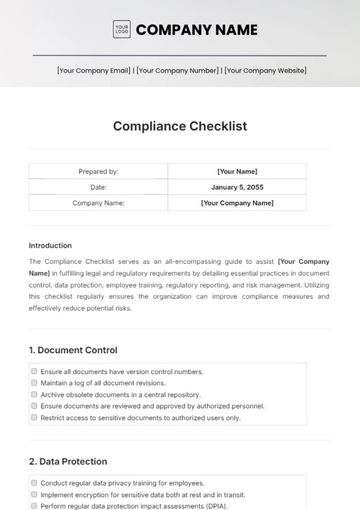

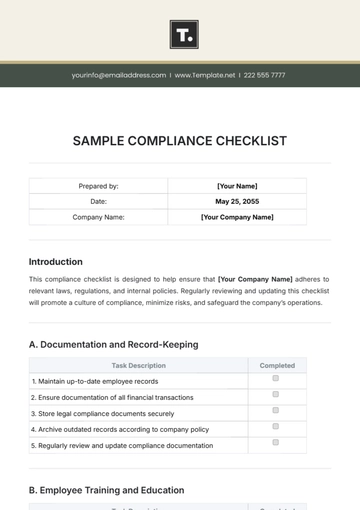

Free RIA Compliance Checklist

I. Compliance Program Overview

This RIA Compliance Checklist Template aids [YOUR COMPANY NAME] in meeting regulatory standards as a Registered Investment Adviser (RIA), fostering client trust and compliance. It covers crucial areas like registration, client disclosures, oversight, advertising, privacy, recordkeeping, training, and business continuity. Customization ensures seamless compliance with [YOUR COMPANY NAME]'s protocols.

Objective: | Ensure [YOUR COMPANY NAME] follows RIA regulations, maintains a strong compliance program and upholds ethics, integrity, and investor protection. |

Responsible Party: | [YOUR NAME], [YOUR DEPARTMENT] |

Date of Last Review: | [DATE] |

Next Scheduled Review: | [DATE] |

Review Schedule: | Bi-annually or as required by changes in regulations. |

Review existing compliance policies and procedures.

Assign a compliance officer responsible for overseeing compliance efforts.

Establish a clear timeline for implementing compliance measures.

Regularly review and update compliance efforts.

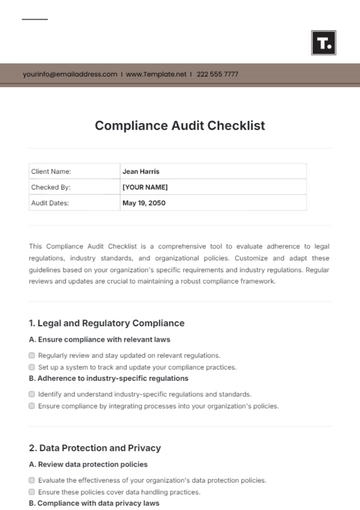

II. Registration and Licensing

Ensure registration with the appropriate regulatory bodies (e.g., SEC, state securities regulators).

Maintain required licenses and qualifications for investment advisory services.

Renew registrations and licenses as necessary to remain in compliance.

III. Code of Ethics and Standards of Conduct

Establish a code of ethics outlining standards of conduct for employees.

Implement procedures for reporting and addressing conflicts of interest.

Provide ongoing training and education on ethical standards and compliance requirements.

IV. Disclosure Documents

Provide clients with Form ADV Part 2A and 2B disclosing firm information and services.

Update Form ADV promptly to reflect material changes in firm operations or disclosures.

Deliver Form CRS (Client Relationship Summary) to clients as required by SEC regulations.

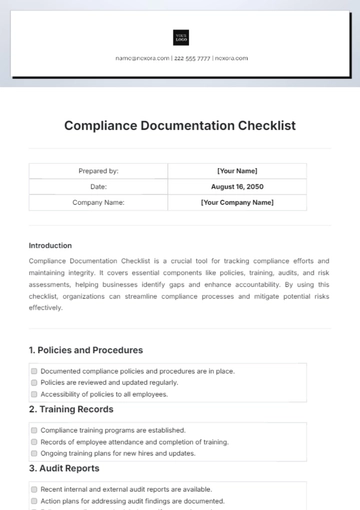

V. Compliance Policies and Procedures

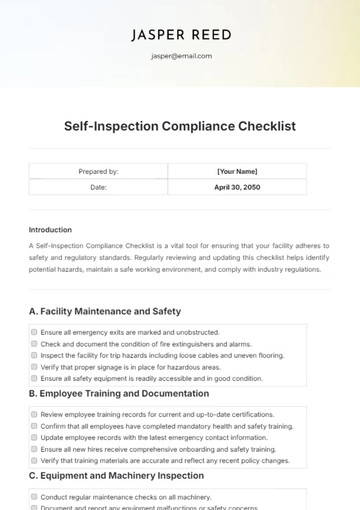

Develop and maintain written compliance policies and procedures tailored to the firm's operations.

Conduct regular reviews and updates of compliance manuals to reflect changes in regulations or business practices.

Train staff on compliance policies and procedures and ensure understanding and adherence.

VI. Custody and Safeguarding of Client Assets

Implement controls to safeguard client assets and prevent unauthorized transactions.

Maintain accurate records of client accounts and transactions.

Comply with custody rules and requirements for maintaining custody of client funds or securities.

VII. Advertising and Marketing Compliance

Ensure all marketing materials and communications comply with SEC advertising rules.

Review and approve marketing materials before dissemination to clients or the public.

Maintain records of advertising and marketing activities for compliance purposes.

VIII. Client Suitability and Best Interest Obligations

Conduct thorough client suitability assessments before making investment recommendations.

Document client investment objectives, risk tolerance, and financial situation.

Act in the best interest of clients and avoid conflicts of interest when providing investment advice.

IX. Recordkeeping and Reporting

Maintain accurate and complete records of client transactions, communications, and account information.

Retain records in accordance with SEC recordkeeping requirements.

File required reports and disclosures with regulatory authorities in a timely manner.

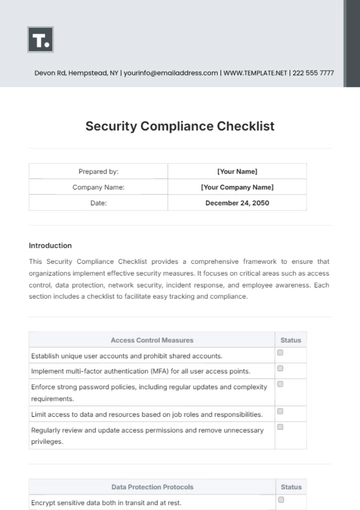

X. Cybersecurity Measures

Implement cybersecurity policies and procedures to protect client information and firm operations.

Conduct regular risk assessments and vulnerability scans to identify and address cybersecurity threats.

Provide cybersecurity training to staff and ensure awareness of best practices for data security.

XI. Signature

I, [YOUR NAME], hereby acknowledge that I have reviewed and understand the contents of this RIA Compliance Checklist. I am committed to upholding the standards outlined herein and ensuring compliance with regulatory requirements as a Registered Investment Adviser (RIA) at [YOUR COMPANY NAME].

[YOUR NAME]

Compliance Officer

[YOUR COMPANY NAME]

[YOUR COMPANY ADDRESS]

Date:

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover unparalleled convenience with the RIA Compliance Checklist Template from Template.net. This editable and customizable tool ensures effortless compliance management. Seamlessly tailor it to your needs using our Ai Editor Tool. Streamline your regulatory processes today and elevate your business with ease.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

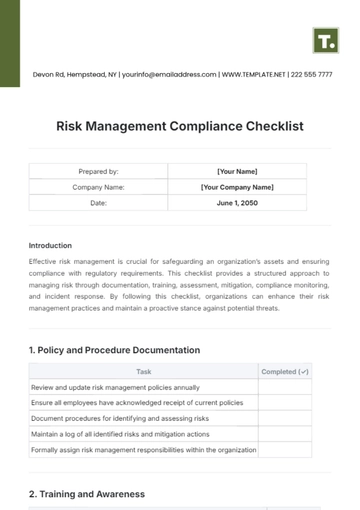

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

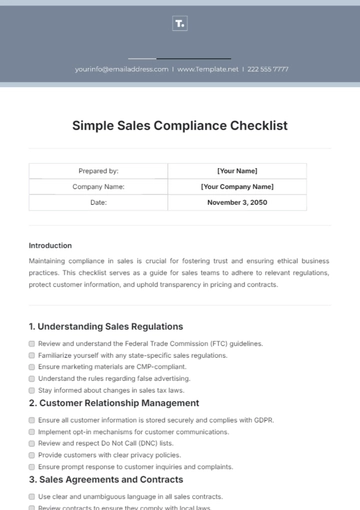

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

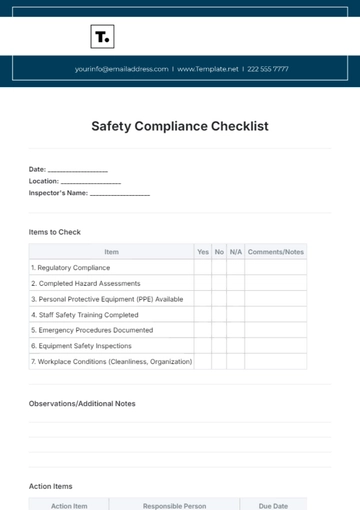

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

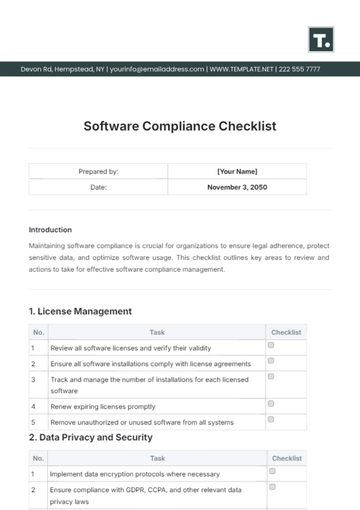

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

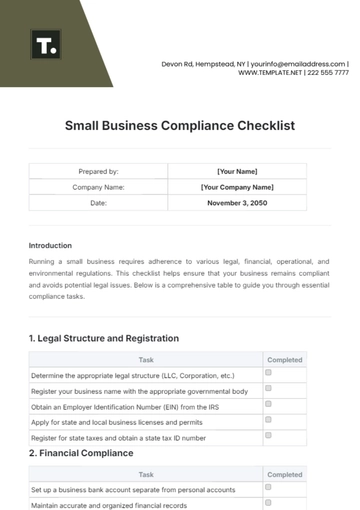

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

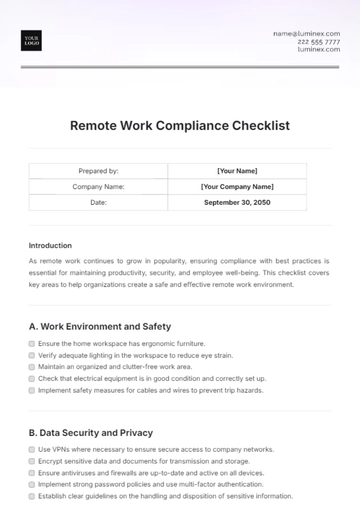

- Work From Home Checklist

- Student Checklist

- Application Checklist