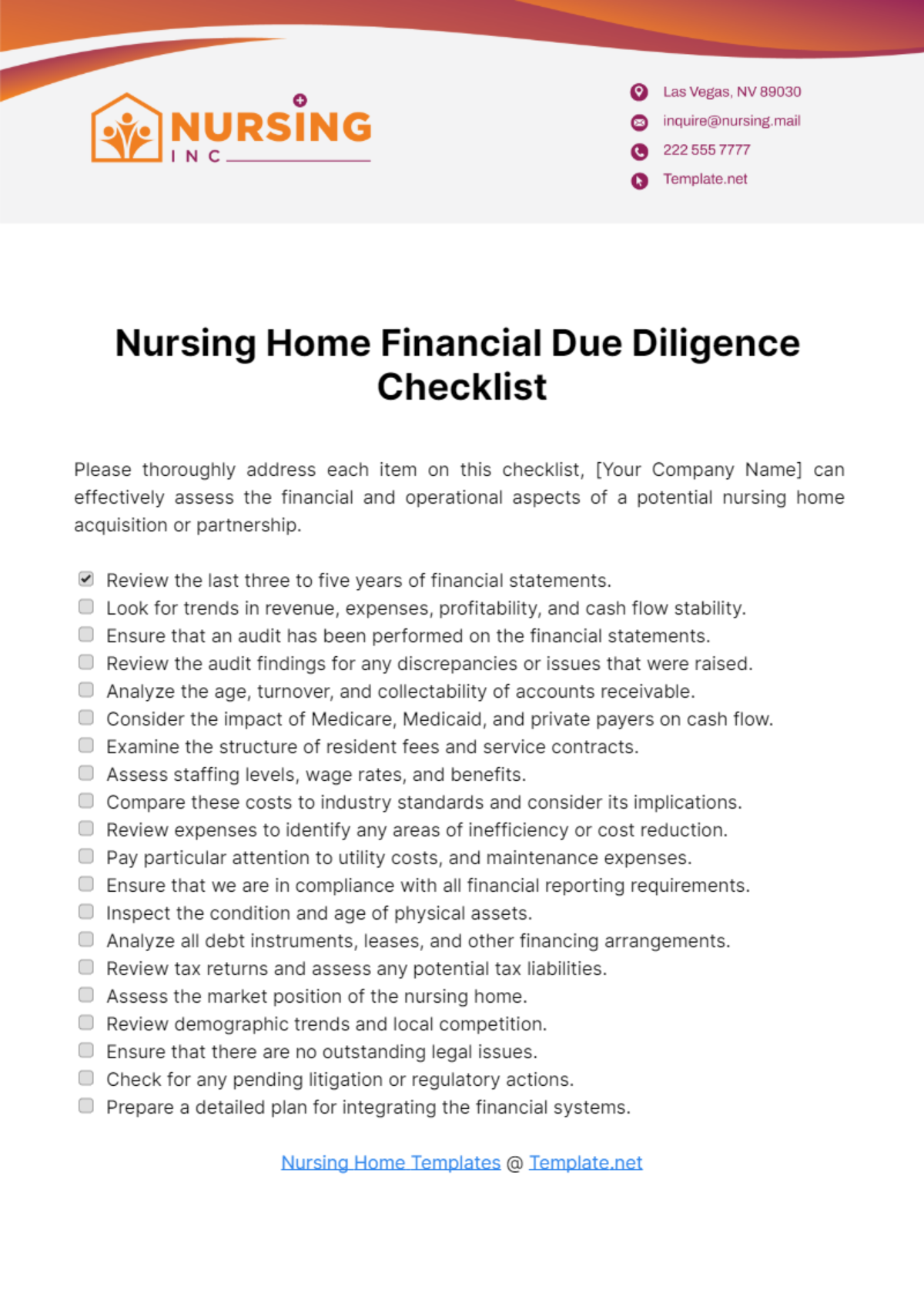

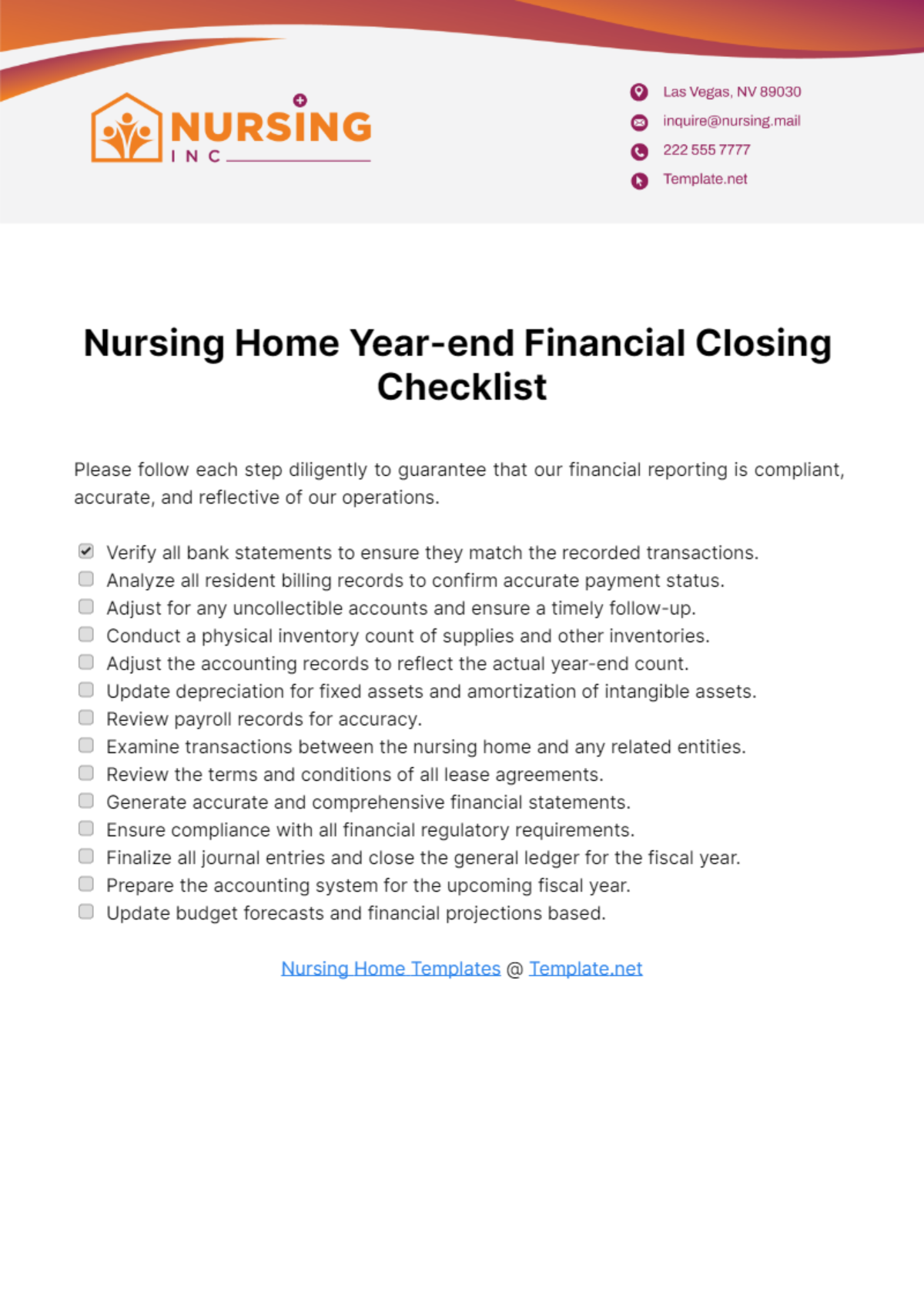

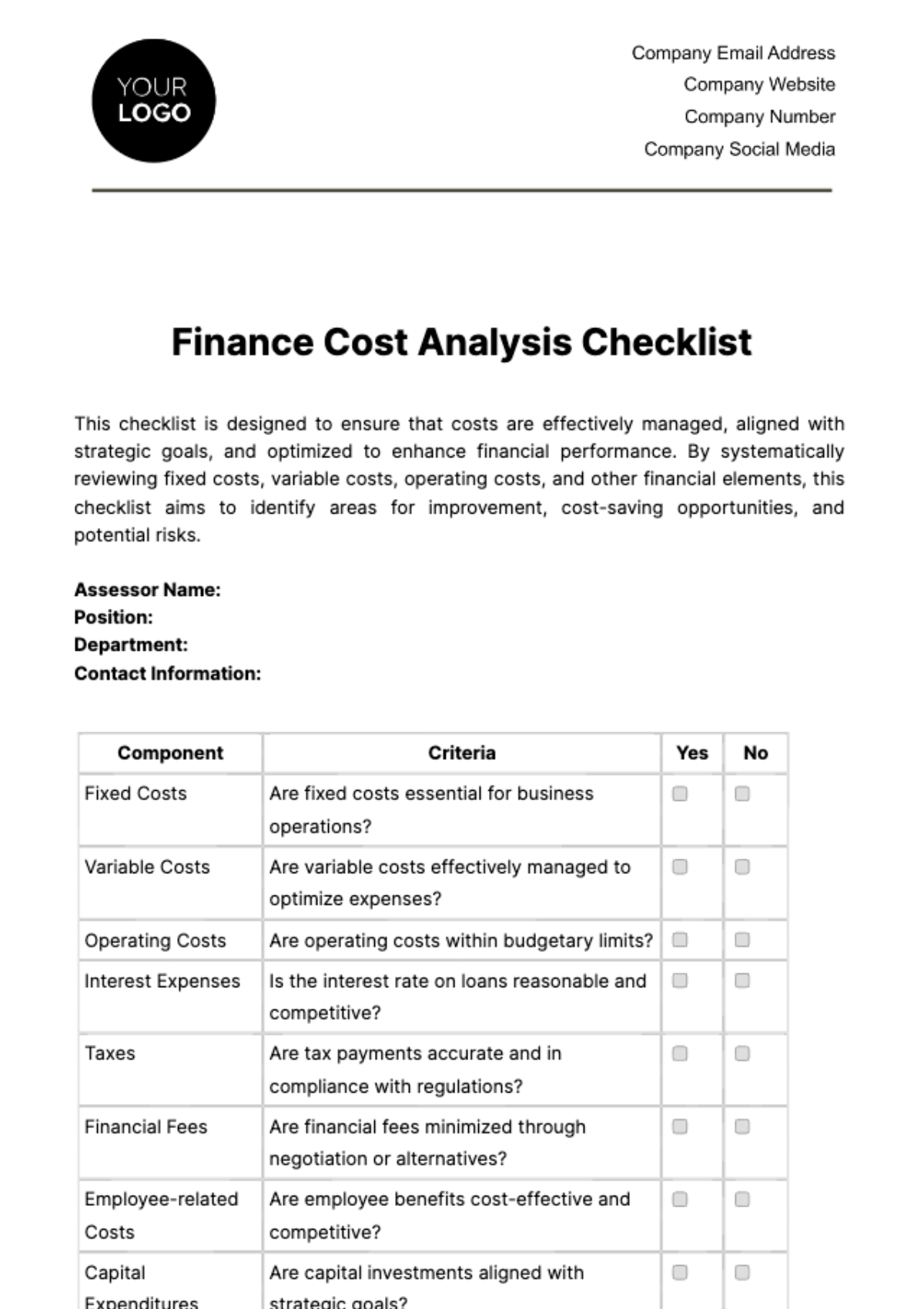

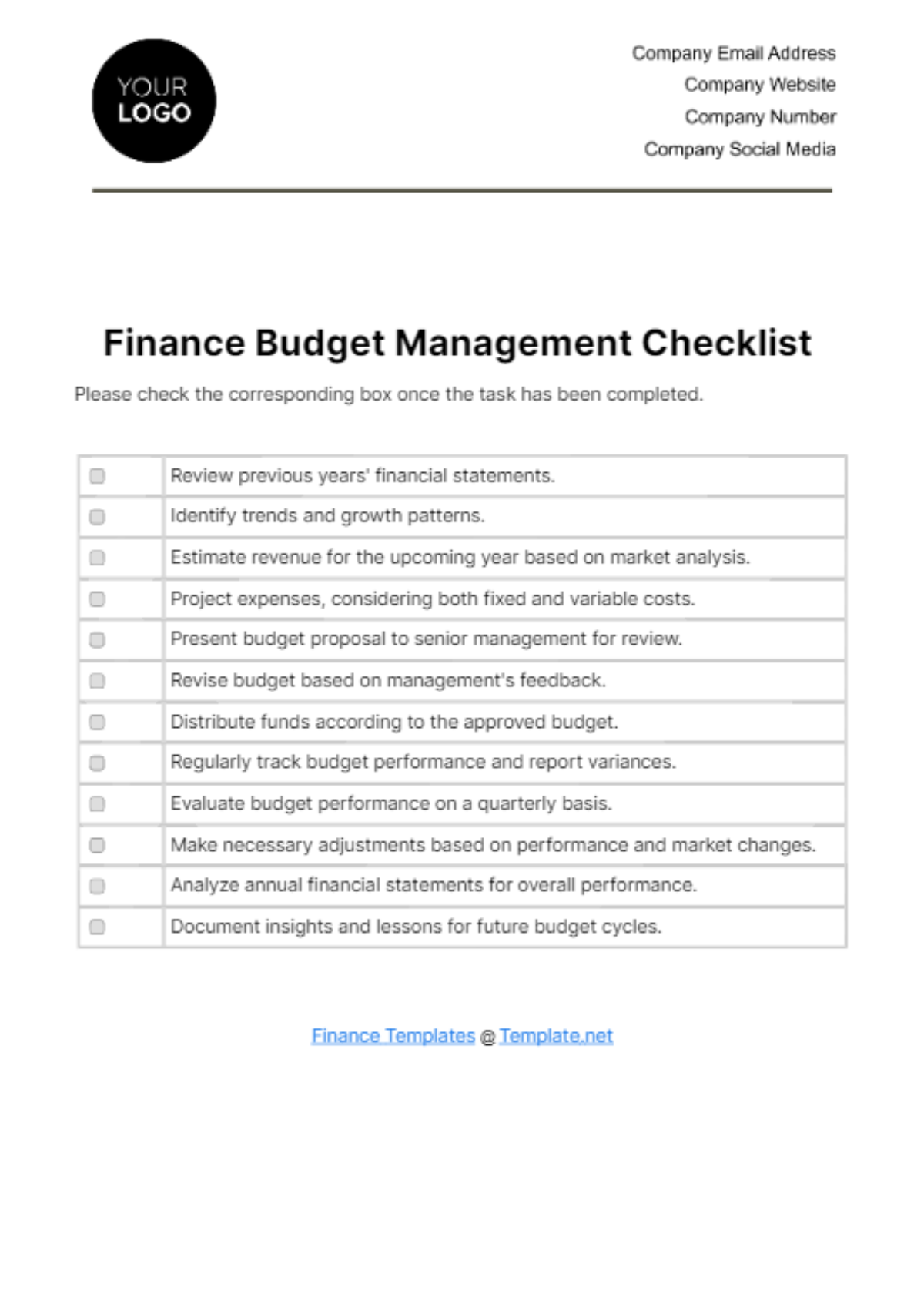

Free Nursing Home Financial Due Diligence Checklist

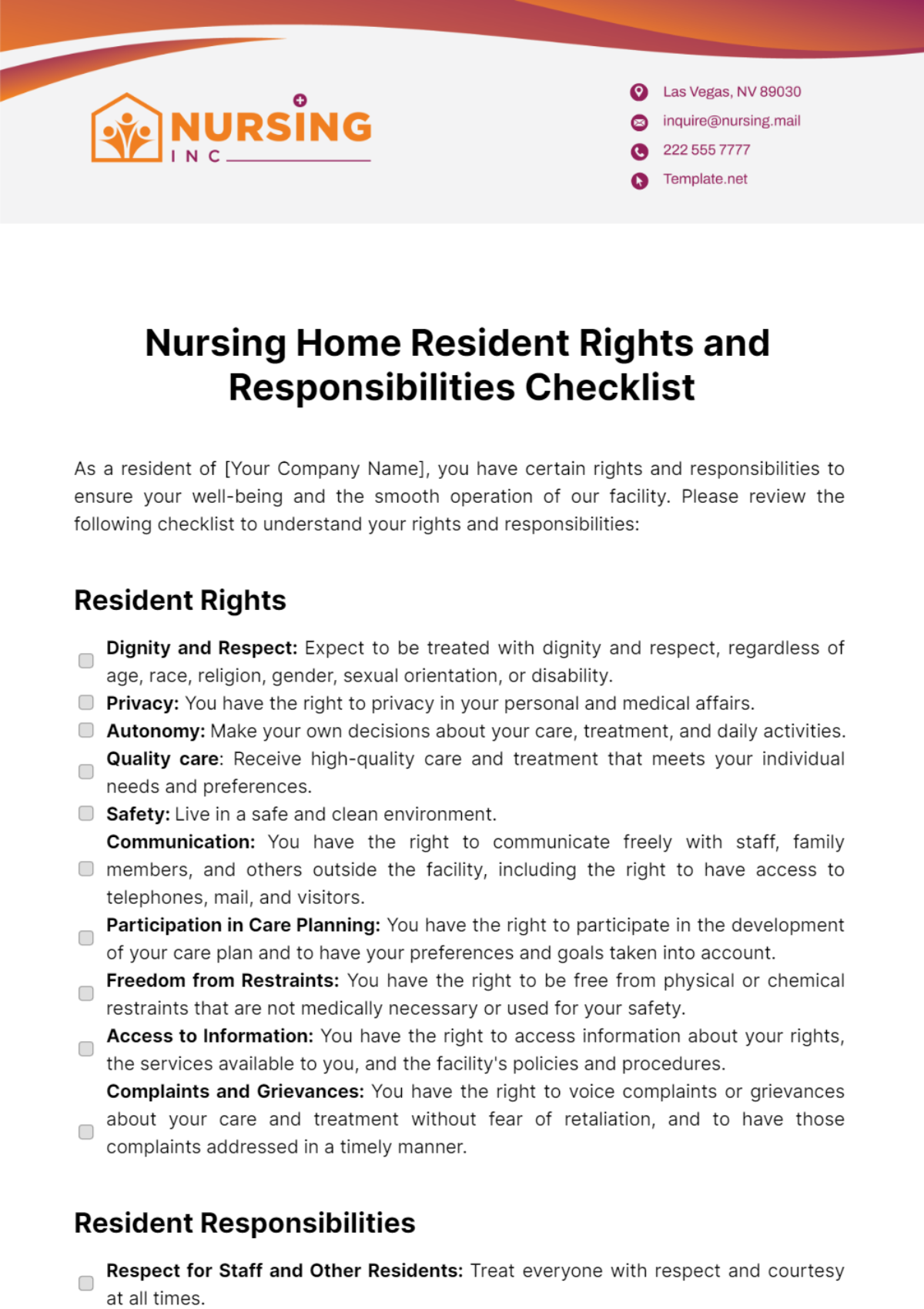

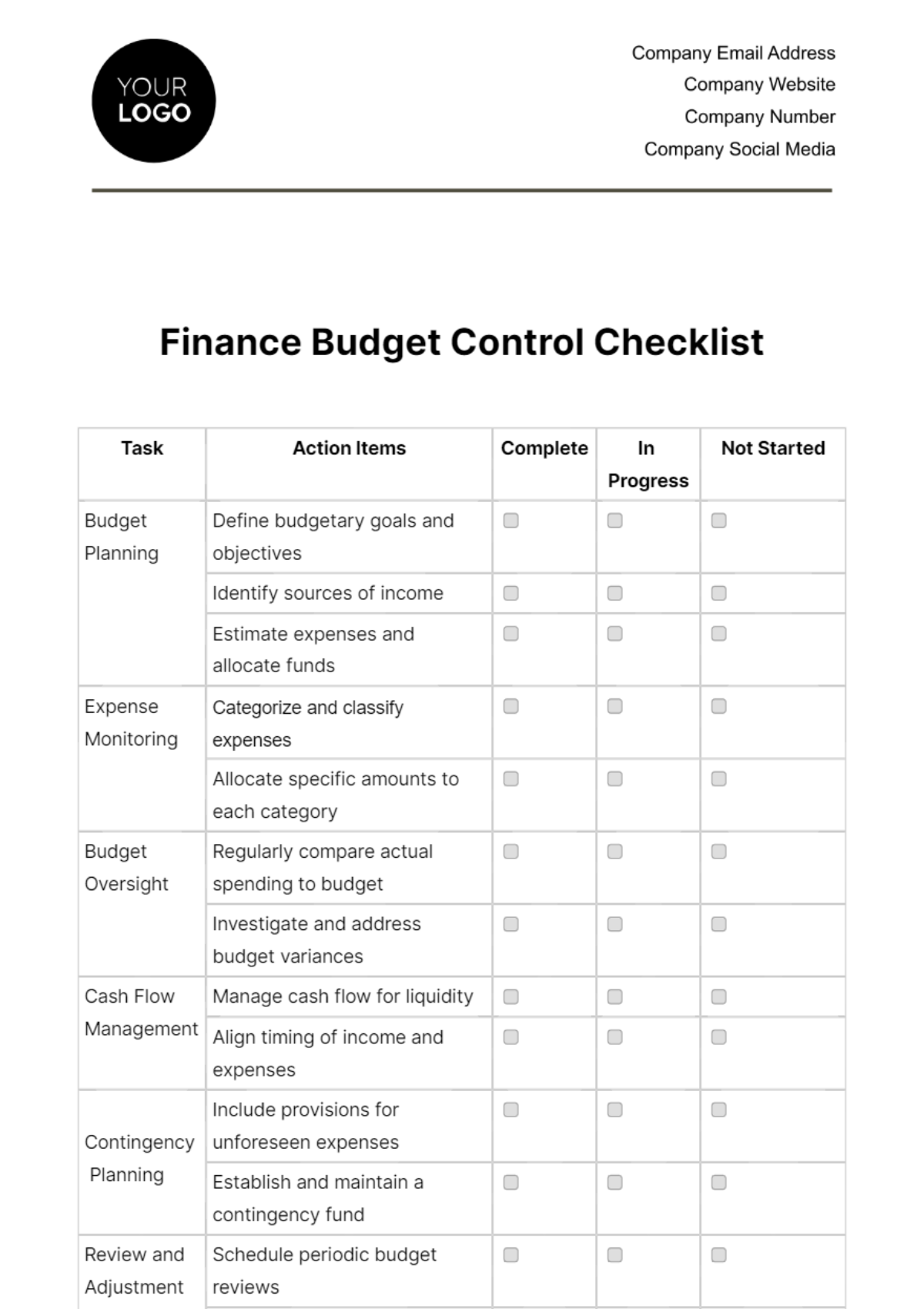

Enhance your financial evaluation processes with the Nursing Home Financial Due Diligence Checklist Template from Template.net. This template is both editable and customizable, tailored to facilitate thorough assessments. Utilize our Ai Editor Tool to adjust the checklist to meet specific due diligence requirements.