BUDGET ANALYSIS BRIEF

Prepared by: [YOUR NAME]

Executive Summary

This Budget Analysis Brief provides a comprehensive review of the financial performance for the concluded financial year. It aims to highlight significant variances between the budgeted and actual figures, identify prevailing trends within our financial landscape, and offer insights into our financial health and the efficacy of our budget allocations. This document supports strategic decision-making and fosters a deeper understanding of financial management practices.

Financial Overview

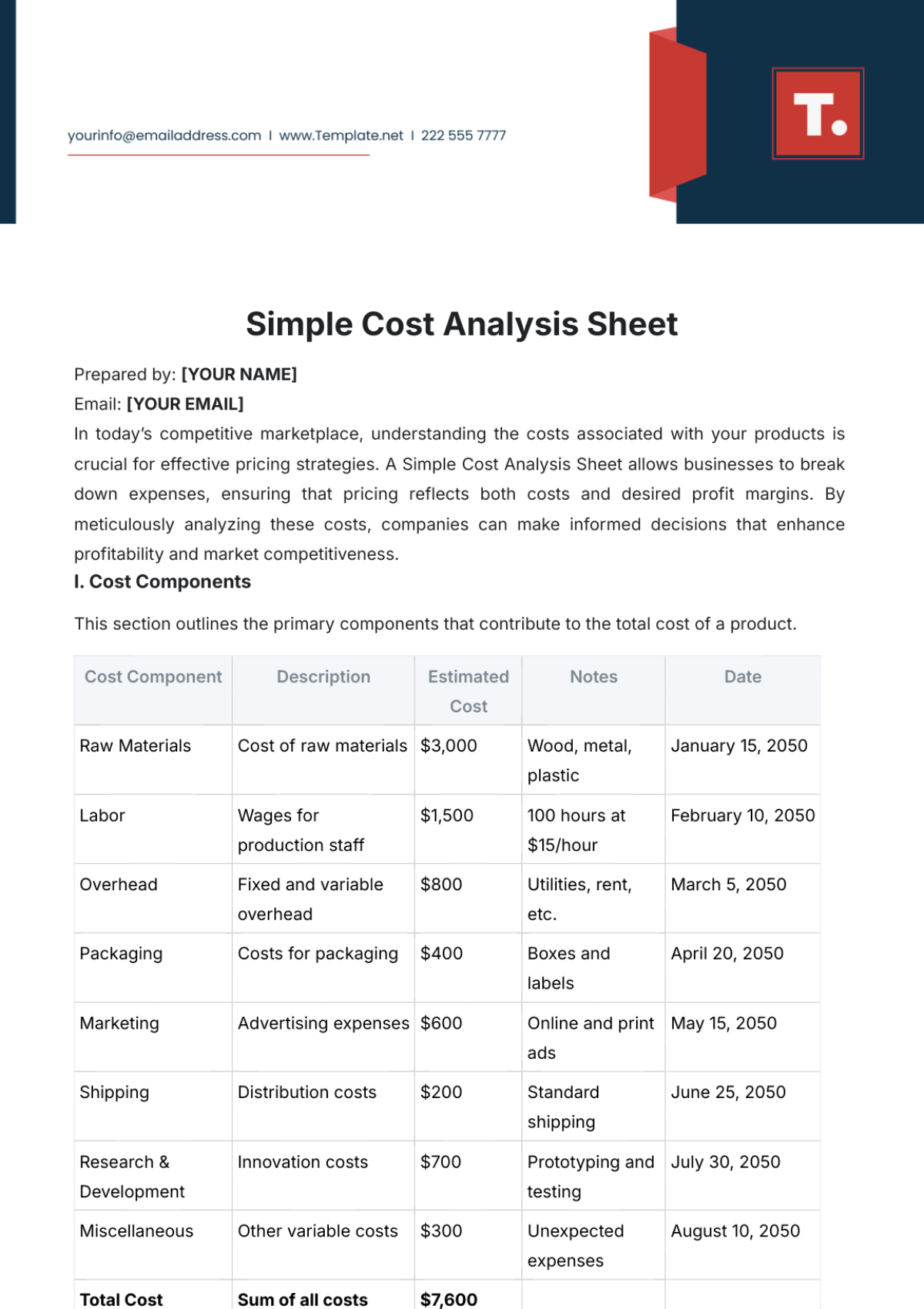

Category | Budgeted | Actual | Variance | Variance (%) |

|---|---|---|---|---|

Total Revenue | $500,000 | $450,000 | -$50,000 | -10% |

Total Expenses | $300,000 | $320,000 | $20,000 | 6.67% |

Key Variances and Analysis

Sales Revenue Variance:

The shortfall in revenue can primarily be attributed to the unexpected downturn in market demand in Q2 and Q3. Strategic promotions and a pivot in sales strategy mid-Q3 helped in partially recuperating the initial losses.

Cost of Goods Sold (COGS) Variance:

COGS was slightly below budget by $5,000 (2%) due to renegotiated supplier contracts and more efficient inventory management practices adopted in Q1.

Operating Expenses Variance:

Operating expenses exceeded the budget by $25,000 (8.33%), mainly due to unplanned marketing expenditures aimed at boosting sales and unforeseen legal expenses.

Capital Expenditure (CapEx) Variance:

CapEx was under budget by $10,000 (20%) as the planned upgrade for the IT infrastructure was postponed to the next financial year, following a strategic review of IT needs.

Financial Trends

Revenue Trends:

Despite a challenging start to the year, revenue trends showed improvement in Q4, indicating a positive response to the strategic changes implemented.

Expense Trends:

Expenses have shown a steady increase, primarily driven by marketing and legal expenses. A focus on cost management and efficiency is recommended.

Profitability Trends:

Despite the variances in revenue and expenses, profitability margins remained relatively stable, thanks to effective cost control measures and adjustments in pricing strategies.

Observations and Recommendations

Financial Health: The company remains in a strong financial position, with solid liquidity and manageable debt levels. However, attention should be given to enhancing revenue streams and further optimizing expenses.

Budget Allocation Efficiency: The analysis indicates areas of both efficiency and overspending. It is recommended to reallocate the budget towards high-performing marketing channels and delay non-critical capital expenditures.

Strategic Recommendations: It is advisable to further analyze market trends to better predict demand fluctuations and adjust budget allocations accordingly. Investing in market research and customer feedback mechanisms will be critical to guiding future strategies.

Conclusion

This Budget Analysis Brief underscores the importance of vigilant financial management and the need for adaptive strategies to navigate financial complexities. By closely monitoring financial performance and responding proactively to variances and trends, we can ensure financial stability and drive sustained growth.

For further details or specific inquiries regarding this analysis, please contact the finance department.