Free Property Tax Measure Fact Sheet

This Fact Sheet is provided by [YOUR COMPANY NAME] and has been prepared to offer a comprehensive overview of the proposed property tax measure. This document aims to inform stakeholders, including residents and business owners in [YOUR CITY OR COUNTY], about the key elements and implications of the tax measure.

I. Overview of the Property Tax Measure

The proposed property tax measure, referred to as [MEASURE NAME], aims to generate additional revenue for [SPECIFIC PURPOSES] in the [LOCATION]. This measure is set to appear on the ballot on [DATE].

II. Key Provisions

Increase in property tax by [PERCENTAGE] starting [START DATE].

Projected to raise approximately [AMOUNT] annually.

Funds allocated specifically for [DETAILS OF FUND USAGE].

III. Impact Analysis

This section outlines the potential impacts of the measure on different segments of the community:

Stakeholder | Impact |

|---|---|

Homeowners | Estimated increase in tax bill by an average of [AMOUNT] per year. |

Businesses | Potential increase in operating costs due to higher property taxes. |

Renters | Possible indirect cost increases if landlords pass down additional costs. |

IV. Arguments For and Against

A. Supporters Say:

Enhances local services and infrastructure.

Increases funding for [SPECIFIC BENEFICIARIES] which will improve [DETAILS].

B. Critics Argue:

May burden homeowners and small businesses disproportionately.

Risks reducing property values in the area.

V. Voting Information

For those eligible to vote on this measure, here is the critical information:

Voting date: [DATE]

Polling locations: Available at [WEBSITE] or contact [LOCAL GOVERNMENT OFFICE].

Registration deadline: [REGISTRATION DEADLINE]

VI. Contact Information

For more details on the property tax measure, please contact:

[YOUR NAME], [YOUR POSITION]

Email: [YOUR EMAIL]

Phone: [YOUR PHONE NUMBER]

[YOUR COMPANY NAME]

VI. Conclusion

The proposed property tax measure, [MEASURE NAME], represents a significant opportunity to address key community needs and enhance local services and infrastructure. However, it also raises concerns about potential financial burdens on homeowners and businesses. It's crucial for residents to weigh the benefits and drawbacks carefully and exercise their right to vote on [DATE]. For further inquiries or clarifications, please don't hesitate to reach out to the provided contact information.

This fact sheet was created by [YOUR NAME] from [YOUR COMPANY NAME] to provide crucial details about the proposed property tax measure for the benefit of [YOUR CITY OR COUNTY] residents and stakeholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate solution for informing stakeholders about property tax measures with Template.net's editable and customizable Property Tax Measure Fact Sheet Template. Crafted to perfection, this template is not only editable but also compatible with our Ai Editor for seamless customization. Simplify your communication effortlessly with Template.net.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

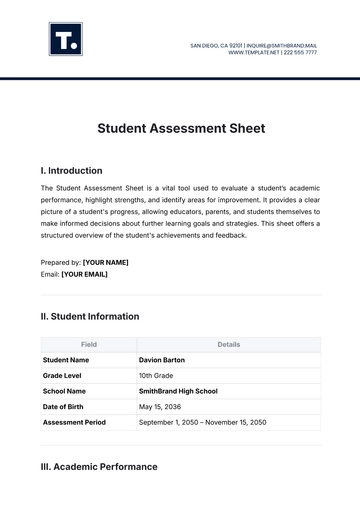

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

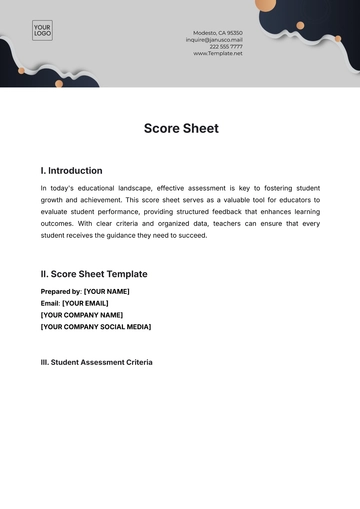

- Score Sheet

- Estimate Sheet

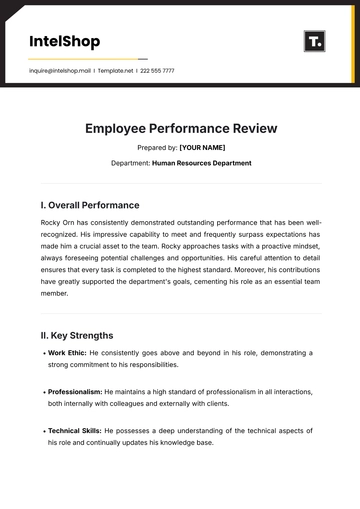

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

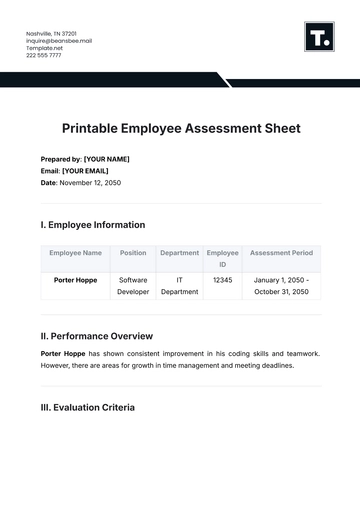

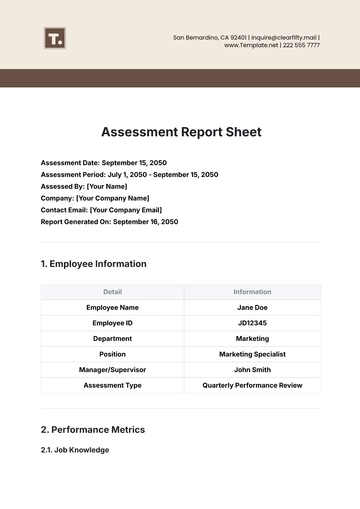

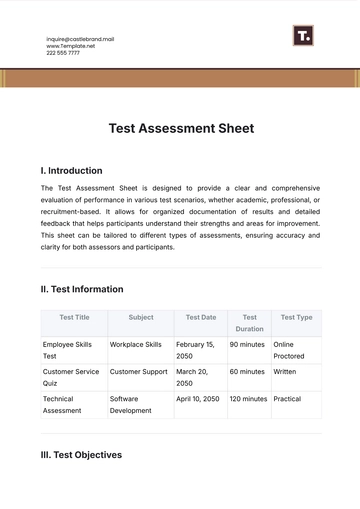

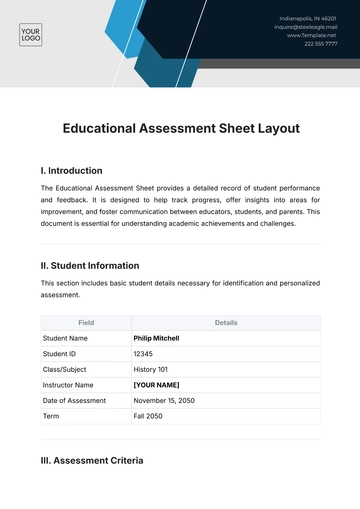

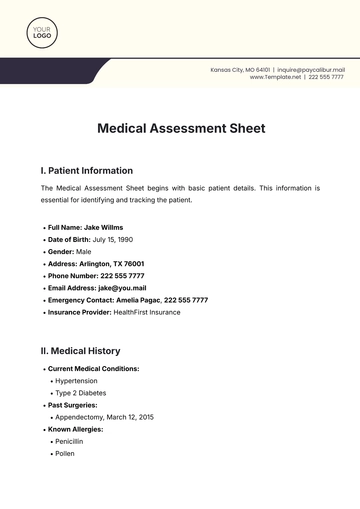

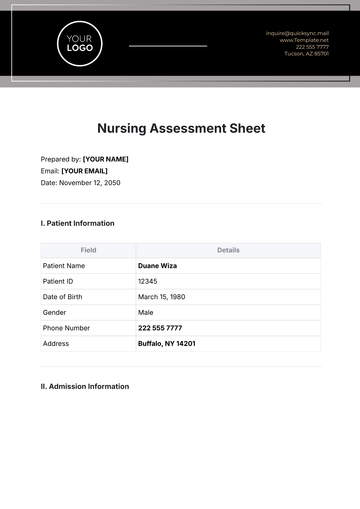

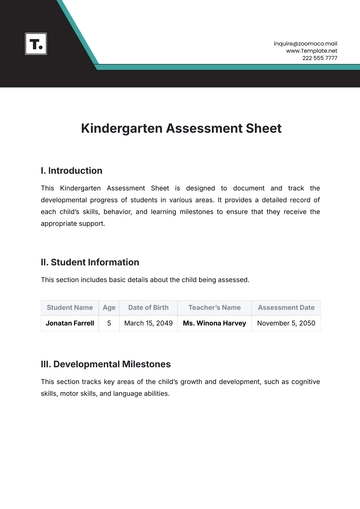

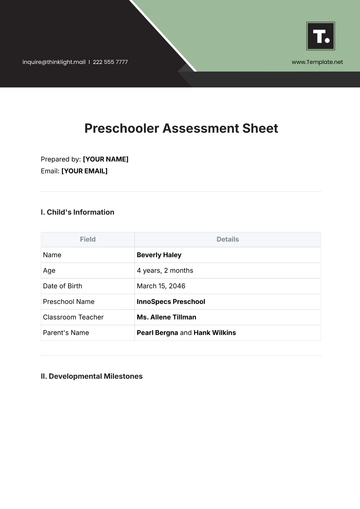

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet