Free Bank Teller Resume Summary

Name: | [YOUR NAME] |

|---|---|

Company: | [YOUR COMPANY NAME] |

Date: | [DATE] |

Introduction:

Detail-oriented and customer-focused bank teller with [X years] of experience in providing efficient banking services. Proficient in cash handling, account management, and customer service. Skilled in accurately processing transactions and promoting financial products to enhance customer satisfaction and loyalty.

Key Skills:

Key Skills | Description |

|---|---|

Cash Handling & Balancing | Proficient in accurately handling cash transactions, including deposits, withdrawals, and check cashing, while ensuring precise balancing at the end of each shift. |

Account Management | Skilled in assisting customers with account inquiries, and providing comprehensive information on balances, transactions, and available services to ensure customer confidence. |

Customer Service Excellence | Dedicated to delivering exceptional service to customers by addressing inquiries, resolving issues, and promoting bank products to exceed customer expectations. |

Transaction Processing | Excel in processing various financial transactions with precision and adherence to banking protocols, including loan payments, wire transfers, and other banking transactions. |

Financial Product Knowledge | Stay updated on the latest financial products and services offered by the bank to effectively promote offerings based on customer needs and goals, facilitating informed decisions. |

Compliance & Regulation Adherence | Thorough understanding of banking regulations and procedures to ensure compliance, mitigate risks, and safeguard customer information and confidentiality. |

Problem-Solving | Solution-oriented mindset to identify and resolve customer concerns and operational challenges, enhancing efficiency and customer satisfaction. |

Attention to Detail | Meticulous attention to detail in verifying transaction details, maintaining accurate documentation, and minimizing errors to uphold the integrity of banking operations. |

Professional Experience:

[Current/Previous Position] Bank Name, City, State [Month, Year] - [Month, Year]

Conducted cash transactions, including deposits, withdrawals, and check cashing, accurately and efficiently.

Assisted customers with account inquiries, providing information on balances, transactions, and account services.

Promoted bank products and services to customers, identifying opportunities to meet their financial needs.

Ensured compliance with banking regulations and procedures, minimizing risks and maintaining security protocols.

[Previous Position] Bank Name, City, State [Month, Year] - [Month, Year]

Managed cash drawer, ensuring proper balancing at the beginning and end of each shift.

Resolved customer issues and inquiries in a timely and professional manner, exceeding service expectations.

Processed loan payments, wire transfers, and other financial transactions accurately and securely.

Collaborated with team members to achieve branch goals and deliver exceptional customer service.

Education:

Degree: [YOUR DEGREE NAME]

University/College: [UNIVERSITY NAME]

Graduation Year: [YEAR]

Certifications:

Certification Name | Year of Certification |

|---|---|

[Certification Name] - [Certifying Organization] | [Year of Certification] |

[Certification Name] - [Certifying Organization] | [Year of Certification] |

Conclusion:

My experience as a bank teller, combined with strong customer service skills and attention to detail, makes me well-suited for [target bank]. I am dedicated to providing efficient banking services and ensuring customer satisfaction. With a proven track record of accuracy and professionalism, I am prepared to contribute to the success of the bank and exceed performance expectations.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

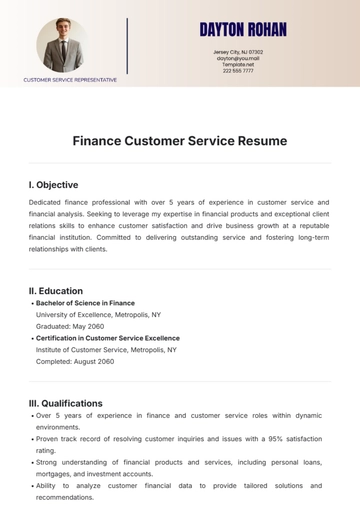

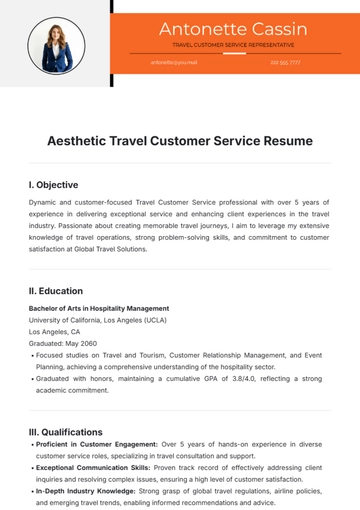

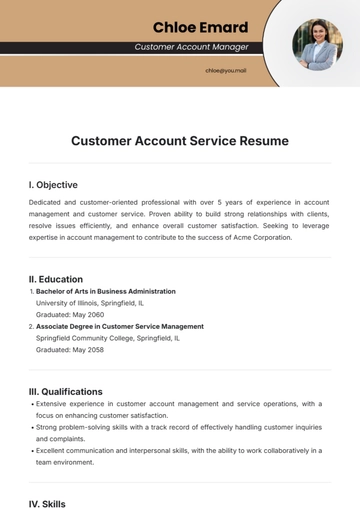

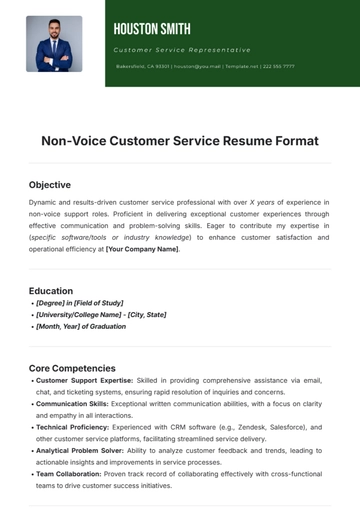

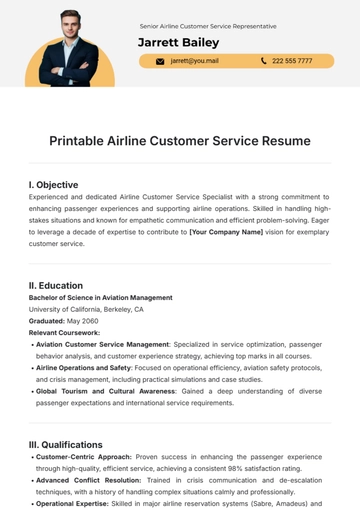

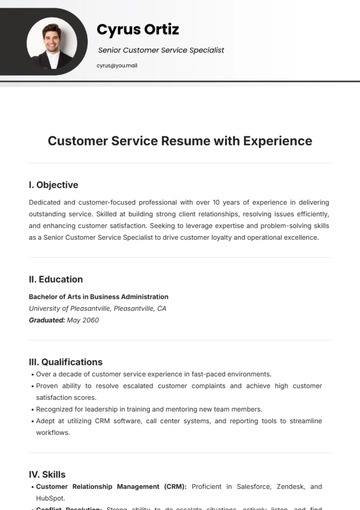

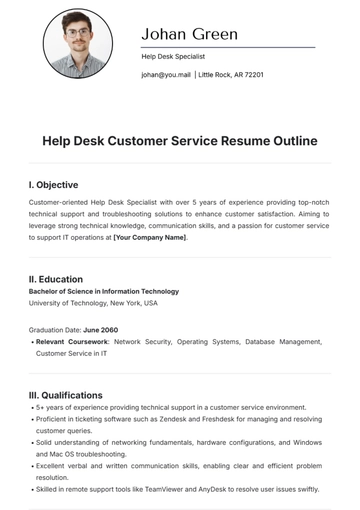

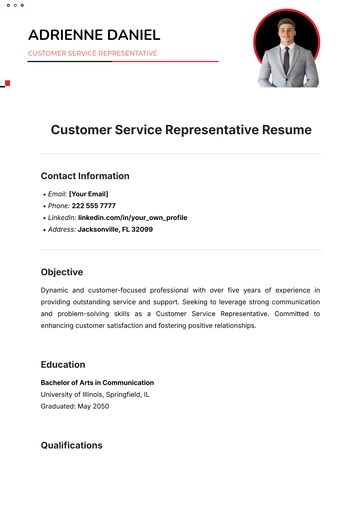

Introducing the Bank Teller Resume Summary Template from Template.net! Crafted for aspiring bank tellers, this editable and customizable template ensures your resume stands out. Tailor your skills and experience effortlessly using our AI Editor Tool. Get noticed in the competitive banking industry with a professional resume that speaks volumes.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

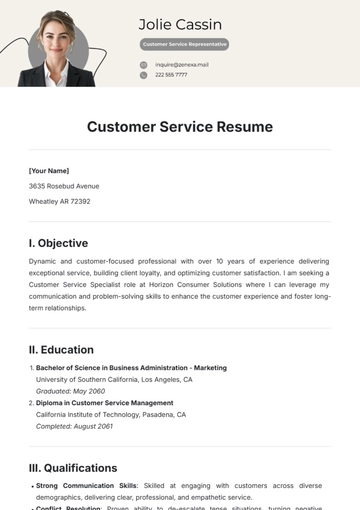

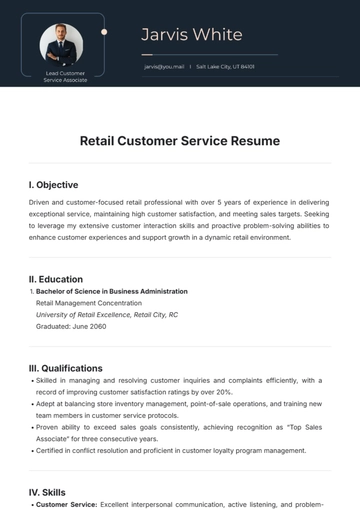

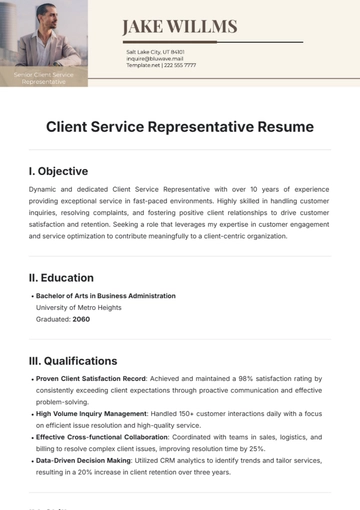

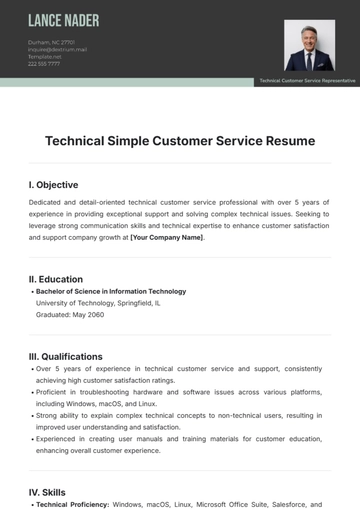

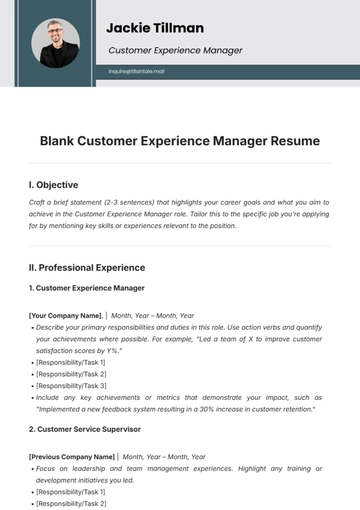

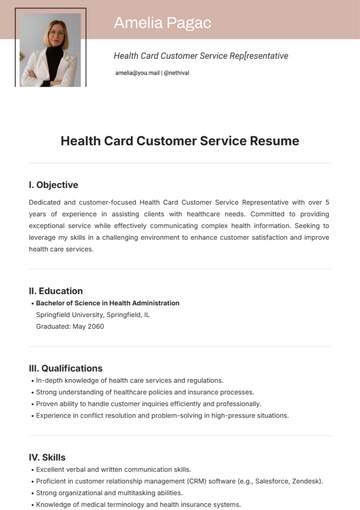

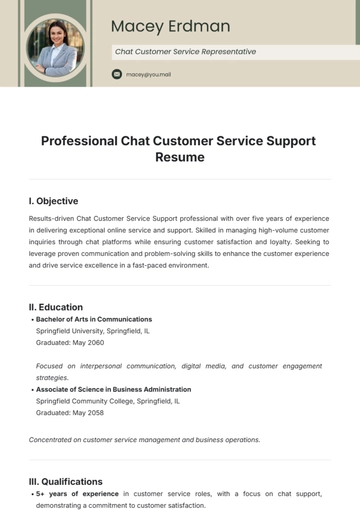

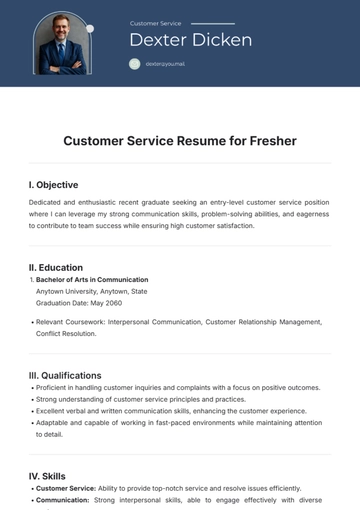

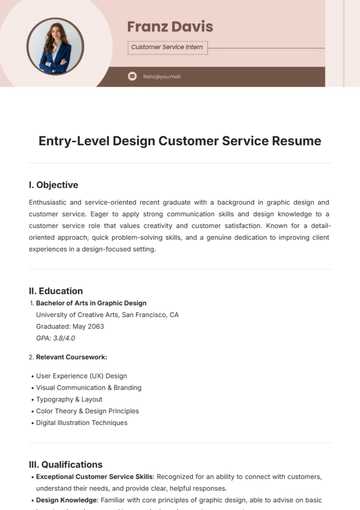

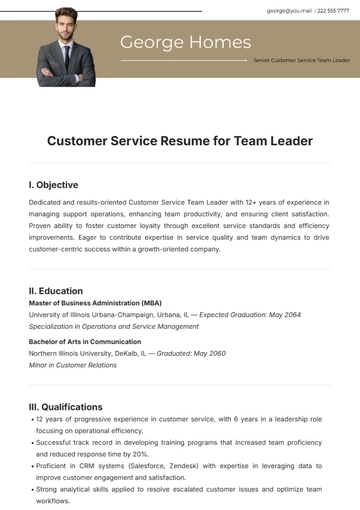

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

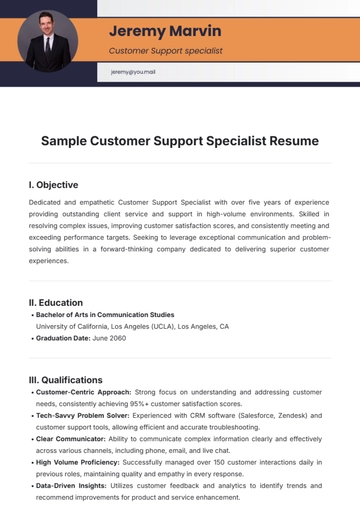

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

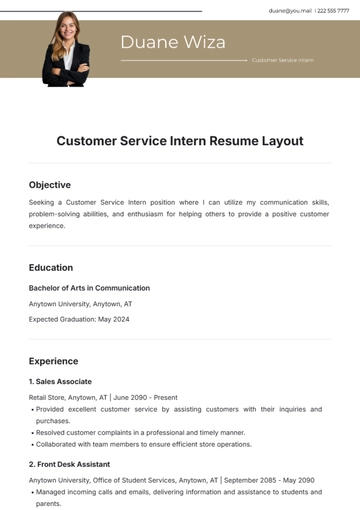

- Internship Resume

- Graphic Designer Resume

- College Resume