Free Investment Advisor Compliance Checklist

I. Compliance Overview

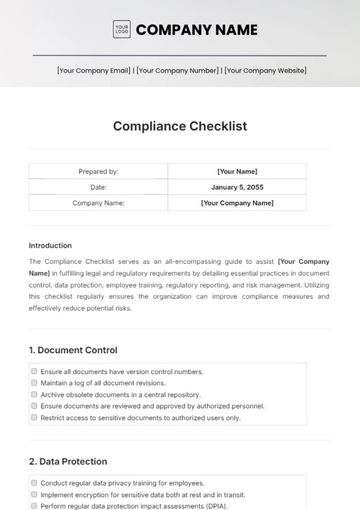

Objective: This checklist is designed to guide investment advisors and their compliance departments in conducting internal audits and assessments to ensure regulatory compliance. It also assists in preparing for regulatory examinations or audits by government agencies and provides guidance for implementing compliance policies and procedures within the organization. Additionally, these checklists can serve as educational tools for training new employees and educating existing staff on compliance requirements and best practices.

Responsible Party: [YOR NAME] [YOUR DEPARTMENT]

Date of Last Review: [DATE]

Next Scheduled Review: [DATE]

II. Regulatory Compliance

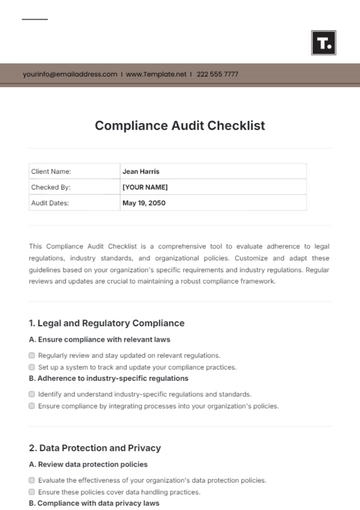

Review and understand all relevant regulatory requirements applicable to investment advisors.

Ensure compliance with regulations such as SEC rules, state securities laws, and other industry standards.

Regularly monitor changes in regulations and update compliance policies and procedures accordingly.

III. Compliance Policies and Procedures

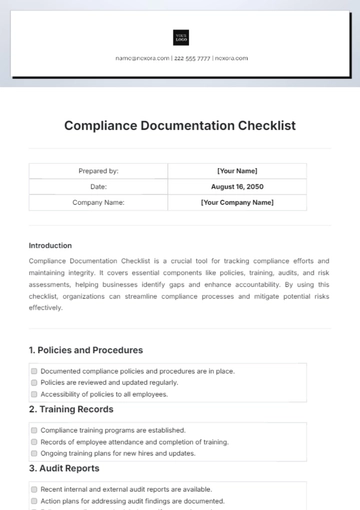

Develop comprehensive compliance policies and procedures tailored to the firm's business activities.

Communicate compliance policies and procedures to all employees and provide training as necessary.

Establish procedures for reviewing and updating compliance policies and procedures on a regular basis.

IV. Recordkeeping and Documentation

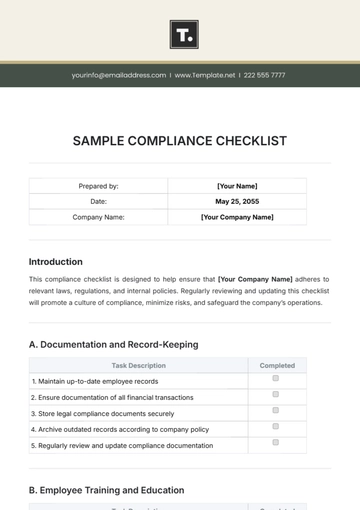

Maintain accurate and up-to-date records of all client transactions, communications, and activities.

Establish procedures for the retention and storage of records in accordance with regulatory requirements.

Conduct periodic reviews of recordkeeping practices to ensure compliance with applicable rules and regulations.

V. Client Suitability and Due Diligence

Implement processes for assessing the suitability of investment recommendations for clients.

Conduct thorough due diligence on investment products and strategies before recommending them to clients.

Document client suitability assessments and due diligence processes to demonstrate compliance with regulatory requirements.

VI. Advertising and Marketing Compliance

Review all marketing materials and communications for compliance with regulatory requirements.

Ensure that advertising and marketing materials are accurate, fair, and not misleading to clients or prospective clients.

Maintain records of all marketing activities and communications for regulatory review.

VII. Employee Training and Education

Provide ongoing training and education to employees on compliance requirements and best practices.

Conduct regular compliance training sessions and provide resources for employees to stay informed about regulatory changes.

Document employee training and education activities to demonstrate compliance efforts to regulators.

VIII. Conflict of Interest Management

Implement policies and procedures to identify and manage conflicts of interest effectively.

Disclose conflicts of interest to clients and establish procedures for obtaining client consent when necessary.

Monitor and review potential conflicts of interest regularly to ensure compliance with regulatory requirements.

IX. Complaint Handling and Resolution

Establish a process for receiving, investigating, and resolving client complaints in a timely and fair manner.

Maintain records of all client complaints and the actions taken to resolve them.

Review complaint trends to identify underlying issues and implement preventive measures.

XI. Annual Compliance Review

Conduct an annual review of the firm's compliance program to assess its effectiveness.

Identify areas for improvement based on the results of the review and implement necessary changes.

Document the annual compliance review process and outcomes for regulatory purposes.

XII. Vendor and Third-Party Due Diligence

Perform due diligence on vendors and third-party service providers to ensure they meet compliance standards.

Establish contractual provisions to hold vendors accountable for compliance with regulatory requirements.

Monitor the performance of vendors and third parties regularly to ensure ongoing compliance.

XIII. Completion and Sign-off

By checking the box below, I acknowledge that I have reviewed and completed the Investment Advisor Compliance Checklist Template.

Completed by: [YOUR NAME] [YOUR DEPARTMENT]

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

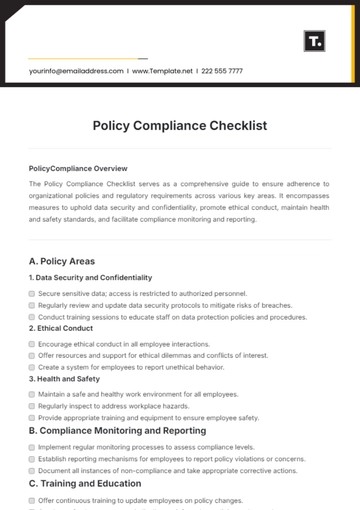

Introducing our Investment Advisor Compliance Checklist Template, meticulously crafted to ensure thorough evaluation and adherence to regulatory requirements within your advisory firm. Accessible on Template.net, this editable and customizable checklist covers essential areas such as client suitability, disclosure requirements, recordkeeping, and regulatory filings. Utilize our Ai Editor Tool to tailor the checklist to your firm's specific compliance needs and regulatory obligations. Simplify your compliance monitoring process and identify areas for improvement effectively with our meticulously crafted template. Elevate your investment advisor's compliance standards with Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

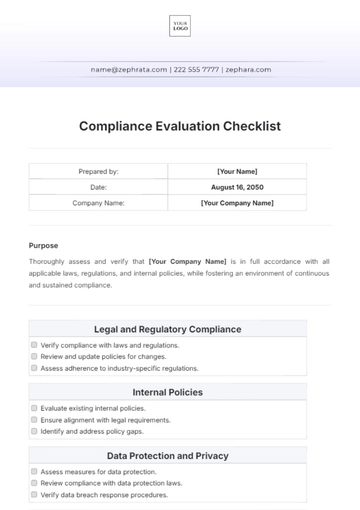

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

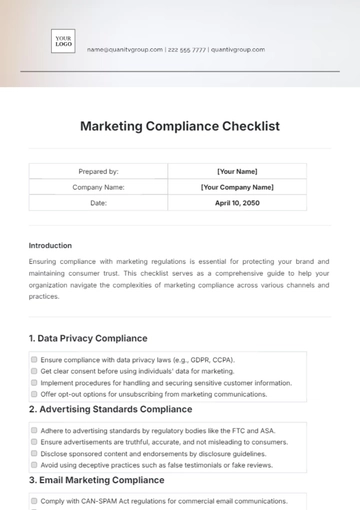

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

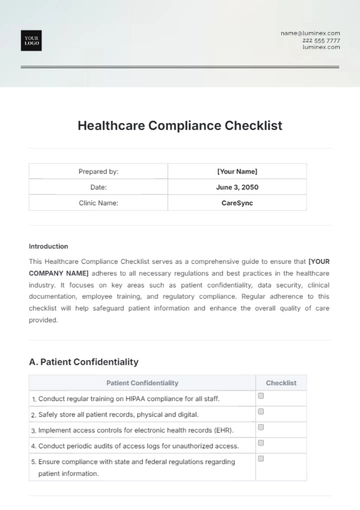

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

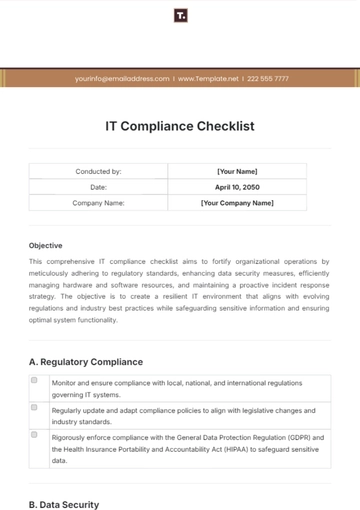

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist