Free Annual Financial Report

I. Introduction

Welcome to the Annual Financial Report for [YOUR COMPANY NAME] for the fiscal year ending December 31, 2050. This report provides an in-depth analysis of our financial performance, strategic initiatives, and outlook for the future. Our commitment to transparency and accountability ensures that all stakeholders are well-informed about our financial health and strategic direction.

II. Financial Statements

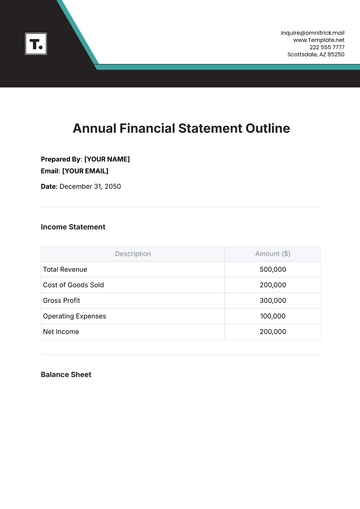

Income Statement

Income Statement | Amount |

|---|---|

Revenue | $1,200,000,000 |

Cost of Goods Sold | $700,000,000 |

Gross Profit | $500,000,000 |

Operating Expenses | $250,000,000 |

Operating Income | $250,000,000 |

Interest Expense | $20,000,000 |

Income Before Taxes | $230,000,000 |

Income Tax Expense | $50,000,000 |

Net Income | $180,000,000 |

Balance Sheet

Balance Sheet | Amount |

|---|---|

Total Assets | $2,500,000,000 |

Current Assets | $1,000,000,000 |

Non-Current Assets | $1,500,000,000 |

Total Liabilities | $1,000,000,000 |

Current Liabilities | $400,000,000 |

Non-Current Liabilities | $600,000,000 |

Shareholders’ Equity | $1,500,000,000 |

Common Stock | $500,000,000 |

Retained Earnings | $1,000,000,000 |

Cash Flow Statement

Cash Flow Statement | Amount |

|---|---|

Net Cash from Operating Activities | $220,000,000 |

Net Cash from Investing Activities | -($50,000,000) |

Net Cash from Financing Activities | $80,000,000 |

Net Increase in Cash | $250,000,000 |

III. Management Discussion and Analysis (MD&A)

Overview

In 2050, [YOUR COMPANY NAME] achieved significant milestones, including record revenue growth and substantial improvements in operational efficiency. Our strategic initiatives focused on expanding market share, enhancing product offerings, and optimizing our cost structure.

Market Conditions

The global market experienced robust growth, driven by advancements in technology and increased demand for innovative products. Key sectors such as artificial intelligence, renewable energy, and biotechnology saw significant expansion, creating opportunities for our diverse product portfolio. Despite challenges such as increased competition and regulatory changes, we navigated the landscape successfully by leveraging our strengths and adapting quickly.

Financial Performance

Our financial performance in 2050 was marked by a 15% increase in revenue compared to the previous year. This growth was driven by successful product launches and expansion into new markets. Cost management initiatives helped improve our gross margin by 2%. The increase in operating income reflects our ability to manage expenses effectively while investing in key areas like research and development.

Strategic Initiatives

Key strategic initiatives in 2050 included:

Product Innovation: Launching three new products, including the AI-powered SmartHome Assistant, the EcoDrive electric vehicle, and the BioHeal medical device. These products have been well-received in the market, contributing to a 20% increase in sales.

Market Expansion: Entering five new international markets, including Brazil, India, and South Africa, contributing to a 20% increase in international sales.

Operational Efficiency: Implementing advanced manufacturing technologies and lean production processes, resulting in a 10% reduction in operational costs.

IV. Auditor’s Report

We engaged [AUDITOR'S NAME] to conduct an independent audit of our financial statements. The auditor's report confirms that our financial statements present a true and fair view of our financial position in accordance with the relevant accounting standards. The audit included an examination of evidence supporting the amounts and disclosures in the financial statements, as well as an assessment of the accounting principles used and significant estimates made by management.

V. Notes to the Financial Statements

Accounting Policies

The financial statements have been prepared in accordance with generally accepted accounting principles (GAAP). Key accounting policies include:

Revenue Recognition: Revenue is recognized when the control of the goods or services is transferred to the customer.

Inventory Valuation: Inventory is valued at the lower of cost or net realizable value.

Depreciation Methods: Property, plant, and equipment are depreciated using the straight-line method over their estimated useful lives.

Additional Disclosures

Segment Reporting: The company operates in three main segments: Consumer Electronics, Automotive, and Healthcare. Each segment has shown growth and contributed positively to the overall performance.

Contingent Liabilities: The company is involved in several ongoing legal proceedings, with potential liabilities estimated at $30,000,000.

Related Party Transactions: Transactions with related parties totaled $10,000,000, primarily involving shared services and joint ventures.

VI. Strategic Planning

Vision for the Future

[YOUR COMPANY NAME] is committed to sustaining growth and creating value for our shareholders. Our strategic vision for the next five years includes:

Innovation Leadership: Continuously investing in research and development to maintain our position as an industry leader. Our goal is to allocate 10% of annual revenue to R&D to foster innovation and bring cutting-edge products to market.

Global Expansion: Further expanding our footprint in emerging markets to drive growth. We aim to increase our presence in Asia and Africa, targeting a 30% increase in international sales.

Sustainability: Enhancing our sustainability initiatives to minimize environmental impact and promote social responsibility. We are committed to achieving carbon neutrality by 2060 and reducing waste by 50% over the next decade.

Goals and Objectives

Our primary goals for the next fiscal year include:

Goals and Objectives | Targets |

|---|---|

Achieving a 10% increase in revenue | Enhance product offerings and enter new markets |

Launching two new product lines | Focus on smart technology and renewable energy |

Reducing operational costs by 5% | Continue process optimization and technology integration |

Enhancing shareholder value through strategic acquisitions and partnerships | Explore opportunities in AI and biotechnology sectors |

VII. Conclusion

The fiscal year 2050 was a year of significant achievements and growth for [YOUR COMPANY NAME]. We are proud of our accomplishments and remain committed to our strategic goals. We extend our gratitude to our shareholders, employees, customers, and partners for their continued support and trust.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your financial reporting with our Annual Financial Report Template from Template.net. This customizable and editable template offers a seamless experience for professionals seeking precision and efficiency in their reporting process. Crafted with the user in mind, it integrates seamlessly with our AI Editor Tool, ensuring accuracy and ease of use.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report