Free Mortgage Compliance Checklist

I. Compliance Program Overview

Company Commitment: | Clearly state [YOUR COMPANY NAME]'s commitment to mortgage compliance. |

Responsible Party: | [YOUR NAME], [YOUR DEPARTMENT] |

Date of Last Review: | [DATE] |

Next Scheduled Review: | [DATE] |

II. Regulatory Compliance

Ensure compliance with applicable mortgage lending laws and regulations, such as RESPA, TILA, and Dodd-Frank.

Implement policies and procedures to adhere to regulatory requirements for loan origination, processing, and servicing.

Stay updated on changes in mortgage laws and regulations and adjust practices accordingly.

III. Loan Disclosures

Provide borrowers with all required loan disclosures, including Loan Estimate (LE) and Closing Disclosure (CD) forms, in accordance with TILA-RESPA Integrated Disclosure (TRID) rules.

Ensure accuracy and completeness of loan disclosures, including loan terms, fees, and closing costs.

Obtain borrower acknowledgment of receipt of loan disclosures and maintain records for auditing purposes.

IV. Fair Lending Compliance

Implement fair lending policies to prevent discrimination in mortgage lending based on race, ethnicity, gender, or other protected characteristics.

Monitor loan underwriting and pricing practices to ensure fair treatment of all borrowers.

Conduct regular fair lending risk assessments and address any identified disparities promptly.

V. Anti-Predatory Lending Practices

Prohibit predatory lending practices such as steering, loan flipping, and equity stripping.

Verify borrowers' ability to repay loans and avoid making loans with risky features, such as balloon payments or negative amortization.

Provide counseling and education to borrowers to help them make informed decisions about mortgage loans.

VI. Escrow Account Management

Follow RESPA rules for managing escrow accounts and timely disbursement of funds for taxes, insurance, etc.

Provide borrowers with annual escrow account statements detailing transactions and balances.

Notify borrowers in advance of any changes to escrow account requirements or payments.

VII. Mortgage Servicing Compliance

Adhere to mortgage servicing rules outlined in Regulation X (RESPA) and Regulation Z (TILA).

Give borrowers timely, precise periodic statements with payment breakdown, transaction activity, and escrow account balances.

Respond promptly to borrower inquiries and complaints and provide assistance with loss mitigation options when necessary.

VIII. Compliance Monitoring and Auditing

Conduct regular internal audits and reviews of mortgage lending and servicing practices to ensure compliance with laws and regulations.

Document audit findings and corrective actions taken to address compliance deficiencies.

Engage external compliance consultants or legal counsel for independent audits and assessments as needed.

IX. Employee Training

Provide comprehensive training to employees involved in mortgage lending and servicing on applicable laws, regulations, and company policies.

Offer periodic refresher training sessions to reinforce key concepts and updates.

Encourage employees to report any potential compliance concerns or violations promptly.

X. Signature

I, [YOUR NAME], hereby acknowledge that I have reviewed and understand the contents of this Mortgage Compliance Checklist. I am committed to upholding the standards outlined herein and ensuring compliance with applicable mortgage lending laws and regulations at [YOUR COMPANY NAME].

[YOUR NAME]

Compliance Officer

[YOUR COMPANY NAME]

[YOUR COMPANY ADDRESS]

Date:

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Mortgage Compliance Checklist Template from Template.net. Streamline your mortgage process with this editable and customizable tool. Crafted for efficiency, it's easily editable in our Ai Editor Tool. Ensure compliance effortlessly and expedite your workflow. Get organized and stay ahead with this essential resource.

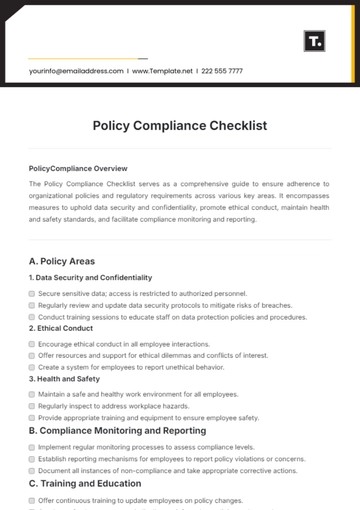

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

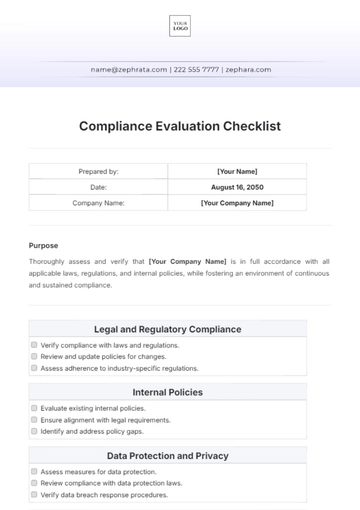

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

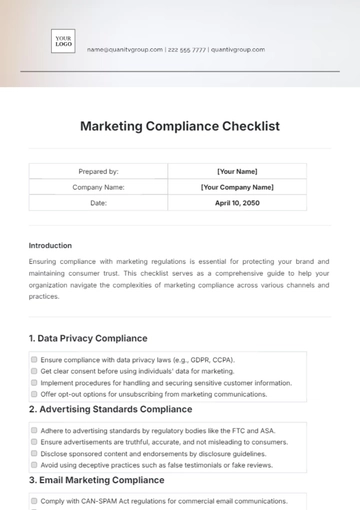

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

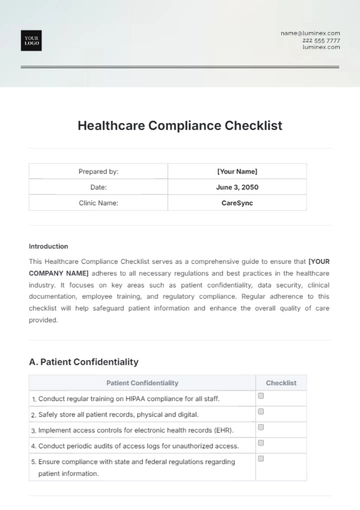

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

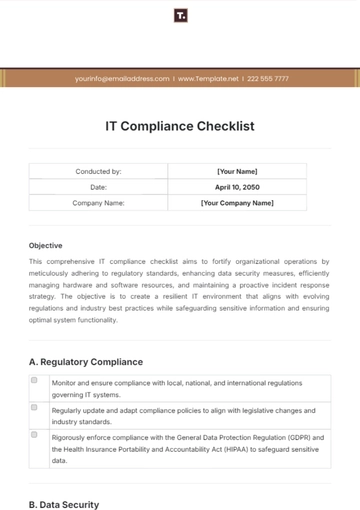

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist