Free Financial SWOT Analysis

I. Executive Summary

This analysis presents an overview of our organization's financial status. Our financial strengths, including robust cash reserves and consistent revenue streams, position us favorably in the market. However, challenges such as high debt levels and operational inefficiencies demand strategic attention. Opportunities lie in emerging markets and technological advancements, while external threats, such as economic uncertainties and regulatory changes, underscore the need for vigilant risk management. This analysis serves as a strategic roadmap, guiding us in leveraging our strengths, addressing weaknesses, capitalizing on opportunities, and mitigating potential threats to ensure sustainable financial growth.

II. Introduction

A. Purpose

The purpose of this analysis is to evaluate the internal and external factors influencing our organization's financial performance. By identifying key strengths, weaknesses, opportunities, and threats, we aim to make informed financial decisions that align with our overall business objectives.

B. Scope

The analysis encompasses a thorough examination of our financial metrics, market positioning, and operational efficiency. It will delve into both quantitative and qualitative aspects, providing a holistic understanding of our financial standing.

C. Objectives

The objectives of this analysis are:

Strategic Planning: Develop strategic financial plans aligned with organizational goals.

Risk Management: Identify and mitigate potential risks affecting financial stability.

Optimization: Optimize financial processes and resource allocation for improved efficiency.

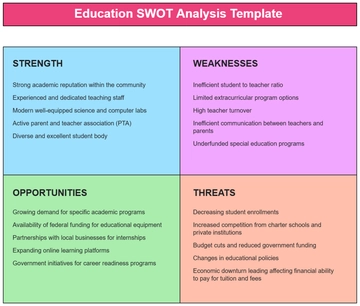

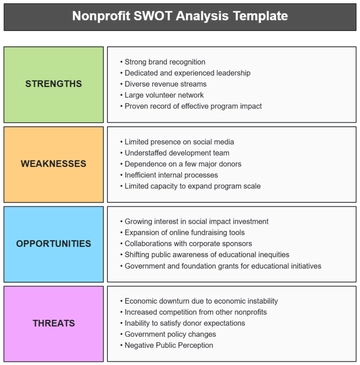

III. Strengths

In evaluating our financial landscape, distinct internal strengths emerge, underpinning the company's stability and growth potential. These are the following:

A. Robust Cash Reserves

Our company maintains robust cash reserves, a product of disciplined financial management. This financial cushion serves as a strategic buffer, allowing us to navigate unforeseen challenges, capitalize on emerging opportunities, and maintain operational agility.

B. Diversified Revenue Streams

Diversification characterizes our revenue streams, stemming from a broad product portfolio or diverse business segments. This strategic approach minimizes vulnerability to market fluctuations in specific sectors, ensuring consistent financial performance even amid industry variability.

C. Efficient Cost Management

A commitment to efficient cost management defines our operational strategy. This dedication results in optimized resource allocation, heightened profitability, and a competitive edge in the market, fostering financial sustainability and growth.

IV. Weaknesses

While recognizing our strengths, it is also imperative to address internal challenges that require strategic attention for fortifying the company's financial foundation. Our weaknesses are:

A. High Debt Levels

High levels of outstanding debt pose a substantial challenge, largely stemming from historical financial commitments and strategic decisions. This debt burden increases financial risk, leading to higher interest payments and potential limitations on future investment opportunities.

B. Operational Inefficiencies

Operational inefficiencies, rooted in outdated processes and technology, hinder optimal financial performance. These inefficiencies may result in increased costs, reduced productivity, and an impediment to our ability to adapt quickly to market changes.

C. Reliance on Single Revenue Source

The company's dependence on a single revenue source is a vulnerability, primarily driven by historical business models or market conditions. This reliance exposes us to heightened risk in the face of changing market dynamics, evolving consumer preferences, or disruptions in the primary revenue-generating sector.

V. Opportunities

Exploring external factors that could positively impact the company's financial performance is crucial for identifying key opportunities and is essential for strategic growth. These opportunities are:

A. Emerging Markets Expansion

Venturing into emerging markets presents a significant opportunity for growth. By tapping into new customer bases and geographical regions, the company can diversify its revenue streams and reduce reliance on specific markets, fostering long-term financial stability.

B. Technological Advancements

Embracing technological advancements opens avenues for enhanced efficiency and innovation. By investing in cutting-edge technologies, the company can streamline operations, reduce costs, and position itself as an industry leader, translating into improved financial performance and competitive advantage.

C. Strategic Partnerships

Forming strategic partnerships is a valuable opportunity for collaborative growth. By aligning with complementary businesses or industry leaders, the company can access new markets, share resources, and leverage expertise, ultimately enhancing its financial standing and market position.

VI. Threats

Assessing external factors that could pose risks or challenges to the company's financial stability is critical for proactive risk management. The threats found are:

A. Economic Downturn

An economic downturn poses a significant threat as it can lead to reduced consumer spending, impacting sales and revenue. This could result in financial strain, making it crucial for the company to implement cost-cutting measures and diversify revenue streams to weather economic uncertainties.

B. Intense Market Competition

Intense competition within the market is a threat that can erode market share and margins. To mitigate this threat, the company must continuously innovate, differentiate its offerings, and invest in marketing strategies to maintain a competitive edge and sustain financial performance.

C. Regulatory Changes

Changes in regulations can pose a threat by impacting operational processes and compliance requirements. Non-compliance may lead to fines or legal consequences, affecting the company's financial health. Proactive monitoring of regulatory environments and adaptability to changes are crucial for navigating this threat successfully.

VII. Financial Performance Analysis

A. Profitability Metrics

The table below provides an overview of crucial profitability metrics, offering insights into the company's ability to generate earnings from its operations.

Metric | Calculation | [Previous Year] Value | [This Year] Projection |

Gross Profit Margin | (Gross Profit / Revenue) x 100 | 35.5% | 56.8% |

Net Profit Margin | |||

Return on Assets |

The table above encapsulates essential metrics that gauge the company's profitability. A healthy gross profit margin indicates effective cost management, while a rising net profit margin signifies efficient overall operations. Return on assets reflects the company's ability to generate profit from its asset base. A consistent upward trend in these metrics is indicative of robust financial performance and strategic fiscal management.

B. Liquidity and Solvency Ratios

The table below presents key liquidity and solvency ratios, providing insights into the company's short-term liquidity position and long-term debt management.

Ratio | Calculation | [Previous Year] Value | [This Year] Projection |

Current Ratio | Current Assets / Current Liabilities | 2.5 | 2.7 |

Quick Ratio | |||

Debt to Equity Ratio |

The table above outlines critical liquidity and solvency ratios. A current ratio above 1 indicates short-term solvency, while a quick ratio considers the immediate availability of assets to cover liabilities. The debt-to-equity ratio provides insights into the company's leverage and financial risk. Maintaining a healthy balance between liquidity and solvency is crucial for navigating operational needs and long-term financial obligations. Regular monitoring of these ratios ensures proactive financial management and a resilient financial position.

VII. Risk Mitigation Strategies

Proactively addressing potential threats is crucial for maintaining the company's financial stability. This list below are the key strategies to mitigate risks and safeguard against external challenges.

A. Economic Downturn Preparedness

Financial Reserve Creation

Establish and maintain a financial reserve to cushion the impact of economic downturns. This reserve can be utilized to cover operational costs during periods of reduced revenue.

Scenario Planning

Conduct scenario planning exercises to anticipate potential economic downturns. Develop contingency plans for varying degrees of economic challenges to ensure the company's preparedness.

Agile Cost-Cutting Measures

Implement agile cost-cutting measures that can be quickly activated during economic uncertainties. This may involve temporary workforce adjustments, renegotiating contracts, and revisiting discretionary spending.

B. Competitive Intelligence and Market Adaptation

Competitor Benchmarking

Regularly benchmark against key competitors to understand their strategies, market positioning, and customer offerings. This intelligence informs the company's own strategies for differentiation and competitive advantage.

Customer Feedback Loop

Establish a robust feedback loop with customers to understand evolving preferences and expectations. This customer-centric approach allows the company to adapt its products and services in response to changing market dynamics.

Agile Product Development

Adopt agile product development methodologies to respond swiftly to market changes. This involves short development cycles, continuous testing, and rapid iterations to bring products to market faster and with greater relevance.

C. Regulatory Compliance and Advocacy

Dedicated Compliance Team

Form a dedicated compliance team to stay updated on regulatory changes and ensure adherence to evolving requirements. This team plays a proactive role in monitoring and interpreting regulations that may impact the company.

Industry Forum Participation

Actively participate in industry forums and associations to stay informed about regulatory discussions and advocate for policies that align with the company's interests. Collaboration with industry peers strengthens the collective voice in regulatory matters.

Government Relations Engagement

Establish proactive engagement with relevant government bodies to contribute to the development of favorable regulatory environments. Building positive relationships with regulators can lead to more informed and collaborative policymaking.

IX. Recommendations

To capitalize on opportunities and address weaknesses identified in the analysis, the company must strategically plan and execute initiatives that align with financial objectives. Listed below are the recommendations:

A. Revenue Diversification

New Product Development

Invest in research and development to introduce innovative products that cater to evolving market demands. This diversification strategy aims to tap into new customer segments and broaden the product portfolio.

Market Expansion

Explore untapped geographical markets to expand the company's market presence. This initiative involves market research and tailoring services to meet the specific needs of customer bases.

Strategic Alliances

Form strategic alliances with complementary businesses to co-create value and access new revenue streams. Collaborative ventures and partnerships can enhance the company's competitive position and provide avenues for shared resources.

B. Cost Optimization Programs

Operational Process Streamlining

Conduct a comprehensive review of operational processes to identify inefficiencies. Implement streamlined workflows and automation technologies to optimize resource allocation.

Debt Restructuring

Negotiate with creditors to restructure existing debt and improve debt terms. This initiative aims to alleviate financial strain, lower interest payments, and enhance the company's financial flexibility.

Technology Upgradation

Invest in technology upgrades to modernize systems and enhance operational efficiency. This includes adopting advanced software solutions, improving cybersecurity measures, and leveraging data analytics for informed decision-making.

C. Market Expansion and Innovation

Emerging Market Entry

Conduct thorough market research to identify viable opportunities in emerging markets. Develop entry strategies tailored to each market's unique characteristics and consumer behaviors.

Product Innovation Labs

Establish dedicated innovation labs to foster a culture of continuous product development. Encourage cross-functional collaboration and creativity to bring new, market-leading products to fruition.

Digital Transformation

Embrace digital transformation initiatives to stay ahead in the digital landscape. This involves investing in e-commerce platforms, mobile applications, and other digital solutions to enhance customer experiences and reach broader audiences.

X. Conclusion

This analysis has provided a view of the company's financial status, highlighting strengths to leverage, weaknesses to address, opportunities to capitalize on, and threats to mitigate. By embracing innovation, optimizing costs, and proactively managing risks, the company can navigate the business environment and position itself for long-term growth and resilience in the market. This holistic approach ensures that the company remains adaptable, competitive, and well-prepared to overcome challenges on its path to financial excellence.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Uncover financial insights with Template.net's Financial SWOT Analysis Template. This editable and customizable tool, powered by our Ai Editor Tool, enables thorough analysis of strengths, weaknesses, opportunities, and threats. Empower your financial planning and decision-making processes with precise and actionable insights derived from this comprehensive SWOT analysis template.