Free Real Estate Project Compliance SWOT Analysis

I. Introduction

In this Real Estate Project Compliance SWOT Analysis, [Your Company Name] examines the compliance landscape within our real estate development projects. Compliance is a pivotal aspect of our operations, ensuring adherence to regulatory standards and mitigating risks. This analysis delves into the strengths, weaknesses, opportunities, and threats related to compliance, guiding our strategic decisions and enhancing project outcomes.

II. Executive Summary

This Real Estate Project Compliance SWOT Analysis underscores the significance of compliance within our projects. Key findings include robust regulatory frameworks as a strength but also highlight weaknesses such as resource constraints and potential threats from evolving regulations. Opportunities lie in technological advancements and collaboration avenues. Strategic recommendations aim to capitalize on strengths, address weaknesses, seize opportunities, and mitigate threats to bolster compliance effectiveness.

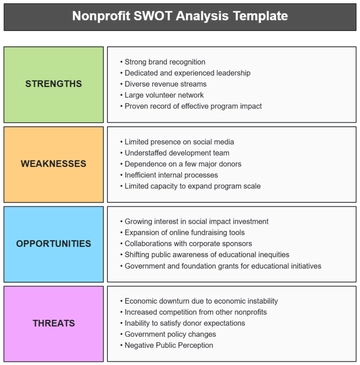

III. SWOT Analysis

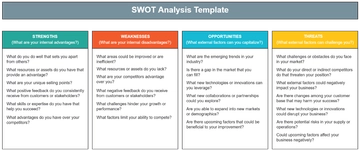

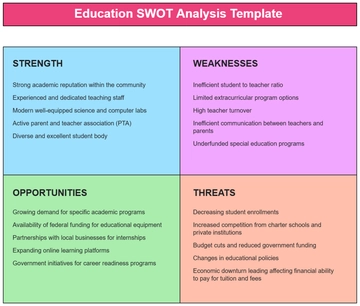

The SWOT Analysis section provides a comprehensive evaluation of the internal strengths and weaknesses, as well as external opportunities and threats, pertaining to compliance within our real estate development projects.

The table below provides a concise overview of the internal strengths and weaknesses as well as external opportunities and threats related to compliance within the real estate development projects of [Your Company Name].

Strengths | Weaknesses |

|---|---|

|

|

Opportunities | Threats |

|

|

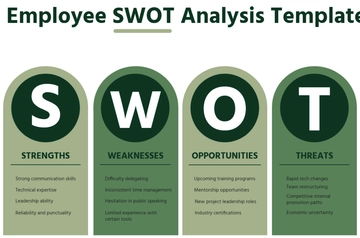

A. Strengths:

Established regulatory compliance framework: This indicates that the company has a solid structure in place to ensure compliance with relevant regulations and standards.

Experienced compliance team: It suggests that the company has a team with specialized knowledge and skills to navigate compliance requirements effectively.

Effective communication with regulatory authorities: This implies that the company has established channels of communication with regulatory bodies, which can facilitate smoother compliance processes.

Access to resources and technology: It indicates that the company has the necessary resources and technological tools to support compliance efforts efficiently.

Track record of successful compliance: This suggests that the company has a history of complying with regulations effectively, which can enhance its reputation and credibility.

B. Weaknesses:

Lack of clarity on certain regulatory requirements: This indicates areas where the company may struggle to understand or interpret specific regulatory mandates, potentially leading to compliance gaps.

Insufficient allocation of resources for compliance efforts: It suggests that the company may face challenges due to limited financial or human resources dedicated to compliance activities.

Need for enhanced training programs on compliance: This highlights a potential weakness in employee knowledge and awareness of compliance requirements, which could impact overall compliance effectiveness.

Reliance on manual processes: It indicates that the company may be using outdated or inefficient manual processes for compliance management, which can increase the risk of errors or delays.

Limited experience in navigating specific regulatory challenges: This suggests that the company may lack experience or expertise in addressing certain regulatory complexities or unique challenges.

C. Opportunities:

Integration of technology for streamlining compliance processes: This presents an opportunity for the company to leverage technology solutions to improve the efficiency and effectiveness of compliance management.

Expansion into markets with favorable regulatory environments: It suggests potential opportunities for the company to enter new markets with less stringent regulatory requirements, reducing compliance burdens.

Collaboration opportunities with regulatory agencies or consultants: This indicates potential partnerships or collaborations with regulatory bodies or consultants to enhance compliance practices and stay updated on regulatory changes.

Introduction of innovative compliance solutions: It suggests opportunities for the company to differentiate itself by introducing innovative compliance solutions or practices that set it apart from competitors.

Rising demand for environmentally sustainable and socially responsible development: This presents an opportunity for the company to align its compliance efforts with growing market trends towards sustainability and social responsibility, enhancing its reputation and market competitiveness.

D. Threats:

Rapidly evolving regulatory landscape: This highlights the risk posed by frequent changes or updates to regulations, which can increase compliance complexity and uncertainty.

Risk of penalties, fines, or legal action: It indicates potential consequences of non-compliance, including financial penalties, legal liabilities, and damage to reputation.

Competition from developers with superior compliance practices: This suggests the threat posed by competitors who may have stronger compliance systems or practices, potentially eroding the company's market share or reputation.

Economic downturns affecting regulatory priorities: It suggests that economic fluctuations or downturns could impact regulatory priorities or resources allocated to enforcement, affecting compliance requirements or expectations.

Reputational damage from compliance failures: This highlights the risk of negative publicity or damage to the company's reputation resulting from compliance failures or incidents, which can undermine stakeholder trust and confidence.

IV. Strategic Recommendations

A. Enhance Compliance Infrastructure:

Invest in Advanced Compliance Management Systems: Implement robust compliance management software to streamline processes, centralize data, and automate compliance tracking and reporting.

Allocate Sufficient Resources: Ensure adequate financial and human resources are allocated to compliance efforts, including staffing, training, and technology investments.

Establish Clear Compliance Policies and Procedures: Develop comprehensive policies and procedures that outline regulatory requirements, internal controls, and accountability mechanisms to guide compliance efforts effectively.

B. Strengthen Compliance Culture and Training:

Foster a Culture of Compliance: Promote a culture of compliance throughout the organization by emphasizing the importance of adherence to regulations, ethics, and integrity in all business activities.

Enhance Staff Training Programs: Provide regular and comprehensive training programs on regulatory requirements, compliance best practices, and ethical standards to all employees, ensuring awareness and understanding of their compliance responsibilities.

Conduct Periodic Compliance Audits and Assessments: Implement regular audits and assessments to evaluate compliance performance, identify areas for improvement, and address any compliance gaps or deficiencies promptly.

C. Forge Collaborative Partnerships:

Collaborate with Regulatory Authorities: Foster collaborative relationships with regulatory agencies to stay informed about regulatory changes, seek guidance on compliance matters, and proactively address any compliance-related issues or concerns.

Engage with Compliance Consultants: Partner with external compliance consultants or legal experts to obtain specialized expertise, guidance, and support in navigating complex regulatory requirements and enhancing compliance practices.

Establish Industry Partnerships: Collaborate with industry associations, peer companies, and stakeholders to share best practices, benchmark performance, and collectively advocate for regulatory reforms or improvements that benefit the real estate sector.

D. Monitor Regulatory Developments and Adapt Strategies:

Stay Abreast of Regulatory Changes: Monitor regulatory developments, updates, and trends relevant to the real estate industry, and proactively assess their potential impact on compliance requirements and business operations.

Conduct Risk Assessments: Conduct regular risk assessments to identify emerging compliance risks, prioritize mitigation efforts, and develop contingency plans to address potential compliance challenges or uncertainties.

Implement Agile Compliance Strategies: Adopt flexible and adaptive compliance strategies that can quickly respond to changing regulatory landscapes, market dynamics, or business needs, ensuring continued compliance effectiveness and resilience in the face of evolving challenges.

E. Promote Transparency and Accountability:

Enhance Reporting and Documentation Practices: Improve transparency and accountability by enhancing reporting and documentation practices, ensuring accurate record-keeping, and documenting compliance activities, decisions, and outcomes systematically.

Establish Internal Controls and Monitoring Mechanisms: Implement robust internal controls, monitoring mechanisms, and performance metrics to track compliance performance, detect deviations from established standards, and mitigate compliance risks effectively.

Foster Stakeholder Engagement and Trust: Communicate openly and transparently with stakeholders, including investors, customers, employees, and communities, about the company's commitment to compliance, ethical conduct, and responsible business practices, building trust and confidence in the organization's integrity and credibility.

V. Conclusion

In conclusion, this Real Estate Project Compliance SWOT Analysis highlights the critical importance of proactive compliance management within our real estate development projects. By leveraging internal strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats identified through this analysis, [Your Company Name] can enhance its compliance effectiveness and ensure sustainable project success.

Through strategic investments in compliance infrastructure, fostering a culture of compliance, forging collaborative partnerships, monitoring regulatory developments, and promoting transparency and accountability, [Your Company Name] is well-positioned to navigate evolving regulatory landscapes, mitigate compliance risks, and uphold its commitment to integrity, ethical conduct, and responsible business practices.

By integrating these recommendations into our operations, [Your Company Name] aims to not only meet regulatory requirements but also exceed stakeholder expectations, safeguarding our reputation, enhancing stakeholder trust, and driving long-term value creation for all stakeholders involved.

VI. Sources

List of sources consulted during the preparation of this analysis.

Real estate regulatory guidelines

Industry reports and publications

Compliance management software providers

Legal and compliance experts

Internal documentation and policies

Interviews and surveys

Government regulations and legislation

Case studies and best practices

Academic research

Internal data analysis

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize project compliance strategies with Template.net's Real Estate Project Compliance SWOT Analysis Template. Editable in our AI Editor Tool, this customizable template enables a comprehensive assessment of strengths, weaknesses, opportunities, and threats related to compliance efforts. Streamline planning, identify areas for improvement, and ensure regulatory adherence effortlessly with this user-friendly template from Template.net!