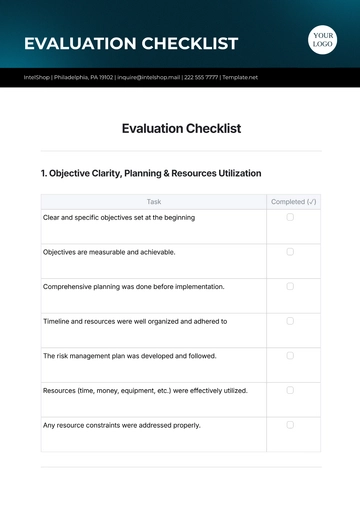

SEC Compliance Checklist

I. Overview

The SEC Compliance Checklist provides a comprehensive framework for [Your Company Name] to ensure adherence to Securities and Exchange Commission regulations. This overview summarizes key areas covered in the checklist.

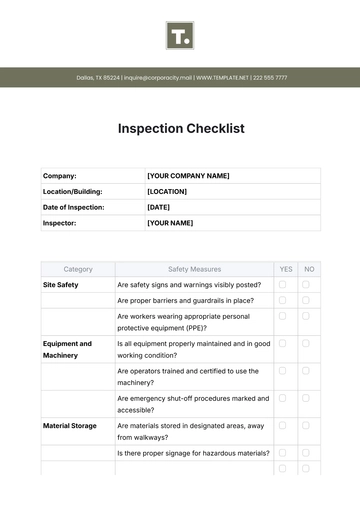

II. General Compliance Requirements

III. Financial Reporting

1. Annual Report (Form 10-K)

2. Quarterly Reports (Form 10-Q)

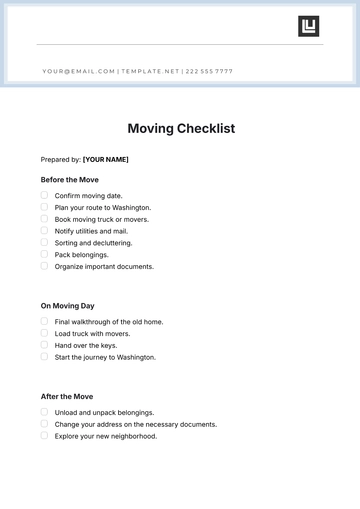

IV. Insider Trading Compliance

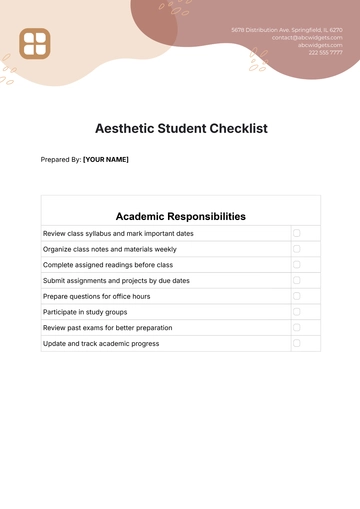

V. Corporate Governance

1. Board of Directors

2. Code of Ethics

VI. Disclosure and Transparency

1. Material Disclosures

2. Proxy Statements

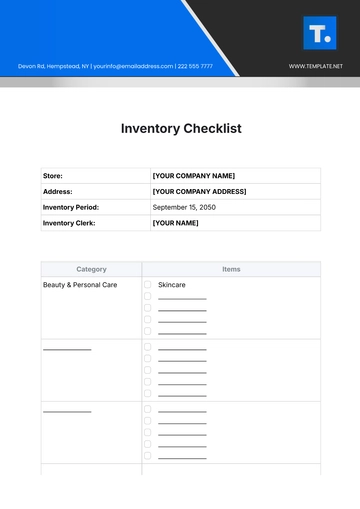

VII. Recordkeeping and Documentation

VIII. Signature

I, [Your Name], hereby acknowledge that I have reviewed and understand the contents of the SEC Compliance Checklist and Overview for [Your Company Name]. I affirm my commitment to ensuring compliance with Securities and Exchange Commission regulations.

[Your Company Name]

Date:

Compliance Templates @ Template.net