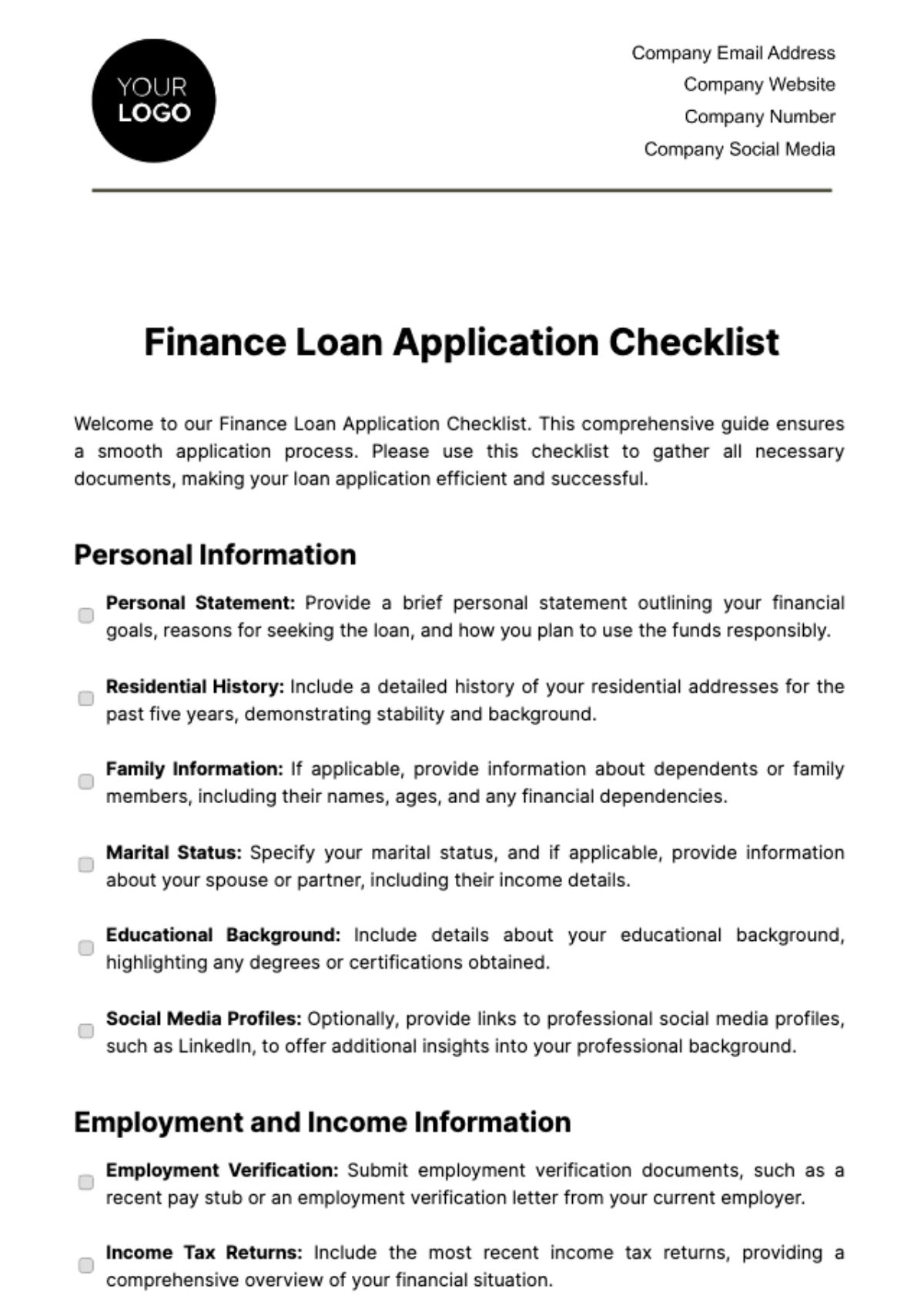

Free Finance Loan Application Checklist

Accelerate your loan application process with the Finance Loan Application Checklist Template from Template.net. This editable and customizable tool, powered by our Ai Editor Tool, ensures a streamlined experience. Tailor it to your needs effortlessly, courtesy of Template.net's intuitive design. Simplify your journey to financial success with this indispensable resource.