Free Corporate Compliance Agreement

1. Introduction

This Corporate Compliance Agreement (CCA) outlines the necessary steps to ensure [Your Company Name]'s adherence to all applicable laws, regulations, and internal policies.

Compliance is vital to maintaining the company's reputation, protecting its assets, and fostering trust with stakeholders.

2. Compliance Governance

Designate individuals responsible for overseeing compliance.

Define the roles and responsibilities of compliance officers.

3. Legal Compliance

3.1 Regulatory Compliance

Ensure compliance with relevant laws and regulations.

List applicable regulations, such as GDPR, HIPAA, etc.

Regularly review and update compliance measures as laws evolve.

3.2 Corporate Governance

Verify adherence to company bylaws and articles of incorporation.

Confirm compliance with securities laws and regulations.

Regularly review and update corporate governance policies.

4. Ethical Standards

4.1 Code of Conduct

Distribute and enforce the company's code of conduct.

Provide training on ethical behavior and reporting procedures.

Regularly update the code of conduct to reflect changing norms.

4.2 Anti-Corruption

Implement anti-corruption policies and procedures.

Conduct due diligence on third-party partners and vendors.

Provide training on anti-corruption laws and reporting mechanisms.

5. Data Protection and Privacy

5.1 Data Security

Implement measures to safeguard sensitive data.

Encrypt data during storage and transmission.

Conduct regular security audits and risk assessments.

5.2 Privacy Compliance

Ensure compliance with data protection regulations.

Obtain consent for data collection and processing.

Maintain records of data processing activities.

6. Financial Compliance

6.1 Accounting Standards

Adhere to Generally Accepted Accounting Principles (GAAP).

Ensure accuracy and transparency in financial reporting.

Regularly review financial policies and procedures.

6.2 Tax Compliance

File accurate and timely tax returns.

Comply with local, state, and federal tax laws.

Conduct regular tax audits to identify potential issues.

7. Reporting and Monitoring

Establish procedures for reporting compliance violations.

Implement a whistleblower protection program.

Conduct regular audits and assessments to monitor compliance.

8. Training and Education

Provide ongoing training on compliance policies and procedures.

Tailor training programs to address specific compliance risks.

Track employee participation and comprehension of training.

9. Documentation and Record-Keeping

Maintain accurate records of compliance activities and decisions.

Establish retention schedules for compliance documents.

Ensure accessibility of records for audits and investigations.

10. Continuous Improvement

Regularly evaluate and update the compliance program.

Solicit feedback from employees and stakeholders.

Benchmark against industry best practices and standards.

11. Conclusion

Reiterate the importance of compliance to the organization.

Encourage reporting of compliance concerns.

Provide contact information for compliance officers.

12. Signature

By signing below, you acknowledge that you have reviewed and understand the contents of this compliance checklist.

Compliance Officer

[Your Company Name]

Date: [INSERT DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Corporate Compliance Agreement Template from Template.net - the ultimate solution for seamless compliance management. This meticulously crafted document is not just editable but fully customizable to suit your corporate needs. What's more, it's editable in our AI Editor too, ensuring effortless modifications. Stay compliant effortlessly with this versatile template. Compliance has never been this easy.

You may also like

- Lease Agreement

- Non Compete Agreement

- Rental Agreement

- Prenuptial Agreement

- Non Disclosure Agreement

- Operating Agreement

- Hold Harmless Agreement

- LLC Operating Agreement

- Arbitration Agreement

- Purchase Agreement

- Residential Lease Agreement

- Executive Agreement

- Confidentiality Agreement

- Contractor Agreement

- Partnership Agreement

- Postnuptial Agreement

- Collective Bargaining Agreement

- Loan Agreement

- Roommate Agreement

- Commercial Lease Agreement

- Separation Agreement

- Cohabitation Agreement

- Room Rental Agreement

- Child Custody Agreement

- Employee Agreement

- License Agreements

- Settlement Agreement

- Joint Venture Agreement

- Indemnity Agreement

- Subordination Agreement

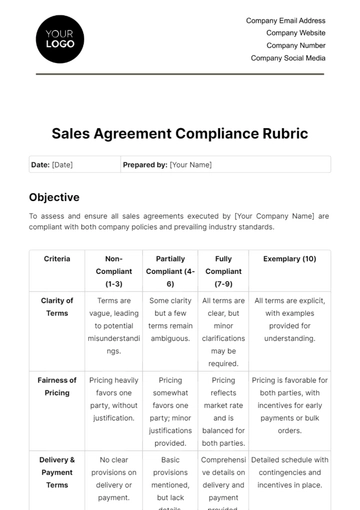

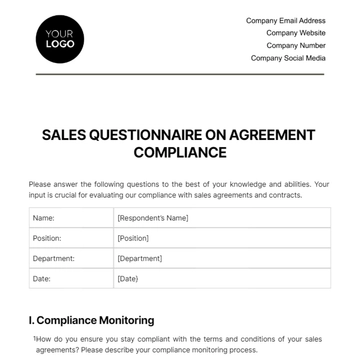

- Sales Agreement

- Agreements Between Two Parties

- Business Agreement

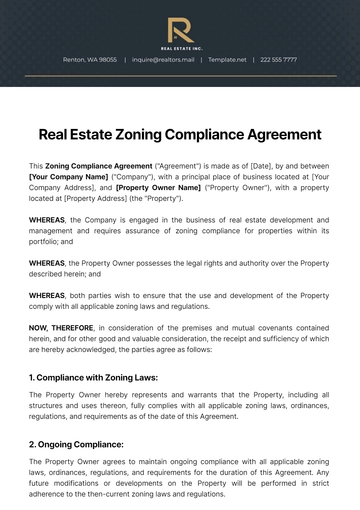

- Real Estate Agreement

- HR Agreement

- Service Agreement

- Property Agreement

- Agreement Letter

- Restaurant Agreement

- Construction Agreement

- Finance Agreement

- Marketing Agreement

- Payment Agreement

- Investment Agreement

- Management Agreement

- Nonprofit Agreement

- Software Agreement

- Startup Agreement

- Agency Agreement

- Copyright Agreement

- Collaboration Agreement

- Reseller Agreement

- Car Rental Agreement

- Cleaning Services Agreement

- Consultant Agreement

- Deed Agreement

- Car Agreement

- Equipment Agreement

- Shares Agreement

- Data Sharing Agreement

- Advertising Agreement

- School Agreement

- Franchise Agreement

- Event Agreement

- Travel Agency Agreement

- Vehicle Agreement

- Board Resolution Agreement

- Land Agreement

- Binding Agreement

- Tenancy Agreement

- Exclusive Agreement

- Development Agreement

- Assignment Agreement

- Design Agreement

- Equity Agreement

- Mortgage Agreement

- Purchase and Sale Agreement

- Shareholder Agreement

- Vendor Agreement

- Royalty Agreement

- Vehicle Lease Agreement

- Hotel Agreement

- Tenant Agreement

- Artist Agreement

- Commission Agreement

- Consignment Agreement

- Debt Agreement

- Recruitment Agreement

- Training Agreement

- Transfer Agreement

- Apprenticeship Agreement

- IT and Software Agreement

- Referral Agreement

- Resolution Agreement

- Waiver Agreement

- Consent Agreement

- Partner Agreement

- Social Media Agreement

- Customer Agreement

- Credit Agreement

- Supply Agreement

- Agent Agreement

- Brand Agreement

- Law Firm Agreement

- Maintenance Agreement

- Mutual Agreement

- Retail Agreement

- Deposit Agreement

- Land Purchase Agreement

- Nursing Home Agreement

- Supplier Agreement

- Buy Sell Agreement

- Child Support Agreement

- Landlord Agreement

- Payment Plan Agreement

- Release Agreement

- Research Agreement

- Sponsorship Agreement

- Buyout Agreement

- Equipment Rental Agreement

- Farm Agreement

- Manufacturing Agreement

- Strategic Agreement

- Termination of Lease Agreement

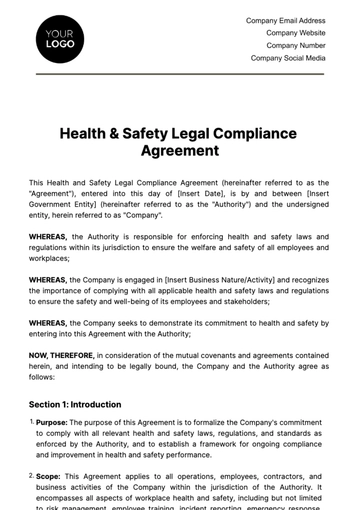

- Compliance Agreement

- Family Agreement

- Interior Design Agreement

- Ownership Agreement

- Residential Lease Agreement

- Retainer Agreement

- Trade Agreement

- University Agreement

- Broker Agreement

- Dissolution Agreement

- Funding Agreement

- Hosting Agreement

- Investor Agreement

- Memorandum of Agreement

- Advisory Agreement

- Affiliate Agreement

- Freelancer Agreement

- Grant Agreement

- Master Service Agreement

- Parking Agreement

- Subscription Agreement

- Trust Agreement

- Cancellation Agreement

- Horse Agreement

- Influencer Agreement

- Membership Agreement

- Vacation Rental Agreement

- Wholesale Agreement

- Author Agreement

- Distributor Agreement

- Exchange Agreement

- Food Agreement

- Guarantee Agreement

- Installment Agreement

- Internship Agreement

- Music Agreement

- Severance Agreement

- Software Development Agreement

- Storage Agreement

- Facility Agreement

- Intercompany Agreement

- Lending Agreement

- Lodger Agreement

- Outsourcing Services Agreement

- Usage Agreement

- Assurance Agreement

- Photography Agreement

- Profit Sharing Agreement

- Relationship Agreement

- Rent To Own Agreement

- Repayment Agreement

- Volunteer Agreement

- Co Parenting Agreement

- HVAC Agreement

- Lawn Care Agreement

- SAAS Agreement

- Work from Home Agreement

- Coaching Agreement

- Protection Agreement

- Security Agreement

- Repair Agreement

- Agreements License