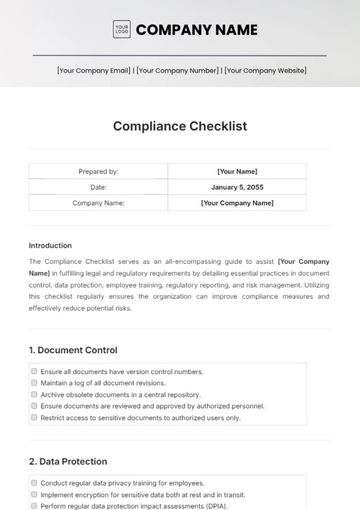

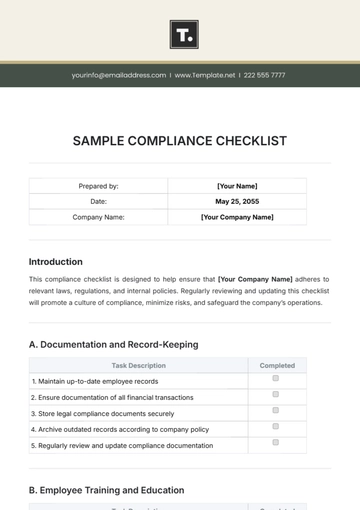

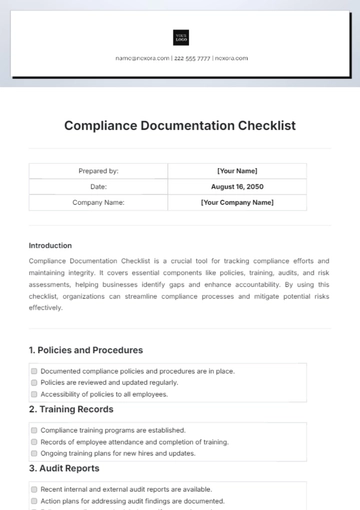

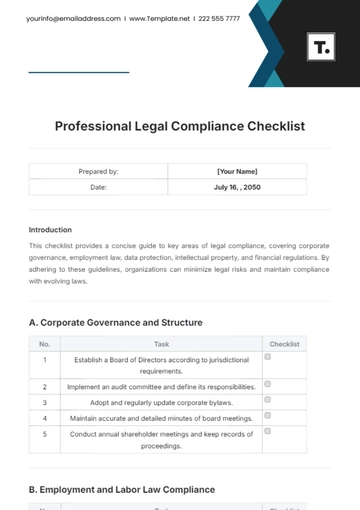

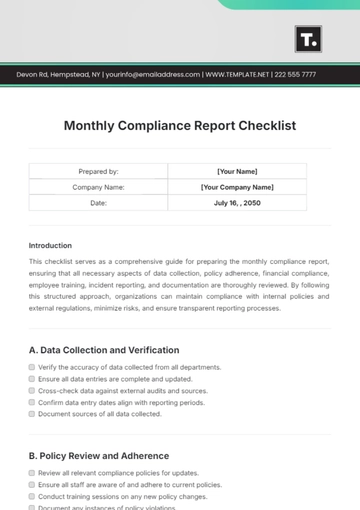

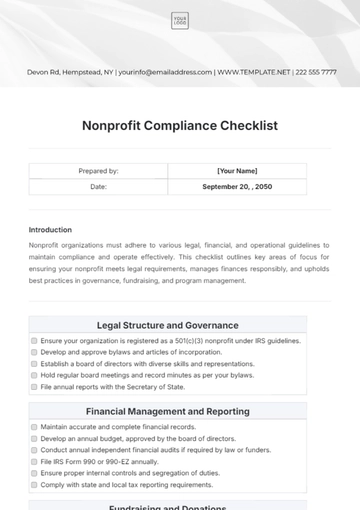

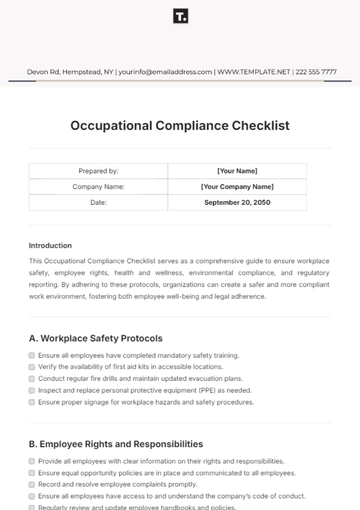

Free Financial Planning Compliance Checklist

I. Compliance Overview

Objective: The Financial Planning Compliance Checklist Template aims to ensure that financial planners conduct regular compliance audits to adhere to regulatory requirements. By systematically reviewing client onboarding, suitability and recommendations, investment portfolio management, regulatory compliance, client communication, fee transparency, and compensation practices, this checklist helps maintain ethical and compliant financial planning practices.

Responsible Party: [YOUR NAME] [YOUR DEPARTMENT]

Date of Last Review: [DATE]

Next Scheduled Review: [DATE]

II. Client Onboarding and Documentation

Verify client identity and perform necessary Know Your Customer (KYC) checks.

Collect and maintain accurate client information, including financial goals, risk tolerance, and investment objectives.

Ensure proper completion and retention of client agreements, disclosures, and consent forms.

III. Suitability and Recommendations

Conduct thorough assessments to ensure that recommended financial products and strategies align with clients' financial goals and risk profiles.

Document the rationale behind each recommendation and any alternative options considered.

Provide clear and transparent communication regarding potential risks and benefits associated with recommended products or strategies.

IV. Investment Portfolio Management

Regularly review client investment portfolios to ensure alignment with stated investment objectives and risk tolerance.

Implement appropriate diversification strategies to mitigate risk and optimize returns.

Monitor investment performance and make adjustments as needed based on changing market conditions or client circumstances.

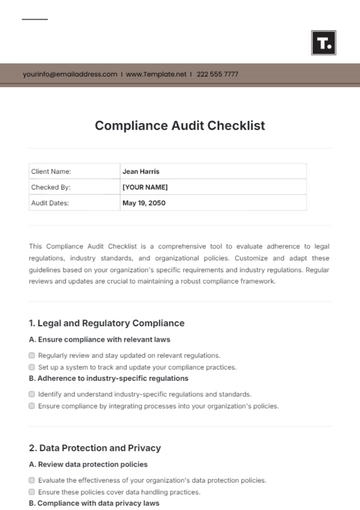

V. Regulatory Compliance

Stay updated on relevant regulatory requirements, including those set forth by financial regulatory authorities such as SEC, FINRA, or relevant state agencies.

Implement and adhere to compliance policies and procedures designed to ensure regulatory compliance.

Conduct periodic reviews and assessments to identify and address any compliance gaps or deficiencies.

VI. Client Communication and Reporting

Provide clients with timely and accurate account statements, performance reports, and other relevant documentation.

Maintain clear and open communication channels with clients to address questions, concerns, or changes in their financial circumstances.

Document all client communications and interactions for compliance and regulatory purposes.

VII. Fee and Compensation Transparency

Disclose all fees, charges, and compensation structures associated with financial products and services offered to clients.

Ensure that fee structures are fair, reasonable, and fully disclosed to clients in a transparent manner.

Provide clients with clear explanations of how advisor compensation may influence recommendations or advice.

VIII. Conflict of Interest Management

Establish policies and procedures to identify and manage conflicts of interest effectively.

Disclose conflicts of interest to clients and obtain appropriate consent when necessary.

Monitor and address potential conflicts of interest to ensure fair and impartial advice to clients.

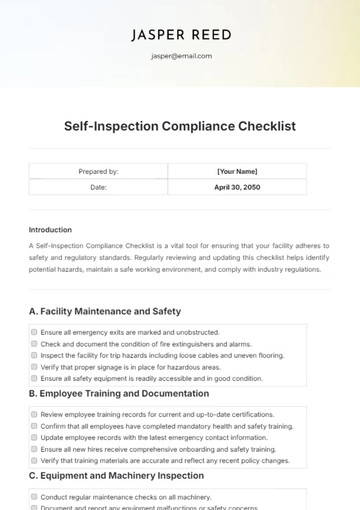

IX. Training and Education

Provide ongoing training to financial planners on compliance requirements, ethical standards, and industry best practices.

Keep records of training sessions attended by financial planning staff.

