Free Bookkeeping Services Brief

1. Introduction

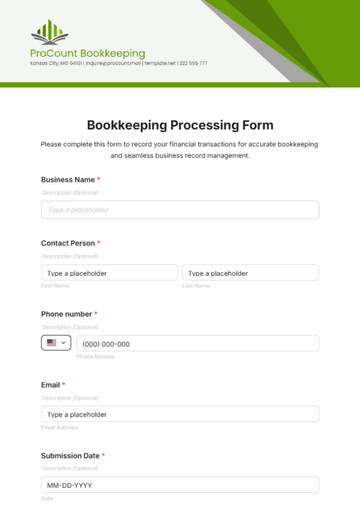

This comprehensive Bookkeeping Services Brief crafted by [YOUR NAME] under the company, [YOUR COMPANY NAME], outlines the specific bookkeeping services that will be provided to our esteemed clients. This clear and concise document aims to establish an understanding of the scope, methods, timelines, and expectations regarding the services to be rendered.

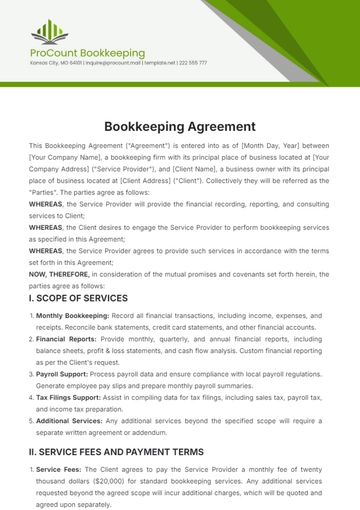

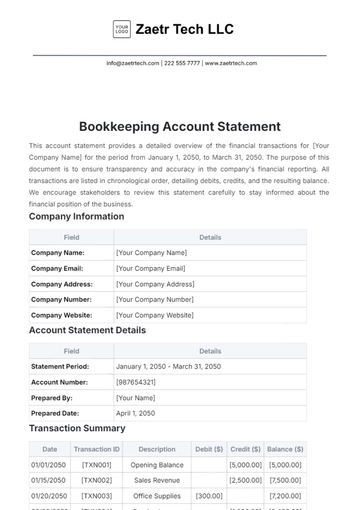

2. Services Overview

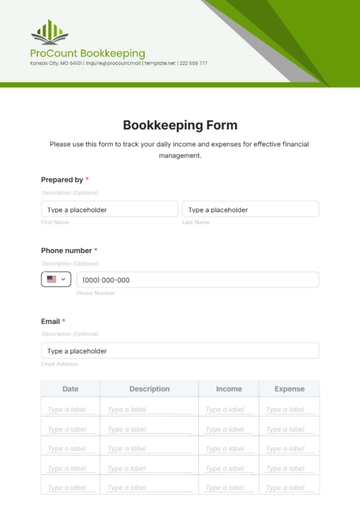

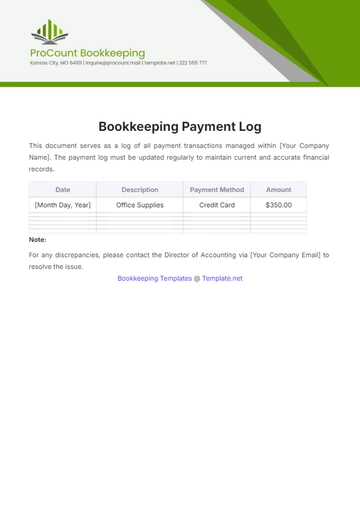

General Ledger Maintenance: Maintaining and updating the general ledger to accurately reflect all financial transactions.

Accounts Payable and Receivable: Managing outgoing bills and invoices owed by the company, as well as incoming payments from clients.

Bank Reconciliation: Comparing the company's financial records against bank statements to ensure accuracy.

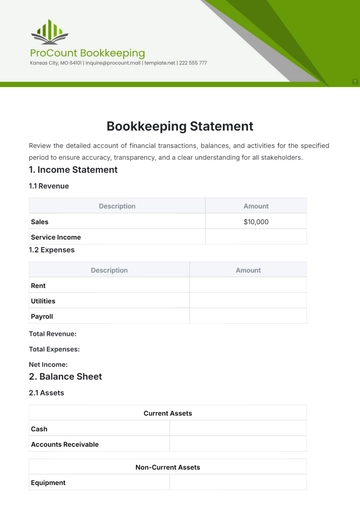

Financial Statement Preparation: Compiling data to produce key financial documents, such as income statements and balance sheets.

Payroll Processing: Handling the calculation, distribution, and record-keeping of employee wages.

3. Scope of Services

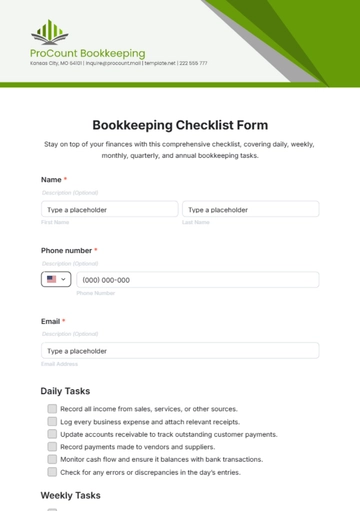

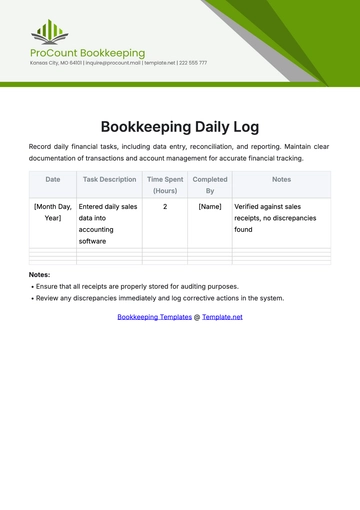

Our services are meticulously tailored to fit the unique needs of each client. Depending on the specific requirements, these bookkeeping tasks are organized into weekly, monthly, and annual tasks.

Weekly Tasks | Monthly Tasks | Annual Tasks |

|---|---|---|

Data Entry | Financial Statements | Tax Planning |

Expense Classification | Month-End Closing | Audit Support |

4. Methodology

The methodology embraced by our accounting professionals ensures that we deliver high-quality bookkeeping services efficiently and accurately. By integrating traditional bookkeeping practices with the latest technology, we're able to offer a blend of reliability and innovation. This combination not only streamlines the accounting process but also significantly enhances the precision and dependability of the financial data we manage. This approach allows us to meet the evolving needs of our clients while maintaining the highest standards of accuracy and integrity in financial reporting.

5. Timelines

This section outlines a basic timeline for the completion of tasks. However, specific schedules can be adjusted based on individual client's needs.

Tasks | Completion Time |

|---|---|

Weekly Tasks | Every Friday |

Monthly Tasks | Last Business Day of the Month |

Annual Tasks | First Quarter of the New Year |

6. Special Considerations

We're committed to accommodating these and any other special considerations with the highest level of expertise and precision, ensuring that our clients receive comprehensive, customized bookkeeping services that fully address their specific circumstances and requirements.

Legal Requirements:

Compliance with industry-specific financial regulations and standards to ensure legal accountability.

Extra Reporting:

Provision of additional financial reports beyond standard financial statements, tailored to the client's specific informational needs or for strategic decision-making.

Specific Tax Situations:

Handling complex tax scenarios, including multi-state operations, international transactions, or sector-specific tax obligations, to optimize tax positions and compliance.

Custom Financial Analysis:

Offering in-depth financial analyses such as cash flow forecasting, budget variance analysis, or investment appraisal to support strategic planning and management.

7. Conclusion

In conclusion, this Bookkeeping Services Brief offers a clear overview of the tailored accounting solutions provided by [YOUR COMPANY NAME]. Our dedication to upholding the highest standards of excellence is at the core of everything we do, ensuring that our clients receive the most reliable, accurate, and efficient bookkeeping services available. We greatly value the input of our clients and always welcome comments and feedback as opportunities to further refine and enhance our services. At [YOUR COMPANY NAME], your financial clarity and success are our top priorities, and we are committed to achieving these goals through continuous improvement and client-focused strategies.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial records with Template.net's Bookkeeping Services Brief. This editable, customizable template offers a systematic approach to maintaining accurate financial transactions and records. Suitable for businesses of all sizes, it can be adapted to meet specific bookkeeping needs using our AI Editor Tool, enhancing financial clarity and compliance.