planning for future growth.

Thorough Audit Reports: Audit reports are prepared following internal and external audits to summarize findings, recommendations, and actions taken. These reports are vital for assessing the effectiveness of financial controls, compliance with regulations, and identifying areas for improvement.

By adhering to these objectives, guidelines, and utilizing the prescribed materials and equipment, [Your Company Name] ensures a robust financial management system that supports sustainable growth, operational excellence, and unwavering trust among all stakeholders.

IV. Procedure

Ensuring meticulous financial management within [Your Company Name] necessitates a structured approach to handling transactions, leveraging technology for accuracy, and maintaining transparency through digital records. The following procedure table outlines a robust methodology designed to enhance the precision, reliability, and integrity of our financial operations:

Step | Instructions |

|---|---|

1 | Begin by recording every transaction in the ledger book. Ensure all entries are accurate to avoid financial discrepancies. |

2 | Utilize financial software to automate complex calculations. This prevents potential human error and makes calculations more precise. |

3 | Digitize invoices and receipts for easy tracking and access. This creates a digital trail for all transactions enhancing accountability. |

4 | Regularly review bank statements to cross-verify with the company's records. This ensures there are no unnoticed discrepancies in the financial records. |

Implementing these steps will significantly contribute to the financial health of [Your Company Name] by ensuring that all transactions are recorded accurately, calculations are error-free, records are easily accessible, and financial data is consistently verified for accuracy. This procedural rigor supports [Your Company Name]'s commitment to financial transparency, compliance, and operational excellence, paving the way for informed decision-making and sustainable growth.

V. Data Collection

The meticulous collection of financial data underpins the integrity of [Your Company Name]'s financial management and reporting processes. As part of the Administration Financial Protocol, the following categories of data are pivotal:

Income and Expenditure Reports: These reports provide a detailed account of the company's revenue streams versus its operational expenses over a specific period. Regular analysis of these reports helps in identifying trends, managing costs, and optimizing profitability.

Budget Versus Actual Expenditure Reports: Comparing budgeted expenditures against actual spending is crucial for financial discipline and control. This comparison sheds light on variances, enabling departments to adjust their strategies and operations in alignment with financial realities.

Financial Audit Reports: Audit reports are invaluable for assessing the accuracy of financial records and the effectiveness of internal controls. They highlight discrepancies, potential areas of risk, and opportunities for improving financial management practices.

Cash Flow Statements: Cash flow statements track the inflow and outflow of cash, providing insights into the company’s liquidity. Effective cash flow management is essential for maintaining operational viability and investing in growth opportunities.

Balance Sheets: The balance sheet provides a snapshot of the company's financial health at a specific point in time, detailing assets, liabilities, and equity. It is fundamental for assessing the company's financial stability and capacity for future investments.

Collecting and analyzing these data types enable [Your Company Name] to make informed financial decisions, forecast future trends, and maintain robust financial health.

VI. Safety Considerations

Ensuring the safety and security of financial records is paramount to maintaining the trust of stakeholders and complying with legal and regulatory requirements. The Administration Financial Protocol incorporates several safety considerations:

Confidentiality of Financial Records: Access to financial records is strictly controlled and limited to authorized personnel. Confidentiality protocols prevent unauthorized access and protect sensitive financial information.

Protection Against Cyber Threats: With the increasing digitization of financial records, safeguarding against cyber threats is crucial. Implementing advanced cybersecurity measures, such as encryption and firewalls, protects financial data from breaches and cyber-attacks.

Legality of Financial Transactions: All financial transactions are scrutinized to ensure they comply with relevant laws and regulations. This includes adherence to tax laws, financial reporting standards, and anti-money laundering regulations.

Adherence to the Budget: Maintaining financial discipline by adhering to the approved budget is essential. It prevents overspending and ensures financial resources are allocated efficiently to support strategic objectives.

Regular Audits: Conducting regular internal and external audits is vital for identifying and rectifying financial anomalies. Audits also verify the accuracy of financial records and the effectiveness of internal controls, enhancing financial integrity.

VII. Expected Results

Implementing the Administration Financial Protocol is expected to significantly improve the financial operations of [Your Company Name], with the following anticipated outcomes:

Simplified Compliance: The protocol simplifies the process of complying with financial regulations, reducing the risk of legal penalties and enhancing regulatory relationships. It ensures that all financial activities are conducted within the bounds of the law.

Reduced Financial Mismanagement: By establishing clear guidelines and procedures for financial management, instances of mismanagement are minimized. This contributes to more effective use of resources and protects the company’s assets.

Efficient Internal Audits: Streamlined audit processes make internal audits more efficient and less stressful. Regular audits help in early detection of discrepancies, allowing for timely corrective actions.

Enhanced Transparency and Accountability: The protocol fosters an environment of openness, where financial decisions are made transparently and individuals are held accountable for their actions. This boosts stakeholder confidence and trust in the company’s financial practices.

Strengthened Reputation: A strong commitment to financial integrity and transparency enhances [Your Company Name]'s reputation among investors, business partners, and employees. It positions the company as a trustworthy and stable entity, attractive for investment and collaboration.

Increased Financial Stability and Sustainability: By ensuring disciplined financial management, the protocol contributes to the long-term financial stability and sustainability of the company. It enables [Your Company Name] to weather economic fluctuations, invest in growth opportunities, and build a resilient financial foundation.

The Administration Financial Protocol serves as a comprehensive guide for [Your Company Name] to manage its financial affairs with efficiency, integrity, and accountability. By adhering to this protocol, the company not only enhances its financial operations but also strengthens its position in the market, paving the way for sustained success and growth.

VIII. Conclusion

The Administration Financial Protocol is integral to [Your Company Name], embodying our commitment to transparency, responsibility, and operational efficiency. It serves as a vital guide for managing financial resources, conducting audits, and strategic financial planning. By implementing this protocol, we ensure that our financial management practices are sound, reliable, and conducive to our company's growth and success.

Disclaimer: This protocol is subject to adjustments based on evolving laws, regulations, and operational needs. It is a living document that reflects our commitment to continuous improvement and compliance in our financial operations.

This comprehensive document not only serves as a foundational guide for financial management within [Your Company Name] but also as a testament to our dedication to operational excellence and regulatory compliance. Through its meticulous application, we safeguard our assets, streamline our financial processes, and uphold the highest standards of transparency and accountability, thereby securing our company's future in an ever-changing business environment.