Free Real Estate Property Insurance Policy Review Checklist

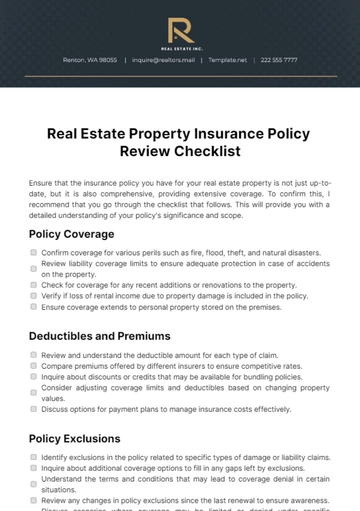

Ensure that the insurance policy you have for your real estate property is not just up-to-date, but it is also comprehensive, providing extensive coverage. To confirm this, I recommend that you go through the checklist that follows. This will provide you with a detailed understanding of your policy's significance and scope.

Policy Coverage

Confirm coverage for various perils such as fire, flood, theft, and natural disasters.

Review liability coverage limits to ensure adequate protection in case of accidents on the property.

Check for coverage for any recent additions or renovations to the property.

Verify if loss of rental income due to property damage is included in the policy.

Ensure coverage extends to personal property stored on the premises.

Deductibles and Premiums

Review and understand the deductible amount for each type of claim.

Compare premiums offered by different insurers to ensure competitive rates.

Inquire about discounts or credits that may be available for bundling policies.

Consider adjusting coverage limits and deductibles based on changing property values.

Discuss options for payment plans to manage insurance costs effectively.

Policy Exclusions

Identify exclusions in the policy related to specific types of damage or liability claims.

Inquire about additional coverage options to fill in any gaps left by exclusions.

Understand the terms and conditions that may lead to coverage denial in certain situations.

Review any changes in policy exclusions since the last renewal to ensure awareness.

Discuss scenarios where coverage may be limited or denied under specific circumstances.

Documentation and Record-Keeping

Maintain a digital and physical copy of the current insurance policy for easy reference.

Keep a record of all insurance-related correspondence, including emails and letters.

Create a home inventory list with item descriptions, values, and photographs for insurance claims.

Update contact information for the insurance provider and agent for easy communication.

Set reminders for policy renewal dates and review periods to avoid lapses in coverage.

Additional Considerations

Discuss the option of umbrella insurance to provide supplemental liability coverage beyond the policy limits.

Inquire about coverage for specific high-value items such as jewelry, artwork, or collectibles.

Review the process for filing and settling insurance claims to understand the steps involved.

Consider the need for additional coverage for rental properties or vacation homes under separate policies.

Seek advice from a qualified insurance professional for personalized recommendations and guidance.

Prepared By: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the comprehensive Real Estate Property Insurance Policy Review Checklist Template on Template.net. This editable and customizable checklist empowers you to assess coverage details, limits, and exclusions effortlessly. Tailor it to your needs with the AI Editor Tool for a seamless insurance policy review experience. Ensure your property's protection with this versatile and user-friendly template.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

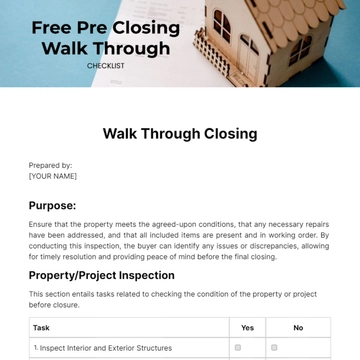

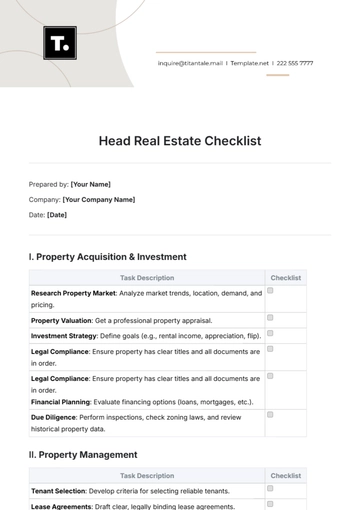

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

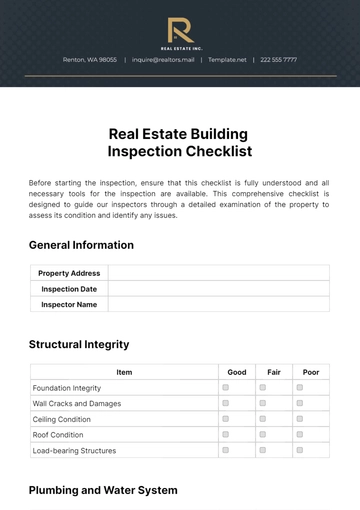

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

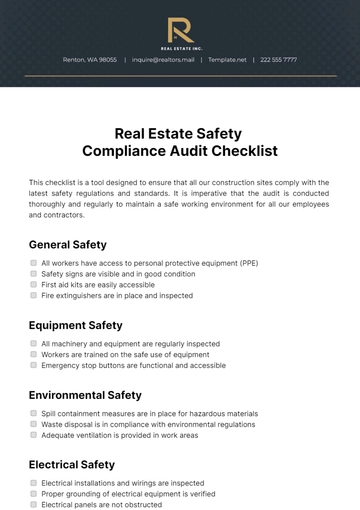

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

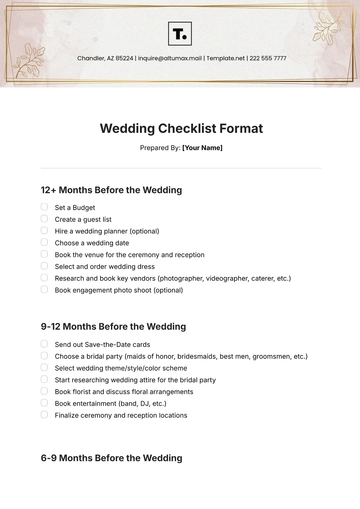

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

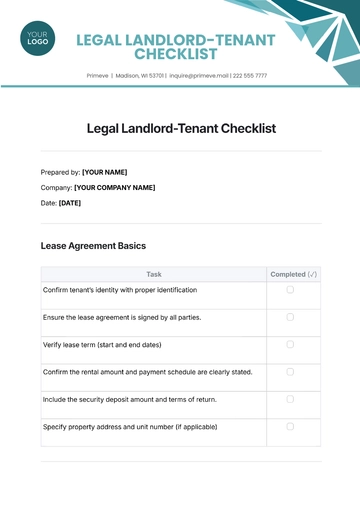

- Legal Checklist

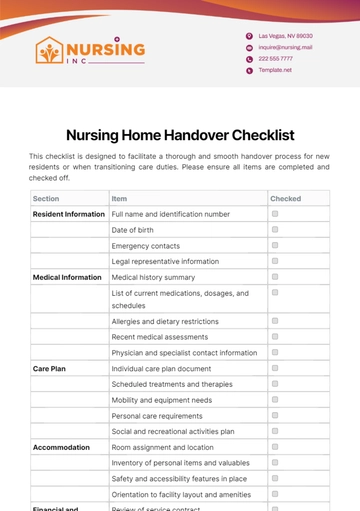

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist