Free Finance Budget Review

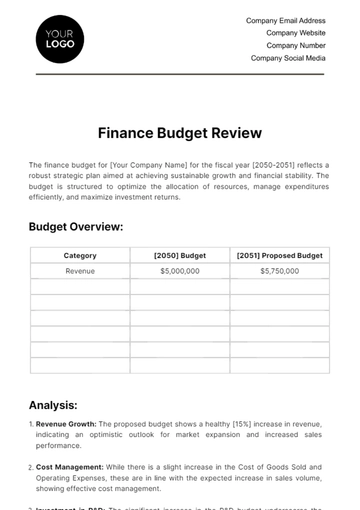

The finance budget for [Your Company Name] for the fiscal year [2050-2051] reflects a robust strategic plan aimed at achieving sustainable growth and financial stability. The budget is structured to optimize the allocation of resources, manage expenditures efficiently, and maximize investment returns.

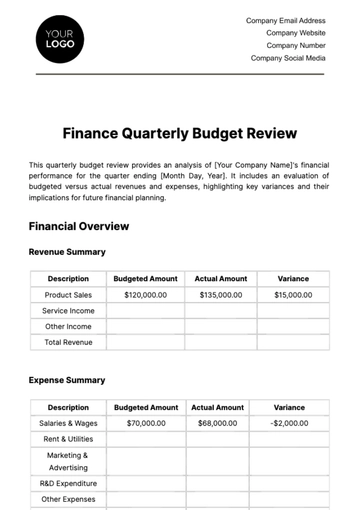

Budget Overview:

Category | [2050] Budget | [2051] Proposed Budget |

Revenue | $5,000,000 | $5,750,000 |

Analysis:

Revenue Growth: The proposed budget shows a healthy [15%] increase in revenue, indicating an optimistic outlook for market expansion and increased sales performance.

Cost Management: While there is a slight increase in the Cost of Goods Sold and Operating Expenses, these are in line with the expected increase in sales volume, showing effective cost management.

Investment in R&D: The significant increase in the R&D budget underscores the company's commitment to innovation and long-term competitiveness. This strategic move is expected to open new market opportunities and enhance product offerings.

Marketing and Sales: The increase in marketing and sales budget is designed to boost brand visibility and customer engagement, critical for achieving the projected revenue growth.

Net Profit Margin: The projected increase in the net profit margin from [30%] to [35.65%] is an indicator of enhanced operational efficiency and effective financial management.

The [2051] budget for [Your Company Name] demonstrates a forward-thinking approach, balancing aggressive growth with prudent financial practices. The increased investment in R&D and marketing, along with efficient cost management, positions the company favorably for future success. This budget is a strong foundation for the company's strategic objectives and long-term vision.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Budget Review Template, an essential tool for analyzing and optimizing financial plans. Fully customizable and editable in our Ai Editor Tool, this template empowers businesses to assess budget allocations, identify areas for improvement, and enhance financial performance. Streamline budget review processes with ease, ensuring accuracy and efficiency in financial management. Simplify your budgeting tasks and achieve fiscal success with our user-friendly platform.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising