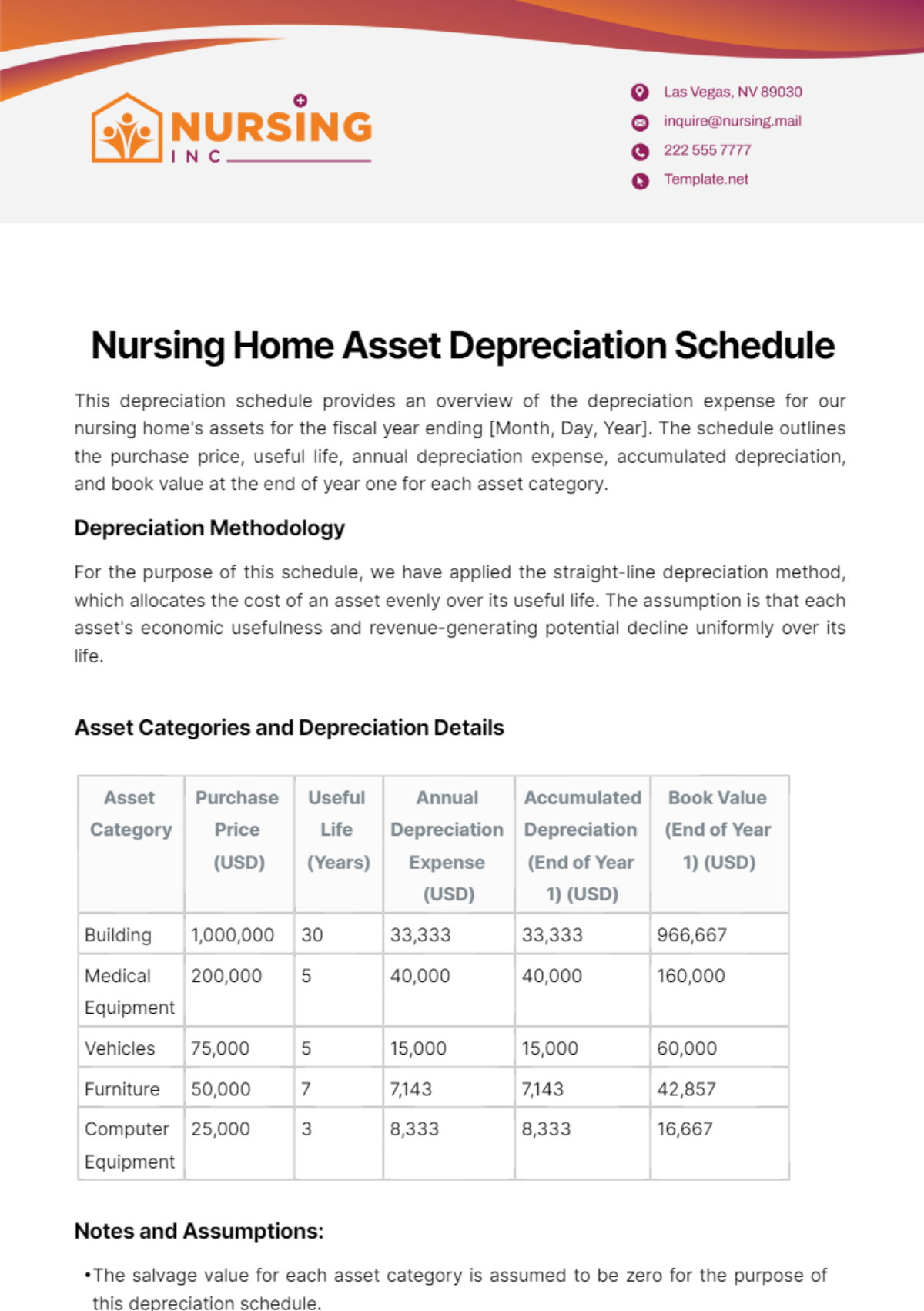

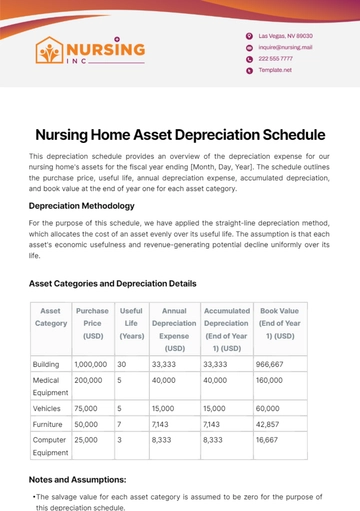

Nursing Home Asset Depreciation Schedule

This depreciation schedule provides an overview of the depreciation expense for our nursing home's assets for the fiscal year ending [Month, Day, Year]. The schedule outlines the purchase price, useful life, annual depreciation expense, accumulated depreciation, and book value at the end of year one for each asset category.

Depreciation Methodology

For the purpose of this schedule, we have applied the straight-line depreciation method, which allocates the cost of an asset evenly over its useful life. The assumption is that each asset's economic usefulness and revenue-generating potential decline uniformly over its life.

Asset Categories and Depreciation Details

Asset Category | Purchase Price (USD) | Useful Life (Years) | Annual Depreciation Expense (USD) | AccumulatedDepreciation (End of Year 1) (USD) | Book Value (End of Year 1) (USD) |

|---|

Building | 1,000,000 | 30 | 33,333 | 33,333 | 966,667 |

Medical Equipment | 200,000 | 5 | 40,000 | 40,000 | 160,000 |

Vehicles | 75,000 | 5 | 15,000 | 15,000 | 60,000 |

Furniture | 50,000 | 7 | 7,143 | 7,143 | 42,857 |

Computer Equipment | 25,000 | 3 | 8,333 | 8,333 | 16,667 |

Notes and Assumptions:

The salvage value for each asset category is assumed to be zero for the purpose of this depreciation schedule.

The straight-line method has been chosen for its simplicity and for providing a consistent depreciation expense each year.

Adjustments for asset additions or disposals during the year have not been included in this schedule.

Nursing Home Templates @ Template.net