Free Bank Fraud Incident Report

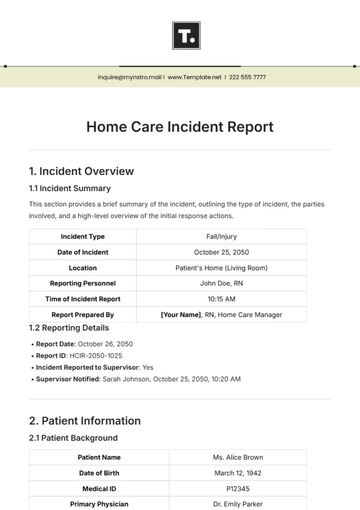

Prepared By | Company | Date Prepared |

|---|---|---|

[YOUR NAME] | [YOUR COMPANY NAME] | [DATE] |

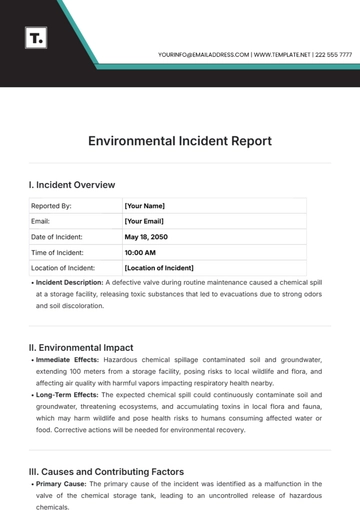

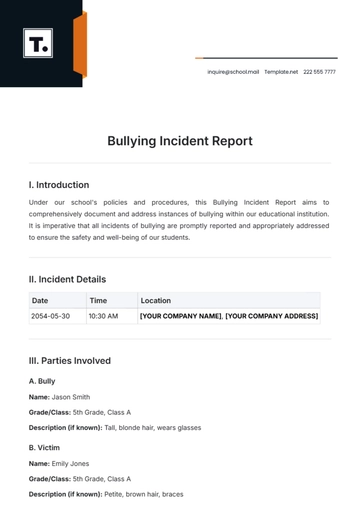

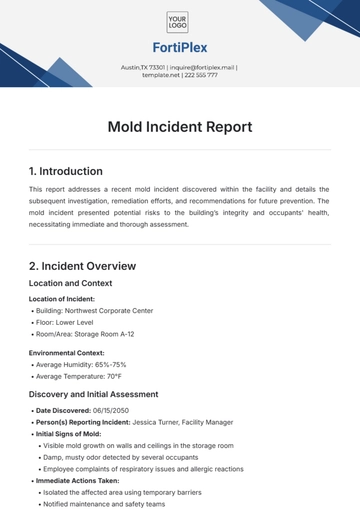

I. Introduction

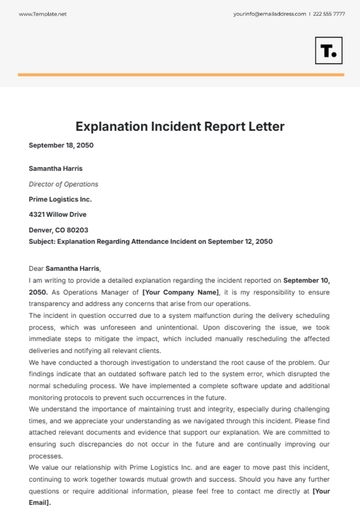

The Bank Fraud Incident Report provides a detailed account of any suspected or confirmed fraudulent activities that have occurred within [BANK NAME]. This report aims to document, investigate, and analyze fraud incidents to understand the nature of the fraud, assess its impact, and recommend preventive measures. By maintaining comprehensive records of fraud incidents, the bank can enhance its fraud detection and prevention mechanisms, protect customer assets, and maintain trust and confidence among its stakeholders.

Purpose

Document and categorize suspected or confirmed fraudulent activities.

Investigate the root causes and methods used in fraud incidents.

Assess the financial impact of fraud on the bank and affected customers.

Develop and implement preventive measures to mitigate future fraud risks.

Scope

This report will focus on analyzing various types of fraud incidents reported in [BANK NAME], including unauthorized transactions, identity theft, phishing scams, and internal fraud. It will cover incident identification, classification, investigation, resolution, and recommendations for strengthening fraud prevention measures.

II. Methodology

To gather relevant data and insights for this report, a structured fraud management process was followed, which included:

Data Collection

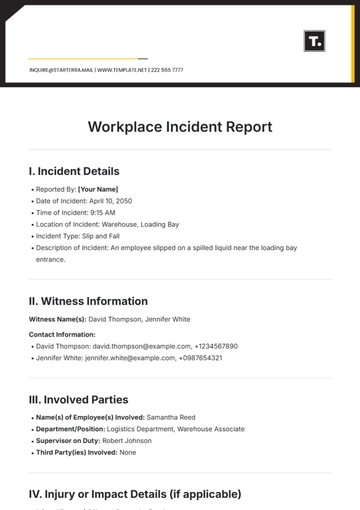

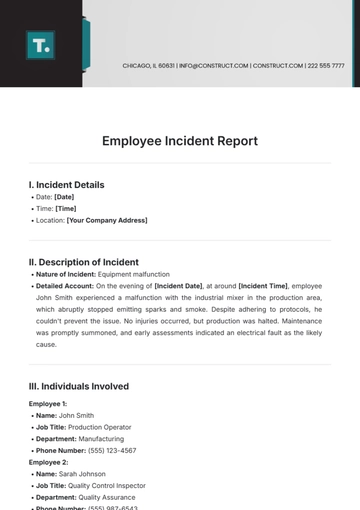

Incident Reporting: Recording detailed information about each fraud incident, including date, time, affected accounts, transaction details, and initial assessment.

Incident Classification: Categorizing fraud incidents based on type, severity, and impact to prioritize investigation efforts.

Incident Investigation: Conducting a thorough investigation to determine the root causes, methods, and perpetrators involved in fraud incidents.

Data Analysis

The collected fraud incident data was analyzed using fraud detection tools and techniques to identify patterns, trends, and common modus operandi. This analysis helped in understanding the nature and extent of fraud, assessing the financial impact, and identifying areas for improvement in fraud prevention and detection.

III. Findings

Fraud Classification

The analysis reveals the following categories of fraud incidents within [BANK NAME]:

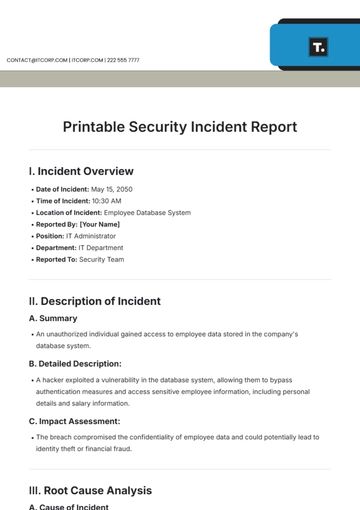

Unauthorized Transactions: [DESCRIPTION OF UNAUTHORIZED TRANSACTIONS]

Identity Theft: [DESCRIPTION OF IDENTITY THEFT INCIDENTS]

Phishing Scams: [DESCRIPTION OF PHISHING SCAMS]

Internal Fraud: [DESCRIPTION OF INTERNAL FRAUD INCIDENTS]

IV. Analysis

Financial Impact Assessment

Quantify the financial losses incurred due to fraud incidents.

Assess the impact on affected customers' accounts and the bank's reputation.

Root Cause Analysis

Identify the underlying causes and vulnerabilities that allowed fraud incidents to occur.

Evaluate the effectiveness of current fraud prevention and detection controls.

Trend Analysis

Identify patterns and trends in fraud incident data to anticipate potential future risks.

Monitor key performance indicators (KPIs) to measure the effectiveness of fraud management efforts over time.

V. Recommendations

Based on the findings, the following recommendations are proposed to strengthen fraud prevention and detection mechanisms:

Recommendation | Description |

|---|---|

Recommendation 1 | Enhance Security Measures: Implement advanced security measures, such as multi-factor authentication, encryption, and fraud monitoring systems, to protect customer accounts and transactions from unauthorized access and fraudulent activities. |

Recommendation 2 | Improve Customer Awareness: Launch awareness campaigns and educational programs to educate customers about common fraud schemes, phishing scams, and identity theft prevention tips. Encourage customers to regularly review their account statements and report any suspicious activities promptly. |

Recommendation 3 | Strengthen Internal Controls: Review and update internal controls and procedures to detect and prevent internal fraud. Implement segregation of duties, regular audits, and monitoring mechanisms to identify and deter fraudulent activities by employees. |

Recommendation 4 | Collaborate with Law Enforcement: Establish strong partnerships with law enforcement agencies and regulatory authorities to collaborate on fraud investigations, share information, and prosecute fraudsters effectively. |

VI. Conclusion

In conclusion, the Bank Fraud Incident Report provides valuable insights into the fraudulent activities occurring within [BANK NAME]. By implementing the recommended strategies and enhancing fraud management practices, the bank can strengthen its defenses against fraud, protect its assets and customers, and maintain its reputation as a trusted financial institution.

Note: This template serves as a tool for analyzing and managing fraud incidents within a bank. It can be customized to fit the specific needs and requirements of [BANK NAME].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Bank Fraud Incident Report Template on Template.net—a meticulously crafted document designed for accuracy and efficiency. This editable and customizable template can be effortlessly tailored to your specific needs. Plus, it's fully editable in our AI Editor Tool, ensuring seamless customization for precise reporting. Ideal for safeguarding financial integrity!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report