SMART Goals for Home Ownership

prepared by: [YOUR NAME]

OBJECTIVE:

The objective of the SMART Goals for Home Ownership is to assist individuals in setting clear, achievable, and time-bound objectives for purchasing a home. By providing specific guidance on defining property preferences, establishing measurable progress tracking methods, outlining actionable steps, ensuring relevance to broader financial goals, and setting realistic timelines, this resource aims to empower individuals in their journey towards homeownership. The objective is to enable users to create a comprehensive plan that aligns with their aspirations, facilitates effective decision-making, and enhances the likelihood of successfully achieving their goal of owning a home.

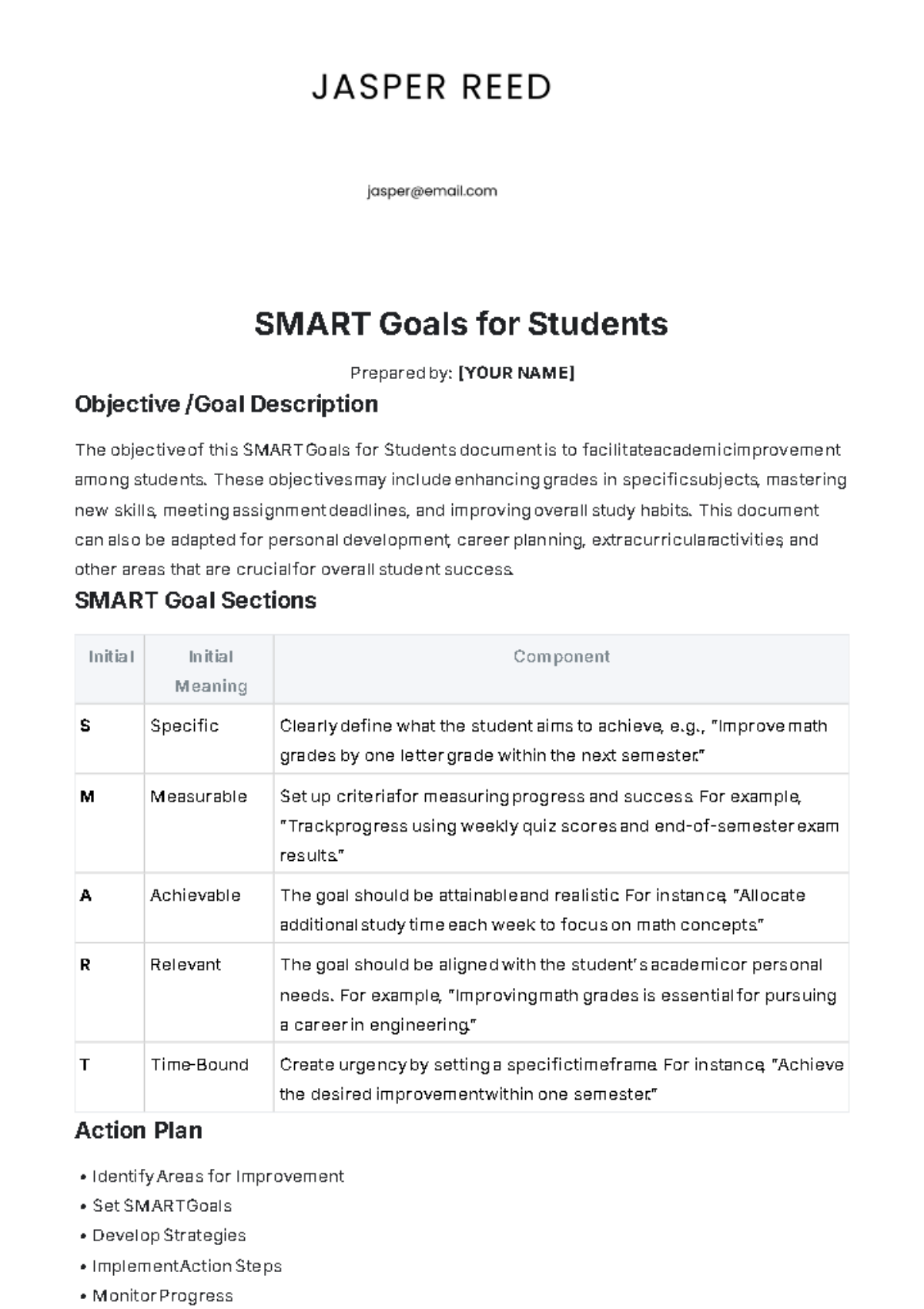

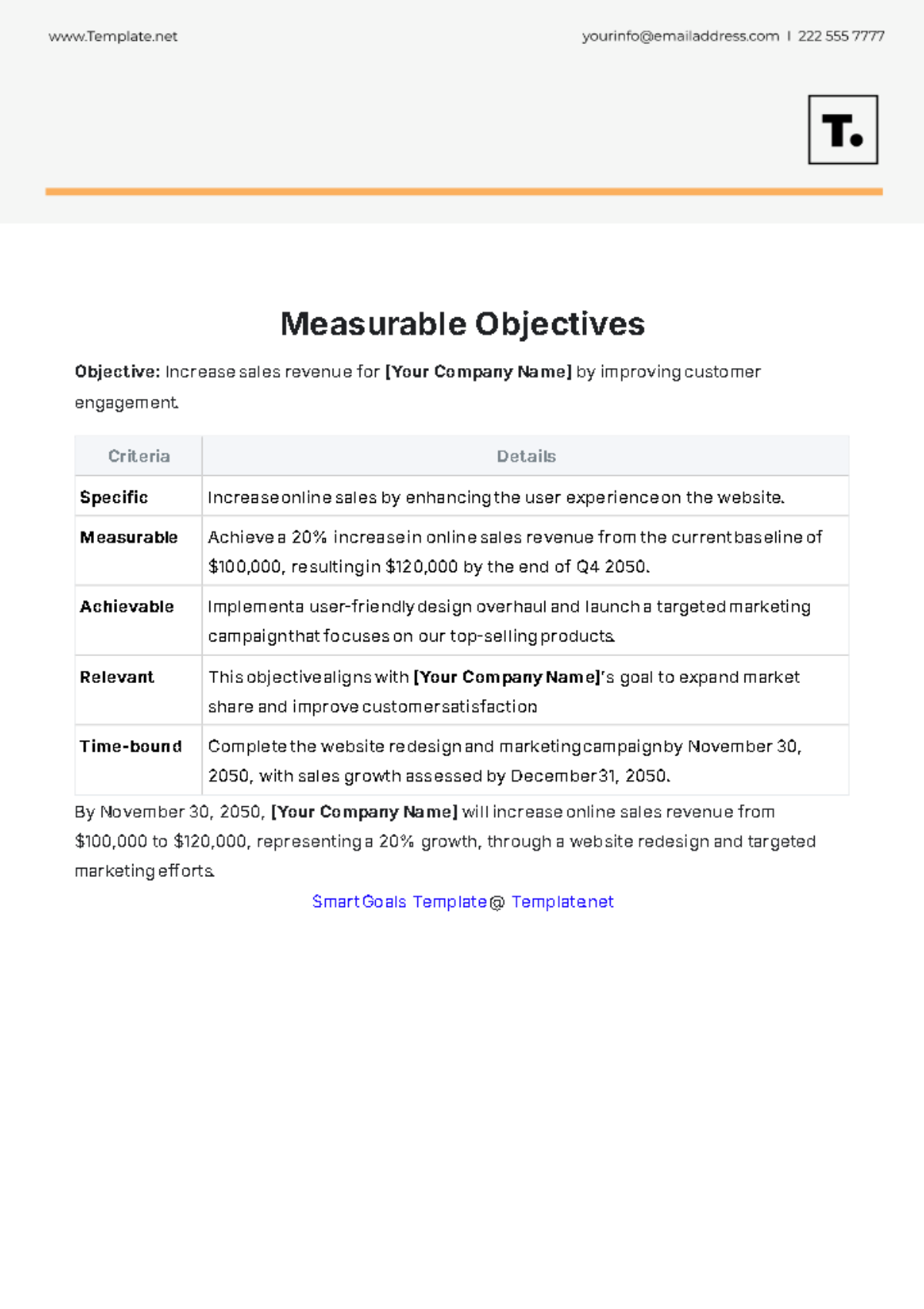

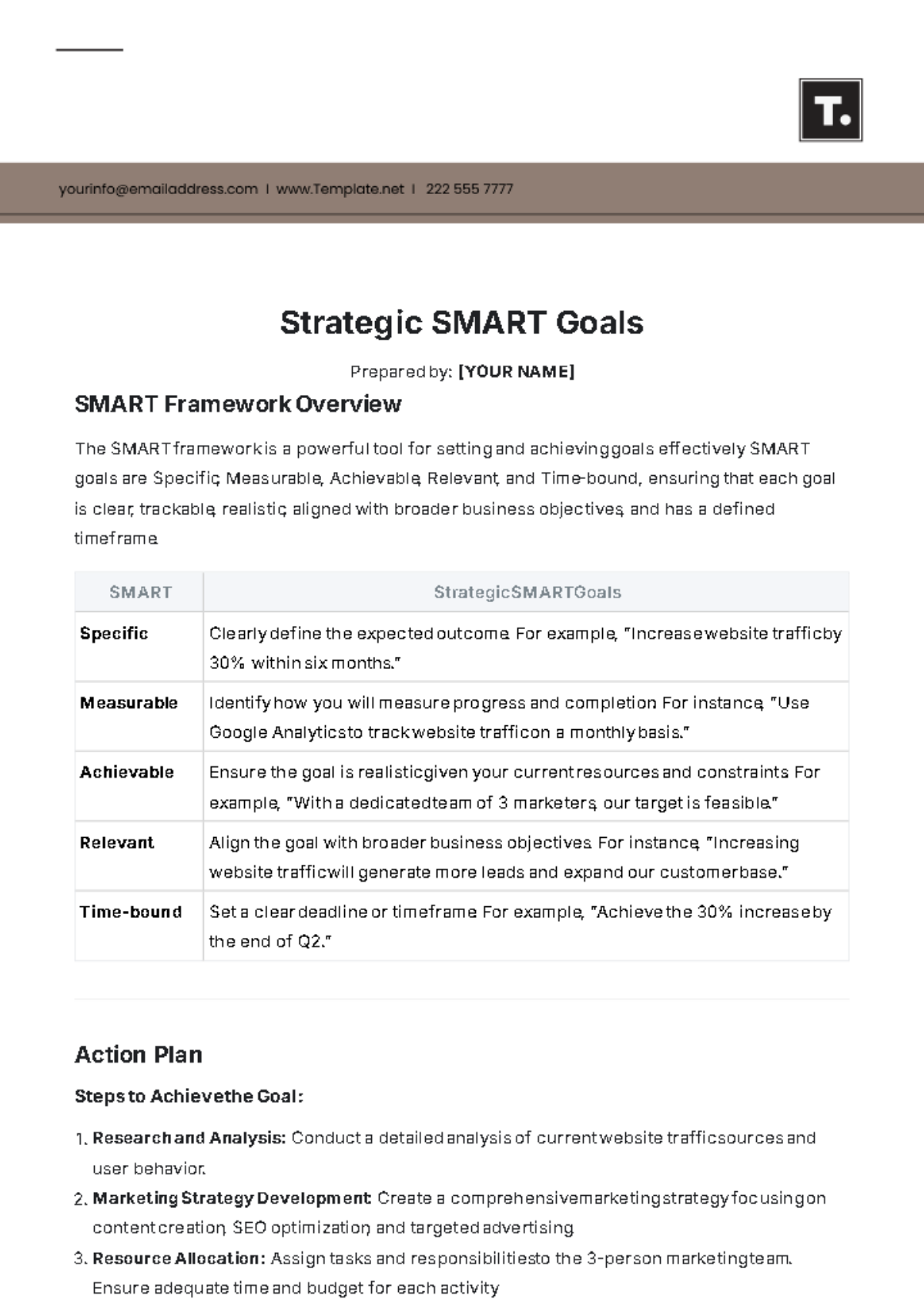

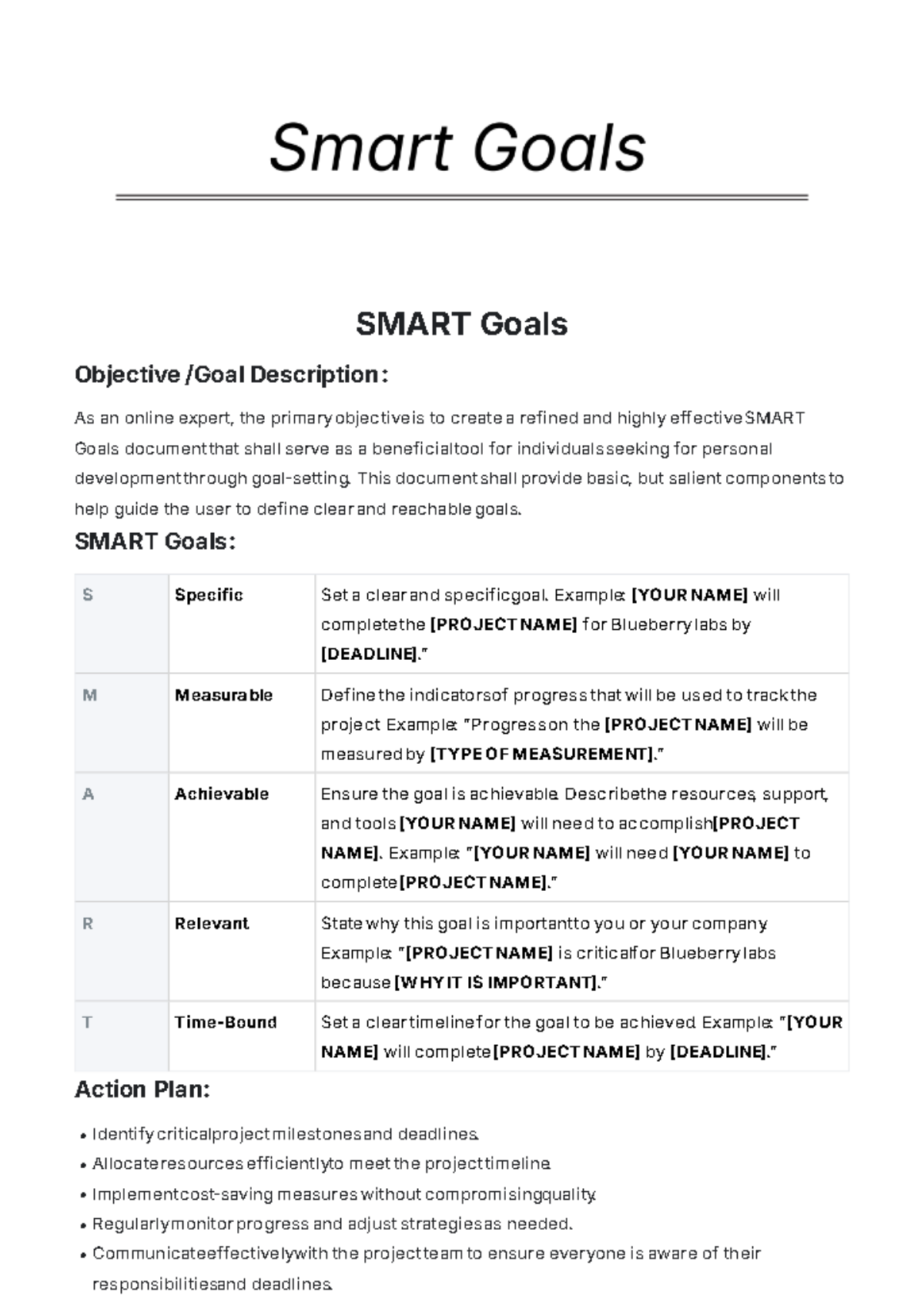

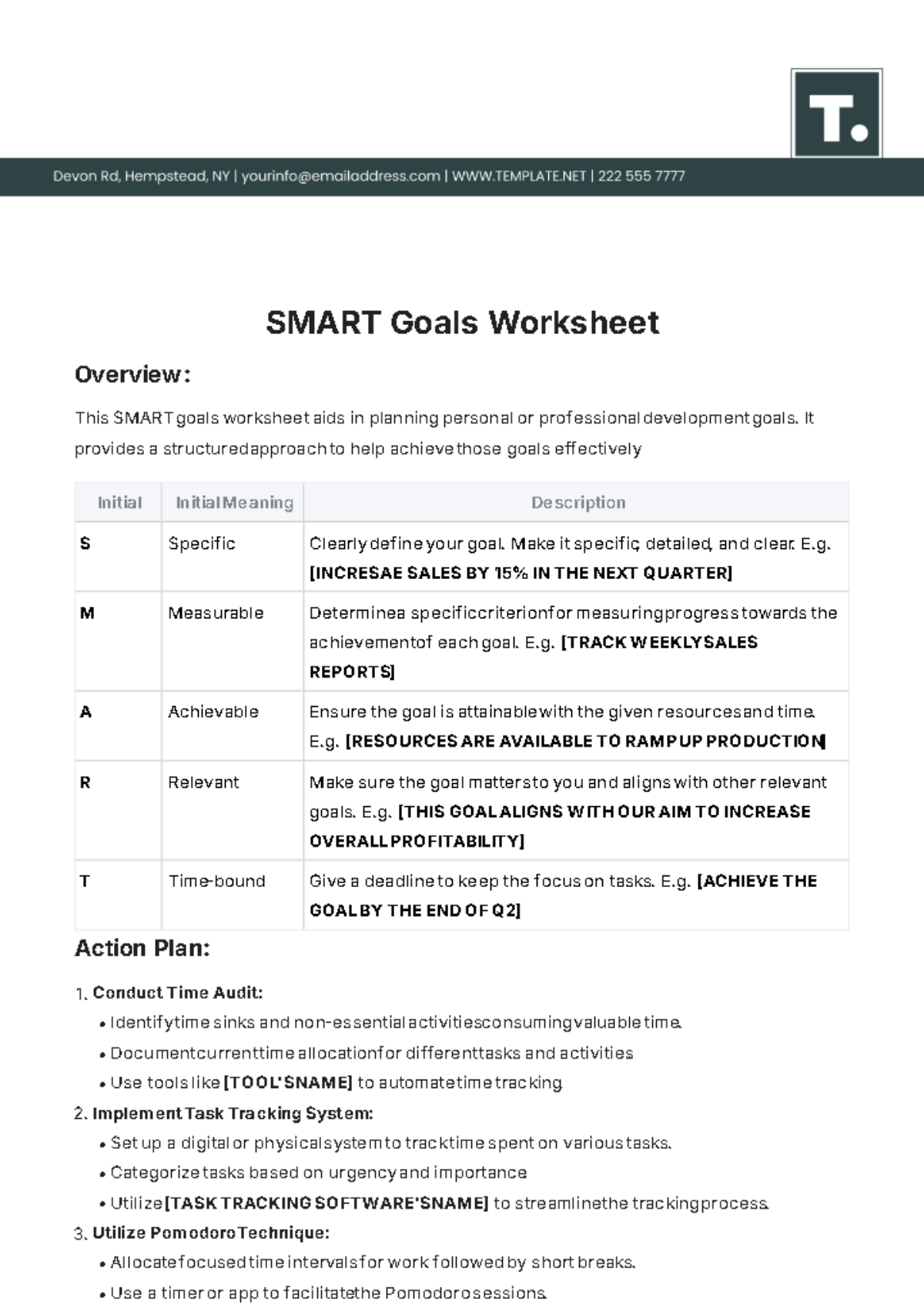

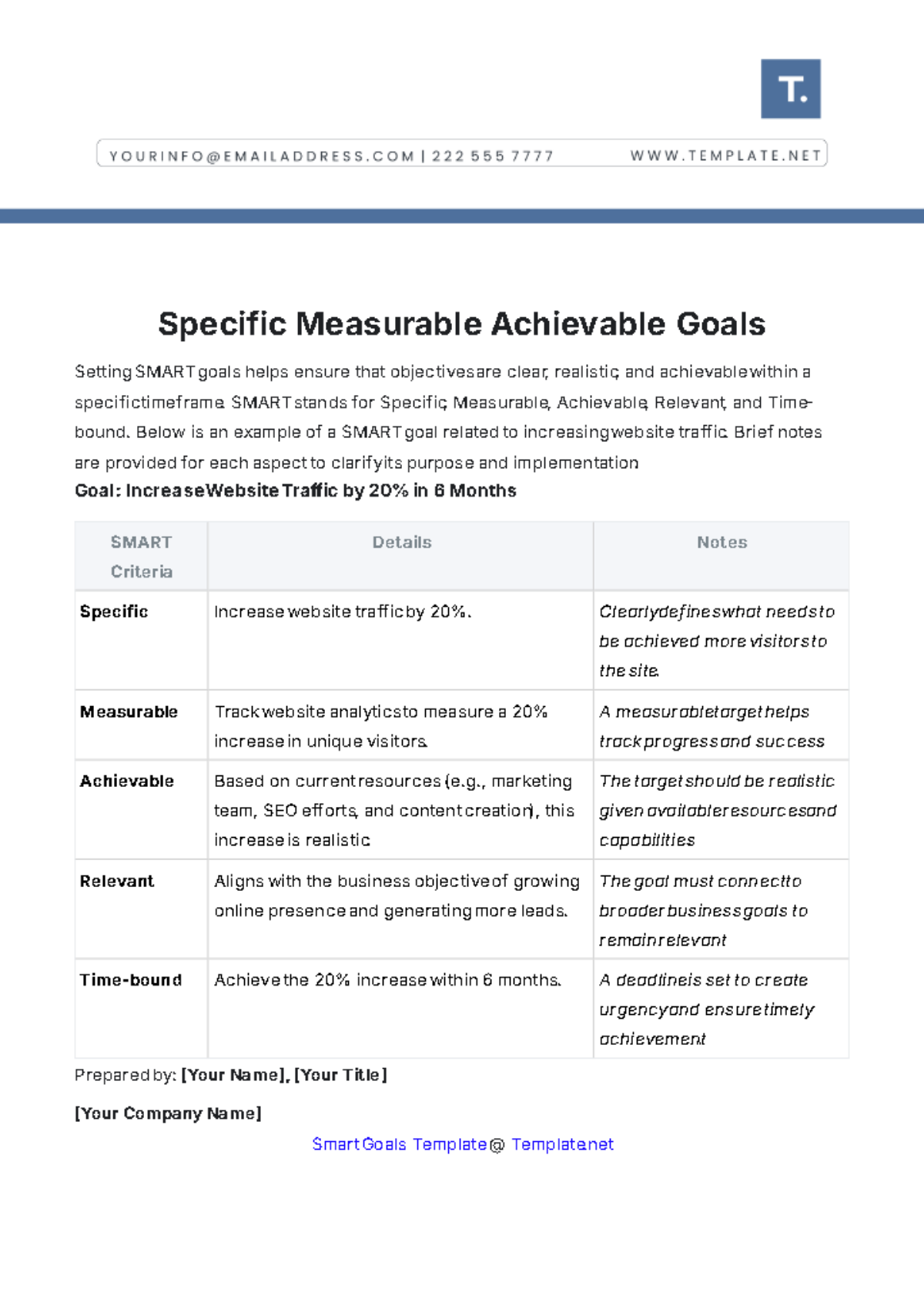

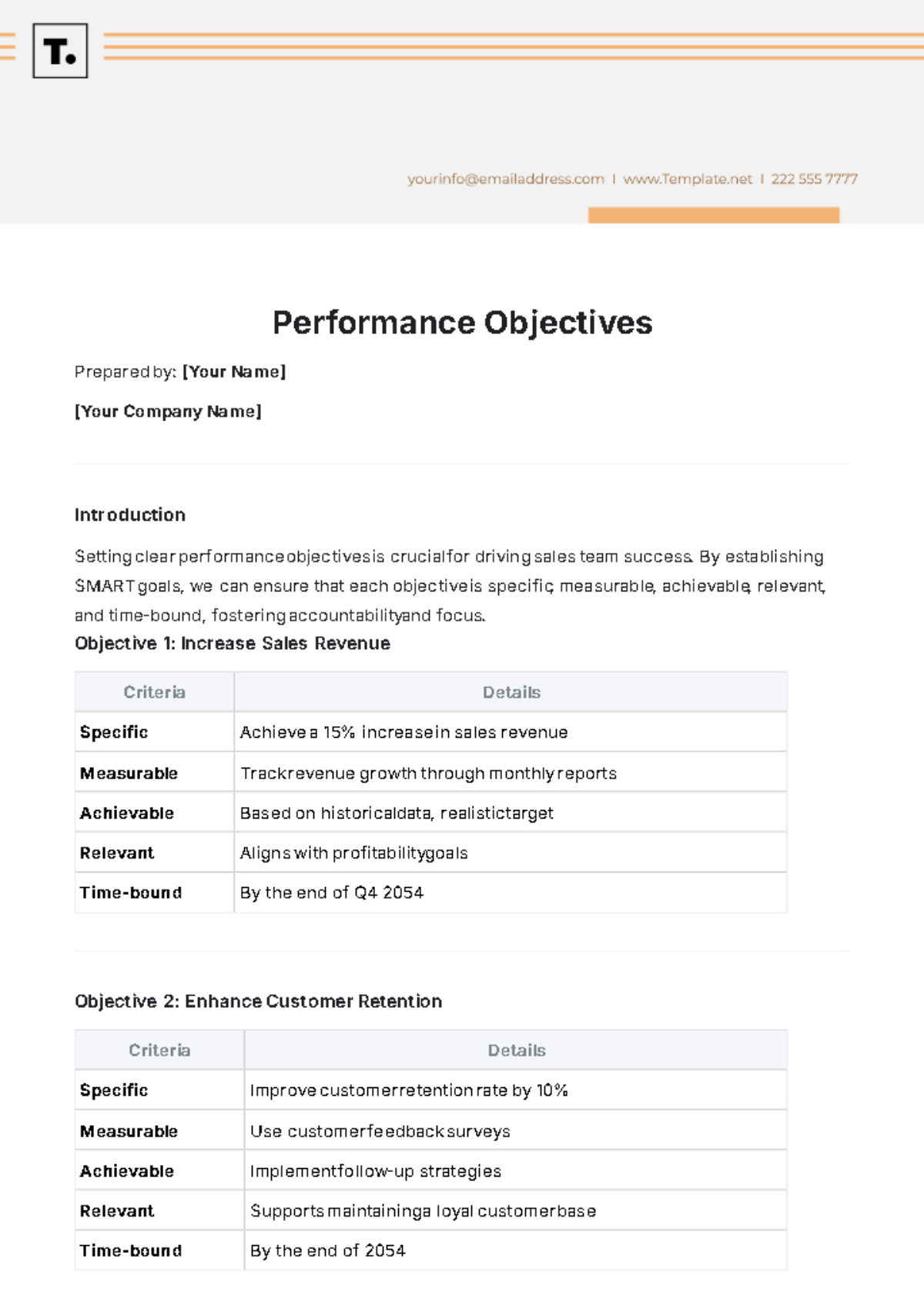

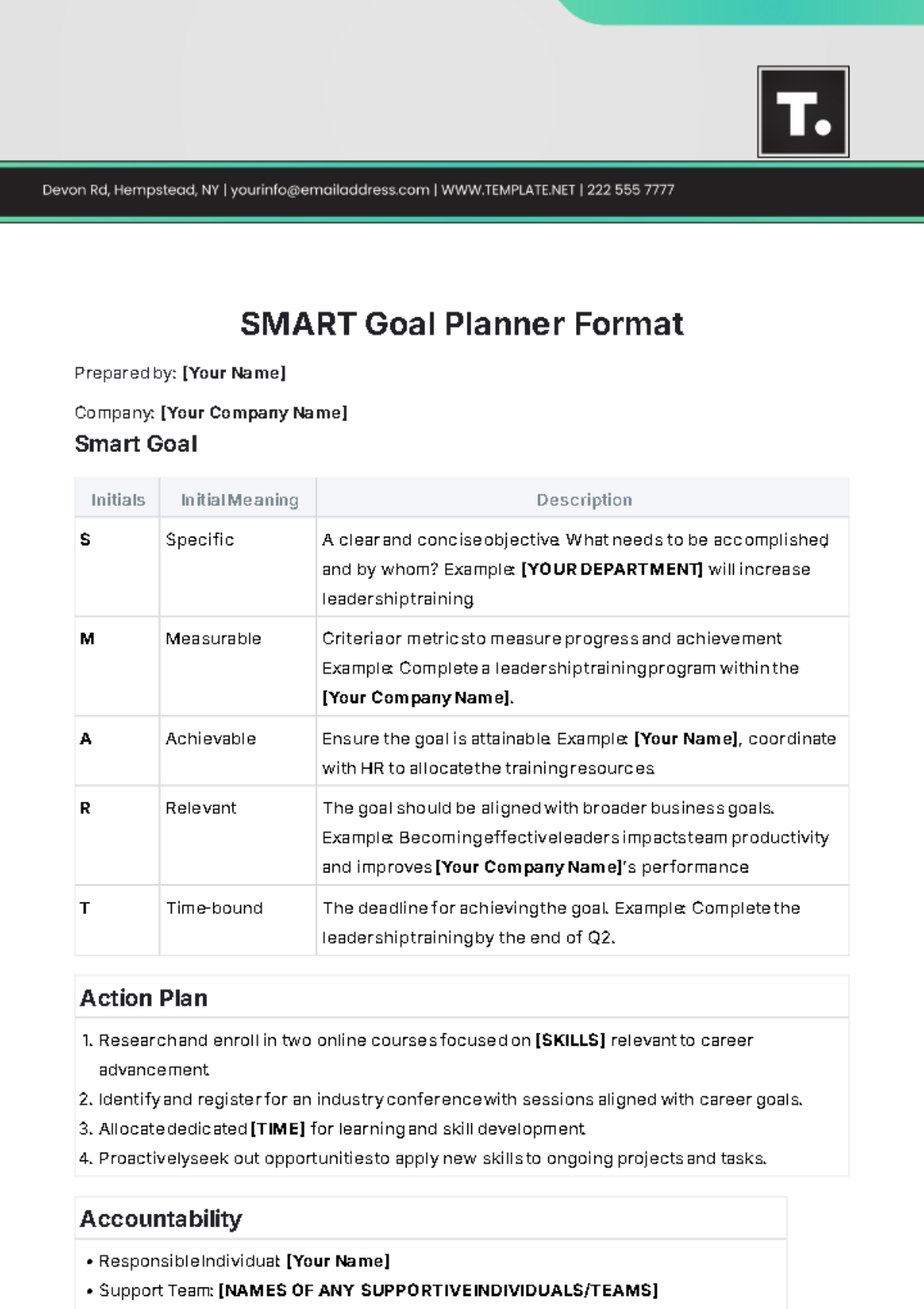

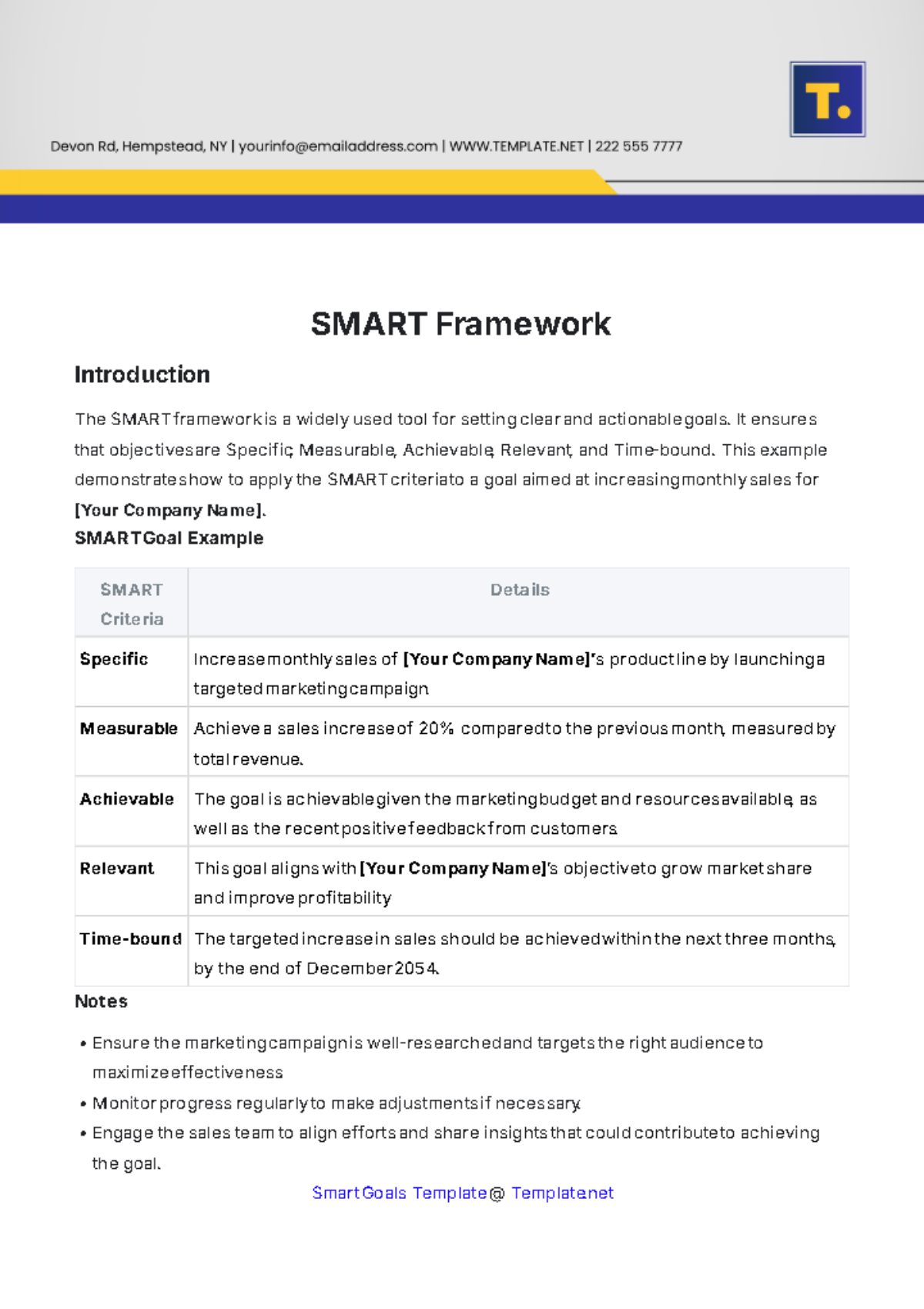

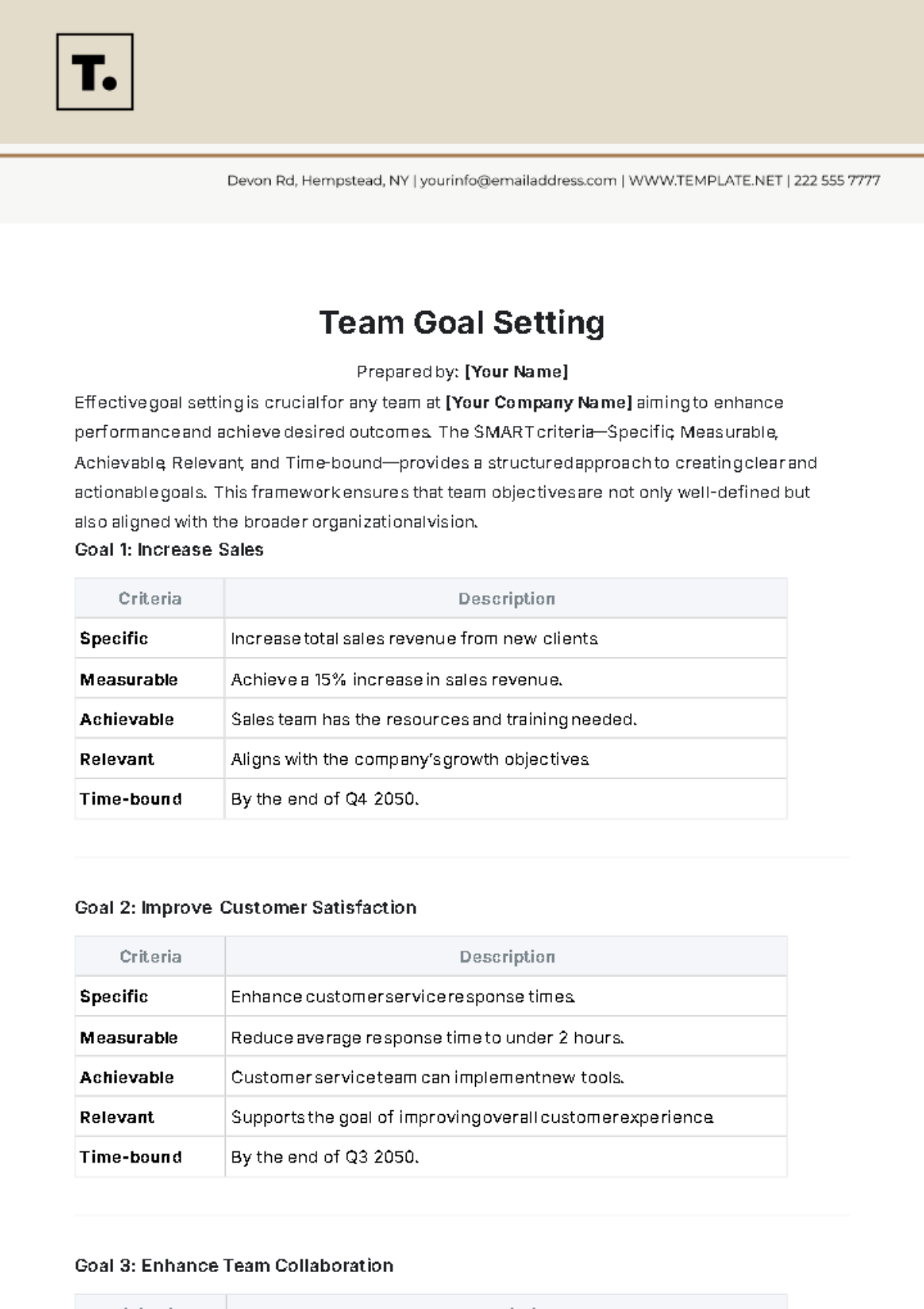

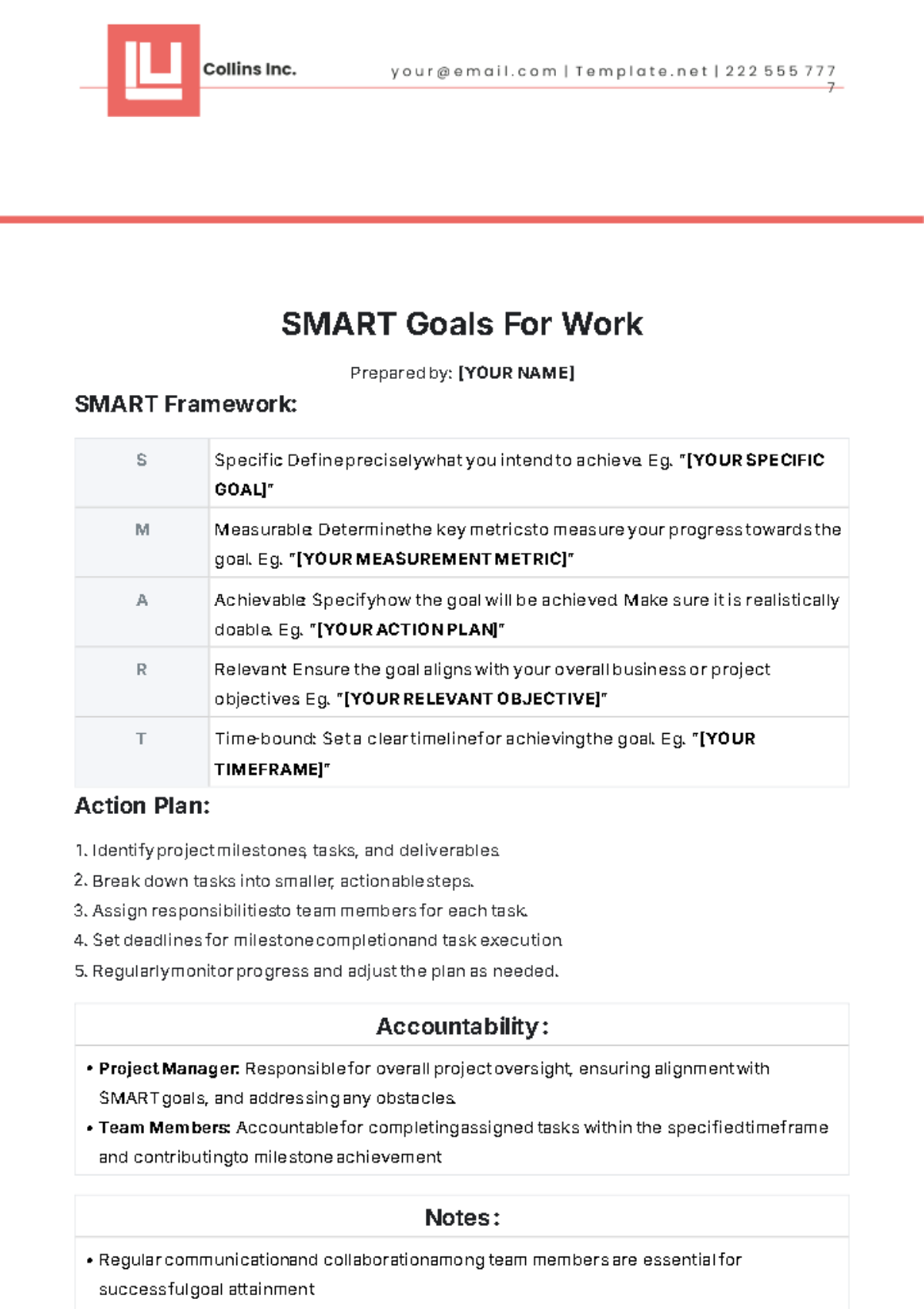

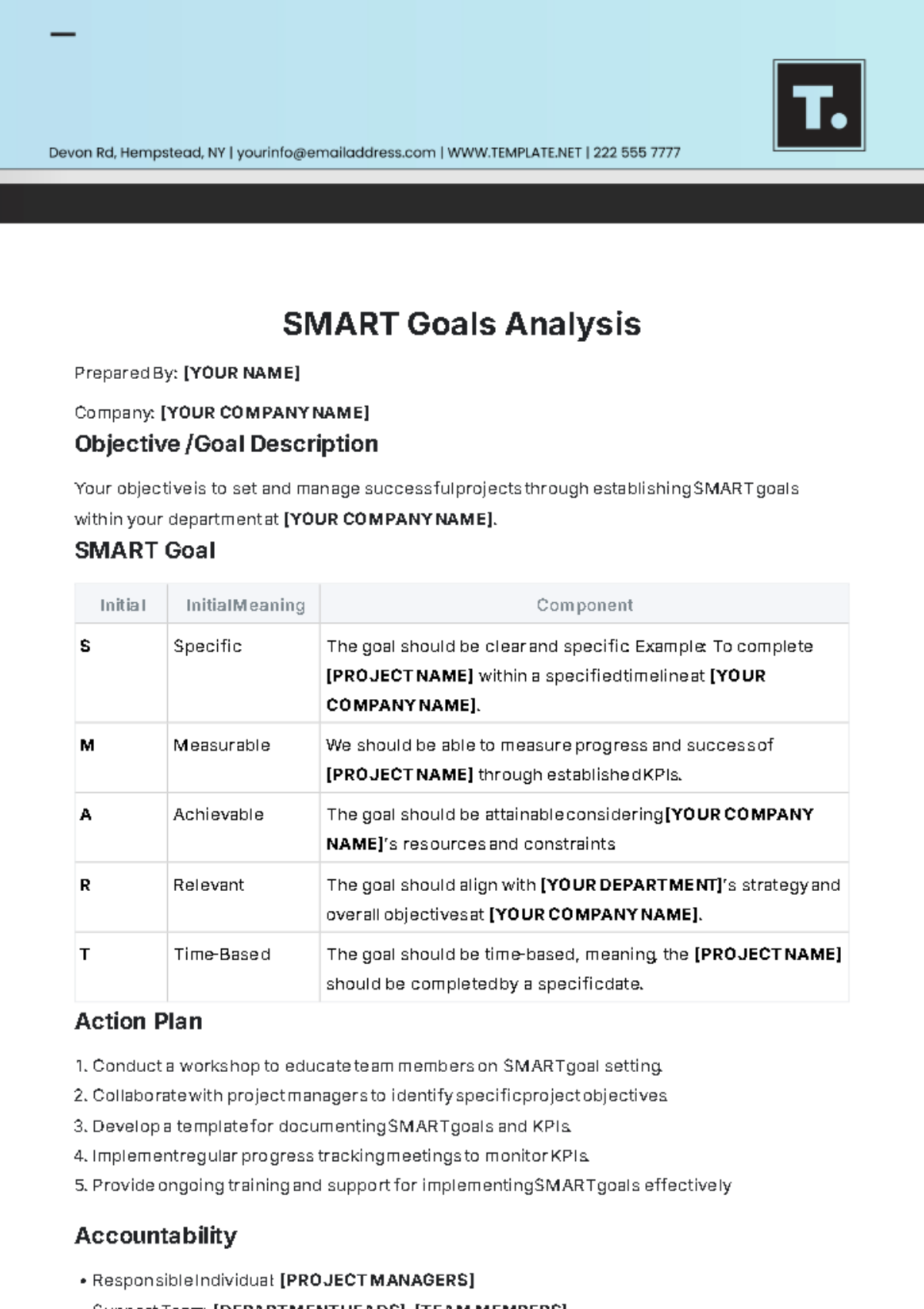

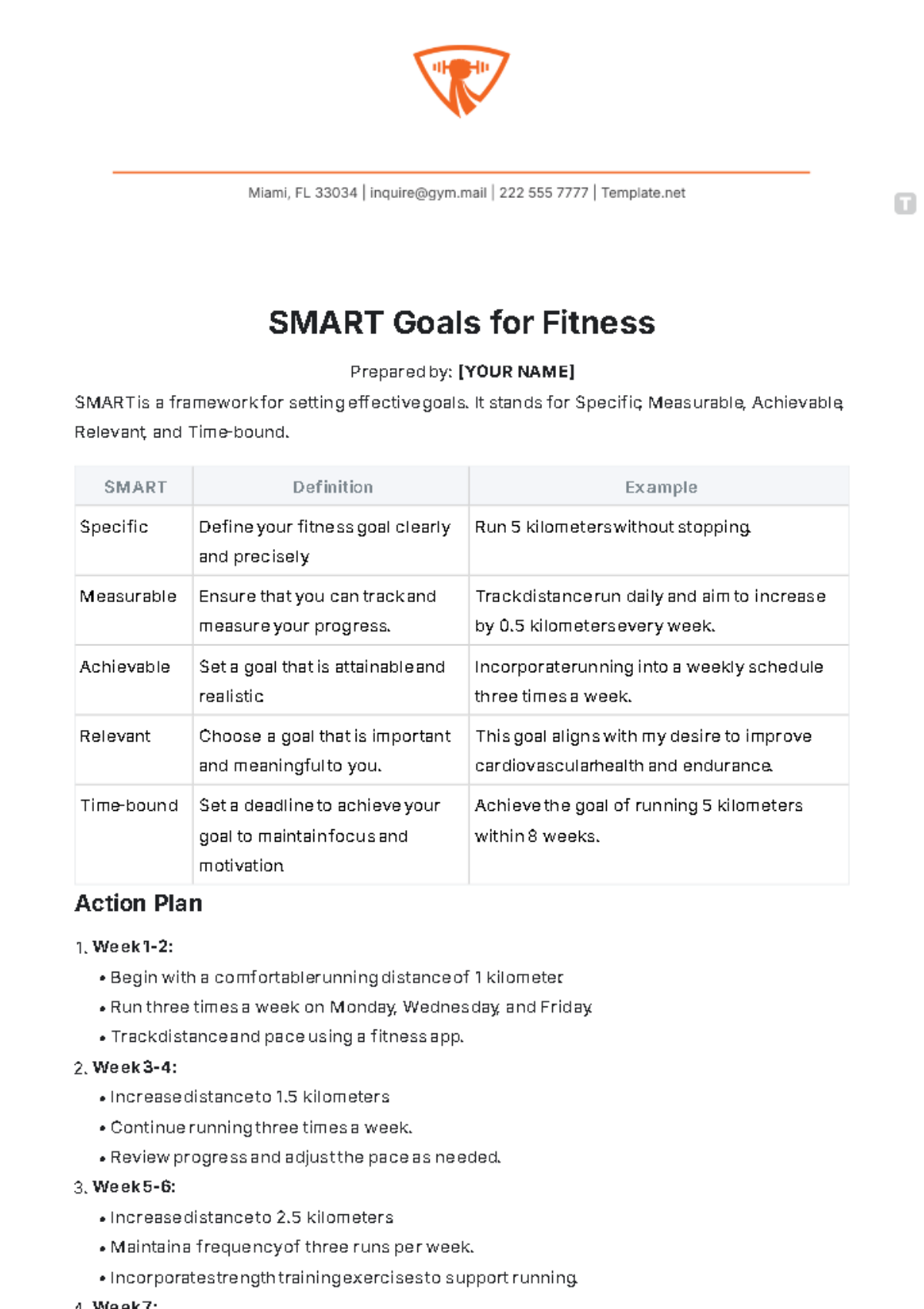

SMART Goal

Component | Description |

|---|---|

Specific | Define the exact type of property, location, and price range you are interested in. For example, a [NUMBER]-bedroom [TYPE OF PROPERTY] in [CITY], priced under [$XXX]. |

Measurable | State clear methods for tracking your progress. For instance, set milestones on saving for a down payment, or [SPECIFIC METHOD FOR TRACKING]. |

Achievable | Describe actionable steps, such as setting a monthly saving amount of [AMOUNT], having a pre-approval for a mortgage in place, or seeking professional advice from a reputable real estate consultant. |

Relevant | Ensure your goal aligns with your broader financial and lifestyle goals. For example, if you aim to achieve better work-life balance, consider [RELEVANT FACTOR]. |

Time-Bound | Set a deadline for when you plan to make the purchase, such as [SPECIFIC DATE]. Make sure your timeline is realistic and allows for possible setbacks, such as changes in the real estate market or your personal circumstances. |

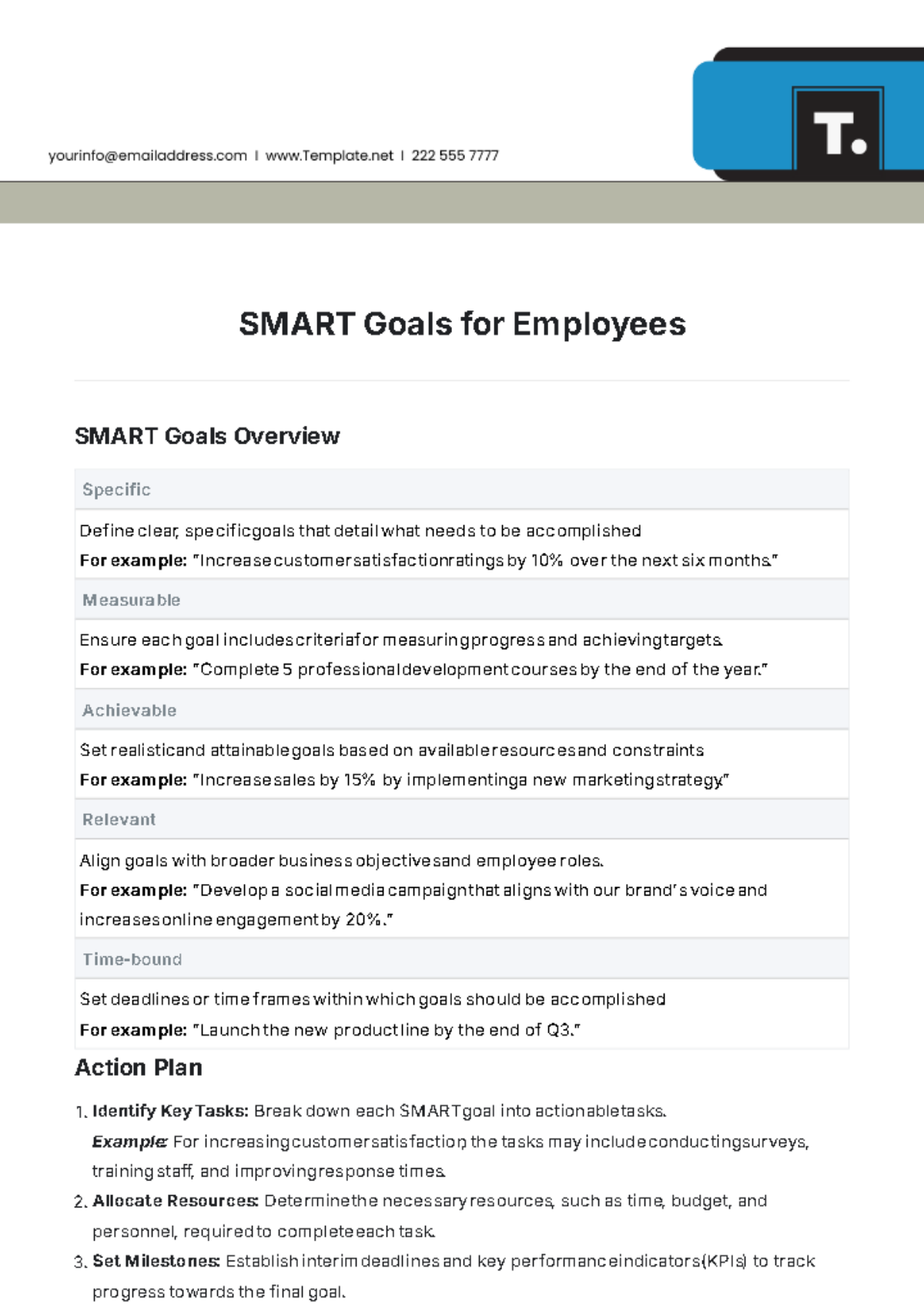

Action Plan:

Identify Property Criteria: Define the specific features and characteristics you desire in a property, such as [NUMBER] bedrooms, [TYPE OF PROPERTY], in [CITY], priced under [$XXX].

Research Properties: Utilize online resources, real estate listings, and professional networks to research available properties that match your criteria.

Financial Planning: Create a detailed financial plan outlining your budget, savings goals, and financing options. Consult with [FINANCIAL ADVISORS] or mortgage brokers for assistance.

Save for Down Payment: Set a monthly saving amount of [AMOUNT] to accumulate funds for a down payment. Consider automating your savings and reducing unnecessary expenses to reach your goal faster.

Obtain Pre-Approval: Secure pre-approval for a mortgage to determine your purchasing power and streamline the buying process. Contact [MORTGAGE BROKERS] or [LENDERS] for assistance.

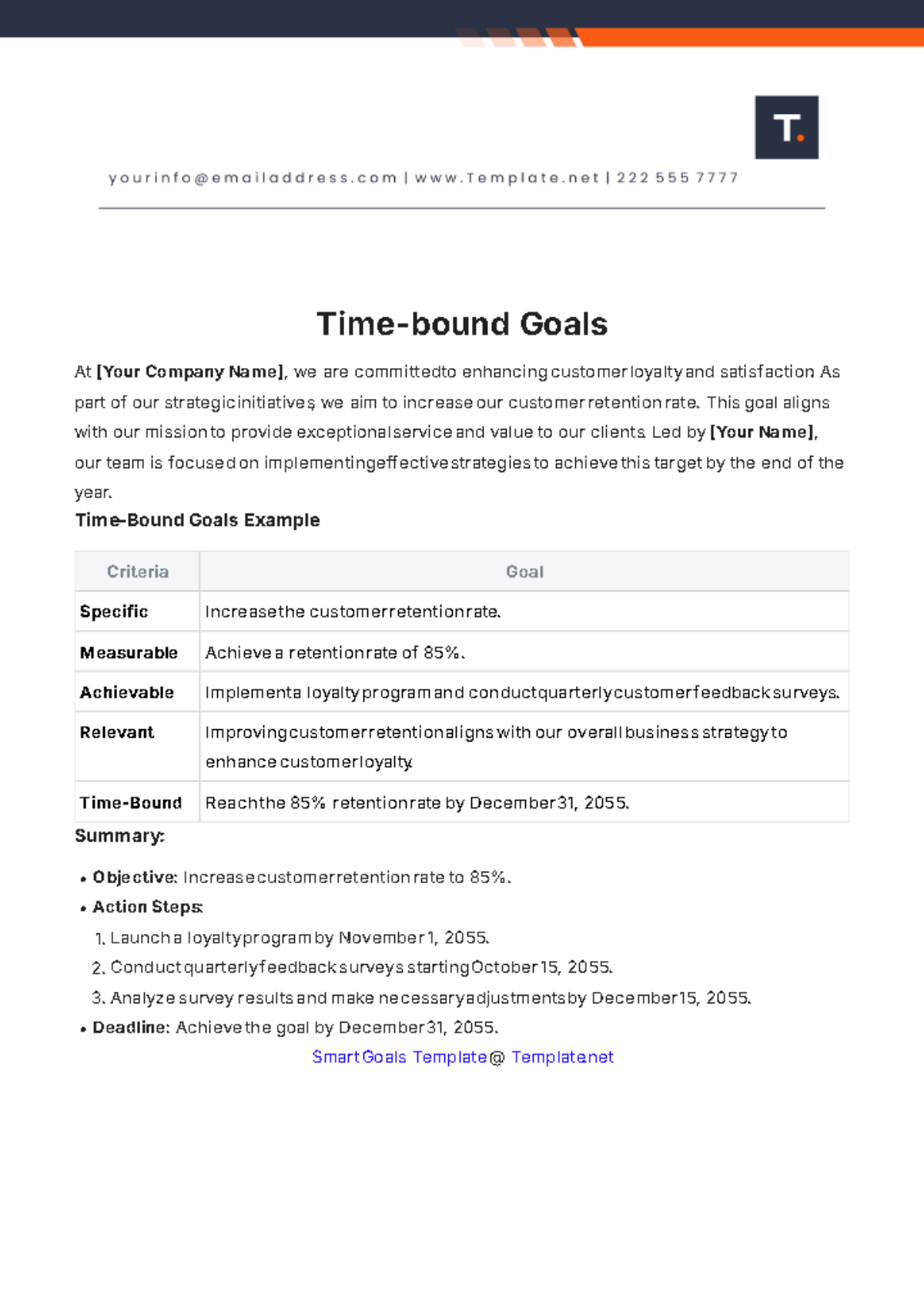

Accountability:

Regularly check in with a [MENTOR / PARTNER] to provide updates on progress and discuss any challenges or obstacles faced. Accountability partners can offer support, encouragement, and guidance to help you stay on track and motivated towards achieving your goals. For example, [NAME OF ACCOUNTABILITY PARTNER] will be responsible for regular check-ins every [TIME FRAME] to review progress and provide feedback. Additionally, [METHOD OF COMMUNICATION], such as weekly calls or monthly meetings, will be utilized to ensure consistent communication and accountability.

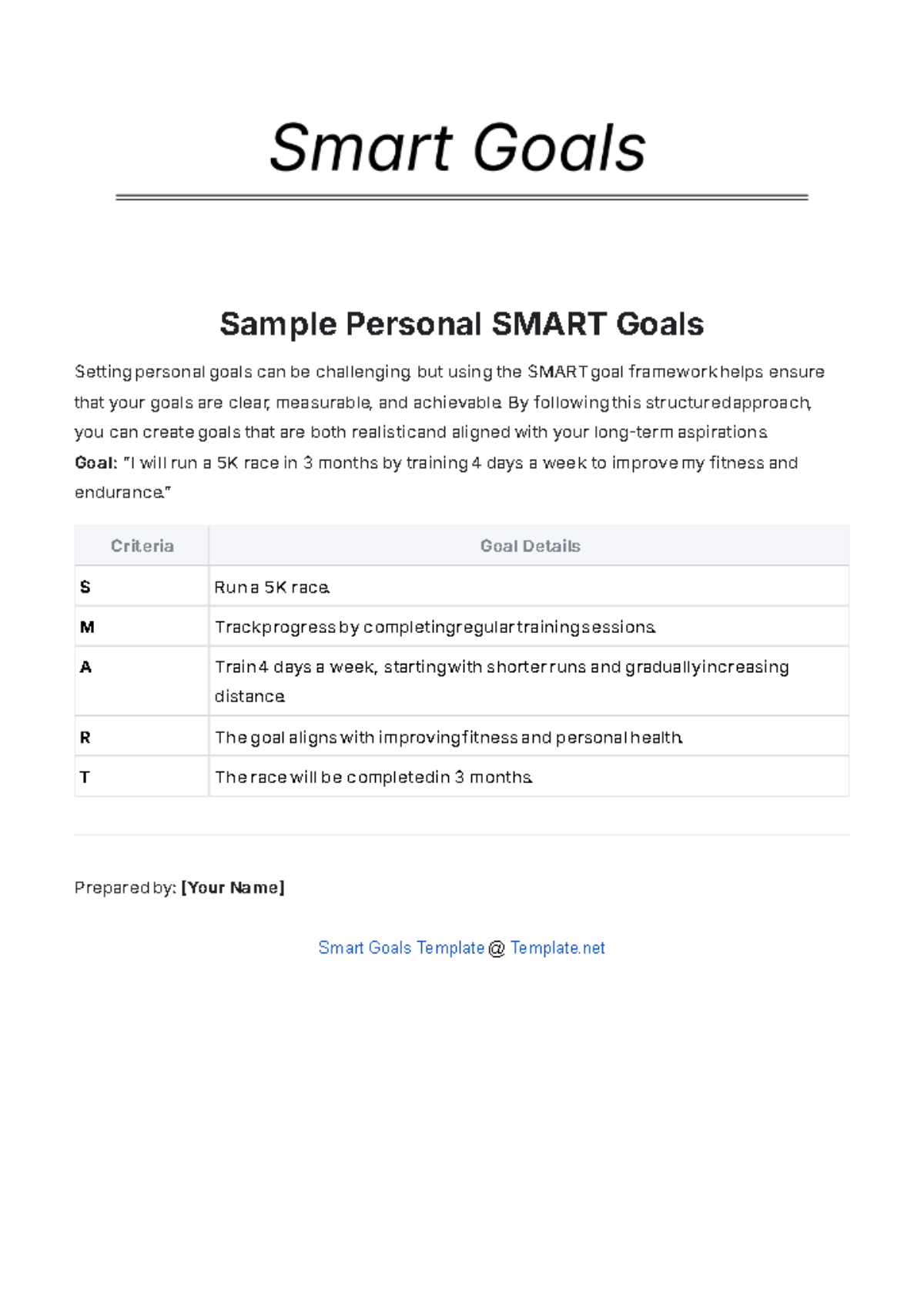

Notes:

Stay committed to your goal of homeownership by consistently adhering to the action plan outlined above.

Keep track of your progress and any adjustments made along the way to ensure you stay on course.

Don't hesitate to seek support from [FRIENDS/FAMILY/PROFESSIONALS] in the real estate industry if you encounter challenges or need guidance.

Celebrate each milestone achieved towards your goal as it signifies progress and motivates you to continue moving forward.

Remain flexible and adaptable to changes, both in your personal circumstances and the real estate market, to ensure your goal remains achievable within the specified timeline.