Free Finance Investment Evaluation Rubric

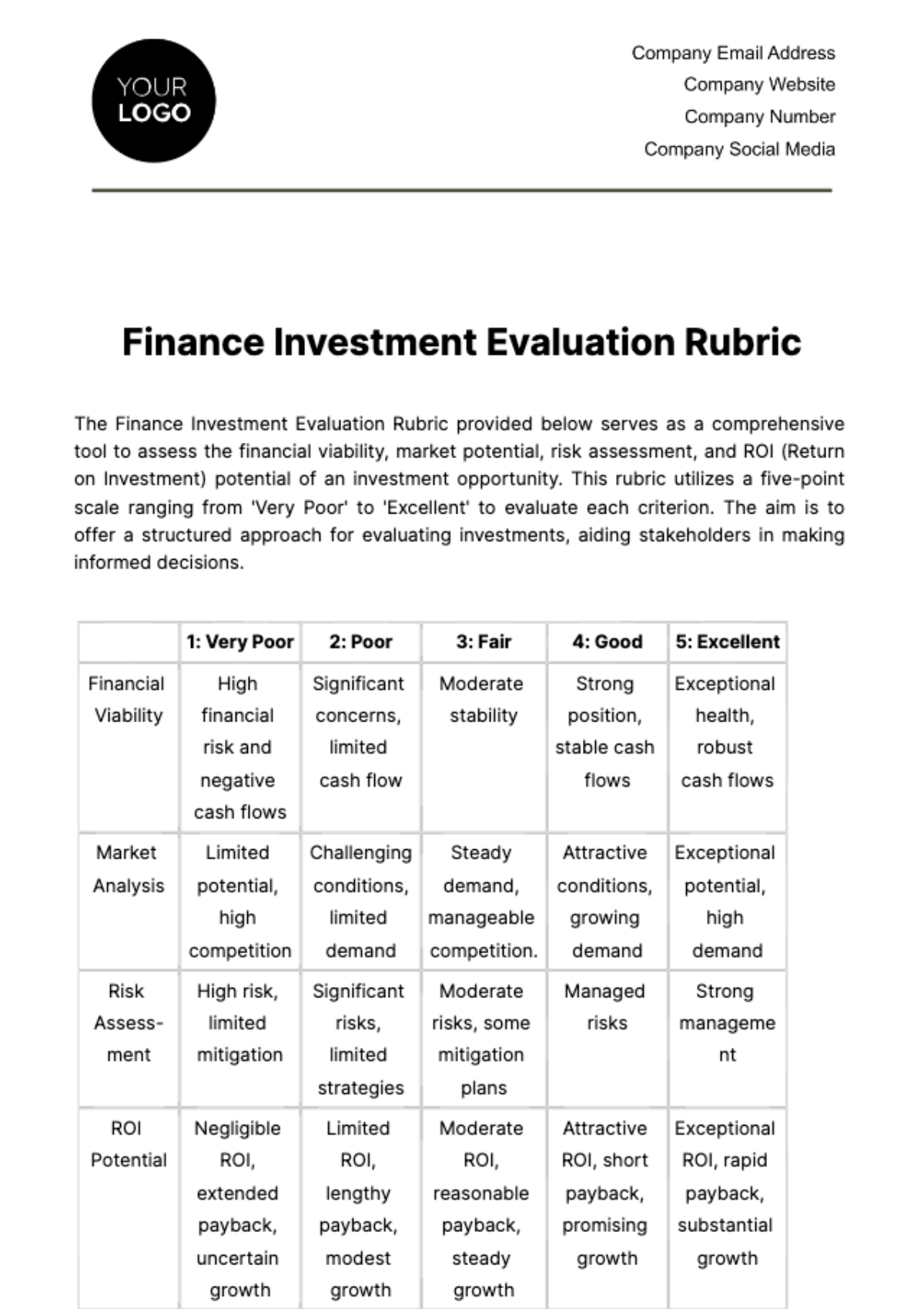

The Finance Investment Evaluation Rubric provided below serves as a comprehensive tool to assess the financial viability, market potential, risk assessment, and ROI (Return on Investment) potential of an investment opportunity. This rubric utilizes a five-point scale ranging from 'Very Poor' to 'Excellent' to evaluate each criterion. The aim is to offer a structured approach for evaluating investments, aiding stakeholders in making informed decisions.

1: Very Poor | 2: Poor | 3: Fair | 4: Good | 5: Excellent | |

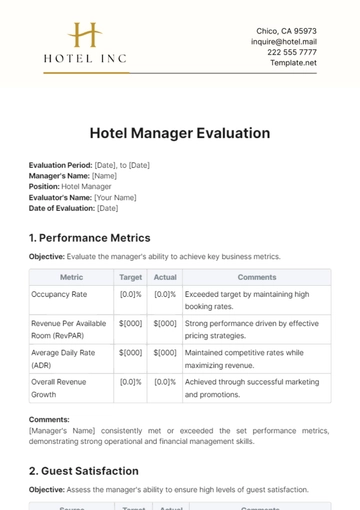

Financial Viability | High financial risk and negative cash flows | Significant concerns, limited cash flow | Moderate stability | Strong position, stable cash flows | Exceptional health, robust cash flows |

Market Analysis | Limited potential, high competition | Challenging conditions, limited demand | Steady demand, manageable competition. | Attractive conditions, growing demand | Exceptional potential, high demand |

Risk Assess- ment | High risk, limited mitigation | Significant risks, limited strategies | Moderate risks, some mitigation plans | Managed risks | Strong management |

ROI Potential | Negligible ROI, extended payback, uncertain growth | Limited ROI, lengthy payback, modest growth | Moderate ROI, reasonable payback, steady growth | Attractive ROI, short payback, promising growth | Exceptional ROI, rapid payback, substantial growth |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for financial analysis with the Finance Investment Evaluation Rubric Template from Template.net. Crafted to streamline investment assessment, this editable and customizable template offers precision and efficiency. Seamlessly integrate data using the Ai Editor Tool for insightful decision-making. Elevate your investment strategies effortlessly.