Free Tax Planning Strategies Brief

Prepared by: [Your Name]

Company Name: [Your Company Name]

Introduction

The essence of this brief is to shed light on effective tax planning strategies, aimed at individuals and organizations keen on optimizing their tax situations. With a focus on minimizing liabilities and enhancing tax efficiency, this guide offers concise, practical advice for navigating the complexities of tax regulations.

In a landscape where tax laws frequently change, understanding how to leverage these strategies becomes pivotal for financial health and compliance. This document distills essential tax planning insights, aiming to empower you with the knowledge to make informed decisions that align with both financial goals and legal requirements.

Understanding Tax Laws

Navigating the tax landscape requires a solid grasp of the laws that govern taxation. This understanding is crucial for crafting strategies that align with your financial goals while ensuring compliance. Tax laws are multifaceted and can differ significantly based on various factors including your geographical location, nature of income, type of employment, and more.

Individual Tax Laws: These govern the taxes on personal income, including wages, salaries, investments, and other forms of income. Understanding your obligations and the deductions or credits available can significantly impact your tax liabilities.

Business Tax Laws: Applicable to entities ranging from sole proprietorships to large corporations, these laws cover income tax, payroll tax, excise taxes, and more. Knowledge of business tax laws is vital for optimizing your business's tax position.

International Tax Laws: For individuals and businesses with cross-border incomes or operations, international tax laws and treaties play a critical role in determining tax duties. Navigating these requires an understanding of how taxes apply in different jurisdictions and how to avoid double taxation.

Property Tax Laws: These laws affect individuals and businesses owning real property. Property taxes are usually levied by local governments and are based on the assessed value of the property.

Localization Tax Laws: Specific to your city, state, or country, these laws can significantly impact your tax planning. They include state-specific income taxes, sales taxes, and other local taxes. Understanding the nuances of these local laws is essential for accurate and effective tax planning.

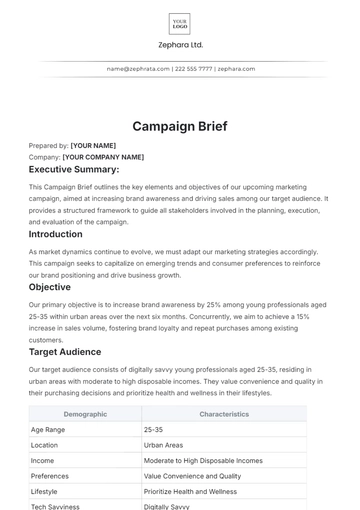

Case Studies

These case studies demonstrate the importance of strategic planning and understanding the timing and type of deductions or investments that can favorably impact your tax situation.

Case Study | Strategy Used | Outcome |

|---|---|---|

Case 1 | Strategy A: Early Investment in Retirement Accounts | Outcome A: By maximizing contributions to retirement accounts like 401(k)s and IRAs early in the fiscal year, the individual was able to significantly reduce their taxable income, leading to lower tax liabilities and a more robust retirement fund. |

Case 2 | Strategy B: Utilization of Business Expenses | Outcome B: A small business owner strategically timed significant purchases and investments in business infrastructure to coincide with high-revenue periods. This not only allowed for immediate operational upgrades but also maximized deductible expenses, substantially lowering the business's taxable income for the year. |

Actionable Strategies

Effective tax planning involves leveraging legal strategies to minimize tax liabilities and enhance financial efficiency. Below are several actionable strategies that, when applied correctly, can lead to substantial tax savings and improved financial outcomes:

Deductible Expenses

Strategy: Keep meticulous records of all potential deductible expenses. This includes everything from business-related expenditures to eligible personal expenses such as certain healthcare costs and charitable donations.

Benefit: Reduces your taxable income, which in turn can lower your tax bracket and reduce the overall tax owed.

Income Splitting

Strategy: Distribute income among several family members or legal entities to take advantage of lower tax brackets.

Benefit: Overall family or group tax liability decreases as income is taxed at lower rates across multiple entities rather than at a higher rate for a single entity.

Investing in Pension Plans

Strategy: Maximize contributions to pension plans like 401(k)s or IRAs, which are often tax-deductible or offer tax-deferred growth.

Benefit: Reduces current taxable income and facilitates growth of savings in a tax-efficient manner, benefiting long-term financial planning.

Establish Trusts

Strategy: Use trusts to manage how your assets are distributed and taxed. This can include setting up educational trusts for children or life insurance trusts.

Benefit: Can help in estate planning, reducing estate taxes, and ensuring that income distributed through the trust is taxed more favorably.

Make Use of Tax Credits

Strategy: Identify and claim all applicable tax credits, such as for education expenses, energy-efficient home improvements, or investment in renewable energy.

Benefit: Tax credits directly reduce the amount of tax owed, dollar for dollar, leading to significant savings.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize efficiency in tax management with Template.net's Tax Planning Strategies Brief. This fully editable and customizable template provides insightful strategies for navigating the complexities of taxation, ensuring compliance and optimization of financial resources. Adapt it to personal or business needs with our AI Editor Tool, laying the groundwork for effective tax planning and savings.