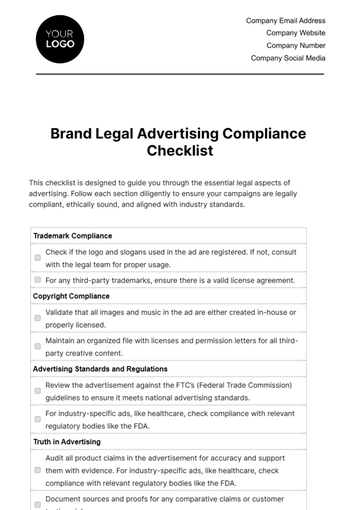

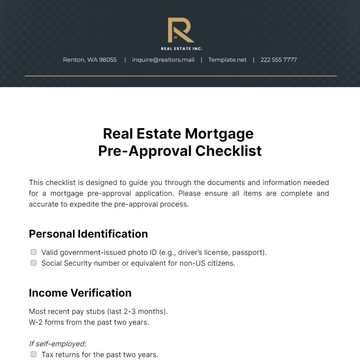

Free Real Estate Mortgage Pre-Approval Checklist

Pre-Approval Checklist

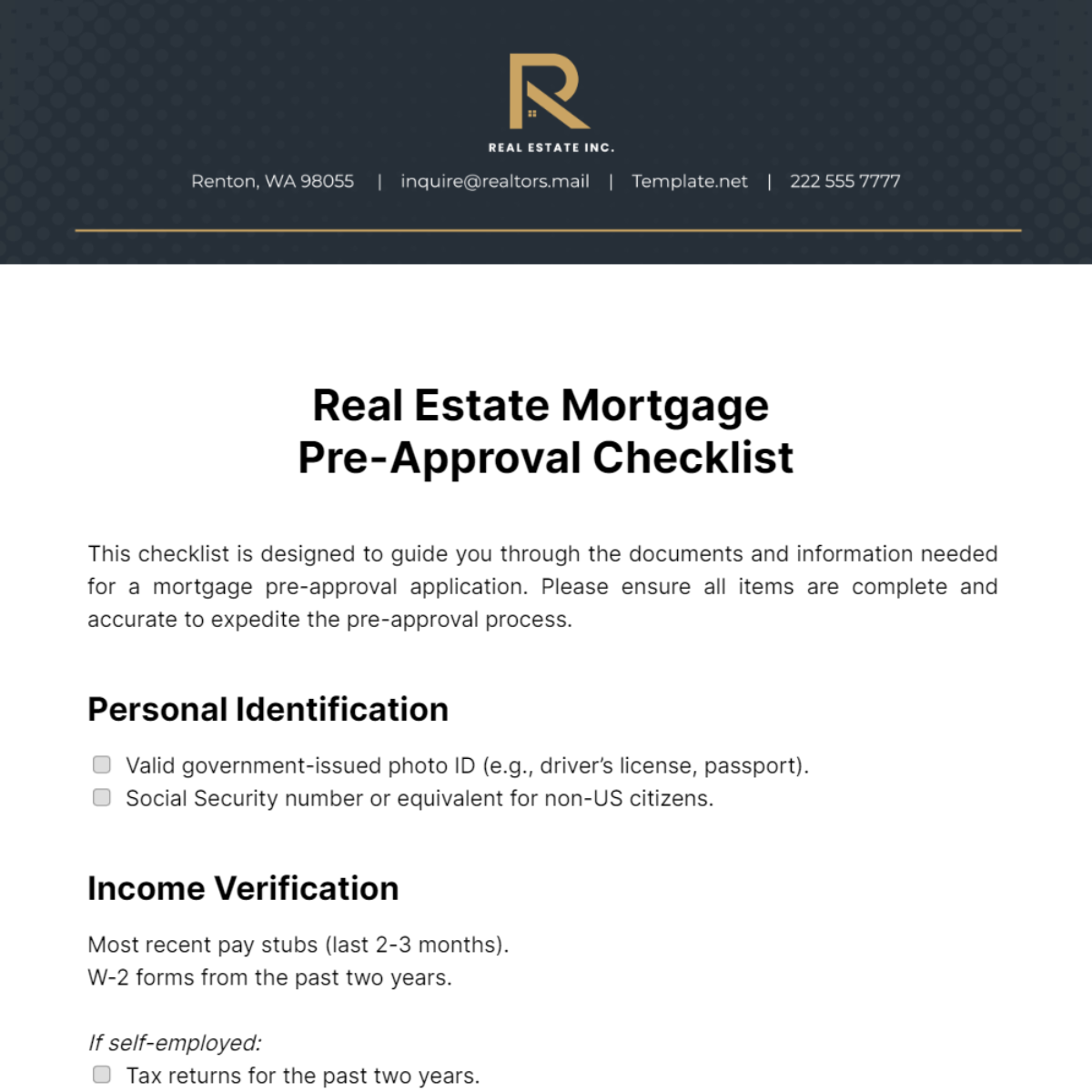

This checklist is designed to guide you through the documents and information needed for a mortgage pre-approval application. Please ensure all items are complete and accurate to expedite the pre-approval process.

Personal Identification

Valid government-issued photo ID (e.g., driver’s license, passport).

Social Security number or equivalent for non-US citizens.

Income Verification

Most recent pay stubs (last 2-3 months).

W-2 forms from the past two years.

If self-employed:

Tax returns for the past two years.

Current year profit and loss statement.

Asset Verification

Bank statements for the past two months (checking and savings accounts).

Investment account statements for the past two months.

Documentation of any other assets (e.g., real estate, vehicles).

Credit Information

Authorization to perform a credit check.

Details of current debts (e.g., credit card, auto loan, existing mortgage).

Employment Verification

Contact information for your current employer.

If employed less than two years, provide details of previous employment.

Property Information (if already chosen)

The address of the property you intend to purchase.

A signed purchase agreement (if applicable).

Additional Documents

If applicable, divorce decrees, child support orders, and any other legal documents affecting income or debt.

Documentation for any large deposits or gifts that will be used for down payment or closing costs.

Please contact us if you have any questions or need assistance with any of the items listed above. Our goal is to help you secure your mortgage pre-approval efficiently and with ease.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

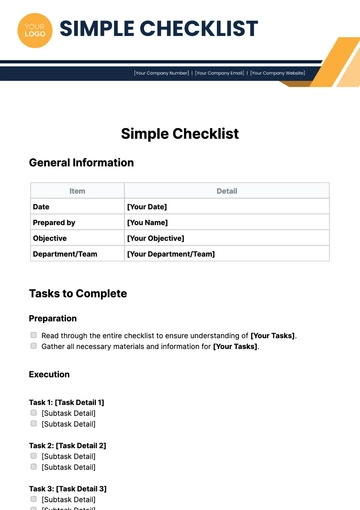

Introducing the Real Estate Mortgage Pre-Approval Checklist Template at Template.net, designed to prepare buyers for the mortgage pre-approval process. This template is editable and customizable, providing a detailed list that can be tailored to individual requirements, streamlined through our AI Editor tool, making mortgage preparation both thorough and efficient.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

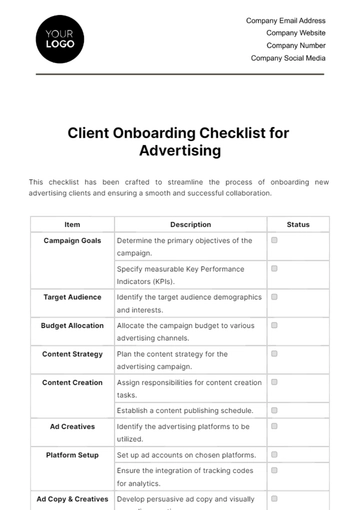

- Onboarding Checklist

- Quality Checklist

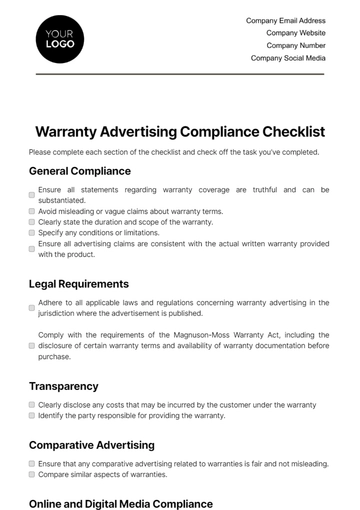

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

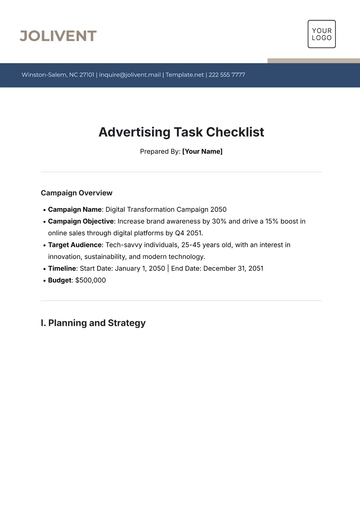

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

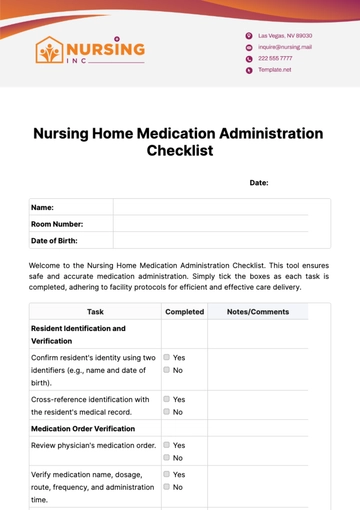

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

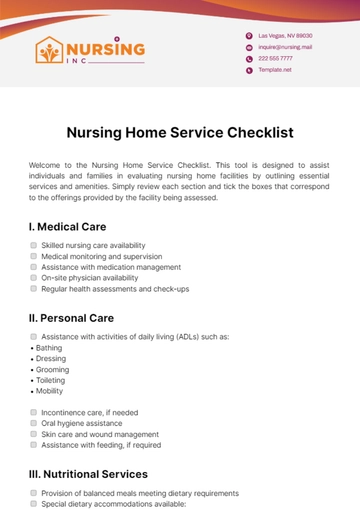

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist