Free Finance Budget Outline

This outline serves as a structured guide for [Your Company Name] to develop its financial budget, incorporating various aspects like revenue, expenses, cash flow, and strategic financial planning to ensure fiscal responsibility and growth in [2050].

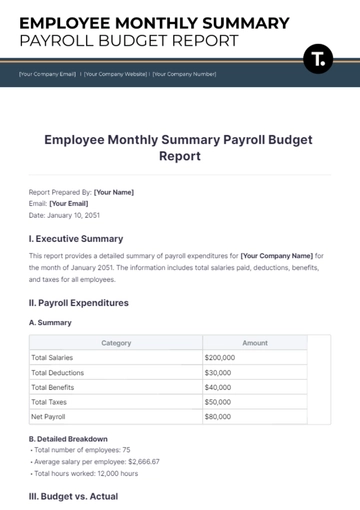

I. Executive Summary

A. Overview of [Your Company Name]

B. Key Financial Objectives for [2050]

C. Summary of Financial Forecasts

II. Revenue Projections

A. Sales Forecast

B. Revenue Streams

C. Product Sales

D. Service Revenue

E. Other Income Sources

F. Market Analysis and Growth Projections

III. Expense Budget

A. Operating Expenses

B. Salaries and Wages

C. Rent and Utilities

D. Marketing and Advertising

E. Research and Development

F. Capital Expenditures

G. Depreciation and Amortization

IV. Cash Flow Forecast

A. Monthly Cash Flow Analysis

B. Cash Reserves and Liquidity Planning

V. Profit and Loss Projection

A. Quarterly and Annual P&L Forecast

B. Break-even Analysis

VI. Risk Assessment and Mitigation Strategies

A. Market Risks

B. Financial Risks

C. Operational Risks

VII. Investment Plan

A. Planned Investments

B. Expected ROI on Investments

C. Funding Sources

VIII.Financial Controls and Performance Metrics

A. Budgetary Controls

B. Key Performance Indicators (KPIs)

C. Regular Financial Reviews and Audits

IX. Conclusion and Strategic Financial Goals

A. Long-term Financial Vision for [Your Company Name]

B. Strategies for Financial Growth and Stability

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Budget Outline Template. With our user-friendly interface and Ai Editor Tool, this template is fully editable and customizable, allowing you to tailor your budget to fit your specific needs. Streamline your financial planning process and ensure accuracy with Template.net's innovative solutions.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

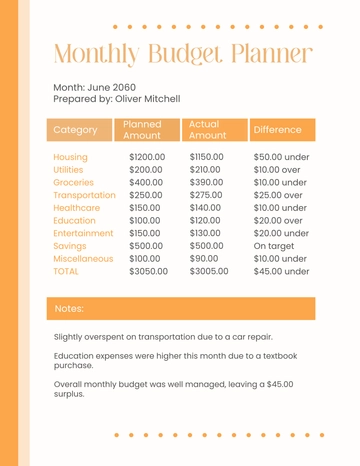

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

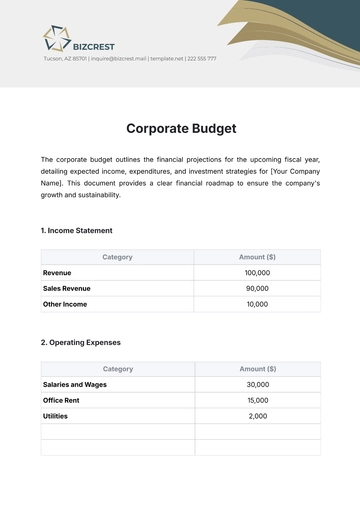

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

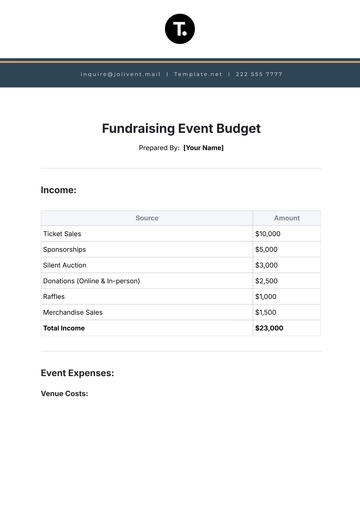

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising