Free Sales Tax Compliance Checklist

1. Compliance Overview

Objective: Ensure that [YOUR COMPANY NAME] adheres to all relevant legal and industry standards regarding sales tax compliance.

Responsible Party: [YOUR NAME], [YOUR COMPANY ADDRESS]

Date of Last Review: [DATE]

Next Scheduled Review: [DATE]

2. Registration and Filings

1. Sales Tax Registration

Registered for sales tax with relevant authorities.

Valid sales tax registration numbers obtained for all jurisdictions.

Regular review of registration status to ensure compliance.

2. Filing Deadlines

Knowledge of filing deadlines for each jurisdiction.

Timely submission of sales tax returns and payments.

Procedures in place to monitor and track filing deadlines.

3. Taxable Transactions

1. Product Taxability

Understanding of products/services subject to sales tax.

Regular review of product/service offerings for changes in taxability.

Documentation of tax-exempt sales and applicable exemptions.

2. Nexus Determination

Assessment of nexus in various jurisdictions.

Compliance with nexus thresholds for sales tax collection.

Monitoring changes in nexus laws and regulations.

4. Calculation and Collection

1. Tax Rate Updates

Awareness of current sales tax rates in each jurisdiction.

Procedures to update tax rates in billing systems.

Regular review of tax rate changes and updates.

2. Exemption Certificates

Collection and validation of valid exemption certificates.

Maintenance of exemption certificate records for audit purposes.

Periodic review and renewal of exemption certificates.

5. Reporting and Documentation

1. Recordkeeping

Maintenance of accurate sales records and documentation.

Retention of sales tax returns, payment confirmations, and supporting documents.

Organized recordkeeping system for easy retrieval during audits.

2. Audit Preparation

Readiness for sales tax audits with complete and organized documentation.

Procedures for responding to audit requests and inquiries.

Training of staff on audit procedures and compliance requirements.

6. Technology and Automation

1. Sales Tax Software

Utilization of sales tax automation software for calculation and compliance.

Regular updates and maintenance of sales tax software.

Integration of sales tax software with accounting and ERP systems.

2. Data Accuracy

Validation of transactional data accuracy for sales tax purposes.

Implementation of data validation checks and controls.

Regular reconciliation of sales tax data with financial records.

7. Education and Training

Staff Training

Training programs for employees on sales tax laws and compliance.

Awareness of sales tax responsibilities among relevant personnel.

Ongoing education on changes in sales tax regulations.

8. Conclusion

Summary of Compliance Status

Assessment of overall sales tax compliance status.

Identification of areas for improvement.

Action plan for enhancing sales tax compliance measures.

9. Signature

By signing below, you acknowledge that you have reviewed and understand the contents of this Sales Tax Compliance Checklist.

[YOUR NAME]

[YOUR COMPANY NAME]

Date:[DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover seamless tax compliance with Template.net's Sales Tax Compliance Checklist Template. This editable and customizable tool ensures precision in your tax reporting. Crafted for efficiency, it's seamlessly editable in our Ai Editor Tool, empowering you to tailor it to your unique business needs effortlessly. Simplify your tax processes today.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

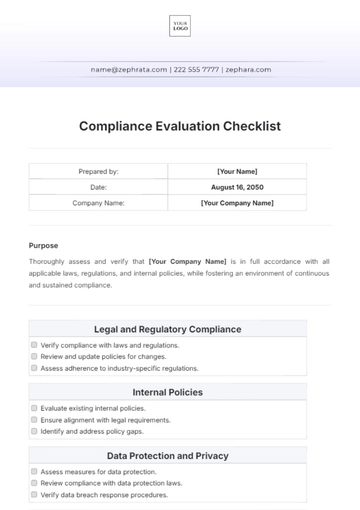

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

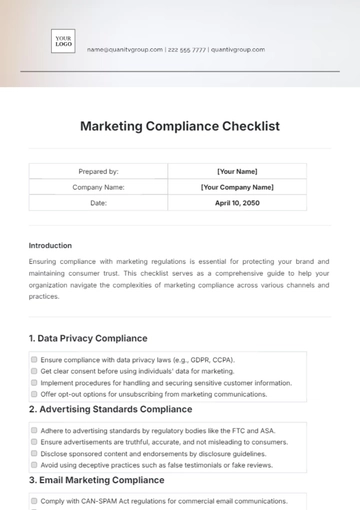

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

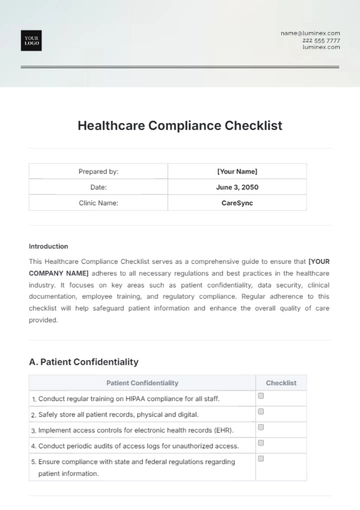

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

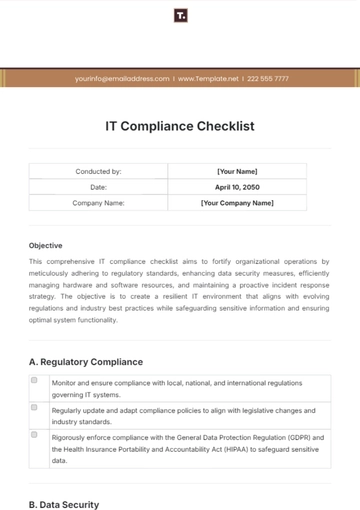

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist