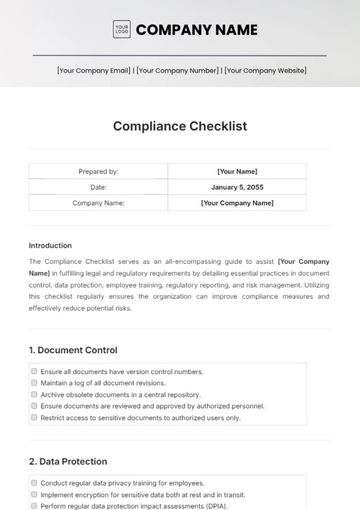

Free Commercial Lending Compliance Checklist

I. Compliance Overview

Objective: Ensure that [Your Company Name] adheres to all relevant legal and industry standards regarding commercial lending practices.

Responsible Party: [Your Name], [Your Title]

Date of Last Review: [Date]

Next Scheduled Review: [Next Review Date]

II. Customer Due Diligence

[Your Company Name] has established procedures for conducting thorough customer due diligence before approving commercial loans.

Verify that customer identification and verification procedures are followed according to regulatory requirements.

Confirm that Know Your Customer (KYC) checks are performed to assess the risk associated with potential borrowers.

III. Loan Documentation

Ensure that all necessary loan documentation is completed accurately and in accordance with regulatory standards.

Verify that loan agreements contain all essential terms and conditions, including interest rates, repayment schedules, and collateral details.

Confirm that loan documentation is reviewed by legal experts to ensure compliance with applicable laws and regulations.

IV. Credit Risk Management

Conduct thorough credit assessments to evaluate the creditworthiness of commercial loan applicants.

Verify that risk rating methodologies are applied consistently to assess and mitigate credit risks.

Monitor credit exposures and establish risk limits to manage credit risk effectively.

V. Regulatory Reporting

[Your Department] is responsible for ensuring timely and accurate regulatory reporting for commercial lending activities.

Verify that all required regulatory reports, such as Call Reports or HMDA reports, are submitted on time.

Confirm that data accuracy and integrity are maintained throughout the reporting process.

VI. Fair Lending Compliance

Ensure that commercial lending practices comply with fair lending laws and regulations to prevent discrimination.

Monitor lending decisions and practices to detect and address any potential disparities in treatment.

Provide fair lending training to staff members involved in the lending process to promote awareness and adherence to fair lending principles.

VII. Anti-Money Laundering (AML) Compliance

[Your Company Name] has implemented AML policies and procedures to prevent money laundering and terrorist financing activities.

Conduct customer due diligence checks to identify and verify the source of funds for commercial loan transactions.

Report suspicious activities to the appropriate regulatory authorities and maintain records of such reports.

VIII. Signature

I, [Your Name], hereby acknowledge that I have reviewed the Commercial Lending Compliance Checklist Template for [Your Company Name] and affirm our commitment to implementing and maintaining the outlined procedures and practices to ensure compliance with commercial lending standards.

Your Company Name]

Date:

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

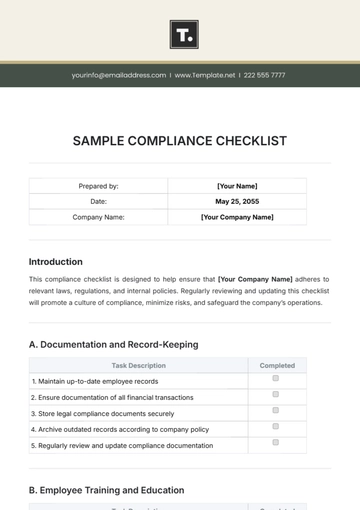

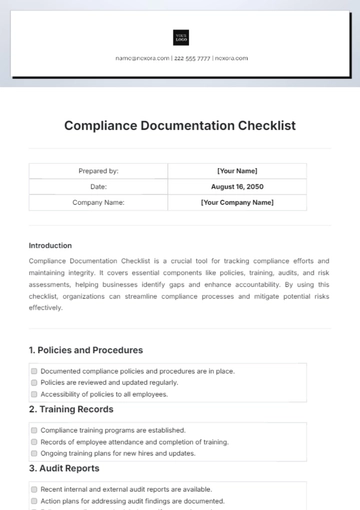

Introducing the Commercial Lending Compliance Checklist Template from Template.net. Simplify your compliance journey with this editable and customizable tool. Tailor it to your institution's unique needs effortlessly. Editable in our Ai Editor Tool for seamless adjustments. Stay ahead of regulations and ensure smooth lending processes with confidence and ease.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

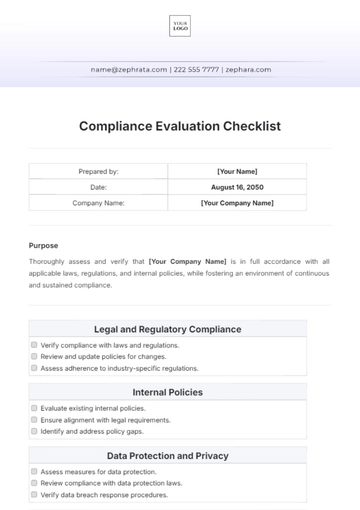

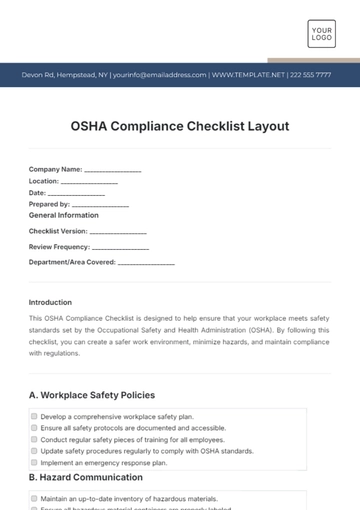

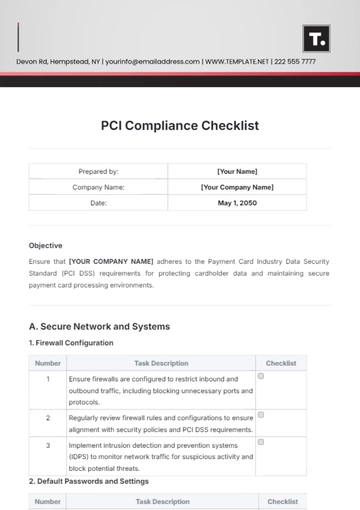

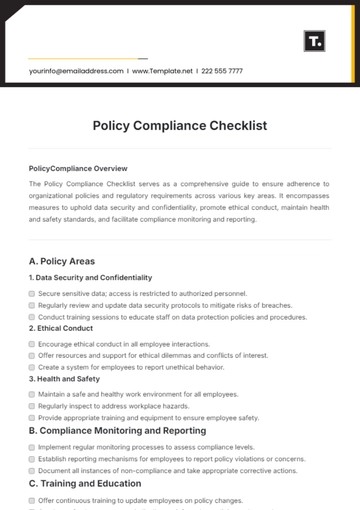

- Compliance Checklist

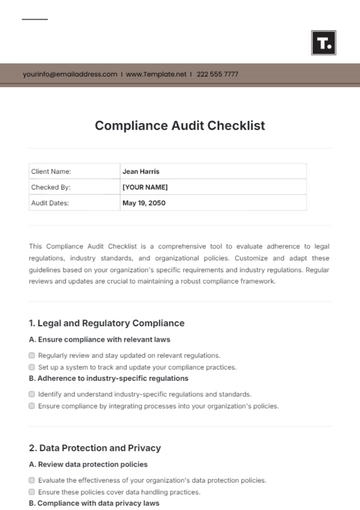

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

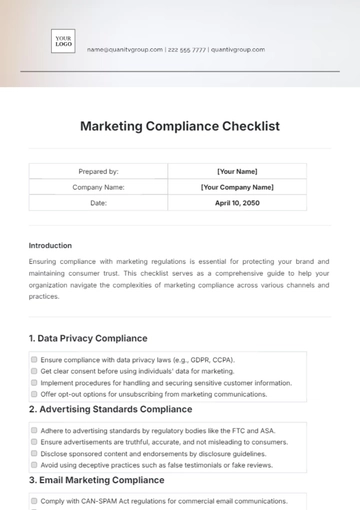

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

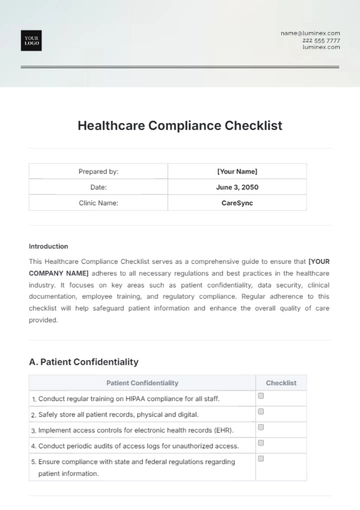

- Medical Checklist

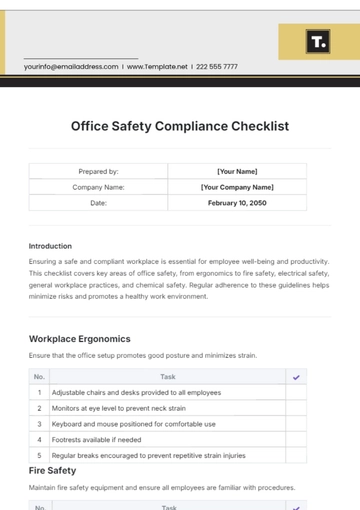

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

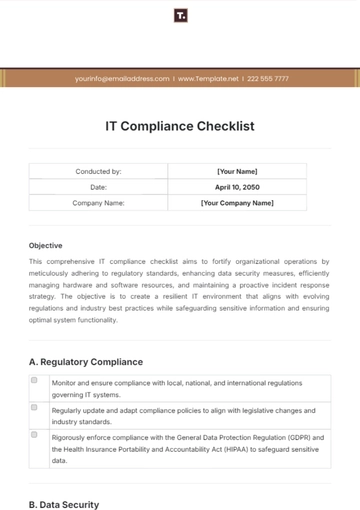

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist