Risk Protocol Development

1. Introduction

The Risk Protocol Development document serves as a guide for [Your Company Name] in establishing robust risk management practices. By systematically identifying, assessing, and managing potential risks, this document aims to fortify the organization's resilience against uncertainties that might otherwise impede its growth and success. It emphasizes a proactive approach to risk management, aligning it with the company's strategic objectives and operational procedures, thus ensuring a sustainable and secure business environment.

Purpose

The primary purpose of this Risk Protocol Development document is to provide [Your Company Name] with a structured and consistent approach to risk management. It is crafted to aid in the identification, evaluation, and mitigation of risks that could adversely affect the company's operations, financial health, and reputation. This document intends to create a culture of risk awareness, where risks are not only identified and assessed but also actively managed. By doing so, it aims to minimize negative impacts while maximizing opportunities, thereby supporting the company's long-term objectives and ensuring its stability and growth in a competitive marketplace.

Scope

This Risk Protocol applies universally across all departments and units within [Your Company Name]. It encompasses a wide range of risks including, but not limited to, operational, financial, strategic, compliance, and reputational risks. The protocol is applicable to all levels of the organization, ensuring that risk management is an integral part of the decision-making process, from the executive level to operational staff.

Definitions

Risk: In the context of this protocol, 'risk' is defined as the possibility of an event occurring that could have a significant impact on the achievement of [Your Company Name]'s objectives. This includes any internal or external event or scenario that could hinder the company's ability to meet its goals or execute its strategies effectively.

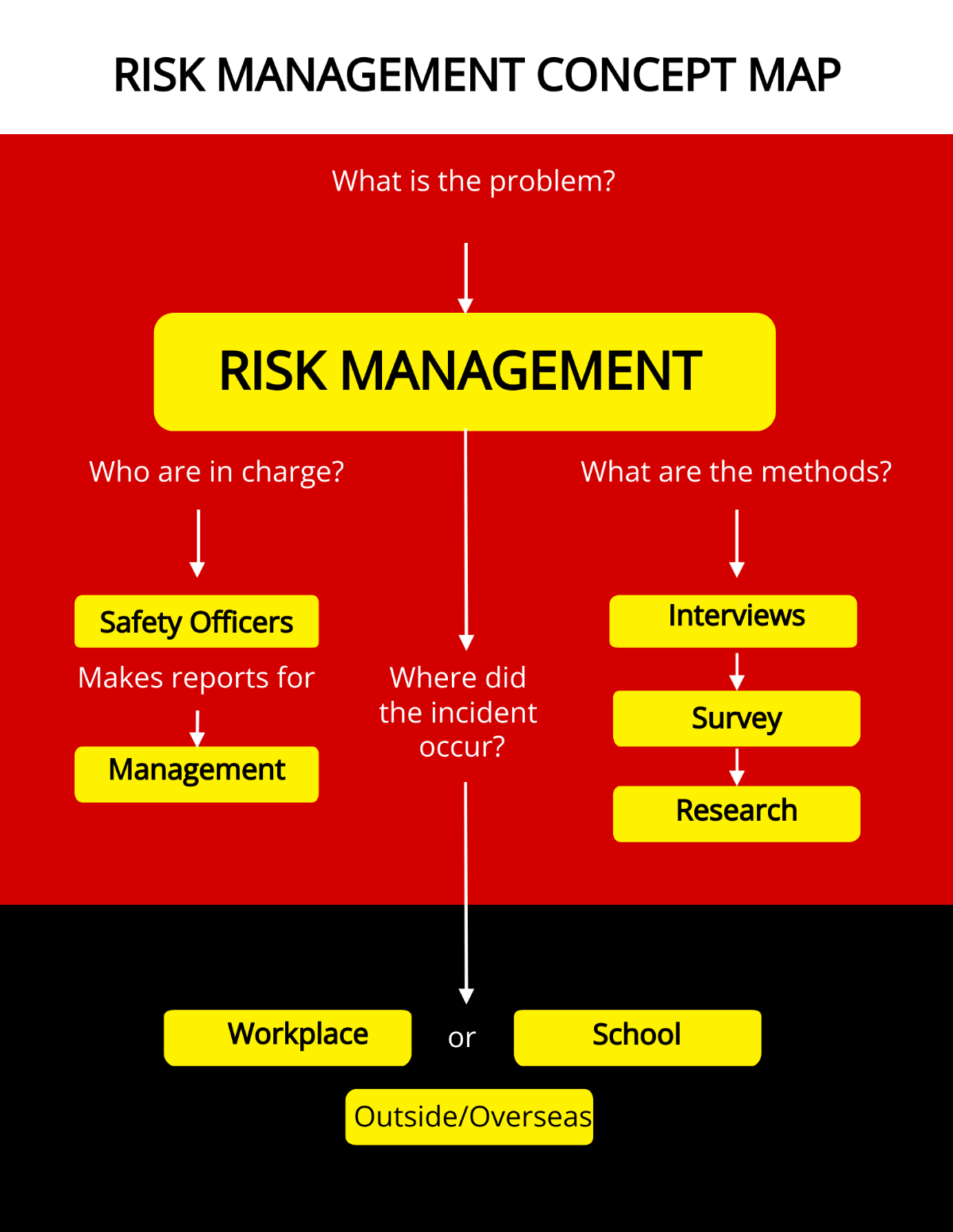

Risk Management: This refers to the coordinated activities undertaken by [Your Company Name] to direct and control the organization with regard to risk. It involves a systematic process of identifying, analyzing, evaluating, treating, monitoring, and communicating risks associated with any activity, function, or process.

By establishing clear definitions and a comprehensive scope, this document aims to ensure that all employees of [Your Company Name] have a common understanding of risk and risk management, fostering a unified approach towards managing uncertainties in a systematic and proactive manner.

2. Risk Identification

Risk identification is the foundational step in the risk management process. It involves a systematic and proactive approach to uncovering potential risks that could adversely affect the organization. This chapter outlines the methodology [Your Company Name] will employ to identify risks. The goal is to ensure a comprehensive understanding of the risks facing the organization, which is essential for effective risk management.

Methodology

The methodology for risk identification at [Your Company Name] involves a structured approach to uncover, document, and update risks. This process is essential for creating a living document that evolves with the company and its external environment. The steps in this methodology are as follows:

Step | Description | Responsible Party |

1 | This initial step involves gathering department heads to brainstorm potential risks. These sessions are aimed at leveraging the diverse perspectives and expertise within the company to identify a wide range of potential risks, from operational to strategic. | Department Heads |

2 | After identification, risks are formally documented in the Risk Register. This document serves as a central repository for all identified risks and is essential for tracking and managing risks throughout their lifecycle. | Risk Management Coordinator |

3 | Risks evolve as the business and its external environment change. Regular updates to the Risk Register ensure that it remains a relevant and effective tool for managing current and emerging risks. | Risk Management Team |

This methodology is designed to be flexible and adaptive, allowing [Your Company Name] to respond swiftly and effectively to new risks and changes in existing risks. It is a critical component of a proactive and strategic approach to risk management.

3. Risk Assessment

Risk assessment is a critical step in the risk management process, enabling [Your Company Name] to understand the magnitude of potential risks and make informed decisions about how to address them. This chapter details the approach for assessing identified risks, focusing on their likelihood of occurrence and potential impact on the organization.

Risk Analysis

In this phase, each identified risk is evaluated in terms of its likelihood and impact. This analysis helps in understanding the severity of the risk and its potential consequences.

Likelihood: This refers to the probability of the risk occurring. It is assessed based on historical data, industry trends, and expert judgment.

Impact: This measures the extent of the effect the risk would have on the organization if it were to occur. It considers factors such as financial loss, reputational damage, and operational disruptions.

Risk Evaluation

Once risks are analyzed, they are evaluated to determine their overall level of risk. This step is crucial for prioritizing which risks need immediate attention and resources for mitigation.

Risk Prioritization: Risks are ranked based on their likelihood and impact scores. Those with high likelihood and high impact are given the highest priority.

Risk Thresholds: [Your Company Name] should establish thresholds for different levels of risks to aid in the decision-making process about which risks to address first.

The evaluation process leads to the development of a risk treatment plan, ensuring that resources are allocated effectively to manage risks that pose the greatest threat to [Your Company Name]. This systematic evaluation helps in creating a focused and efficient risk management strategy.

4. Risk Treatment

Risk treatment involves selecting and implementing measures to modify and manage identified risks. The goal of this chapter is to guide [Your Company Name] in developing effective strategies to address each high-priority risk identified in the risk assessment process.

Treatment Options

There are four primary risk treatment options available:

Avoidance: Eliminating the risk by discontinuing the activities that create the risk. Suitable for high-impact risks that are avoidable.

Reduction: Implementing measures to reduce the likelihood and/or impact of the risk. Appropriate for risks that can be mitigated but not entirely avoided.

Transfer: Shifting the risk to a third party, typically through insurance or outsourcing. Useful for risks that are beyond the company's expertise.

Retention: Accepting the risk and deciding to deal with its consequences, often due to cost-effectiveness or low impact. Applicable to risks that are minor or unavoidable.

Action Plan

An action plan is developed for each high-priority risk, detailing the treatment option chosen and the specific steps to be implemented. The plan also assigns responsibility for each action to ensure accountability. Here is a sample table outlining a risk treatment plan:

Risk | Treatment Option | Action Steps |

Cybersecurity Breach | Reduction |

|

This table serves as a guide for [Your Company Name] to systematically address each significant risk. The action steps are detailed and specific, providing clear guidance on what needs to be done, while the assignment of a responsible party ensures that each step is overseen and implemented effectively.

5. Monitoring and Review

Effective risk management is an ongoing process that requires continuous monitoring and review. This chapter outlines the procedures for [Your Company Name] to regularly track the status of identified risks and the effectiveness of treatment plans. Monitoring and reviewing risks ensure that the risk management strategies remain relevant and effective in the face of changing internal and external environments. This process also provides an opportunity to identify new risks, reassess existing risks, and adjust risk treatment plans as necessary.

The key to successful risk monitoring and review is consistency and diligence. It involves not only checking the progress of risk treatment actions but also reassessing the risk environment to capture any changes that might affect the risk landscape of [Your Company Name].

Monitoring and Review Process

Reviewing the Risk Register: Regularly updating the Risk Register to reflect any changes in the risk profile.

Evaluating the Effectiveness of Risk Treatments: Assessing whether the risk treatment plans are working as intended or if adjustments are needed.

Updating Risk Assessments: Re-evaluating the likelihood and impact of risks in light of new information or changes in the business environment.

Reporting: Keeping management and relevant stakeholders informed about the status of risks and the effectiveness of treatment plans.

This structured approach to monitoring and reviewing risks ensures that [Your Company Name] stays ahead of potential threats and adapts its risk management strategies to changing circumstances, thereby maintaining organizational resilience and operational efficiency.

6. Reporting

Effective communication through structured reporting is vital in risk management. This chapter details the reporting protocols for [Your Company Name], focusing on two key aspects: Incident Reporting and Regular Reporting.

Incident Reporting

In the event of a risk incident, immediate and structured communication is crucial for an effective response. [Your Company Name]'s incident reporting protocol is outlined as follows:

Notification: As soon as a risk incident is identified or occurs, it should be immediately reported to the Risk Management Coordinator.

Incident Report Form: The individual identifying or witnessing the incident must complete the standard Incident Report Form. This form should capture key details of the incident, including the nature of the incident, time and location, a description of what happened, and any immediate actions taken.

Initial Assessment: The Risk Management Coordinator conducts an initial assessment to understand the severity and potential impact of the incident.

Escalation: Depending on the severity and nature of the incident, the Risk Management Coordinator escalates the issue to higher management and other relevant stakeholders.

Documentation: All incidents are documented for future reference, analysis, and learning purposes. This documentation assists in improving the risk management process and preventing similar incidents in the future.

Regular Reporting

Regular reporting on risk management activities provides insight into the effectiveness of risk management strategies and the current risk landscape of [Your Company Name]. The protocol for regular reporting is as follows:

Frequency: Regular risk management reports are prepared and presented on a quarterly basis.

Content: These reports include updates on the current risk profile, status of risk treatment actions, outcomes of monitoring and review activities, and any new risks identified.

Audience: The reports are presented to the Board of Directors and other key stakeholders. This ensures that senior management and decision-makers are kept informed about risk management activities.

Feedback and Action: Following each report, feedback is solicited from the audience to refine risk management strategies and actions. Necessary adjustments are then implemented to enhance the risk management process.

By adhering to these reporting protocols, [Your Company Name] ensures a transparent, accountable, and dynamic approach to managing risks, fostering a culture where risk management is integrated into the fabric of organizational operations and decision-making processes.

7. Document Management

Effective document management is crucial in maintaining the integrity and relevance of the Risk Protocol Development document at [Your Company Name]. This chapter outlines the procedures for version control and distribution of the document, ensuring that it remains up-to-date and accessible to all relevant parties.

Version Control

Version control is essential to track changes, updates, and revisions made to the document over time. It ensures historical accuracy and accountability in the risk management process.

Tracking Changes: Every modification, update, or revision to the document is logged with details including the nature of the change, the date of the change, and the person responsible for the change.

Version Numbering: Each new version of the document is assigned a unique version number. This helps in easily identifying the most current version and understanding the progression of changes.

Document Control Section: All revisions are recorded in the Document Control section at the beginning of the document. This section includes a version history table that lists version numbers, dates, summary of changes, and the names of individuals who authorized the changes.

Review and Approval: Each new version of the document undergoes a review and approval process by designated authorities before it is finalized and distributed.

Archiving Old Versions: Previous versions of the document are archived for reference and record-keeping purposes. They provide a historical record of the evolution of the risk management approach and practices at [Your Company Name].

Distribution

Ensuring that all relevant parties have access to the latest version of the document is critical for effective risk management.

Identifying Recipients: The document is distributed among key stakeholders, including department heads, risk management team, executive management, and other relevant personnel.

Distribution Method: The document is distributed through a secure and efficient method, such as company intranet, email, or a document management system, ensuring that all recipients can easily access it.

Notification of Updates: Whenever a new version of the document is released, all recipients are notified, highlighting the key changes and updates.

Accessibility: The latest version of the document is made readily accessible to all staff, ensuring that everyone is working with the most current information and guidelines.

Feedback Mechanism: A feedback mechanism is established for recipients to provide suggestions or raise concerns regarding the document, facilitating continuous improvement.

By adhering to these document management procedures, [Your Company Name] ensures that the Risk Protocol Development document is always current, reflective of the latest risk management practices, and accessible to all who need it.