Free Small Business Expense Report

Prepared By | Company | Date Prepared |

|---|---|---|

[YOUR NAME] | [YOUR COMPANY NAME] | [DATE] |

I. Introduction

This Small Business Expense Report provides a detailed overview of the business expenses incurred by [YOUR COMPANY NAME] during a specific period. This report aims to track, categorize, and analyze expenses to monitor spending trends, identify cost-saving opportunities, and ensure financial accountability. By maintaining accurate and organized expense records, small businesses can effectively manage their finances, optimize budget allocation, and improve profitability.

A. Purpose

Track and Categorize Expenses: The primary objective is to track and categorize all business-related expenses according to their nature, department, and purpose. This facilitates better understanding and management of expenditure across different operational areas.

Monitor Spending Trends: Through the analysis of expense data, [YOUR COMPANY NAME] seeks to monitor spending trends over time, identifying fluctuations, anomalies, and potential areas of overspending or underutilization.

Evaluate Budget Allocation: By evaluating actual expenses against budgeted amounts, this report enables the company to assess the effectiveness of budget allocation strategies, ensuring alignment with organizational goals and priorities.

Provide Decision-Making Insights: The insights derived from this report empower decision-makers within the company to make informed decisions regarding cost optimization, resource reallocation, and strategic investments.

B. Scope

This report encompasses a wide range of expense categories pertinent to the operations of [YOUR COMPANY NAME], including but not limited to:

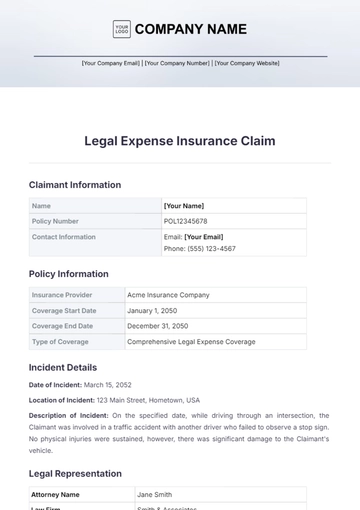

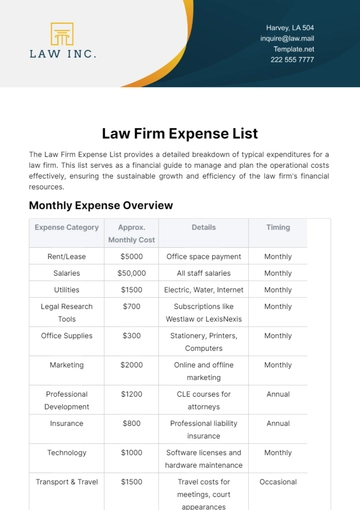

Operating Expenses: This category includes essential expenditures such as rent, utilities, office supplies, maintenance, and repairs necessary for the day-to-day functioning of the business.

Marketing Expenses: Encompassing advertising campaigns, digital marketing initiatives, promotional events, and market research activities aimed at enhancing brand visibility and driving customer engagement.

Payroll Costs: Covering salaries, wages, bonuses, employee benefits, payroll taxes, and other compensation-related expenses incurred in remunerating the workforce of the company.

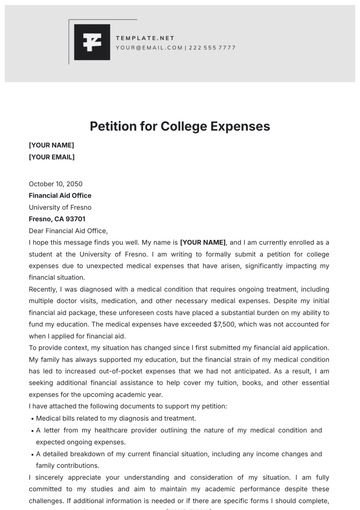

Miscellaneous Expenses: This category comprises various incidental costs, including travel expenses, professional fees, training expenses, subscriptions, and other miscellaneous outlays essential for business operations.

II. Methodology

To gather relevant data and insights for this report, a structured expense tracking process was followed, which included:

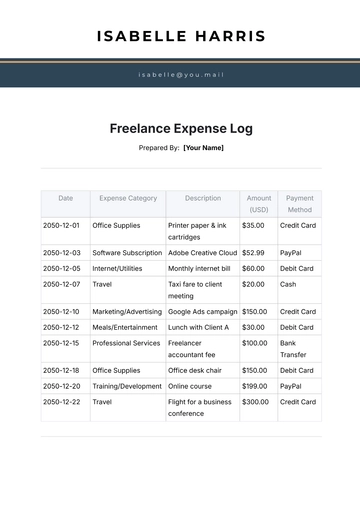

A. Data Collection

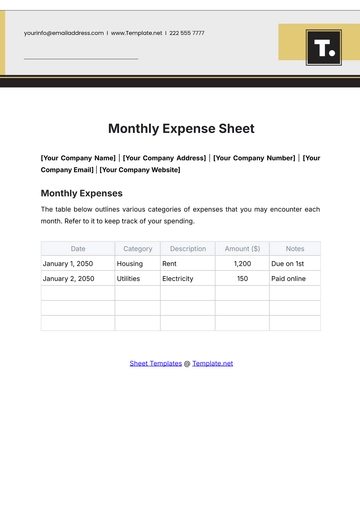

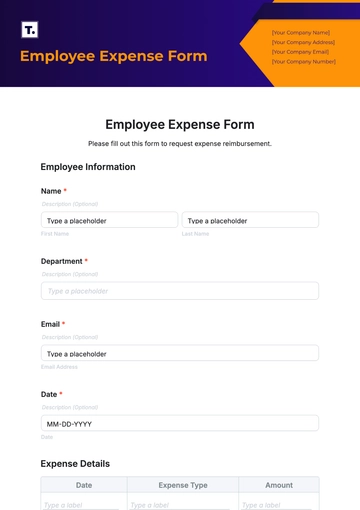

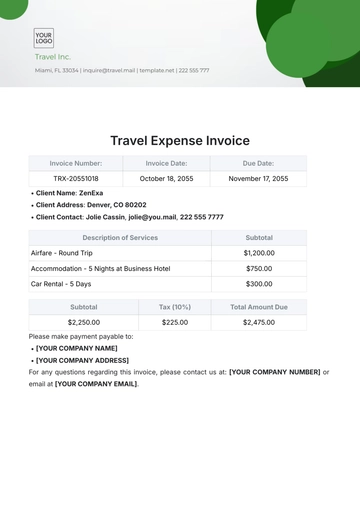

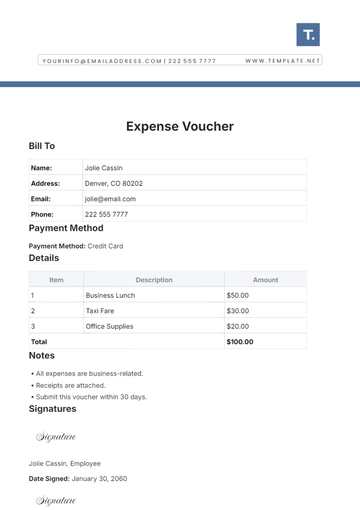

Expense Receipts: All business-related expenses incurred by employees, departments, or the organization as a whole were meticulously documented and supported by valid receipts, invoices, or billing statements.

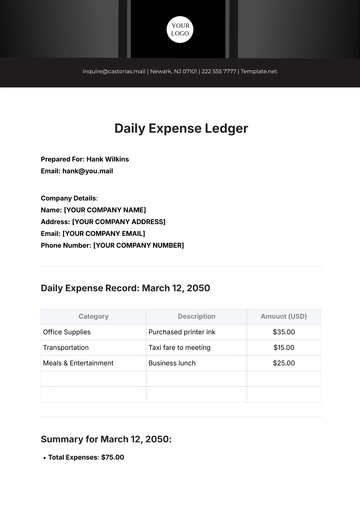

Expense Categorization: Each expense was systematically categorized into relevant expense categories based on its nature, purpose, and departmental allocation, ensuring accurate classification and analysis.

Expense Analysis: The collected expense data underwent thorough analysis using advanced financial analysis tools and techniques to derive meaningful insights, trends, and patterns.

B. Data Analysis

The analysis of expense data involved:

Spending Trends Analysis: Identifying recurring patterns, seasonal fluctuations, and emerging trends in expenditure across different expense categories and departments.

Cost Variance Analysis: Comparing actual expenses with budgeted amounts to determine variances, deviations, and discrepancies, thereby facilitating proactive cost management and budgetary control.

III. Findings

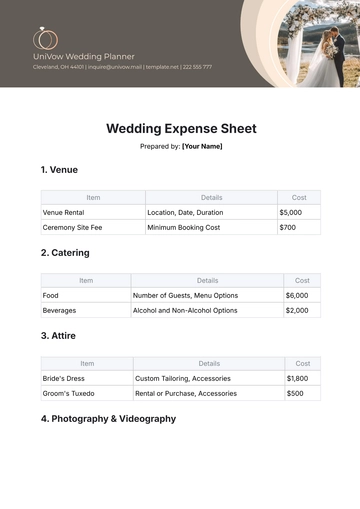

A. Expense Categories

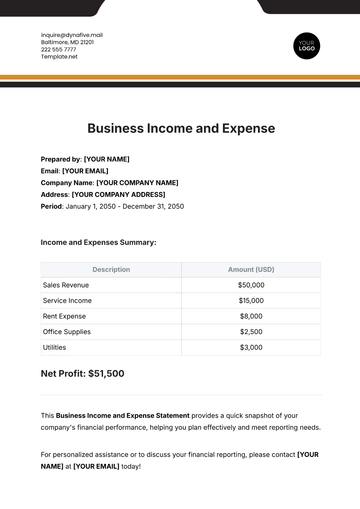

The analysis reveals the following major expense categories for [YOUR COMPANY NAME]:

Operating Expenses: This category accounted for the largest portion of total expenses, primarily driven by rent, utilities, maintenance, and office supplies, reflecting the essential costs of maintaining business operations.

Marketing Expenses: Marketing expenditures constituted a significant portion of total expenses, reflecting investments in brand promotion, advertising campaigns, digital marketing channels, and customer acquisition initiatives.

Payroll Costs: Payroll-related expenses represented a substantial portion of total expenditures, reflecting investments in human capital and employee remuneration, including salaries, wages, bonuses, and benefits.

Miscellaneous Expenses: Miscellaneous outlays comprised various incidental expenses across different operational areas, including travel expenses, professional fees, training costs, and subscription fees.

IV. Analysis

A. Spending Trends

The analysis of spending trends highlighted several key insights, including:

Seasonal Variations: Certain expense categories exhibited seasonal variations, with fluctuations in spending patterns influenced by factors such as business cycles, industry trends, and market dynamics.

Cost Drivers: Identified primary cost drivers contributing to overall expenditure, enabling [YOUR COMPANY NAME] to prioritize cost-saving initiatives and resource optimization efforts.

B. Cost Variance Analysis

Budget Adherence: While certain expense categories remained within budgetary limits, others exceeded allocated amounts, indicating potential areas for budgetary adjustments and reallocation of resources.

Root Cause Analysis: Conducted in-depth analysis to identify underlying reasons for cost variances, distinguishing between controllable and uncontrollable factors impacting expenditure.

V. Recommendations

Based on the findings, the following recommendations are proposed to optimize expense management and improve financial efficiency:

Implement Expense Approval Process: Establish a formal expense approval process to ensure all business expenses are authorized and aligned with the company's budget and objectives. This will help prevent unauthorized spending and improve financial control.

Review and Negotiate Vendor Contracts: Regularly review vendor contracts and negotiate better terms to reduce operating expenses. Consider consolidating suppliers or switching to more cost-effective alternatives without compromising quality.

Optimize Marketing Spend: Evaluate the return on investment (ROI) of various marketing initiatives and focus on channels that provide the highest ROI. Allocate the budget to strategies that have proven to be effective in reaching the target audience and generating leads.

Implement Expense Tracking Software: Invest in expense tracking software to automate the expense reporting process, streamline approvals, and generate real-time expense reports. This will save time, reduce errors, and provide better visibility into company spending.

VI. Conclusion

In conclusion, this Small Business Expense Report provides valuable insights into the business expenses incurred by [YOUR COMPANY NAME]. By implementing the recommended strategies and enhancing expense management practices, the organization can optimize its spending, improve financial efficiency, and achieve its business objectives more effectively.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your business strategy with our Small Business Report Template from Template.net. Tailored for efficiency, this customizable and editable template offers seamless integration into your workflow. Crafted with precision and powered by an intuitive AI Editor Tool, it streamlines your reporting process effortlessly. Elevate your presentations and analyses with this essential tool.