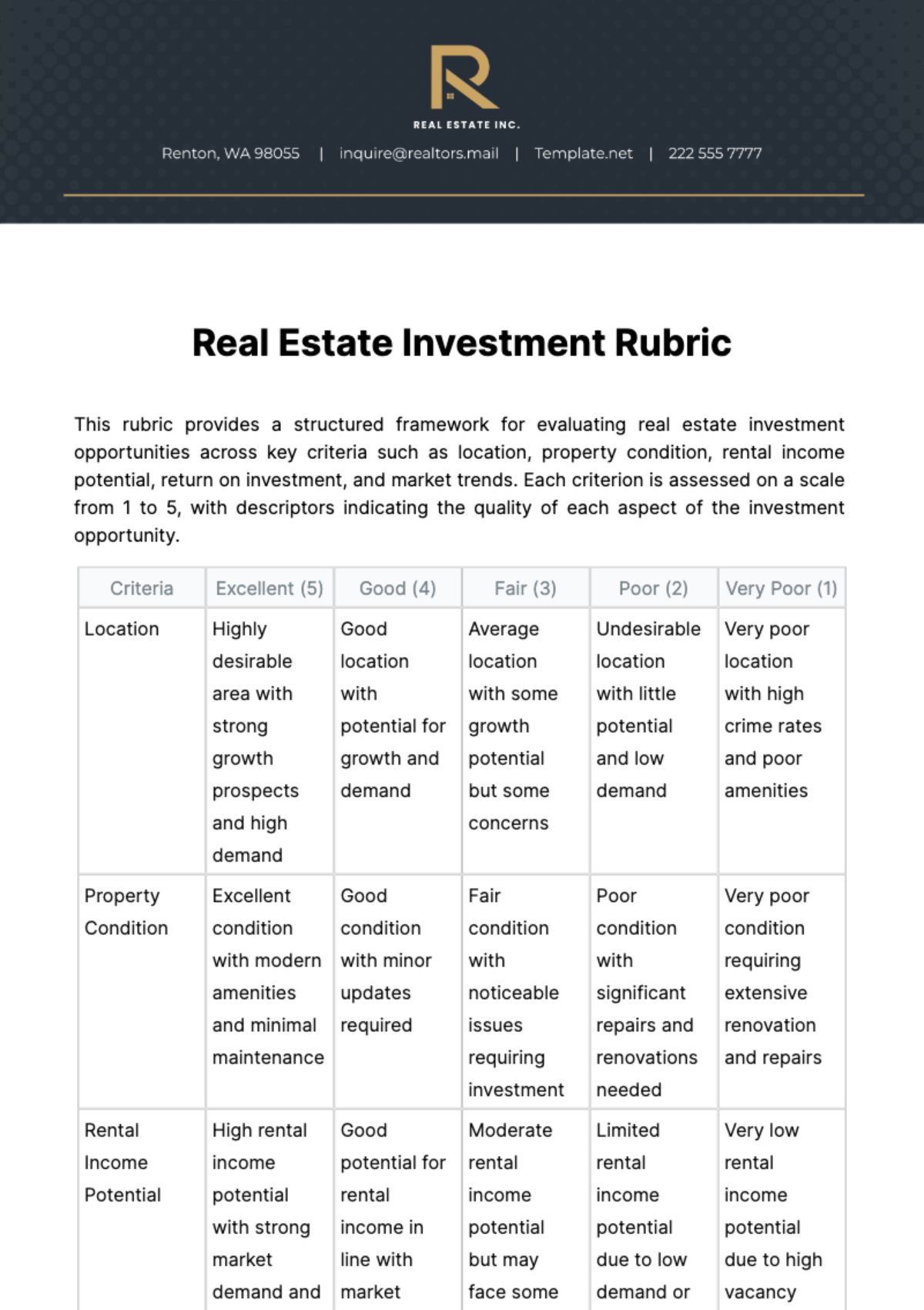

Free Real Estate Investment Rubric

This rubric provides a structured framework for evaluating real estate investment opportunities across key criteria such as location, property condition, rental income potential, return on investment, and market trends. Each criterion is assessed on a scale from 1 to 5, with descriptors indicating the quality of each aspect of the investment opportunity.

Criteria | Excellent (5) | Good (4) | Fair (3) | Poor (2) | Very Poor (1) |

|---|---|---|---|---|---|

Location | Highly desirable area with strong growth prospects and high demand | Good location with potential for growth and demand | Average location with some growth potential but some concerns | Undesirable location with little potential and low demand | Very poor location with high crime rates and poor amenities |

Property Condition | Excellent condition with modern amenities and minimal maintenance | Good condition with minor updates required | Fair condition with noticeable issues requiring investment | Poor condition with significant repairs and renovations needed | Very poor condition requiring extensive renovation and repairs |

Rental Income Potential | High rental income potential with strong market demand and competitive | Good potential for rental income in line with market averages | Moderate rental income potential but may face some challenges | Limited rental income potential due to low demand or undesirable | Very low rental income potential due to high vacancy rates or low demand |

Return on Investment (ROI) | Excellent ROI with high potential for returns exceeding market averages | Good ROI with solid potential for returns meeting market norms | Fair ROI with moderate potential for returns slightly below market | Poor ROI with limited potential and significant risk factors | Very poor ROI with negative potential and high risk factors |

Market Trends and Growth Potential | Positive market trends and strong growth prospects indicating | Favorable market trends and potential for growth | Stable market with moderate growth prospects but some concerns | Declining market trends and limited growth potential | Very poor market trends and negative growth prospects |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize real estate investment decisions with Template.net's Real Estate Investment Rubric Template. Accessible via our AI Editor Tool, this easily editable and customizable template provides a structured framework for evaluating potential investments based on criteria such as ROI, risk, and market trends. Streamline decision-making processes and maximize returns effortlessly with Template.net!