Encourage continuous learning and professional development to enhance staff competency and compliance awareness.

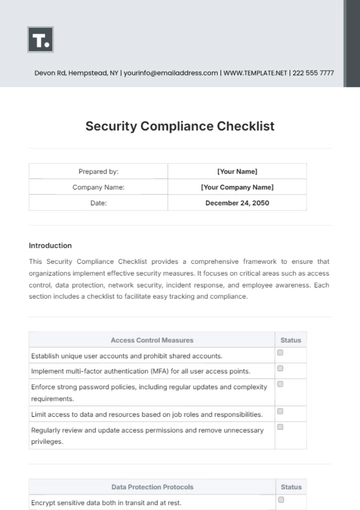

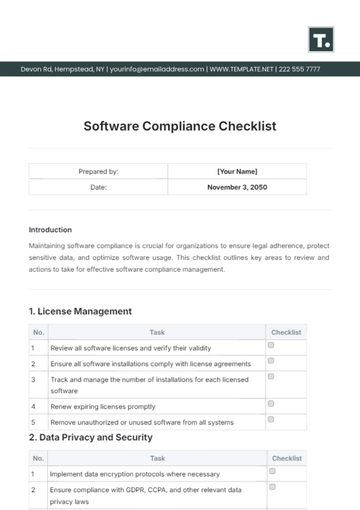

X. Data Protection and Privacy

Ensure compliance with data protection and privacy laws, such as GDPR or CCPA, when handling client information.

Review and update privacy policies and procedures to safeguard client data.

Conduct regular audits to assess data security measures and address any vulnerabilities or breaches.

XI. Complaint Handling and Resolution

Establish procedures for receiving, investigating, and resolving client complaints in a timely and fair manner.

Maintain records of all client complaints and the actions taken to address them.

Use client feedback to identify areas for improvement and implement corrective actions as necessary.

XII. Completion and Sign-off

By checking the box below, I acknowledge that I have reviewed and completed the Financial Planning Compliance Checklist Template.

Completed by: [YOUR NAME] [YOUR DEPARTMENT]

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

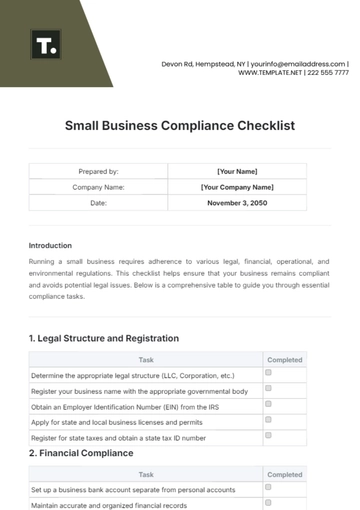

Introducing our Financial Planning Compliance Checklist Template, meticulously designed to ensure thorough evaluation and adherence to regulatory requirements within your financial planning firm. Accessible on Template.net, this editable and customizable checklist covers essential areas such as client disclosure, suitability assessments, recordkeeping, risk management, and regulatory filings. Utilize our Ai Editor Tool to tailor the checklist to your firm's specific compliance needs and regulatory obligations. Simplify your compliance monitoring process and identify areas for improvement effectively with our meticulously crafted template. Elevate your financial planning firm's compliance standards with Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

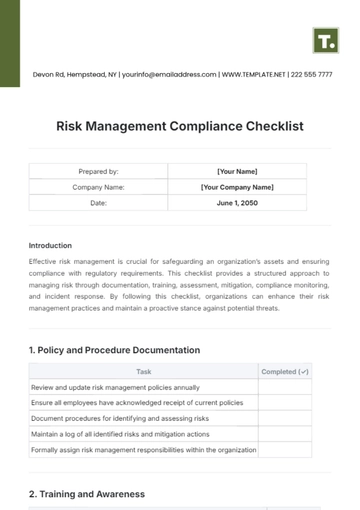

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

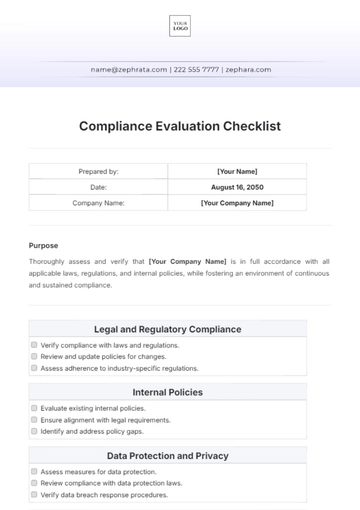

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

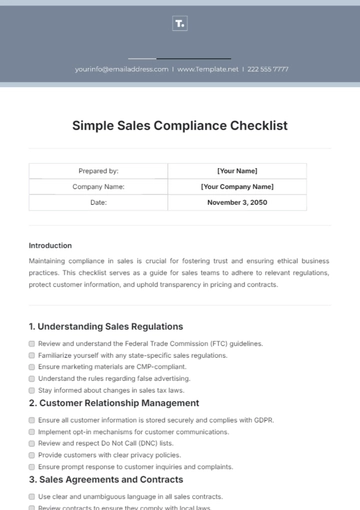

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

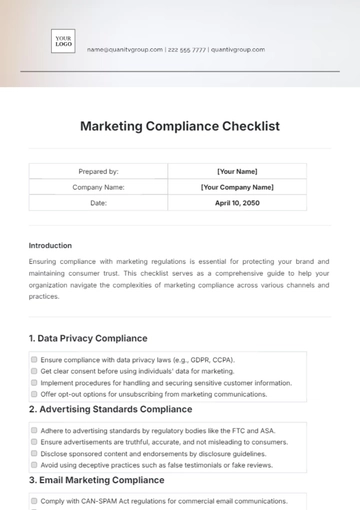

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

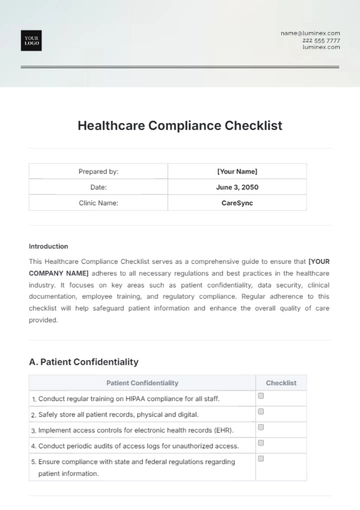

- Medical Checklist

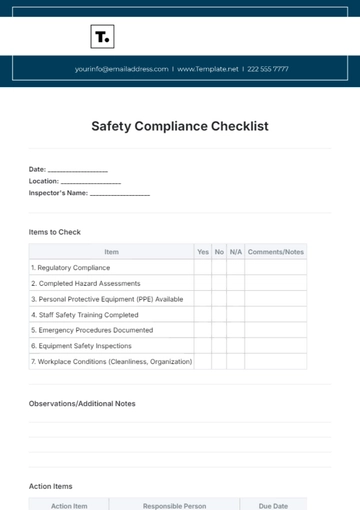

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

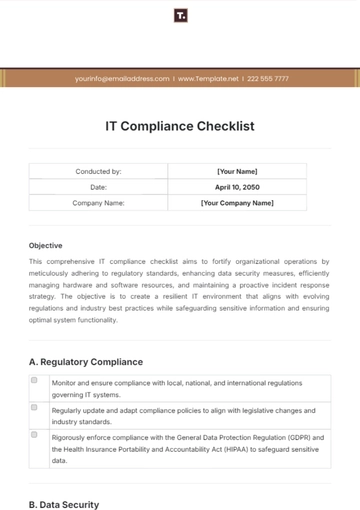

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

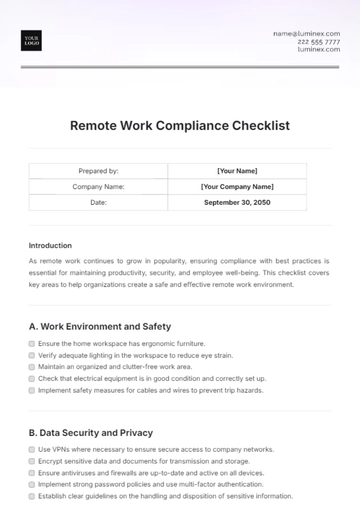

- Work From Home Checklist

- Student Checklist

- Application Checklist