Sample Compliance

I. Compliance Program Overview

Objective: To ensure [Your Company Name] operates within all regulatory frameworks and adheres to best practices in governance, risk management, and compliance (GRC).

Compliance Officer: [Your Name], [Your Title]

Effective Date: [Effective Date]

Review Schedule: Bi-annually or as required by changes in legislation.

II. Organizational Governance

1. Legal Structure and Governance

Confirm [Your Company Name]’s legal structure is properly documented and compliant with relevant laws.

Ensure the roles and responsibilities of the board of directors are clearly defined and in compliance with governance standards.

2. Ethics and Integrity Policies

Implement a Code of Conduct that reflects [Your Company Name]’s commitment to ethical practices.

Regularly review and update the Code of Conduct to address new ethical challenges and expectations.

3. Compliance and Risk Management Policies

Develop a comprehensive risk management plan that identifies, assesses, manages, and monitors compliance risks.

Ensure there are procedures in place for reporting and managing compliance incidents.

III. Financial Compliance

1. Accounting and Financial Reporting

Verify that accounting practices adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Maintain transparent and accurate financial reporting mechanisms.

2. Tax Compliance

Ensure all tax filings and payments are accurate and submitted on time.

Regularly review tax compliance status and prepare for audits.

3. Internal Controls and Audit

Implement strong internal controls to prevent financial misstatements and fraud.

Conduct internal and external audits periodically to ensure financial processes are compliant.

IV. Regulatory Compliance

1. Industry-Specific Regulations

Identify and comply with regulations specific to [Your Industry].

Stay informed on regulatory changes and adjust policies and procedures accordingly.

2. Data Protection and Privacy

Ensure compliance with data protection laws (e.g., GDPR, CCPA) relevant to [Your Company Name]’s operations.

Implement security measures to protect personal and sensitive data.

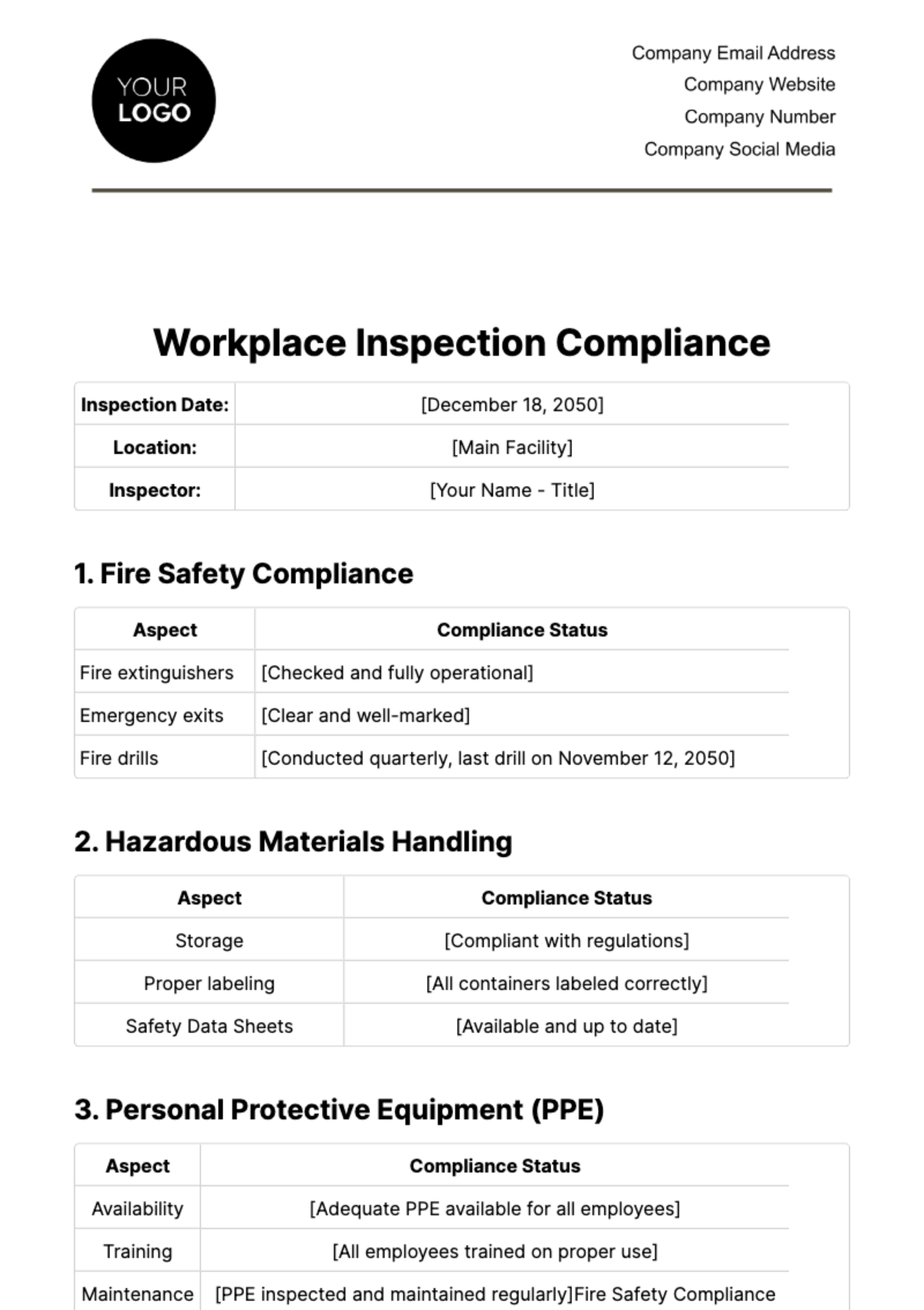

3. Environmental, Health, and Safety

Comply with environmental laws and regulations that apply to [Your Company Name].

Ensure workplace health and safety policies meet or exceed regulatory requirements.

V. Employee Compliance

1. Labor Laws and Employee Rights

Ensure compliance with national and local labor laws, including wages, hours, and working conditions.

Maintain a system for handling employee grievances and complaints.

2. Training and Development

Provide compliance training to employees on relevant laws, regulations, and company policies.

Track and document employee training participation and completion.

3. Diversity and Inclusion

Promote diversity and inclusion within [Your Company Name] and ensure compliance with anti-discrimination laws.

Regularly review and update policies to support a diverse and inclusive workplace.

VI. Vendor and Third-Party Compliance

Assess and monitor the compliance status of vendors and third-party service providers.

Implement contracts that include compliance obligations for third parties.

VII. Compliance Monitoring and Improvement

1. Monitoring and Reporting

Establish mechanisms for ongoing monitoring of compliance with all regulations.

Create a system for reporting compliance issues and breaches.

2. Audit and Review

Schedule regular compliance audits to assess and improve [Your Company Name]’s compliance program.

Update compliance practices based on audit findings and regulatory changes.

3. Compliance Culture

Foster a culture of compliance throughout [Your Company Name] by encouraging openness, transparency, and regular communication on compliance matters.

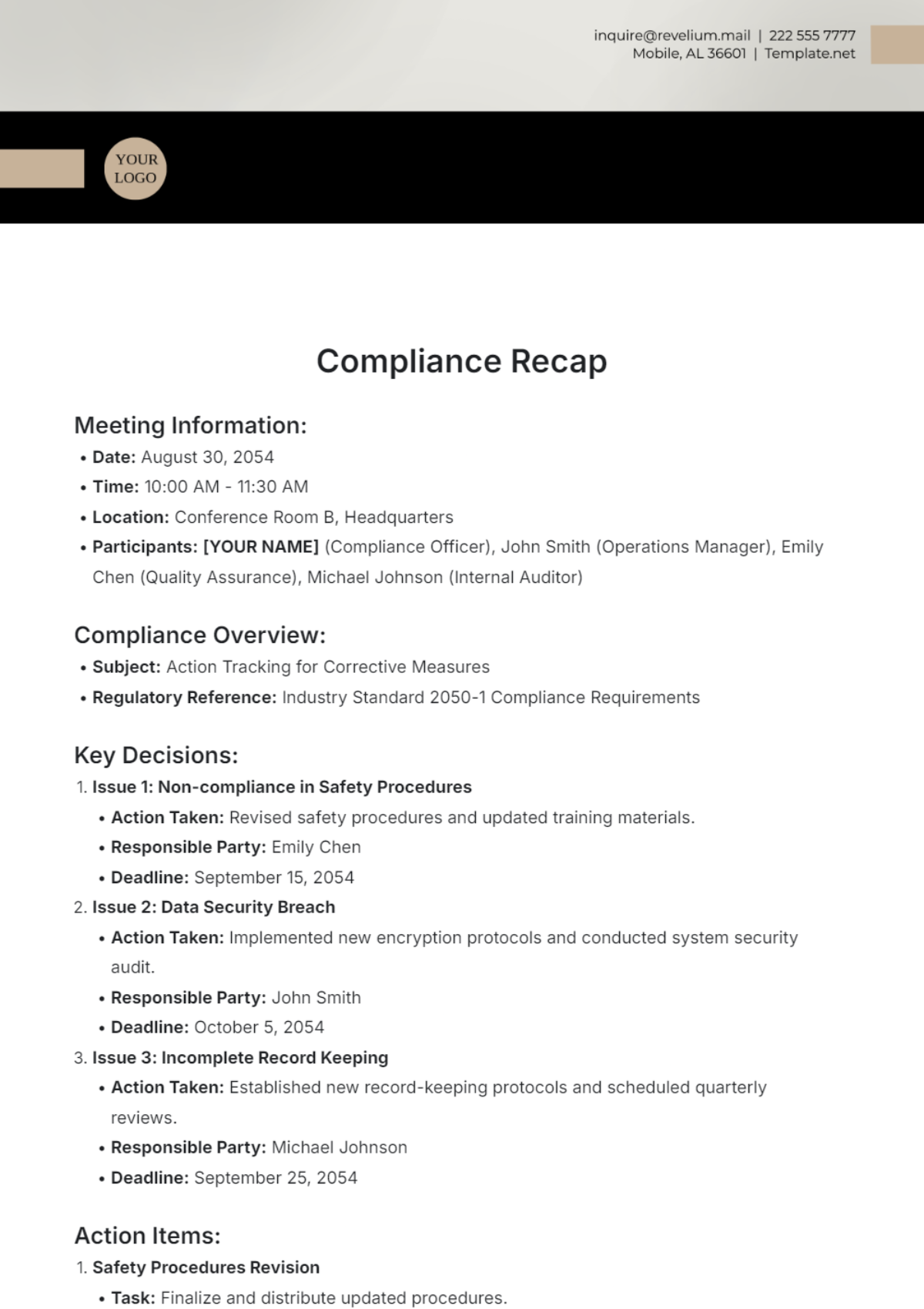

VIII. Non-Compliance Management

Define procedures for addressing non-compliance issues, including investigation, reporting, and remediation.

Document all incidents of non-compliance and corrective actions taken.

This checklist is designed to be a living document, requiring regular updates and revisions to stay aligned with both the regulatory landscape and [Your Company Name]’s operational needs. Always ensure that compliance is integrated into every aspect of [Your Company Name]’s operations.

[Your Name]

Compliance Officer

Date: