Free ESOP Compliance Checklist

I. Compliance Overview

Objective: Ensure that [YOUR COMPANY NAME] adheres to regulations governing Employee Stock Ownership Plans (ESOPs) to promote transparency, fairness, and compliance with fiduciary responsibilities.

Responsible Party: [YOUR NAME], ESOP Administrator

Date of Last Review: [DATE]

Next Scheduled Review:[NEXT REVIEW DATE]

II. Plan Documentation and Administration

Plan Document:

Develop and maintain a comprehensive plan document for the ESOP.

Include eligibility requirements, contribution formulas, vesting schedules, and distribution provisions.

Ensure the plan document is kept current and accurate, reflecting any updates or amendments.

Provide access to the plan document for all ESOP participants and relevant stakeholders.

Plan Administration:

Administer the ESOP in accordance with the terms and conditions outlined in the plan document.

Ensure compliance with ERISA and IRS regulations governing ESOPs.

Establish procedures for contributions, allocations, vesting, and distributions.

Maintain accurate records of participant accounts, transactions, and plan activities.

Participant Communications:

Communicate plan updates, changes, and important information to ESOP participants in a clear and timely manner.

Provide regular statements of account to participants, detailing their ESOP holdings and transactions.

Offer educational resources and support to help participants understand their rights and responsibilities under the ESOP.

Establish channels for participants to ask questions, seek clarification, and provide feedback regarding the ESOP.

III. Fiduciary Responsibilities

Fiduciary Oversight:

Act with prudence and diligence in managing and administering the ESOP.

Always prioritize the best interests of plan participants and beneficiaries.

Ensure compliance with fiduciary duties outlined in ERISA and other applicable regulations.

Document fiduciary decisions and actions taken on behalf of the ESOP.

Investment Management:

Regularly monitor and evaluate the performance of ESOP investments.

Diversify investments to minimize risk and maximize returns for participants.

Review investment strategy and asset allocation periodically to align with ESOP objectives.

Engage qualified investment advisors or consultants to provide expert guidance on investment decisions.

Prohibited Transactions:

Familiarize yourself with prohibited transactions outlined in ERISA and IRS regulations.

Avoid engaging in self-dealing or conflicts of interest that could compromise the ESOP's tax-qualified status.

Exercise caution when conducting transactions involving disqualified persons, such as company officers, directors, and major shareholders.

Implement internal controls and procedures to identify and prevent prohibited transactions within the ESOP.

IV. Participant Rights and Protections

Vesting:

Administer vesting schedules as outlined in the ESOP plan document.

Ensure compliance with regulatory requirements regarding vesting of participants' accrued benefits.

Communicate vesting status to participants on a regular basis.

Update vesting status promptly upon participants reaching vesting milestones.

Distribution Options:

Offer distribution options consistent with plan provisions and regulatory requirements.

Provide clear and timely communication to participants regarding their distribution options.

Educate participants on the tax implications and financial considerations associated with different distribution choices.

Process distribution requests accurately and efficiently, adhering to established timelines and procedures.

Participant Education:

Develop educational materials and resources to inform participants about the ESOP and their rights under the plan.

Conduct regular educational sessions or workshops to help participants understand the benefits of ESOP participation and investment.

Offer personalized guidance and support to participants seeking information about their ESOP accounts or distribution options.

Encourage participants to actively engage with the ESOP and seek clarification on any questions or concerns they may have.

V. Reporting and Disclosure

Form 5500 Filing:

Prepare and file Form 5500 with the Department of Labor annually.

Include accurate and complete information about the ESOP's financial condition, operations, and compliance with regulatory requirements.

Ensure timely submission of Form 5500 by the required deadline each year.

Retain copies of filed Form 5500 and supporting documentation for record-keeping purposes.

Summary Plan Description (SPD):

Develop a comprehensive Summary Plan Description (SPD) for the ESOP.

Include key features such as eligibility criteria, benefits, vesting schedules, and distribution options.

Provide clear and concise explanations of participants' rights and responsibilities under the plan.

Distribute the SPD to all ESOP participants in a timely manner, typically within 90 days of becoming a participant.

Annual Statements:

Generate annual statements for ESOP participants.

Include detailed information about participants' account balances, contributions, earnings, distributions, and other relevant transactions.

Ensure accuracy and completeness of information presented in the annual statements.

Distribute annual statements to participants within the timeframe specified by regulatory requirements or plan provisions.

VI. Compliance Testing

Non-discrimination Testing:

Schedule annual non-discrimination testing for the ESOP.

Ensure testing is conducted in accordance with IRS regulations and guidelines.

Test for compliance with coverage and contribution requirements.

Review testing results to identify any disparities or issues that require correction.

Implement corrective actions as needed to address any failures or deficiencies identified during testing.

Top-Heavy Testing:

Plan and conduct top-heavy testing for the ESOP.

Determine the ratio of key employees to non-key employees.

Assess whether the ESOP meets top-heavy plan requirements.

Review testing results to identify any top-heavy status and its implications.

Take appropriate actions to comply with top-heavy plan requirements, such as adjusting contributions or providing minimum benefits to non-key employees if necessary.

VII. Continuous Monitoring and Improvement

Compliance Audits:

Schedule periodic compliance audits for the ESOP.

Review ESOP operations, processes, and documentation for adherence to regulatory requirements.

Assess compliance with internal policies and procedures.

Identify areas for improvement and corrective actions as needed.

Document audit findings and recommendations for follow-up and future reference.

Professional Assistance:

Engage legal, tax, and financial professionals with expertise in ESOPs.

Seek guidance on complex legal, regulatory, and tax issues related to ESOP design and administration.

Obtain assistance with plan document drafting, amendments, and updates.

Collaborate with professionals to ensure ongoing compliance with changing laws and regulations.

Utilize professional expertise to optimize ESOP structure, operations, and benefits for participants and the company.

VIII. Signature

By signing below, you acknowledge that you have reviewed and understand the contents of this ESOP compliance checklist and affirm [YOUR COMPANY NAME]'s commitment to maintaining compliance with ESOP regulations and fulfilling fiduciary responsibilities.

ESOP Administrator

[YOUR COMPANY NAME]

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the ESOP Compliance Checklist Template from Template.net. This meticulously crafted tool is fully editable and customizable, ensuring seamless integration with your unique requirements. Accessible through our Ai Editor Tool, it streamlines ESOP compliance processes with ease and precision. Simplify your workflow and ensure regulatory adherence effortlessly.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

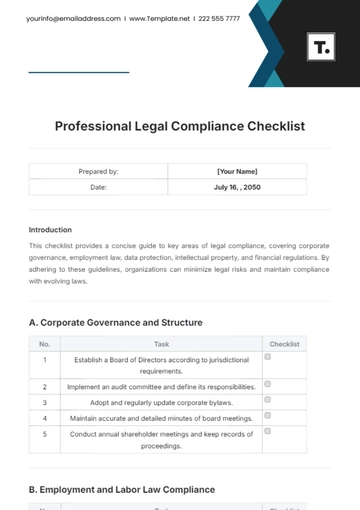

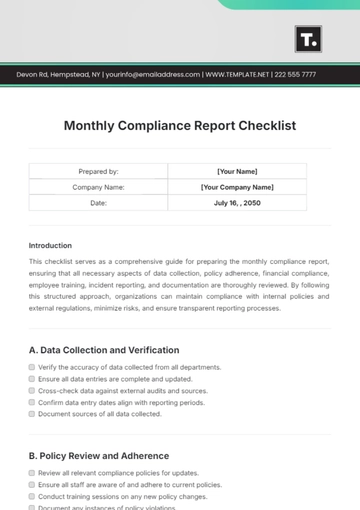

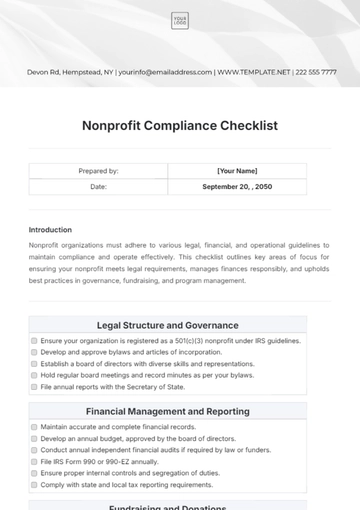

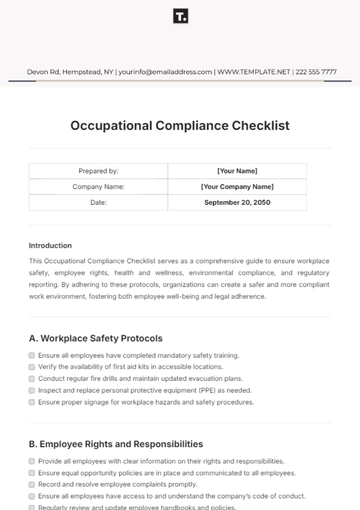

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist